In this report, we take a closer look at Lithium Americas Corp (LAC), including a review of its business, its growth potential, its valuation and risks. We conclude with our strong opinion on investing.

About Lithium Americas:

Lithium Americas Corp stands out for a variety of reasons, but mainly its high expected growth rate (i.e. +248.7% next year) and the electric vehicle battery secular tend behind it.

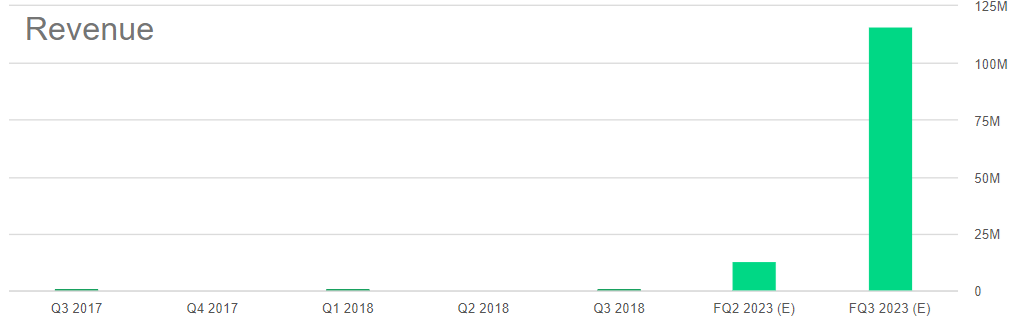

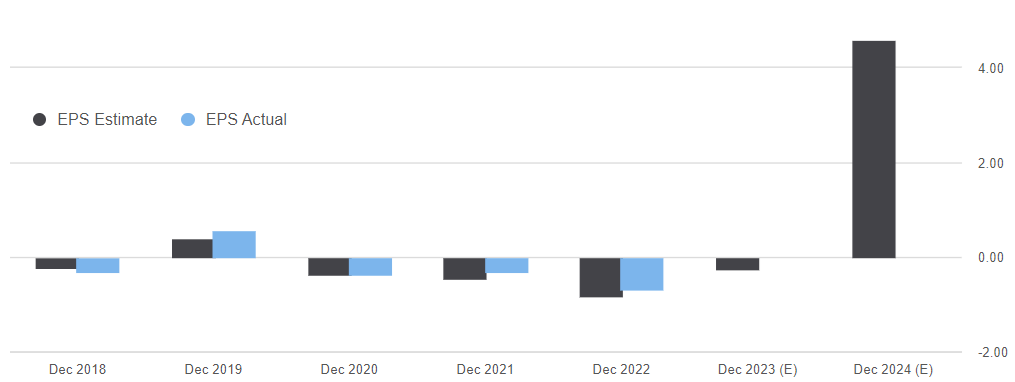

LAC is a materials (mining) company that explores for lithium deposits in the United States, Canada and Argentina (note: it splits into two companies in October, North America (LAC) and Argentina (LAAC). The company owns interests (and is currently developing) three lithium assets. Specifically, two in Argentina (Cauchari-Olaroz and Pastos Grandes) and one in the US in Nevada (Thacker Pass). Interestingly, LAC currently has no significant revenues (the lithium assets are currently under development). For perspective, here is a look at the company’s recent revenues and profits.

It is the company's Cauchari-Olaroz assets that are beginning production this year, while Thacker Pass should start producing sometime around 2025-2026, and Pastos Grandes will begin producing after that.

Also important to note, LAC plans to split into two businesses later this year (“Lithium Argentina” which will own the two Argentina assets, and “Lithium Americas” which will own the Nevada assets). Shareholders will end up owning shares of both companies.

Growth Potential: Why is Lithium so Important?

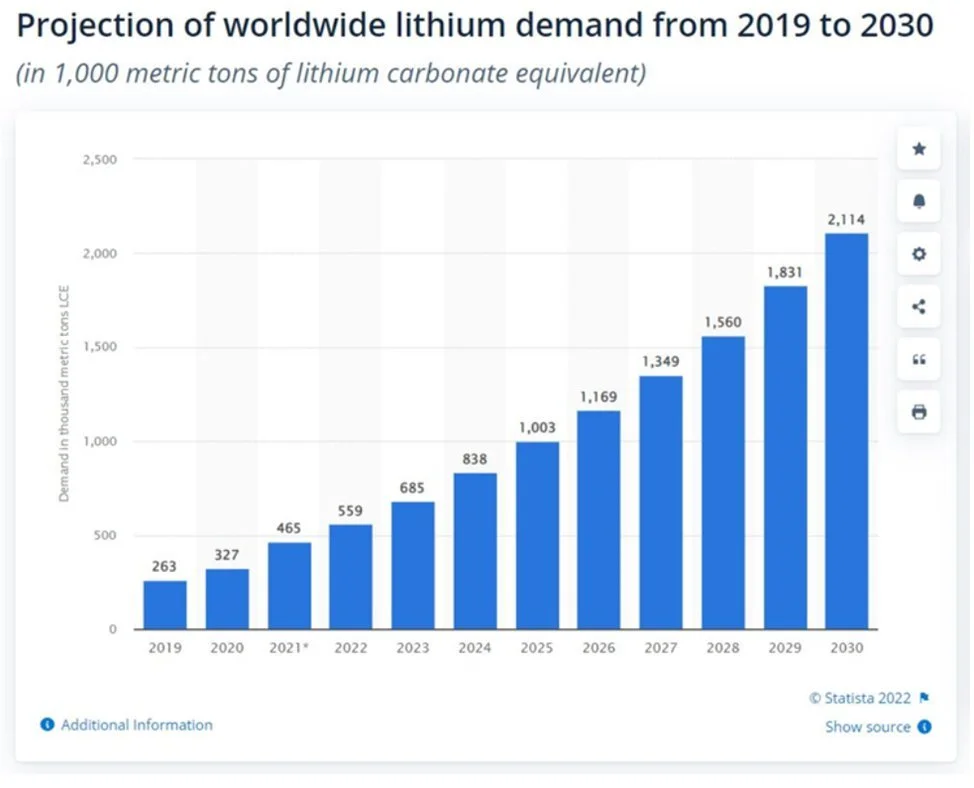

If you don’t know, lithium is increasingly important to the global economy because it is used to make batteries for electric vehicles. So as the world works to reduce carbon emissions, lithium is extremely important. For example, you can see in the following graphic just how dramatically lithium demand is expected to grow in the coming years.

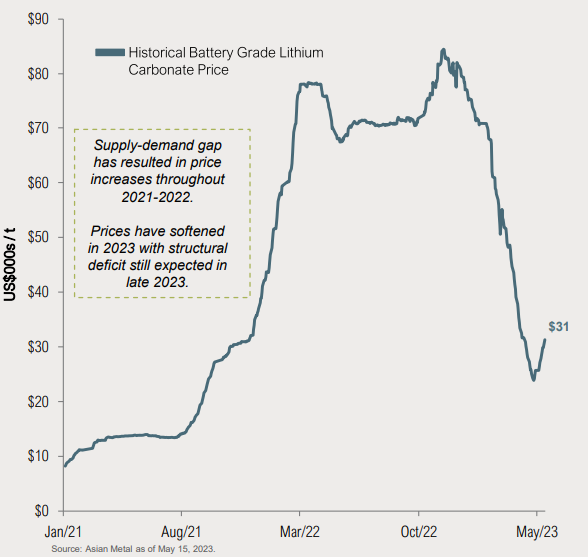

Also, for just a little more perspective on lithium supply and demand dynamics, you can see the recent price of lithium and the share price of three top lithium companies (Lithium Americas, Albemarle (ALB) and Livent (LTHM)) below.

However, according May 22nd note from Morningstar Strategist, Seth Goldstein:

We forecast lithium prices will average over $36,000 per metric ton from 2023 through 2030, leading to solid profits for low-cost producers. With the current stock prices implying prices around $20,000, much of the bad news is already priced in.

So basically, the current lower lithium prices are expected to go higher, and this will be a really good thing for lithium producers such as LAC.

General Motors (GM) Investment in LAC:

Also important to note, in an indication of the high quality lithium LAC is expected to produce (as well as the demand for it), General Motors (GM) recently made the largest investment ever by an automaker ($650 million, across two tranches) in battery raw materials from Lithium Americas Corp.

Further still, new reports suggest there may be a shortage of lithium supplies (a good thing for LAC).

Valuation:

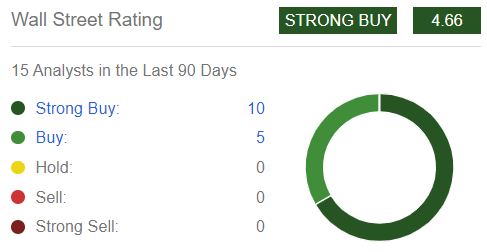

There is a lot of speculation and assumption involved in valuing LAC because it has essentially no revenues (and no profits) yet. However, as we saw above, demand for lithium is expected to increase dramatically over the next decade, and the price of lithium is also expected to increase significantly too (both good for LAC). Here is a look at the average Wall Street Analyst rating of the shares (it’s a “strong buy”).

LAC has ownership of key assets and plenty of capital to fund their development. And the assets are expected to come online and ramp up significantly in the second half of this year.

For a little more perspective, you’ll note the very high profit margins and low price-to-earnings valuation metrics of LAC peers Albemarle and Livent in our earlier table. However, bear in mind these companies are similar, but have differences (for example, Albemarle doesn’t produce only lithium). Nonetheless, as the only pure play American lithium company, Lithium Americas Corp has very significant demand and upside price appreciation potential in the years ahead (and the shares are down quite a bit, as you can see in our earlier chart).

Furthermore, LAC currently trades at ~$20.12 per share, which is only 4.4x 2024 non-GAAP EPS estimates of $4.57 (as we saw in the EPS chart provided earlier).

Risks:

There are a lot of risks to the price of LAC. For starters, it’s not generating revenue or profit yet, so its valuation is basically speculation about future earnings potential. And a lot of things could go wrong. For example, the demand for electric vehicles (and lithium batteries) may not be as great as expected. Also, the price of lithium may fall directly if there is too much supply. Further still, delays in production for LAC’s lithium assets could also hurt the share price. Despite what appears to be a major opportunity for the company, the future is still highly uncertain. Basically, LAC appears to be a high risk—high potential reward opportunity at this point.

Bottom Line:

Lithium Americas is one name that stands out for high growth (revenues are expected to increase by 248.7% next year), and we believe the company looks attractive upon closer review (it’s a pure play lithium opportunity and will benefit from a long-term secular trend considering electric vehicle demand for lithium-based batteries is just getting started). Further still, once the business is in full swing, it will likely have high margins too. If you can handle higher uncertainty risk, we believe Lithium Americas has tremendous long-term price appreciation potential. We do not currently own shares, but it is high on our watchlist for a spot in our prudently-concentrated long-term Disciplined Growth Portfolio.