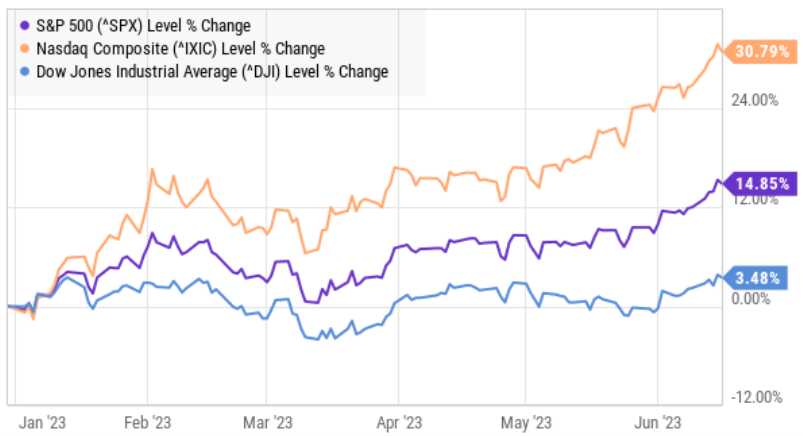

As of Friday’s close, the S&P 500 is up 14.8% year to date, while the tech-heavy Nasdaq is up 30.8% and value-heavy Dow Jones is up only 3.5%. Here is a look at the best and worst S&P 500 stocks, by year-to-date performance, dividend yield, market cap and short interest.

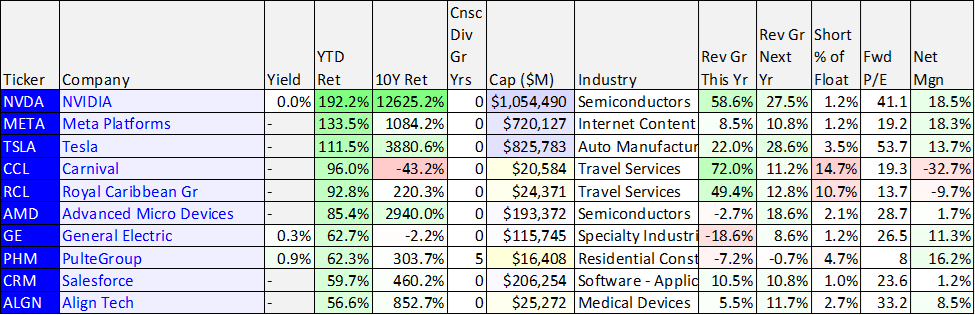

Top 10 Best-Performing S&P 500 Stocks This Year:

No surprise, chip-maker Nvidia (NVDA) leads the way after beating earnings and delivering extraordinarily strong guidance based on growing AI demand for its products.

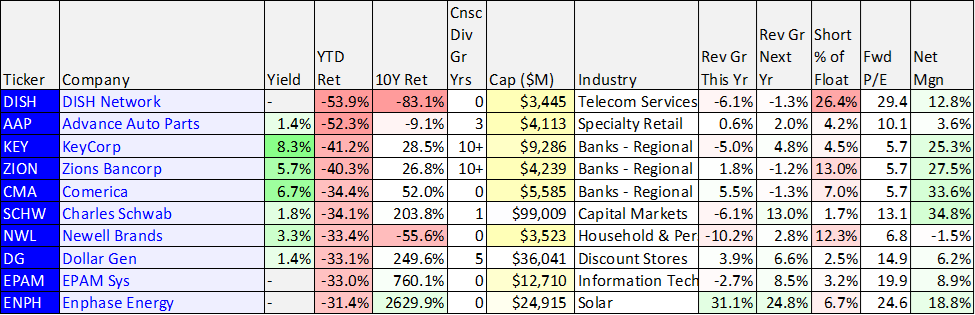

10 Worst Performing Stocks:

Several regional banks (and Charles Schwab) still on this list following fallout from bank runs early this year at Silicon Valley Bank and Signature Bank.

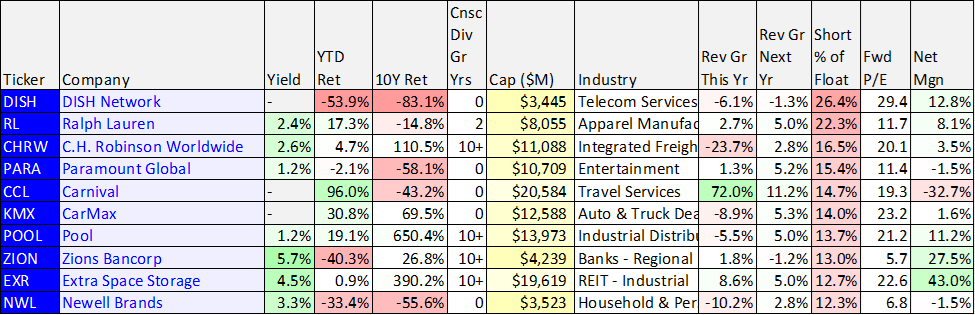

10 Most Shorted S&P 500 Stocks:

This data can sometimes be lagged, but notice several of the most shorted are also on the worst performers list.

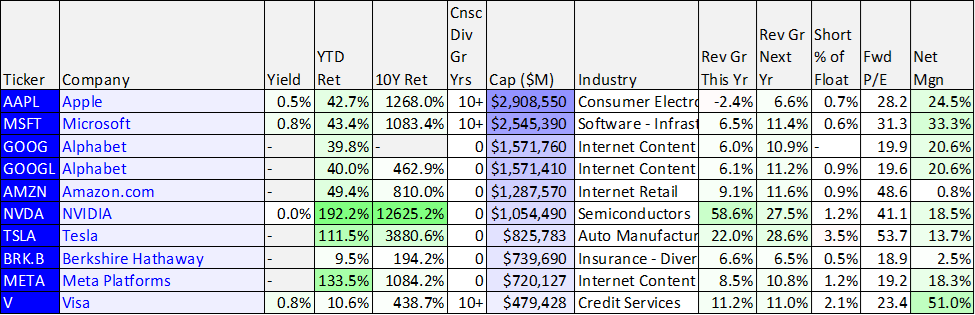

10 Largest S&P 500 Stocks by Market Cap:

As if these names don’t garner enough attention already, it’s interesting to see six names in the “$1 Trillion Plus” club, and two over $2 Trillion now.

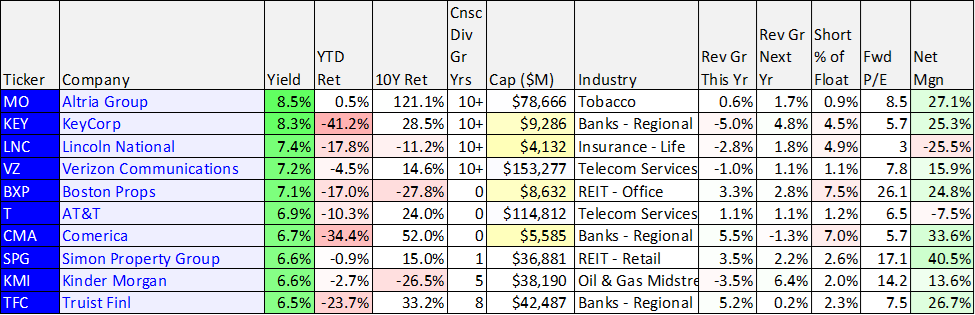

Top 10 Dividend Yields:

And for those into high-yield, you’ll notice the year-to-date returns on the biggest dividend yield stocks has been terrible. Depending on your goals, these can be yield traps, but for those seeking simply income—the story may be different. For example, here is our new report on Verizon Communications. And you can check out our full report on Altria (from back in January too).

The Bottom Line

With strong performance for the S&P 500 this year, especially tech stocks, a lot of investors are looking for a market pullback. However, rather than trying to predict short-term market moves, you’re better off staying focused on your long-term goals. Disciplined goal-focused long-term investing continues to be a winning strategy.