Dividend-growth investing has been one of the most underrated strategies in recent years, however the tide is shifting. Specifically, with interest rates rising, and style leadership now shifting from growth to value, dividend-growth stocks are increasingly attractive and many of them are still significantly undervalued by the market. In this report, we share data on over 100 top dividend-growth stocks (those that have raised their dividend for at least 10 consecutive years), and then dive into four specific stocks that are particularly attractive, undervalued and worth considering as long-term staples in a prudently-diversified income-focused portfolio.

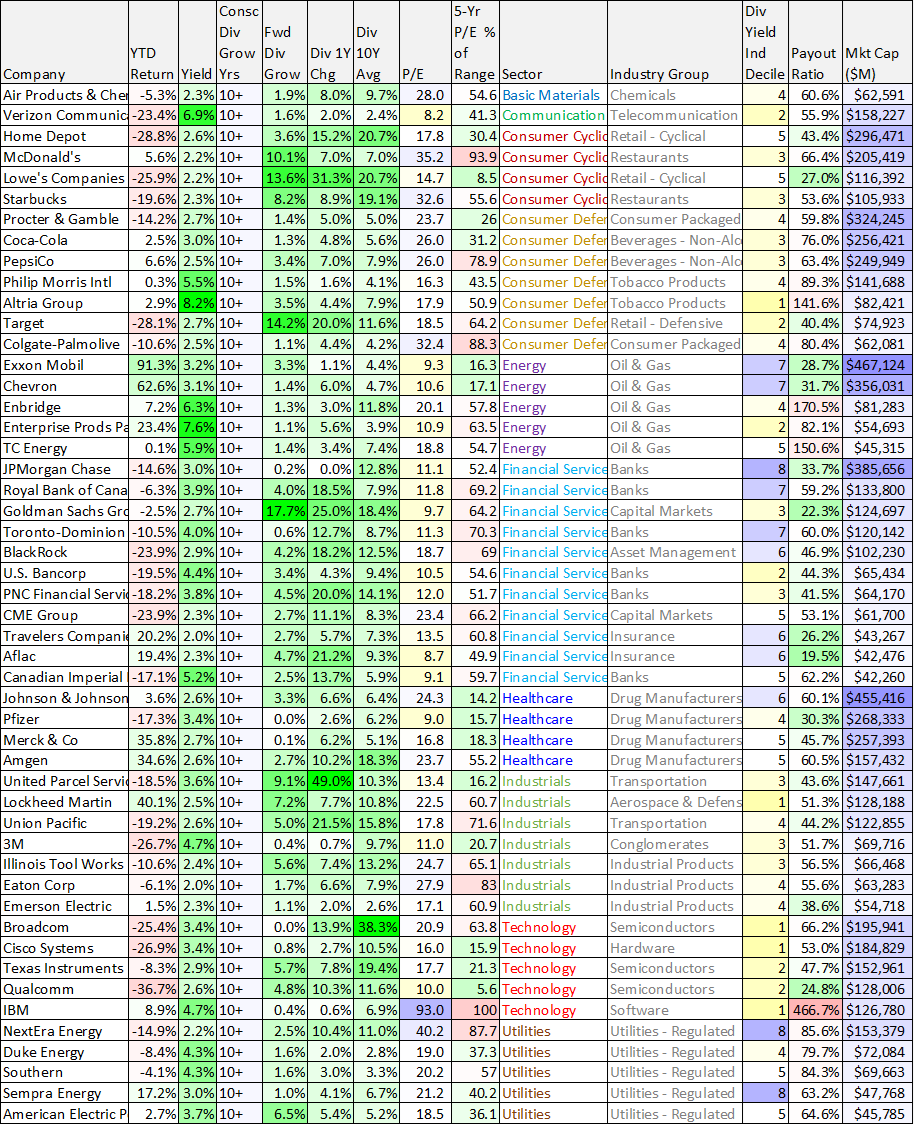

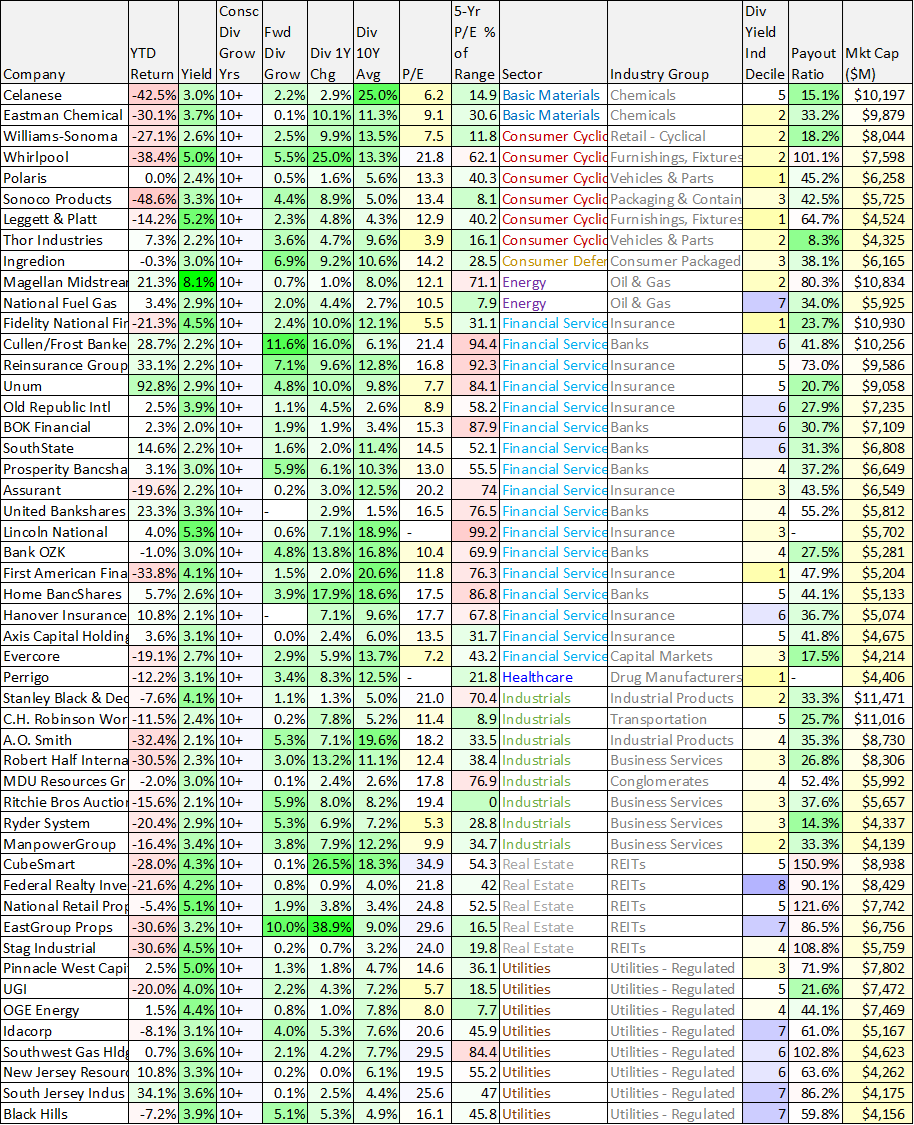

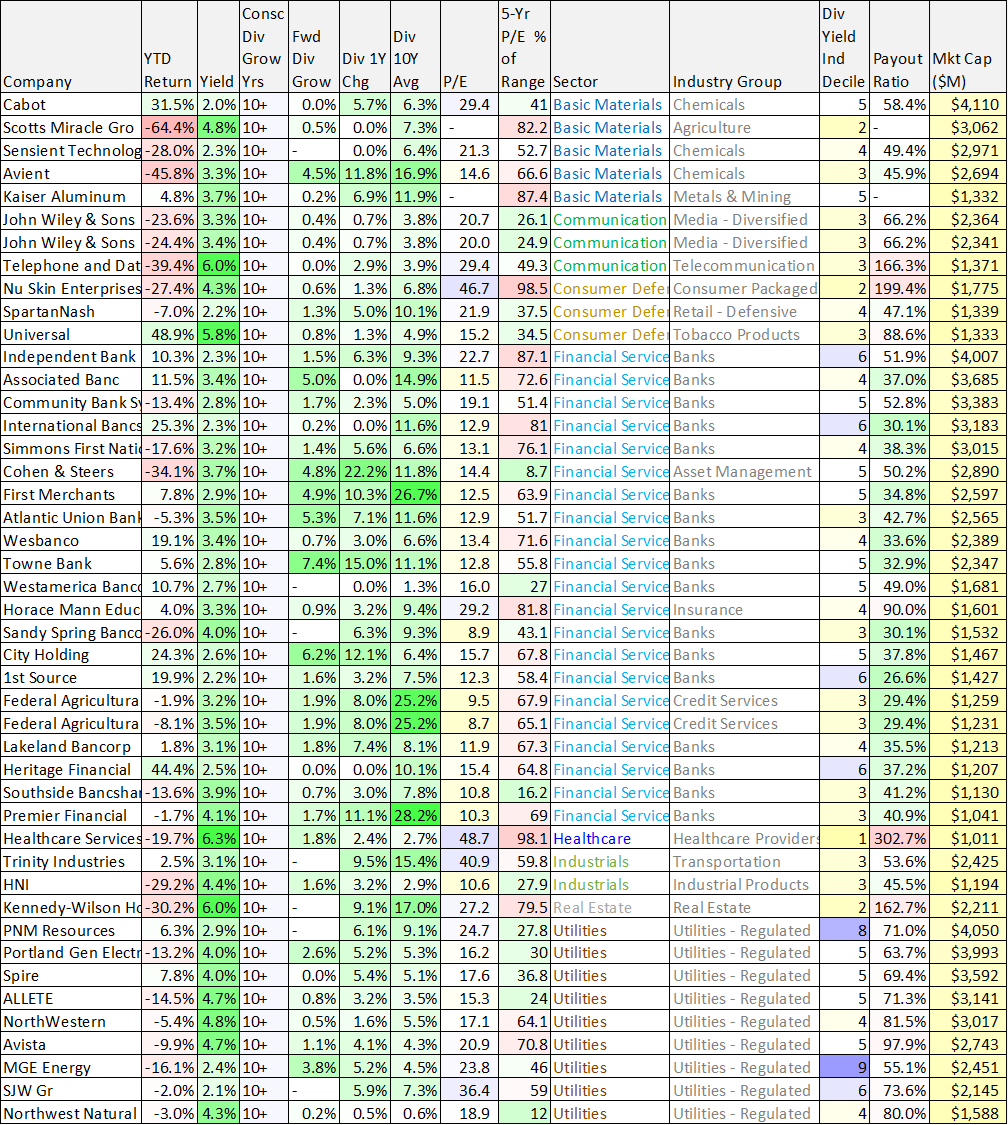

100 Top Dividend-Growth Stocks:

Let’s start with the data. Here is a list of over 100 dividend-growth stocks (those that have increased their annual dividend for at least 10 consecutive years), along with a variety of other valuable data including current yield, the rate of historical dividend increases, payout ratio, P/E ratio, sector, market cap and more. The list is broken into four groups by market cap, and then each of the four groups is sorted by market sector.

data as of midday Mon, Nov 8th. source: StockRover

For your information, here are a few definitions with regards to the column headings in the tables.

Dividend Growth 1-Year Change: the percentage between the last paid dividend and the corresponding dividend 1 year earlier.

Dividend 10-Year Average: the average annual compound dividend growth for the last 10 years based on the last paid dividend and the corresponding dividend 10 years earlier.

5-Year P/E Percent of Range: today's P/E ratio versus the highest and lowest P/E ratios this stock has had over the past 5 years.

Dividend Yield Industry Decile: the decile rank of the company's Dividend Yield among all companies in the same industry. Companies with the highest yields score a 1 and the lowest yielding companies score a 10.

Payout Ratio: dividend payout ratio is Dividend Per Share as a percent of Diluted Earnings Per Share based on the TTM from the most recent quarterly report. Dividend Payout ratio can be used to measure the chance of a dividend increase or cut. For example, a company with a small Payout Ratio has room to increase its dividend.

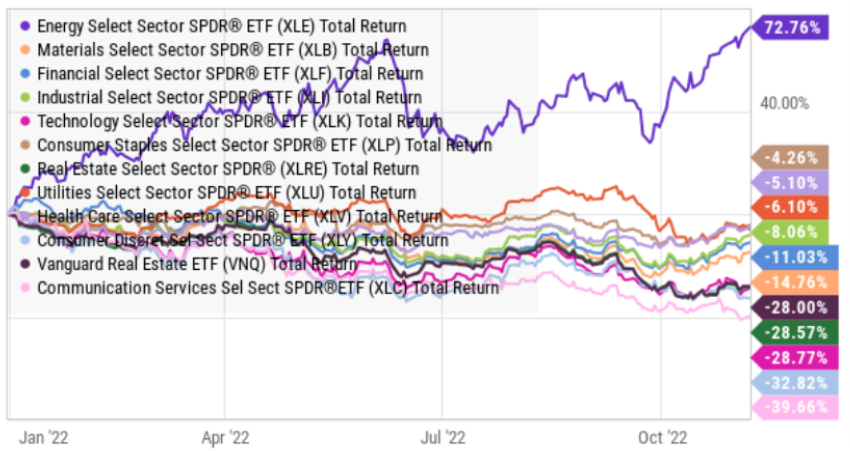

Growth Versus Value Sectors

To add a little more perspective to the data in the table, here is a look at the performance of the various market sectors year-to-date. And as you can see, the value sector (such as Energy, Staples, Health Care, Utilities, Industrials and Financials) have performed better than the growth sectors (such as Technology and Consumer Discretionary).

And this year’s growth leadership is in stark contrast to the performance of the last 5 years, whereby growth sectors were more dominant, as you can see in this next chart.

Growth Versus Value (Top Down):

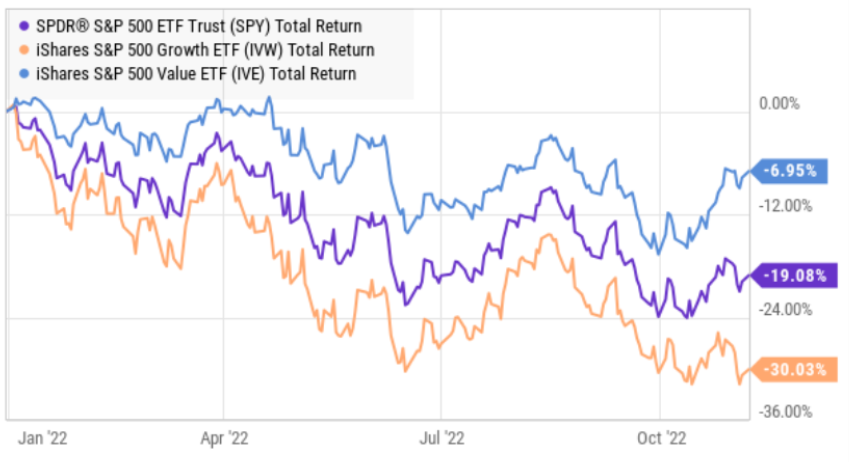

To make this growth-to-value shift more clear, here is a look at the total returns of the S&P 500 this year, versus the S&P 500 Growth and the S&P 500 Value. As you can see, value has significantly outperformed growth this year.

However, the previous 10 years have been a very different story, whereby growth was significantly outperforming value (abnormally low interest rates undoubtedly contributed to growth’s dominance because it was relatively inexpensive to fund growth).

Looking Ahead: Growth Versus Value

However looking forward, it seems unlikely that interest rates will be falling back to the roughly 0% rate of years prior. Specifically, with central bankers focused so strongly on fighting high inflation (the very inflation that was caused by extraordinarily easy monetary and fiscal policies from the Great Financial Crisis and more recently the Covid pandemic), higher rates seem here to stay—and that could support value stocks (over growth) in the years ahead (and as a reversion of the recent years prior).

Dividend-Growth Stock Opportunities

Dividend-growth stocks can offer a unique breed of value opportunities, and because they have been relatively out-of-favor for so long, they could have a lot more upside relative to growth stocks in the years ahead (and based on their lower valuations, such as P/E ratios, some of which you can see in our earlier table).

Dividend Growth “Yield on Cost”

Before getting into specific value-based dividend-growth stock opportunities, “yield on cost” is another important concept to consider. Specifically, a lot of investors avoid dividend growth stocks because there are many stocks that offer higher current yields (but have not grown their yields in the past—and likely won’t grow them in the future either). The reason dividend-growth stocks yields are not the highest current yields available is often because they have been growing the dividend AND their share price, so mathematically the current yield stays relatively lower, but the yield on cost (for example if you bought 10 years ago, or look 10 years into the future) is often MUCH higher. And in absolute dividend dollar terms, dividend growth stocks can pay a lot more after 10 years, just like they pay a lot more now than they did 10 years ago. If you are a long-term investor, it can make A LOT of sense to own dividend-growth stocks, instead of only chasing after stocks with the highest current yields, especially considering current market conditions.

4 Top Dividend Growth Stocks Worth Considering

Taking into account the current shift from growth to value, and assuming interest rates aren’t going back to near-zero anytime soon, the future may be bright for value stocks to outperform growth in a long-overdue mean reversion. Especially for attractive single-stock dividend-growth value opportunities, such as the four we highlight below.

The remainder of this report is available to members only, and it can be accessed here.

Special Offer:

We are currently offering 50% Off all new memberships as part of our “Fall Back” Daylight Savings Flash Sale. *Offer expires Tues, Nov 8th.