The market has been ugly this year. Steep interest rate hikes are not yet slowing inflation, but they are dragging down stock and bond prices, as energy costs continue to soar. And as counterintuitive as it may seem, these conditions are creating select attractive contrarian opportunities, particularly for disciplined high-income investors. In this report, we share data on over 100 big-yield investments (including REITs, MLPs, CEFs and BDCs), and then rank our top 10, starting with 10 and counting down to our top idea.

Current Economic Environment

Monetary and fiscal policies in the US (and around the globe) have gone from extraordinarily accommodative (such as low interest rates, extended unemployment benefits and dramatic stimulus spending in 2020-2021 to fight the pandemic) to extraordinarily hawkish (whereby central bankers are now aggressively raising rates to fight inflation, with seemingly no regard for the negative impacts to stock and bond prices). It’s easy to tell people this has created an attractive “buy low” opportunity, but the reality is things could still get much worse before they get better.

As terrible as conditions currently seem, we do believe things will eventually get better (this is all part of a somewhat unique market cycle), and at some point down the road many investors will be looking back and wishing they had used this opportunity to buy low (or simply to hang on to the investments they already had).

One of the best ways for many investors to deal with 2022’s challenging market conditions is to own investments that have attractive price appreciation potential (for when the rebound does come), but also offer big steady income payments (i.e. dividends and distributions). It can be a lot easier to wait for the rebound when you consistently receive big dividend payments in the meantime.

Of course, not all big-yield investments are created equally. However, select opportunities currently offer unusually high long-term price appreciation potential and unusually high current yields. In the following sections of this report, we have broken big-yield investments into four categories (i.e. REITs, MLPs, CEFs and BDCs), and we will use those categories as we countdown our top 10 big-yield ideas. Let’s start with Business Development Companies, or “BDCs.”

Business Development Companies (“BDCs”)

BDCs are similar to banks (because the provide financing, mainly loans), but unlike traditional banks, BDCs focus on providing capital to riskier middle-market companies. Also like banks, BDCs are helped when interest rates rise (like this year) because it increases their net interest margins (i.e. it widens the gap between the rate they borrow money at versus the rate they lend money at).

For some color, BDCs were created by act of Congress in the early 1980’s to help the economy by providing financing to underserved small businesses, and BDCs can avoid paying corporate income taxes as long as they pay out all of their net income as dividends. This creates a win-win-win for the small businesses (in search of capital), the BDCs (who avoid corporate taxes) and investors (who like big dividends).

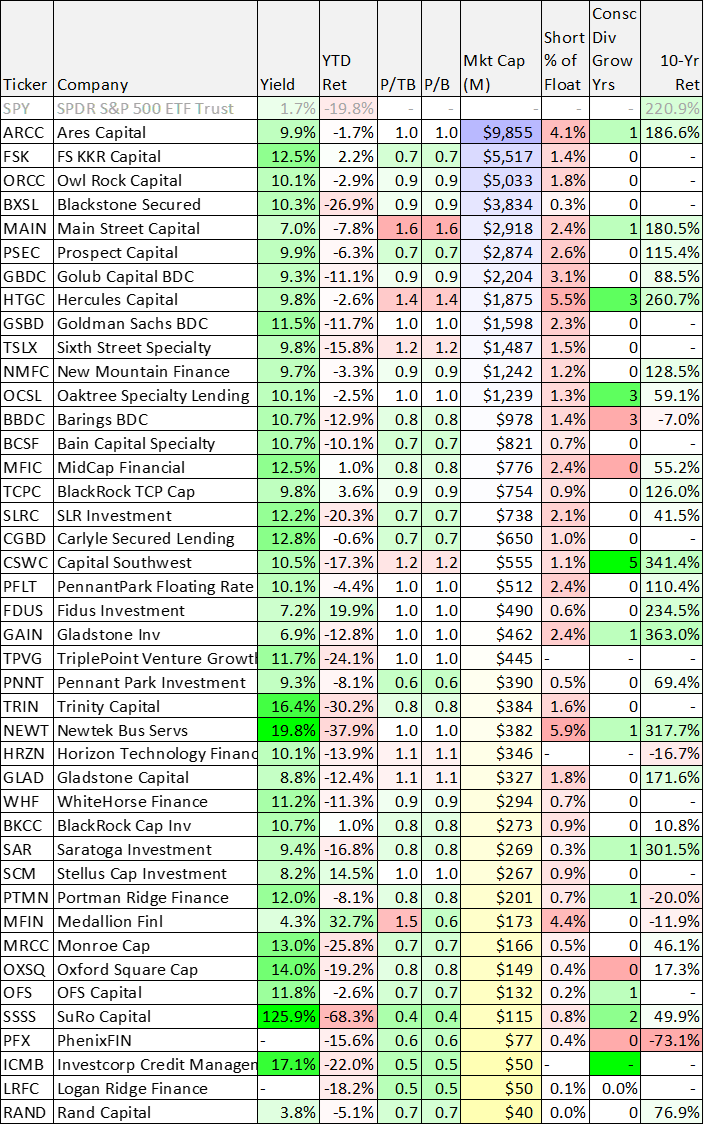

Of course BDCs come in many different shapes, sizes and strategies. We’ve provided a list of over 40 of them (including a variety of important data points) in the table below. You’ll notice yields are big, but returns have been ugly.

data as of Fri 11/4/22 (Stock Rover)

You likely recognize at least a few of the BDCs in the table above (it’s organized by market cap). The table also includes important metrics such as dividend yield, short interest, price-to-book values, market cap, returns and more.

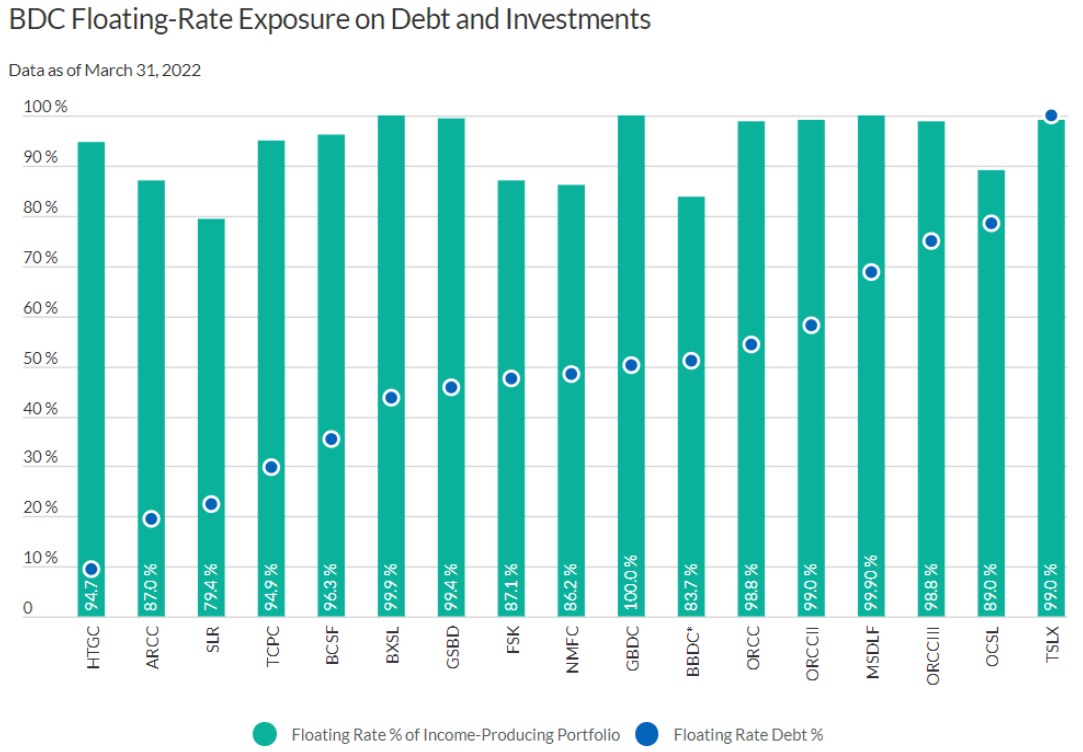

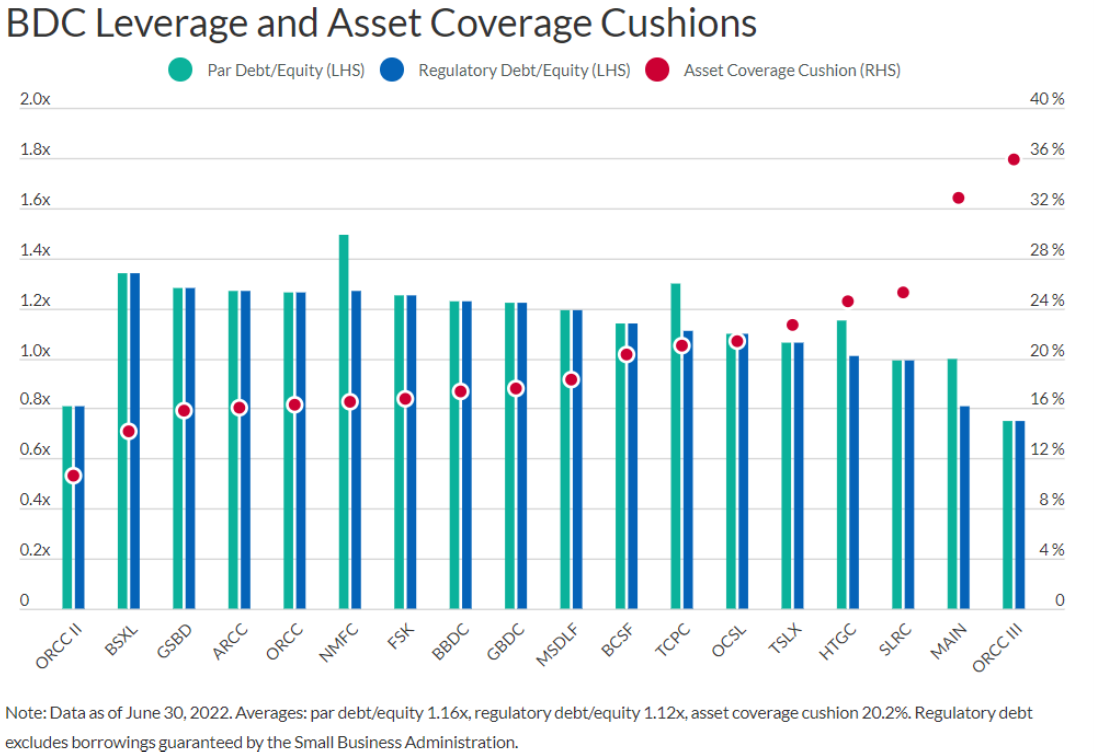

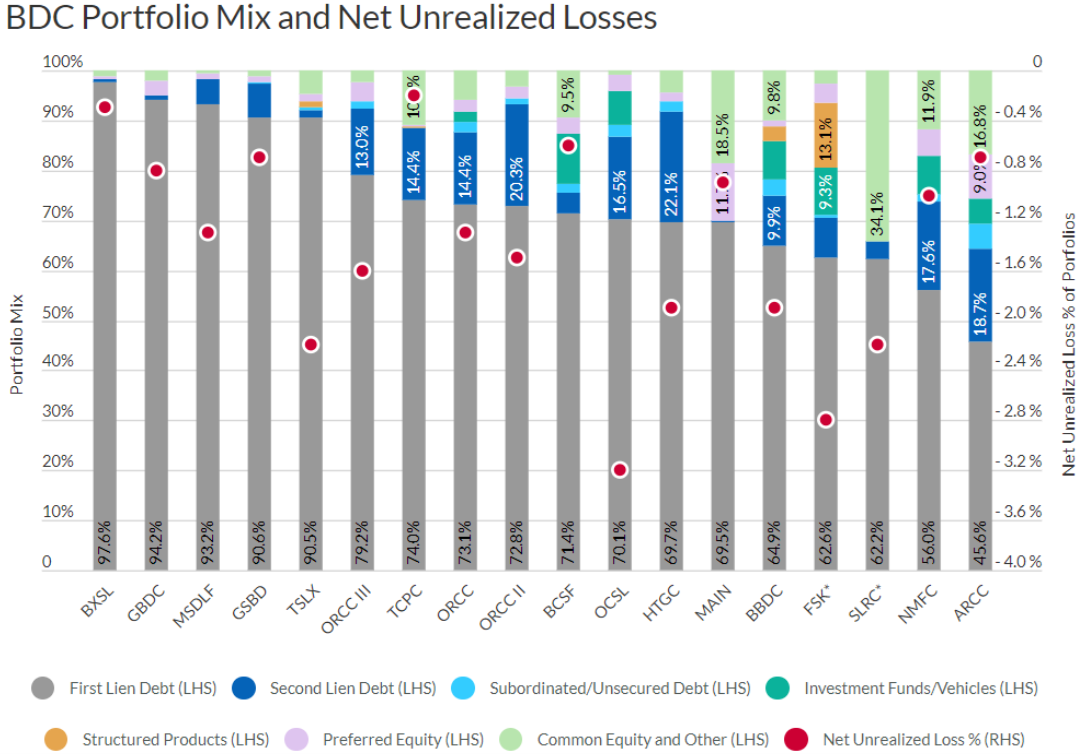

For a little more perspective, here are a few more valuable BDC metrics for you to consider, including floating-rate exposures (very important in a rising rate environment), leverage levels (most are still well below 2x—it was raised to 2x from 1x in 2018), and unrealized losses and capital types.

10. Ares Capital (ARCC), Yield: 9.7%

With interest rates going higher, this particular BDC (Ares Capital) stands to benefit further, especially considering its favorable mix of floating rate investment income versus fixed rate debts. Ares is the “blue chip” BDC in the room considering its large size, impressive portfolio quality, extensive industry relationships and its conservative balance sheet.

At the end of October, Ares announced third quarter Non-GAAP EPS of $0.50 (beating expectations by $0.01), and total investment income of $537M (+21.5% y/y) beating by $22.59M. Further, in a sign of strength, Ares raised its dividend by 11.6% to $0.48 (previously $0.43). And with a price-to-book value of just above 1.0, we’d rank Ares even higher in this countdown if there weren’t even more attractive opportunities available. If you are an income-focused investor, Ares is worth considering for a spot in your portfolio.

MLPs and Other Midstream Companies

Master Limited Partnerships, or “MLPs,” are often an income-investor favorite because they can offer big steady distribution payments. According to Investopedia, a master limited partnership (“MLP”) is:

“A business venture in the form of a publicly-traded limited partnership. It combines the tax benefits of a private partnership with the liquidity of a publicly-traded company.”

Further, many MLPs are often concentrated in the energy industry, midstream operations in particular. Also according to Investopedia:

Currently, most MLPs operate in the energy industry. An energy master limited partnership (EMLP) typically provides and manages resources for other energy-based businesses. Examples might include firms that provide pipeline transportation, refinery services, and supply and logistics support services for oil companies.

Many oil and gas firms will organize MLPs instead of issuing shares of stock. Using the MLP structure, they can both raise capital from investors and maintain a stake in operations.

For some perspective, here is a list of publicly-traded energy (mostly oil & gas midstream) companies, sorted by market cap and including a variety of other important metrics. One thing you'll notice about this table, and in contrast to the other tables we provide in this report, many of these companies have actually posted strong gains this year.

data as of Fri 11/4/22 (Stock Rover)

One other caveat about MLPs is that they generally send you a K-1 statement at tax time instead of a 1099. For some investors this is no big deal, but for others it can create reporting headaches. For example, a K-1 can delay the filing of your tax return (companies sometimes take longer to prepare and deliver the K-1s) and because it can trigger taxable income in an otherwise non-taxable account (such as an IRA) depending on the amount and situation (talk to your tax professional if you are going to invest in any MLPs). Note, all of the midstream companies in the table above are not MLPs, as annotated.

9. Energy Transfer, Yield: 8.7%

With one of America’s largest energy portfolios, Energy Transfer’s core operations include transportation, storage and terminalling for natural gas, crude oil, NGLs, refined products and liquid natural gas. Furthermore, with energy market conditions increasingly healthy, Energy Transfer is positioned to keep benefiting (from wide marketing and optimization spreads) and to keep paying big distributions to its investors. The company announced quarterly earnings on November first, whereby it raised its full-year profit forecast. Trading at only 7.4 times EV/EBITDA (see table above) the valuation has room for earnings growth and multiple expansion. If you are looking for big steady income, and can handle investing in an MLP, Energy Transfer is absolutely worth considering.

Real Estate Investment Trusts (“REITs”)

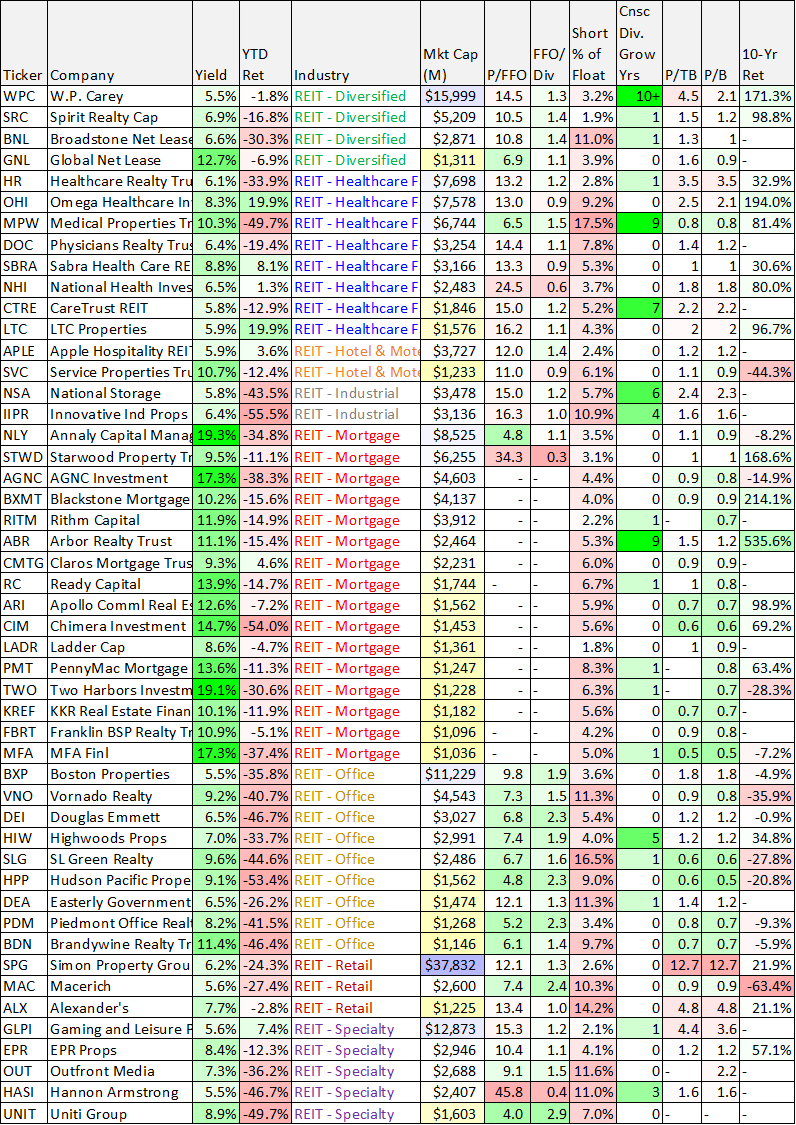

Another category often loved by income investors is REITs because they can deliver big steady dividend payments. However, this year most REIT share prices are down big, as you can see in the following table (organized by REIT industry and then market cap, and also including price-to-FFO and dividend coverage metrics, to name a few). These big price declines have created select opportunities offering attractive long-term price appreciation potential and higher than normal dividend yields.

data as of Fri 11/4/22 (Stock Rover)

Important to note, the various REIT industries in the table above are very different. For example, most REITs own mostly real estate, but Mortgage REITs often own mostly mortgage-related investments, such as Mortgage-Backed Securities (“MBS”).

Mortgage REITs also tend to use very high levels of leverage (often 5x to 7x or more) which can magnify dividends and returns in the good times, but drag them sharply lower in the bad times (as is the case so far this year as rising rates have led to lower asset prices, resulting in forced asset sales at unattractive low prices just to bring high leverage ratios back within mandated levels). In our view, some of these mortgage REITs may offer attractive shorter-term trading opportunities, but as long-term investments—mortgage REITs can be a very risky group. Any time a mortgage REIT trades below its book value (see our table above) some investors see value, but it also generally comes with increased risk as well.

Industrial REITs are another industry group that has been dragged lower this year, but for slightly different reasons. In particular, demand changed and increased during the pandemic (due to supply chain disruptions) but now growth is reverting back to lower levels. Only a couple industrial REITs made our list (because we required at least a 5.5% dividend yield), but there are many attractive lower yielding mortgage REITs currently (as we have been writing about for our members) just with lower yields and more long-term price appreciation potential. Industrial REITs in general are attractive.

8. W.P. Carey (WPC), Yield: 5.7%

When it comes to big-dividend REITs, WPC is a stalwart favorite (it has increased its dividend for over 10 years straight). More specifically, it is a diversified, large cap, net lease REIT, specializing in the acquisition of operationally critical, single-tenant properties in North America and Europe. It owns properties across a variety of market segments (e.g. Industrial (26%), warehouse (25%), office (20%) and retail (16%)). It’s also in a financial strong position, the dividend is well covered, and the yield is high by historical standards (all good things). We recently wrote up WPC in detail, and you can review that report here.

Closed-End Funds (“CEFs”)

CEFs are a widely diverse group of investments, ranging from stocks to bonds and including various sectors and styles, to name a few. However, what they do have in common is that they are funds (they hold many individual stocks and/or bonds, depending on the strategy), and they can trade at wide discounts and premiums to the net asset value of their underlying holdings (this is different from other mutual funds and exchange traded funds, because CEFs are closed-end, they generally cannot issue more shares, and therefore are priced based on supply and demand because there is no mechanism in place to immediately bring the share prices in line with their net asset value, which can create significant risks and opportunities).

Another interesting characteristic is that CEFs can also use varying degrees of leverage (or borrowed money); this can magnify the income and total returns in the good times, but also magnify the pain in the bad times (like this year).

For your reference, here is a list of closed-end funds, sorted by style. The list also includes various other important metrics, such as leverage, yield, distribution frequency, market cap and year-to-date returns (which have been ugly, for the most part).

data as of Fri 11/4/22 (CEF Connect)

data as of Fri 11/4/22 (CEF Connect)

You likely recognize at least a few CEFs from the table, such as those issued by popular managers, including PIMCO, BlackRock and others.

*Honorable Mention:

*PIMCO Corp & Inc Opp Fund (PTY), Yield: 11.7%

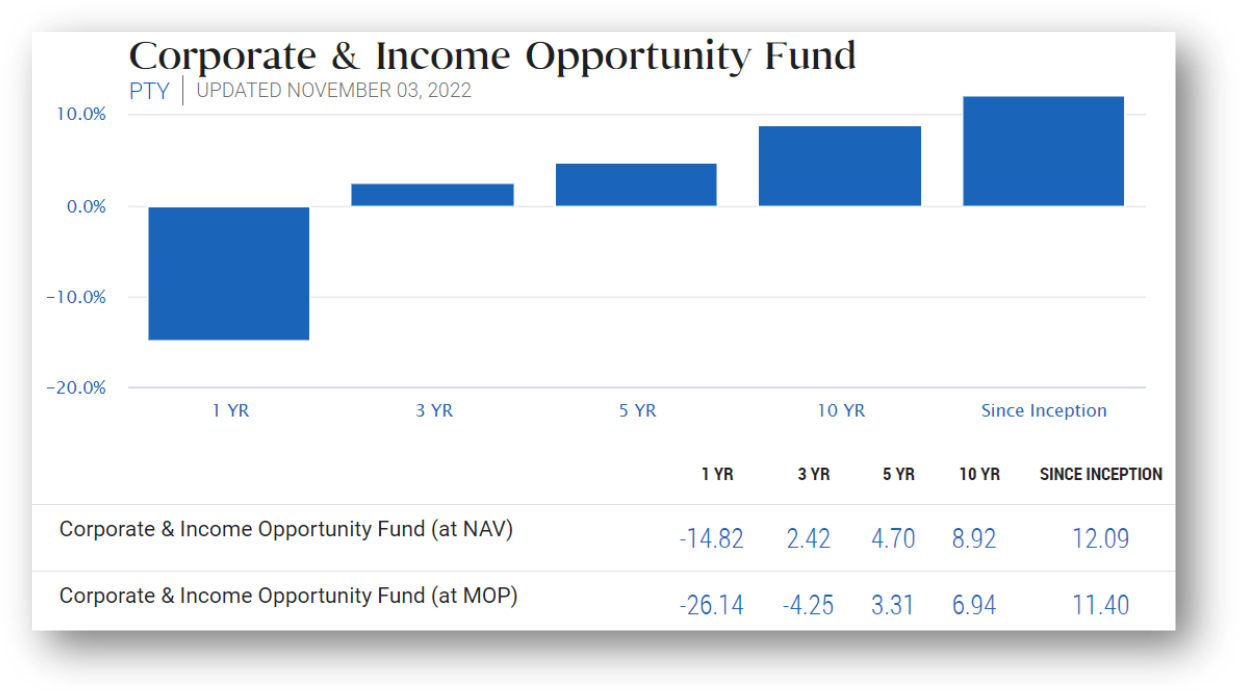

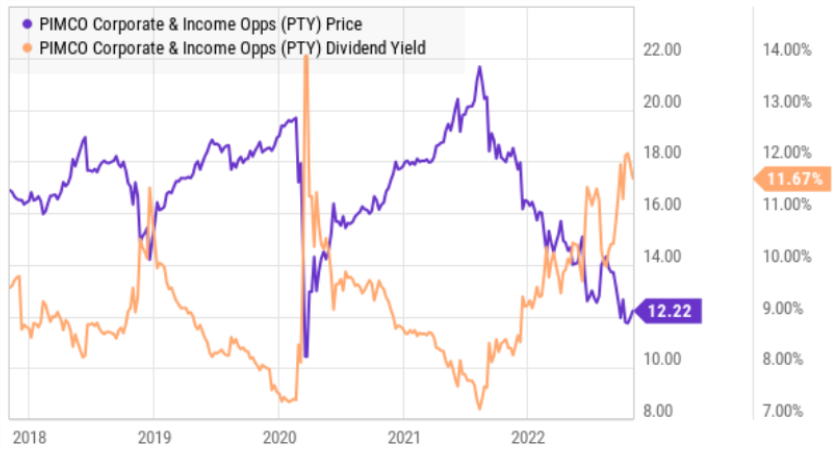

This very large (and previously “rockstar” performer) bond fund, has recently come under strong pressure (the shares are down a lot, as you can see in the following “since inception” performance chart.

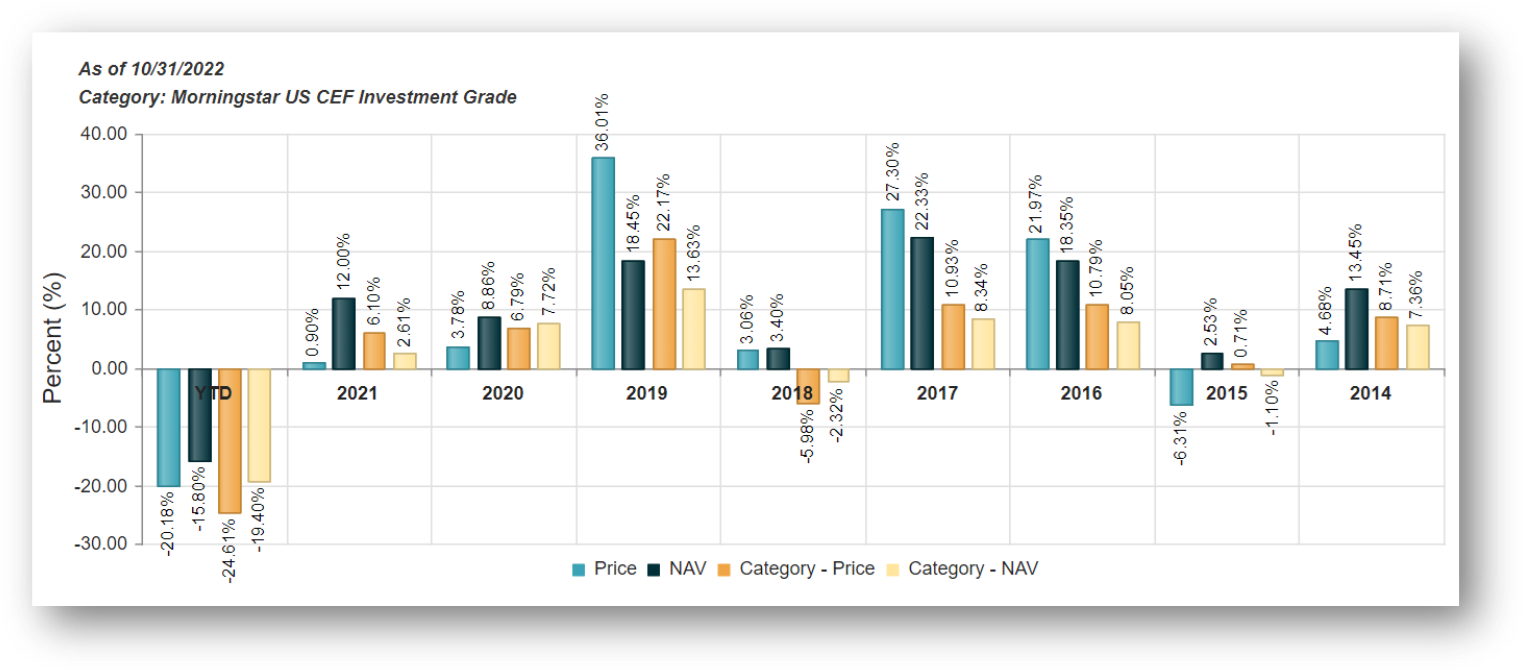

Specifically, PTY has delivered very strong annual returns (+11.4% per year on a price basis) since its inception on December 27, 2002. However, returns have turned very ugly recently as you can see in this next chart which shows the fund has consistently performed very well historically as compared to category benchmarks (on both an NAV and Price relative basis), although absolute returns over the last 1-year have been painful.

However, some investors believe we are in a dramatically different market environment now. Specifically, this highly-levered fund (currently around 42% leverage versus the 50% regulatory limit) performed very well as interest rates were basically falling for most of its first two decades in existence, but have now turned sharply higher and are resulting in sharply different performance over the last one-year in particular, as you can see in the following chart.

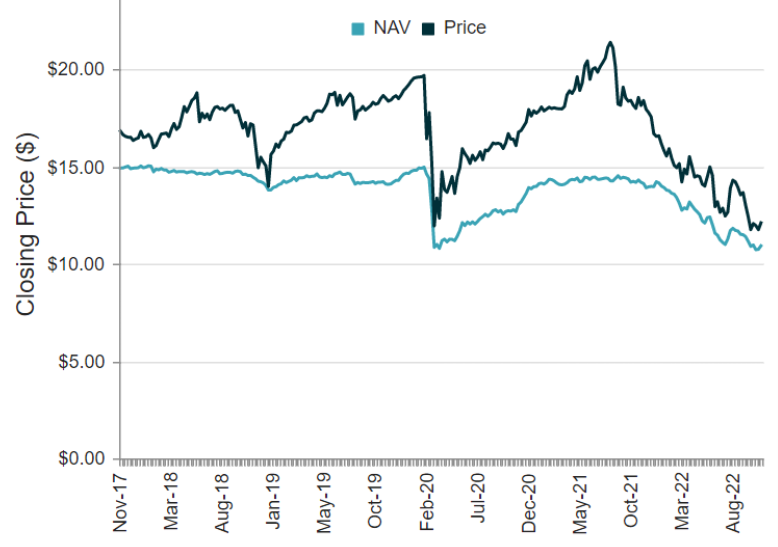

The purple line in the above chart is PTY’s total return (price return plus distributions reinvested), and the total returns were stellar up through roughly the last 1-year. This next chart shows PTY’s price return versus the NAV return (remember, the fund managers are on the hook for the NAV returns, but the market determines the price returns, which can vary significantly).

And as the NAV has faced serious downward pressure when covid hit and again more recently as rates have been rising (remember, when rates go up, bond prices go down, all else equal), PTY’s once enormous price premium has fallen, as you can see above and in this next chart.

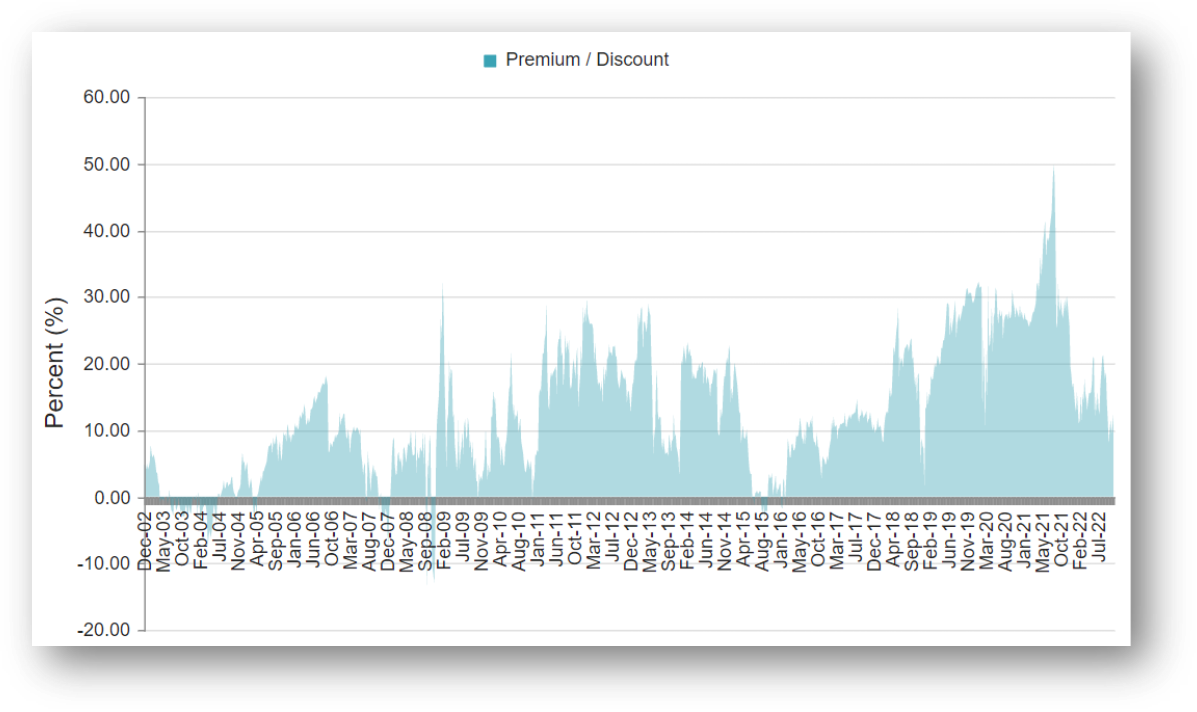

The fund now trades at a more reasonable 12.4% premium as compared to its own history (see chart above). Some investors argue that premium is still too big to consider investing, while others claim the strategy and excellent management team at PIMCO warrant the premium price to NAV. In our view, paying this relatively lower premium (as compared to its own history) is acceptable considering what you get in return, as we will explain in the following paragraphs.

One reason we view PTY as an attractive investment opportunity right now is simply the high distribution yield which is paid to investors monthly. Specifically, we like the yield because as interest rates have risen, a portion of the underlying holdings is constantly being replaced (when they mature or are sold) with new investments offering higher yields going forward. And once the Fed’s aggressive interest rate hike cycle comes to an end—the NAV declines (and likely the selling pressure) will end.

Furthermore, the distribution is well covered (the coverage ratio is 109.3% so far this fiscal year, better than a lot of other PIMCO funds so far.

It is important to note that there is some variability to the distribution payment throughout PTY’s history. Specifically, the distribution payment has been higher and lower at times, so if you are totally opposed to any interest payment volatility, this fund may not be exactly right for you. However, the distribution has always been quite large, and as mentioned previously the fund’s Net Interest Income has recently exceeded the distribution, which leads us to believe a distribution reductions is not imminent (rather an increase or even a special dividend seem more likely). Either way, the distribution has always been quite large.

In addition, the yield on PTY tends to mathematically rise and fall with the price. And as you can see in the chart below, the yield is currently high by recent historical standards (and it can stay high—and go higher—as bonds mature and/or are replaced by new bonds at higher rates).

And another reason the NAV of this fund can go higher is because of its exposure to “high yield credit.” Even though PTY is categorized as “investment grade,” it basically invests in the lowest investment grade and the highest non-investment grade categories, and it recently held 37% of its assets in high yield credit. This is important because credit spreads are currently elevated (see chart below as an example), but as they eventually narrow (as we expect them to do once economic recession risks subside) the price of those "high yield credit” investments will rise, and so too will the NAV of PTY.

Another attractive quality of PTY is that its duration (or interest rate risk) is currently conservative at only around 3.27, which means it is less exposed to the risks of rising rates. Further, approximately 18.4% of PTY assets mature within 0 to 1 year, so if rates do keep rising, the fund can meet its liquidity needs (for example, if the fund bumps up against it regulatory 50% leverage limit, it will have cash to avoid the situation of selling things at “fire sale” prices, an unfortunate situation that some other more aggressive funds are currently facing).

Further still, we also really appreciate the relatively lower management fee on this fund (~0.65%) and the relatively low total expense ratio (1.13% including management fee, operation expenses and the cost of leverage). This is particularly low for PIMCO (often considered the standalone leader in the industry).

Overall, PTY is a very attractive big-distribution CEF, despite the fact that it trades at a premium to NAV (the premium is low by its own historical standards). And despite the premium, the fund will keep paying very large monthly distributions, supported by strong net interest income (the fund has excess NII, so using a less desirable “return of capital” seems very much off the table). Further, the fund is able to support the big distributions through a prudent use of leverage, which magnifies the income payments of the underlying holdings, and will also likely magnify the price returns as interest rate volatility and recession risks eventually settle down. Further still, it is managed by PIMCO (the industry leader) and with a conservative approach so the fund can keep paying big distributions if the market environment gets worse before it gets better (i.e. low duration, paying distributions below NII and plenty of holdings maturing in 0 to 1 year). If you are looking for big monthly distributions, through a fund managed by the industry leader, PTY is absolutely worth considering for a spot in your prudently-diversified portfolio.

7. PIMCO Dynamic Income (PDI), Yield: 13.3%

PDI is the gigantic $4-billion-plus gorilla in the room. And there is a lot to like about this one. For example, it offers a very high yield (paid monthly), it’s never reduced its distribution (it also has paid additional special distributions in the past), and it hasn’t been returning capital or using cap gains to support the dividend. This fund was already big, but got bigger as two other PIMCO funds were merged into it around the turn of 2021-2022.

The fund has been playing hard defense this year as its has reduced its duration (interest rate risk) from over 5 to around 3.4 as it has been bumping up hard against the regulatory 50% leverage limit. The defensive repositioning has been far less than ideal, but PDI now has roughly 28% of its holdings maturing in 0 to 1 years, and it is increasingly well positioned to benefit from higher rates once the fed stops hiking so aggressively (hopefully soon, but slated for early 2023 as per CME fed funds futures). The one drawback on this one (besides the very high leverage and aggressive defense this year) is that it trades a premium to NAV (not unusual for a PIMCO fund, but still relatively less desirable as compared to some peers in the current environment).

6b. Main Street Capital (MAIN), Yield: 7.2%

Switching gears from CEFs and back to BDCs, Main Street Capital is a perennial favorite (for its internal management team and long track record of success), and it comes it at number “6b” on our ranking. Its dividend has grown dramatically over time, and it has a history of paying special dividends too. Main Street is particularly well positioned to benefit from the changed macroeconomic environment as higher interest rates means higher net interest margins and more earnings for MAIN. Main Street also offers a conservative level of leverage (as compared to peers and as per regulatory limits) and it has an attractive mix of first lien loans down through equity investment opportunities too. As an important note, Main Street consistently trades at a higher price-to-book value than almost all peers (because of its attractive differentiated business) so don’t necessarily let that deter you. Main Street is an attractive, long-term, big-dividend investment currently trading at an attractive price as compared to its value.

6a. Triple Point Venture Growth (TPVG), Yield: 11.2%

Triple Point Venture Growth (TPVG) is an externally managed Business Development Company (“BDC”) focused primarily on providing customized debt financing (typically with warrants and often some direct equity investments) to venture growth stage companies in technology and other high grow industries). This is a unique niche strategy in the BDC space and it currently represents an attractive contrarian opportunity, especially for income investors, as growth has fallen sharply out of favor this year.

Specifically, we have entered a lower point in the market cycle—particularly for growth companies (such as those TPVG provides capital to)—and that can be a good time to buy low. Especially considering TPVG remains financially healthy, and the shares no longer trade at a large premium to book value. Not to mention the dividend has mathematically risen to 11.2% (as the share price has fallen) and the dividend remains well covered by net investment income.

Further, TPVG is poised to benefit from portfolio companies’ shift from equity to debt financing, and from rising interest rates (better net interest margins) so long as a dramatically prolonged recession does not occur. If you are an income-focused investor, TriplePoint Venture Growth is absolutely worth considering for a spot in your prudently diversified long-term investment portfolio. We do not currently own shares, but it is high on our watchlist.

The Top 5

Our top 5 big-yield investment ideas are available to members only, and the full report is available here. The top 5 also includes several very attractive “honorable mentions,” so in aggregate, we review one more MLP, two style-specific equity CEFs, two more compelling REITs, two more very attractive BDCs and also our strong views on a great way to play the bond CEF space.

The Bottom Line

The market has been ugly this year, but that doesn’t mean it won’t get better. It will, and hopefully sooner than later. And to make the wait more tolerable, big-dividends can help (volatility doesn’t feel so bad if you keep getting paid big income). The big-yield investments we have shared in this report are particularly attractive for their compelling long-term price appreciation potential and their big steady distributions to investors.

Special Offer:

We are currently offering 50% Off all new memberships as part of our “Fall Back” Daylight Savings Flash Sale. *Offer expires Tues, Nov 8th.