There are many ways to identify top investment opportunities, and one strategy is to screen the universe based on important fundamental metrics and then dig deeper into the names that look attractive. In this report, we share data on 100 high-profit-margin and high-sales-growth stocks, and then dig deeper into two stocks from the list that are interesting, plus several more stocks from the list that we currently own (and consider extremely attractive for disciplined long-term investors).

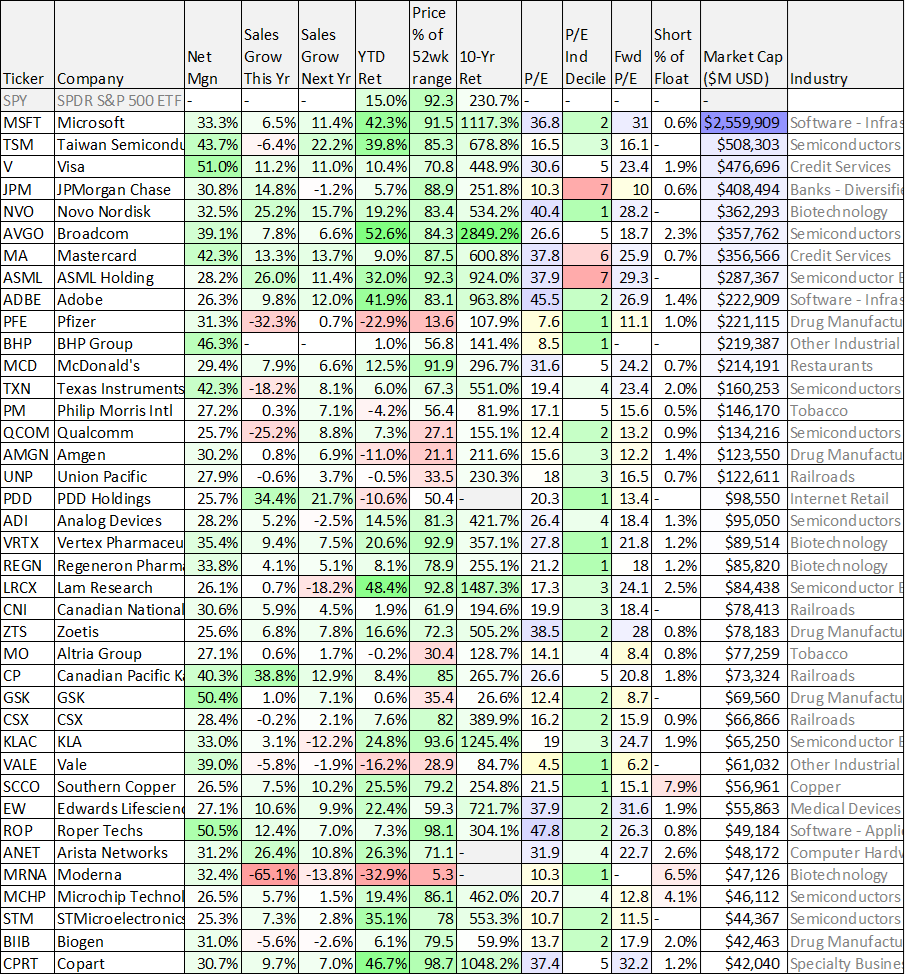

75 High-Profit-Margin Businesses

For starters, we’re sharing data on 50 high-profit-margin businesses below. Profit margin is basically net income as a percent of total revenues. And in this case, we are sharing the top ~10% of stocks that trade on either the New York Stocks Exchange or the Nasdaq, in terms of high profit margins. Specifically, to be in this group, a profit margin (see “Net Mgn” column) of at least 30% was required.

You likely recognize many of the names on the list (it is sorted by market cap). And we believe high profit margin is very important in the current challenging macroeconomic environment. Specifically, the US fed just took a break from hiking interest rates (although the BOE just raised 50 basis points), but as rates are expected to go higher, profits are more important than ever.

More specifically, the high-growth stocks we share in the next table (later in this report) perform really well in a low or decreasing interest rate environment, such as during the pandemic bubble of 2021, because low interest rates and high market valuations made it easier for them to fund growth through borrowing (and low interest rates) and by issuing more shares (at high valuations). However, now that interest rates are higher (and expected to keep rising), current profits are more valuable than ever.

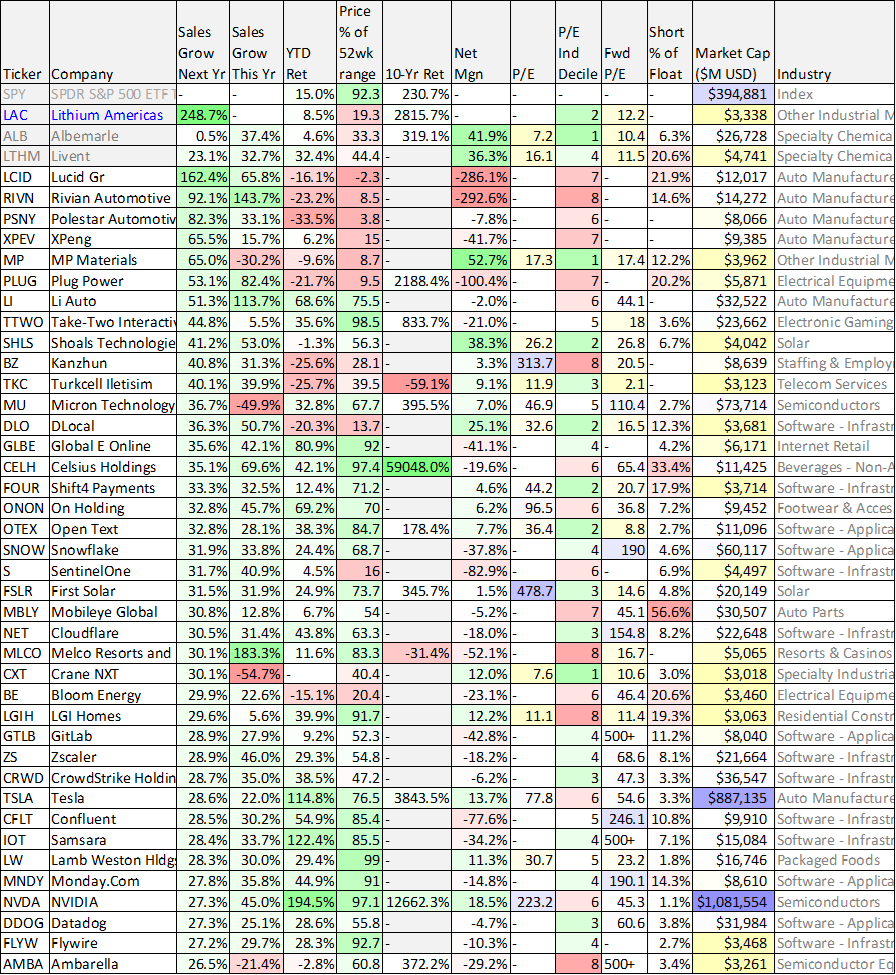

75 High-Revenue-Growth Stocks

In this next table, we share 50 stocks with among the highest revenue growth rates of companies trading on the New York Stock Exchange or the Nasdaq. Many of these stocks have fallen hard from their pandemic highs in 2021 (for the reasons we explained above, such as increasing interest rates). However, some of the stocks on this list have such powerful secular trends supporting their growth that higher interest rates won’t stop them from succeeding (especially considering interest rates aren’t currently that high by historical standards anyway).

Based on the stocks that screen well in the above table, here are a couple names that are interesting and worth considering:

Paycom (PAYC):

Paycom is a stock that screens well in terms of profit margin and revenue growth. Afterall, at a time when the macroeconomic environment is challenging for growth, it helps if your company is already profitable (Paycom’s net profit margin was recently 21%—which is phenomenal compared to other high growth stocks which have negative net profit margins). Further, Paycom is expected to grow revenues at over 20% this year and next. These are very impressive numbers for Paycom!

Paycom is a software-as-a-Service (“SaaS”) company that provides cloud-based human capital management (HCM) solutions for small to mid-sized companies in the United States. And there are a few things that make Paycom particularly attractive. For starters, software is a high-margin business to begin with, and in Paycom’s case they provide software for payroll solutions—an area that is even more sticky (once a company sets up payroll, they’re not likely to switch it). Paycom serves small and mid-sized companies which are much easier to gain as customers than large companies (which are historically served by Automatic Data Processing (ADP)). However, as small and mid-size companies grow they become large companies. And in addition to that growth, Paycom offers a variety of additional services (land-and-expand) that further fuels its high growth rate.

If you are looking for high-profits and high-growth, Paycom is a stock that is worth considering.

Altria (MO), Yield: 8.6%

Altria is basically a cigarettes company (under the premium brand Marlboro) and the stock screens extremely well in our profit margin table (27.1% net profit margin—impressive!) but extremely poorly in our sales growth table (0.6% and 1.7% growth, this year and next). This makes sense considering tobacco is an industry basically in secular decline (it’s bad for your health), but it’s still extremely profitable (because government regulation has made it virtually impossible for any new companies to enter the industry).

We’re highlighting Altria from our tables above because it is a good example of the importance of knowing your goals as an investor. For example, if you are looking for long-term growth and capital appreciation, Altria is probably a bad investment for you (for example, its 10-year total return in our table is only 128.7% versus 230.7% for the S&P 500 index—a trend we expect to continue long-term) because the industry is in secular decline.

However, if you are an income-focused investor, Altria may be a terrific option for you because it pays such a large dividend that is well covered by its cash flow. And companies like Altria should pay a large dividend because they don’t have good opportunities to reinvest in business growth (again, the government regulates the heck out of the cigarette industry, and the industry is basically in secular decline). We wrote up Altria in detail earlier this year, and you can access that report here.

More Stocks Worth Considering:

And for reference, here are detailed reports on several of the stocks that we currently own from the above tables:

The Bottom Line:

When you are trying to identify top investment opportunities, screening the universe (based on important fundamental metrics) is one place to start (assuming you then dig deeper into understanding the reasons certain stocks screen well). In this report, we’ve screened based on profit margins and sales growth, and the differences can help highlight varying investor goals (e.g. current income versus long-term compound growth).

Lithium Americas is one name that stands out for high growth (revenues are expected to increase by 248.7% next year), and we believe the company looks attractive upon closer review (it’s a pure play lithium opportunity and will benefit from a long-term secular trend considering electric vehicle demand for lithium-based batteries is just getting started). Further still, once the business is in full swing, it will likely have high margins too. If you can handle higher uncertainty risk, we believe Lithium Americas has tremendous long-term price appreciation potential. We do not currently own shares, but it is high on our watchlist for a spot in our prudently-concentrated long-term Disciplined Growth Portfolio.