For years, income-investors have decried the artificially low interest rates set by the Fed. However, if you’ve not been paying attention, things have changed significantly in recent months. Yields are a lot more interesting now, ranging from bond closed-end funds to specific individual bonds. In this report, we countdown our top 10 bond ideas for you to consider.

Without further ado, let’s get right into it.

10. PIMCO Dynamic Income (PDI), Yield: 13.6%

This is the widely popular, massive yield, PIMCO Closed-End Fund (“CEF”). It was formed in 2012 and it invests in fixed-income securities (bonds) from across the globe (primarily mortgage-backed securities, investment-grade and high-yield corporate bonds, developed and emerging markets corporate bonds, and sovereign bonds). Many investors have come to love PDI for its massive monthly income payments which have never been decreased (only increased) and which have been sourced primarily from income on the underlying holdings (and not necessarily any return of capital).

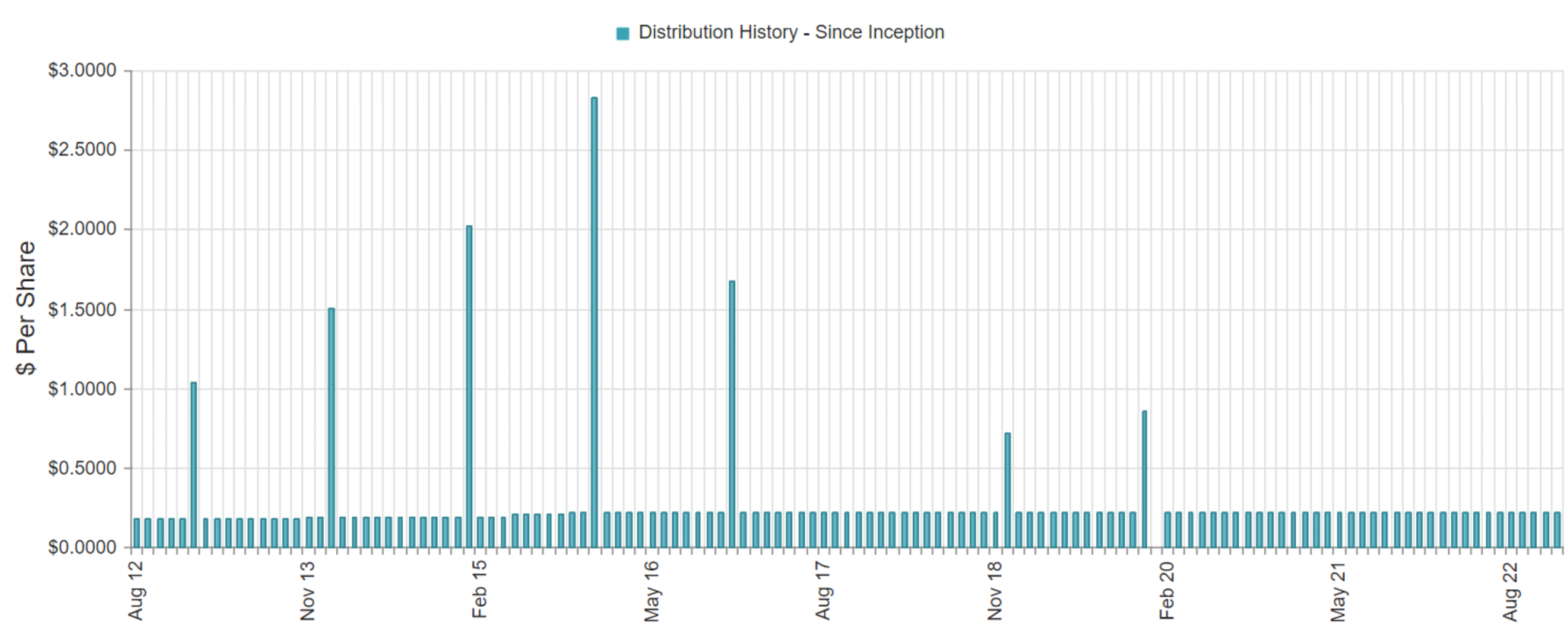

It also has a history of paying special dividends too (as you can see in the chart above). And you can have a look at its recent Undistributed Net Investment Income (“UNII”) in the table below.

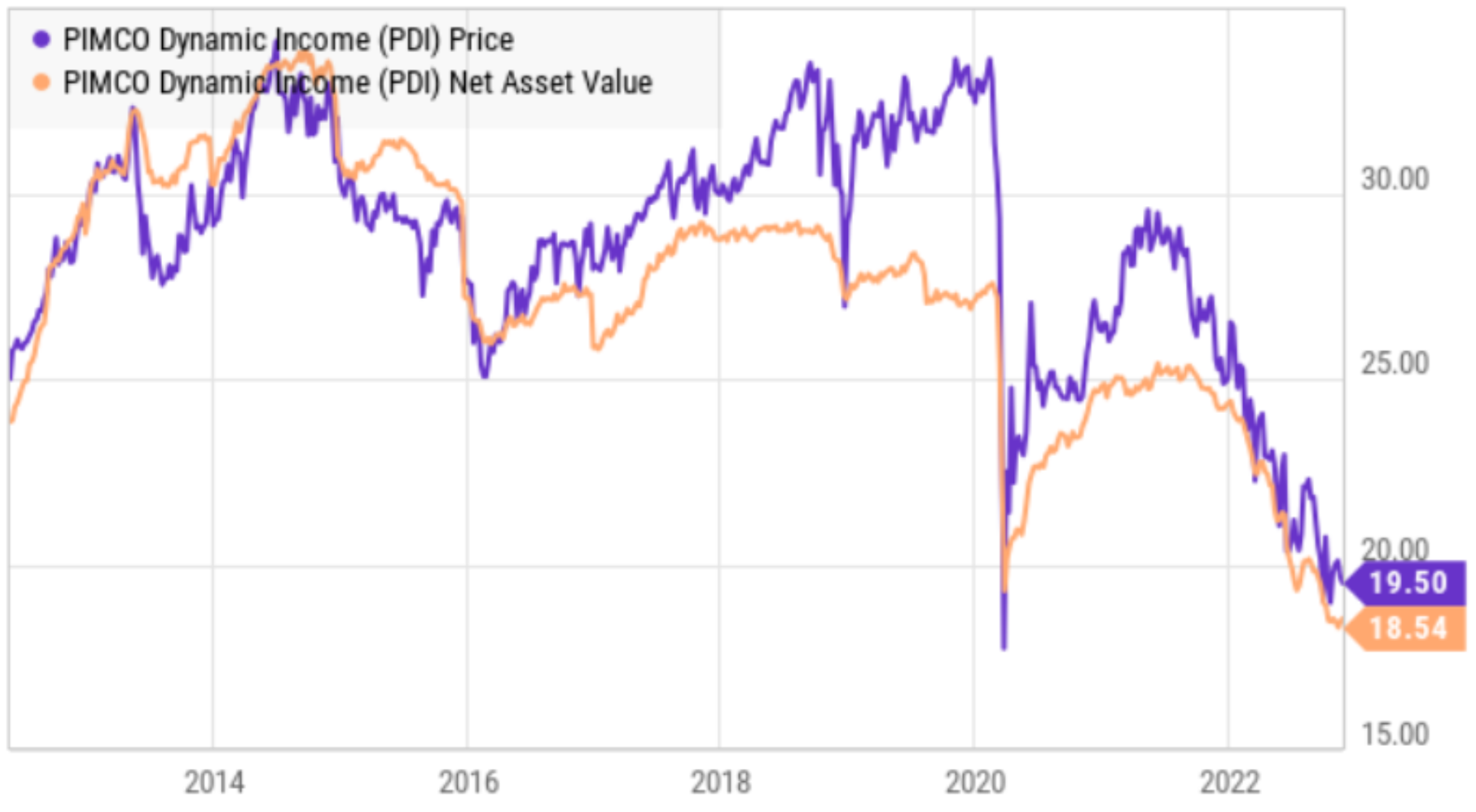

Importantly, even though many investors in this fund are focused mainly on the income payments, it’s been hard not to notice the massive price declines this year as the fed has been aggressively increasing interest rates (as rates rise, bond prices fall). And in PDI’s case, its use of leverage (or borrowed funds) helps keep the income payments high, but has also magnified the price declines this year.

Further, as the price has declined, the leverage percentage has mathematically risen, and now sits at over 48% (50% is the regulatory limit). This can create challenges (i.e. the potential to undergo forced sales of underlying holdings at less than attractive prices—thereby locking in loses—to keep the leverage ratio below 50%). However, even if this fund is forced to sell a few things at losses, and even if it is finally forced to reduce its distribution payment a little—it’ll still keep paying big income.

Also important, PDI currently trades at a relatively small price price premium versus its underlying net asset value (currently around ~5.2%), whereas the premium has been much larger at points over the last few years (as you can see in the price versus NAV chart above).

Furthermore, there are indications the Fed may slow its rate of interest rate hikes (and even reverse course in the second half of 2023, considering the latest CPI and PPI inflation numbers were slightly “less high” than expected) which bodes well for the price of this fund. If you are seeking big monthly income payments, PDI is worth considering.

9. 1-Year US Treasuries, Yield 4.7%

It might be odd to see US treasuries on this list, but the yield has amazingly gone from near 0% to 4.7% in the last year, and treasuries have some distinct advantages over bond funds. First and foremost, they’re 100% guaranteed by the full faith and credit of the US government. In this sense, they are a lot less risky than PIMCO bond funds, such as PDI.

Secondly, with only 1 year to maturity, you will have a lot of control over interest rate risk. Specifically, if you hold until maturity, you are guaranteed to get paid in full. Whereas the PIMCO CEFs may undergo forced sales of some of their underlying holdings (thereby locking in ugly losses, as described above) because the bonds they hold have longer maturities and thereby more interest rate risk. By holding an individual treasury bond, you have total control over when you sell and when you decide to lock in any gains or losses (besides, with only 1-year to maturity, the price won’t vary too much).

And what’s particularly interesting (besides the fact that the yield has gone from 0% to 4.7% over the last year) is that the 1-year treasury actually currently yields more than the 10-year treasury (see chart above). This unusual inverted yield curve can be a sign of and ugly recession (risk) on the horizon. So if you are looking for safe income, 1-year treasuries are surprisingly attractive right now.

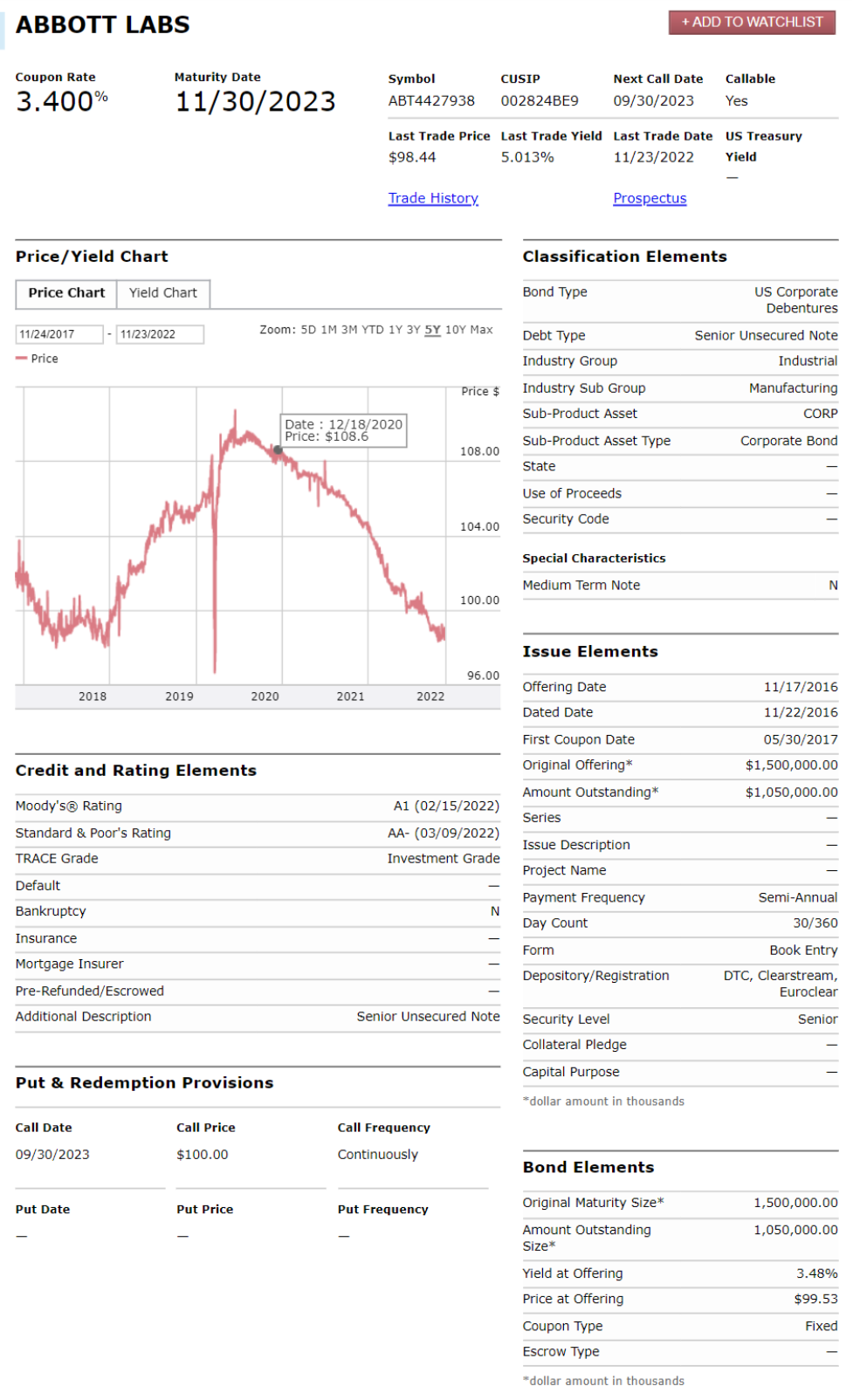

8. Abbott Labs 11/30/23 Corporate Bonds, Yield: 5.0%

Investment-grade corporate bonds (such as these Abbott Labs bonds) can offer even higher yields than treasuries over the same period of time. For example, these Abbott bonds mature in roughly 1-year and offer a yield (coupon payments plus price appreciation) of over 5.0%, as you can see in the graphic below.

Abbott is a highly-rated healthcare equipment company (pharmaceutical, diagnostic, nutritional and medical device products) with a very healthy investment-grade credit rating (currently AA- from S&P). Notably, you can see the price of these bonds (in the chart above) has fallen sharply over the last year (largely due to fed interest rate hikes) and now trade below the $100 price it will mature at in one year. It’s continuously callable at $100 starting at the end of September next year (so you’ll receive a price gain versus the price you can currently buy it at, if it get called early). Abbott is a good example of a corporate bond that’s gone from yielding close to zero (its price was recently well above $100) to now offering an attractive 1-year yield (little interest rate risk) between now and its roughly 1-year maturity date. A portfolio of attractive, relatively short-term, corporate bonds can be a great way to generate very healthy income.

7. Express Scripts 7/15/23 Corp Bonds, Yield: 5.7%

If you don’t know, Express Scripts is one of the largest pharmacy benefit managers in the world, and it was acquired by Cigna (CI) in 2018. Cigna is a highly-rated healthcare services company, and these bonds have a healthy investment-grade credit rating (A-) from S&P. They also trade below par and offer a juicy 5.7% annualized yield to maturity (3.0% coupon + price appreciation).

Like the previous Abbot Labs bonds, these Express Scripts bonds also traded well above par 1-2 years ago, but have fallen in price as interest rates have risen. They mature in July 2023 (with an earliest call date in May) thereby keeping interest rate risk low (i.e. they mature in just 8 months), and providing some compelling short-term income for investors.

6. PIMCO Dynamic Income Ops (PDO), Yield: 10.6%

We previously wrote about the attractiveness of this relatively new big-yield bond fund for our members-only (and it has since risen in price and narrowed in discount to NAV), and it still offers a compelling high-income opportunity. Some investors prefer PDI (mentioned above) simply because the yield is higher, but we view PDO as an even safer form of high income because the fund is less “stretched.” In particular, the strategies of the two funds are somewhat similar, but PDO is smaller in assets (more nimble) and trades at a better price relative to net asset value (PDO actually trades at a discount to NAV of around 4.6%).

Both funds have been paying distributions from income (not necessarily “return of capital”), but that may soon change for PDI considering its been challenging to keep income payments high (PDI has a higher payout ratio) while the NAV has been falling. It’s true rising rates have hurt the NAV this year, but will also incrementally help earn higher yields going forward (but we’re not entirely out of the woods yet as rates are expected to keep rising and PDI seems particularly “stretched” to maintain the status quo high distribution payments). Both funds are attractive, but we prefer PDO given the current rising rate environment.

Top 5 Bond Ideas:

Our top 5 bond ideas are reserved for members-only, and the report can be accessed here. The top 5 includes a variety of big-yield bond idea for you to consider (and we also cover a handful of additional high-income investments based mainly on lending strategies). The current market environment has changed dramatically, and there are currently a lot of attractive ideas worth considering.

Conclusion:

The yield on shorter-term bonds is now the highest it's been in over a decade. Some investors prefer owning bonds through very-high-yield CEFs (such as PDI and PDO), despite the risks. While others prefer owning individual bonds because of the distinct advantages (and especially now that shorter-term yields are up sharply).

Importantly, if you are going to invest in bonds, we recommend doing so through a diversified portfolio because it can help reduce your unwanted idiosyncratic risks. However, at the end of the day, you need to choose an investment strategy that is right for you; disciplined goal-focused long-term investing is a winning strategy.