Income investors often select big-dividend opportunities from across diverse categories in order to build a customized portfolio that is right for them. In this report, we share data on 25+ high-income opportunities from each of four categories, including Closed-End Funds (CEFs), Real Estate Investment Trusts (REITs), Business Development Companies (BDCs) and Master Limited Partnerships (MLPs). We also dive deeper into four specific opportunities (one from each category) that we believe are particularly attractive and worth considering for investment. We begin with a special focus on PIMCO’s Dynamic Income Fund (PDI), in light of its recent large reorganization, significantly decreased share price, and unusually small price premium (not to mention its very large 10.6% yield, paid monthly).

1. PIMCO Dynamic Income Fund (PDI), Yield: 10.6%

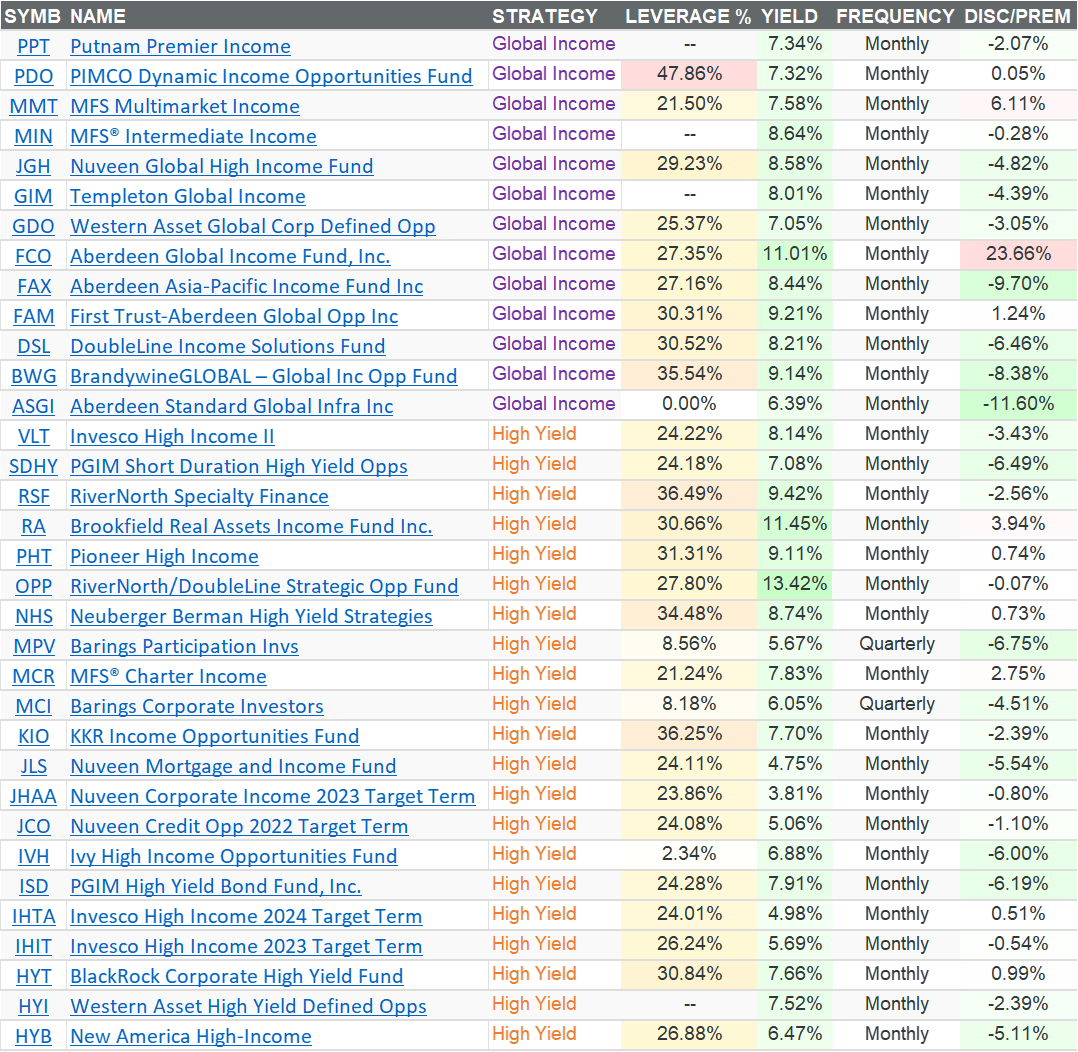

PDI is a closed-end fund. Like mutual funds and exchanged traded funds, closed end funds generally own a basket of securities (in the case of PDI, it owns over 900 securities—mainly bonds from a variety of sectors). However, unlike mutual funds and exchange trade funds, there is no immediate mechanism to ensure the market price of a closed end closely tracks the net asset value of the underlying holdings—and as such, CEFs can trade at wide discounts and premiums—thereby creating both risks and opportunities. For example, you can see the current discounts and premiums for a wide variety of CEFs (including PDI—see the “Multi-Sector” section) in the following table.

data source: CEF Connect

We currently own shares of PDI. We received them within the last month when PIMCO completed its consolidation of two other CEFs (PCI) and (PKO) into PDI. To be specific, we received 0.818509 shares of PDI for each share of PCI we owned.

Some PIMCO followers view the consolidation as a bad thing, but it’s not—and it has created an outstandingly attractive investment opportunity. For starters, both the NAVs and the once large price premiums on PDI, PCI and PKI all dropped precipitously leading up to the consolidation (contrarian investors like to “buy low”). Also, PCI investors (that now own PDI) are receiving a slightly smaller dividend going forward. Specifically, PCI shareholders went from receiving a $0.1740 dividend per share to a $0.2205 dividend per share, and even though this sounds like an increase, it’s actually a small decrease when you consider the factor by which you received less PDI shares (see above) per each share of PCI you owned. And this small decrease is totally fine because it’s still a big dividend and it’s now safer than it was before the reorganization because PDI now benefits from greater economies of scale.

Additionally, as mentioned, PDI now trades at an unusually small premium to NAV versus history (keep in mind most PIMCO funds have a history of trading at large premiums because investors are attracted to the expertise, competencies and resources of PIMCO). Here is a look at PDI’s historical price versus NAV, since inception.

source: CEF Connect

Keep in mind this price chart (above) doesn’t include the dividend, and when you do include the dividends (see chart below) the total return story continues to be quite attractive (PDI is all about the dividends).

At this point, we’d also be remiss not to mention PIMCO’s relatively newer bond CEF (PDO). This CEF was launched in 2021 and it’s not yet captured by the CEF Connect screening tool we used to generate the earlier CEF list table above. PDO only offers a 7.3% distribution yield, but it currently trades at a 0.05% discount to NAV (extremely rare for a PIMCO bond fund).

Also important, you’ll notice the “Leverage %” column in our earlier table. Many CEFs use leverage (or borrowed money) to help magnify returns. This can be a great thing when the market goes up, but a big risk when the market goes down. In our view, the amount of leverage used by PDI is relatively high, but not unreasonable given the types of bonds the fund holds (and if it ever trades at a big discount—like it did around March 2020—that’s generally a buying opportunity).

Lastly, a lot of people like to brag about PIMCO’s history of never cutting the dividend (true for both PDI and PDO), but this is truly less important so long as the dividend remains big, and the fund remains healthy (true for PDI—especially after the reorganization). Also, PDI has a history of paying the dividend mainly from interest on the underlying holdings (this is also important because it impacts taxes differently (if you own it in a taxable account) as compared to long-term capital gains and especially return of capital (return of capital can reduce your cost basis—thereby leading to a potential capital gain surprise if/when you ever do sell your shares).

Overall, we view PDI as attractive and worth considering if you are an income-focused investor. And we hope the list of data on other CEFs included above is helpful to you too.

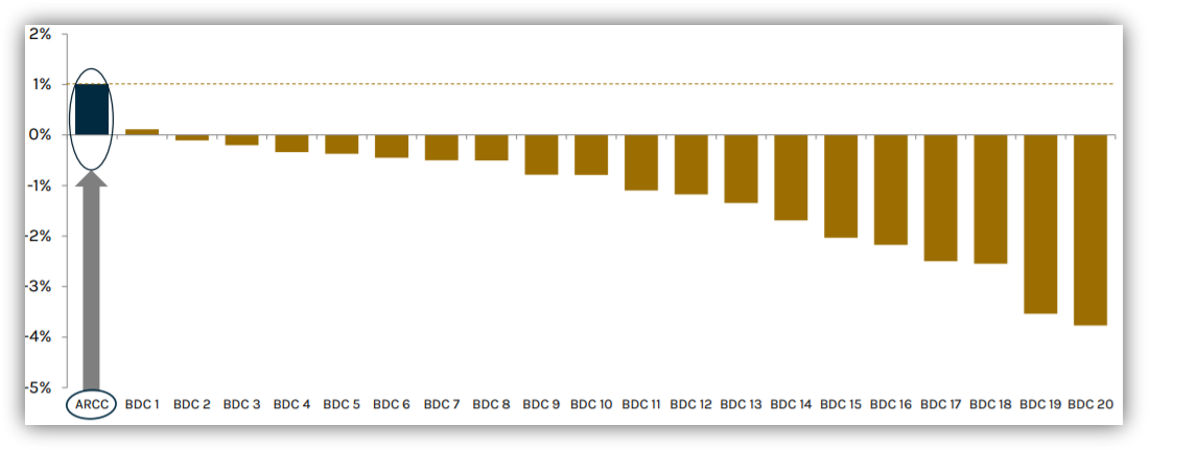

2. Ares Capital (ARCC), Yield: 7.9%

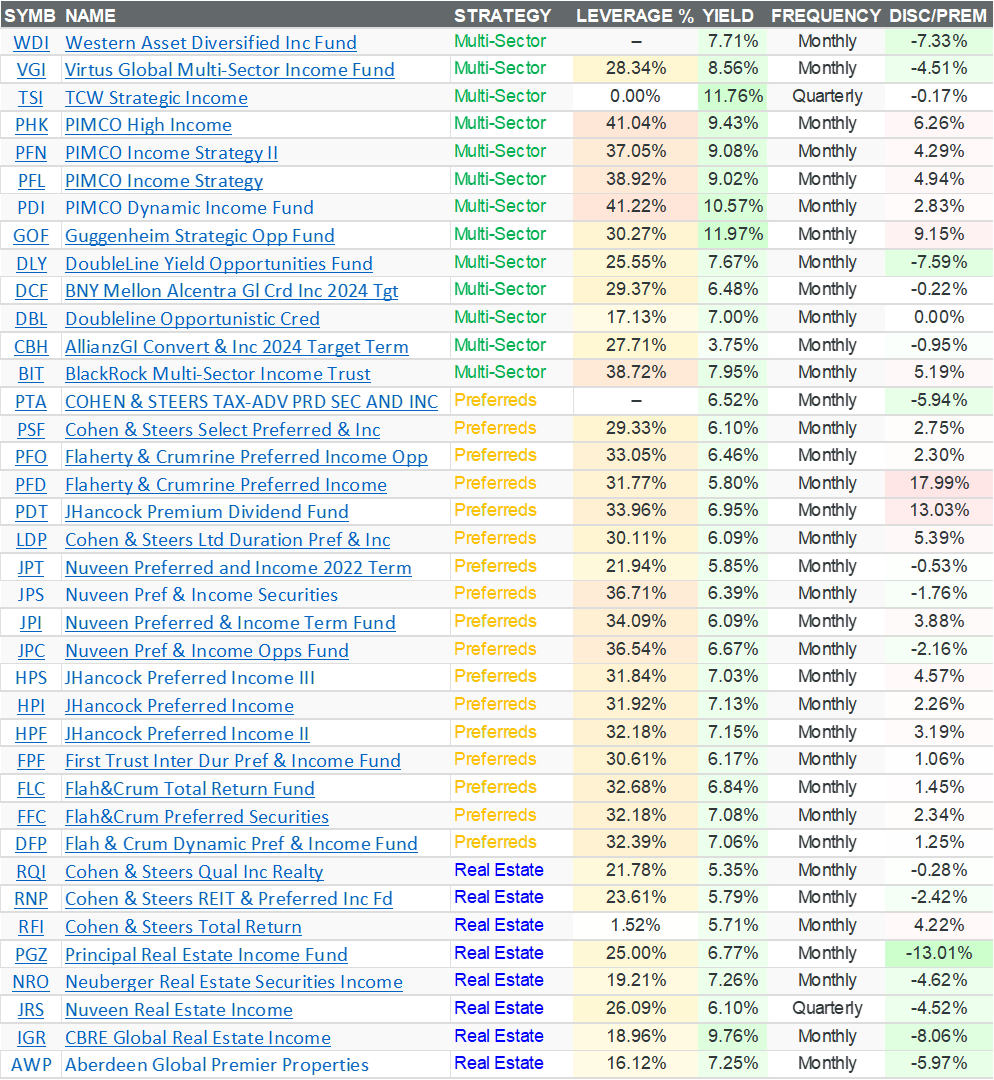

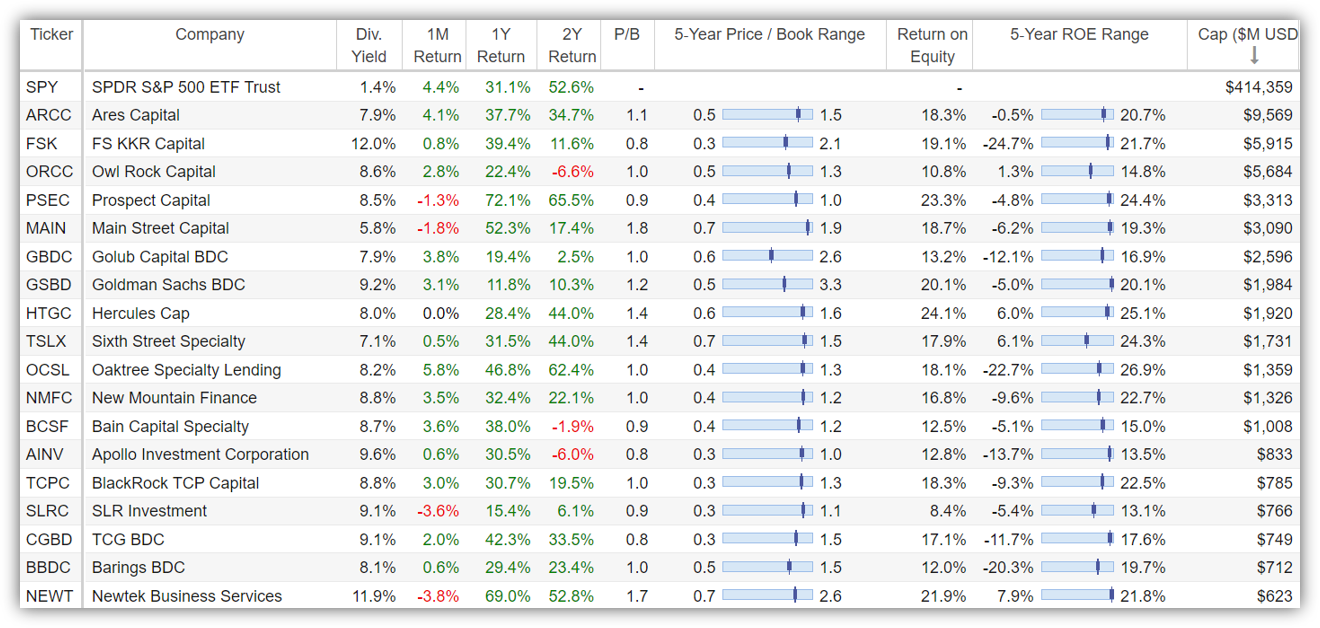

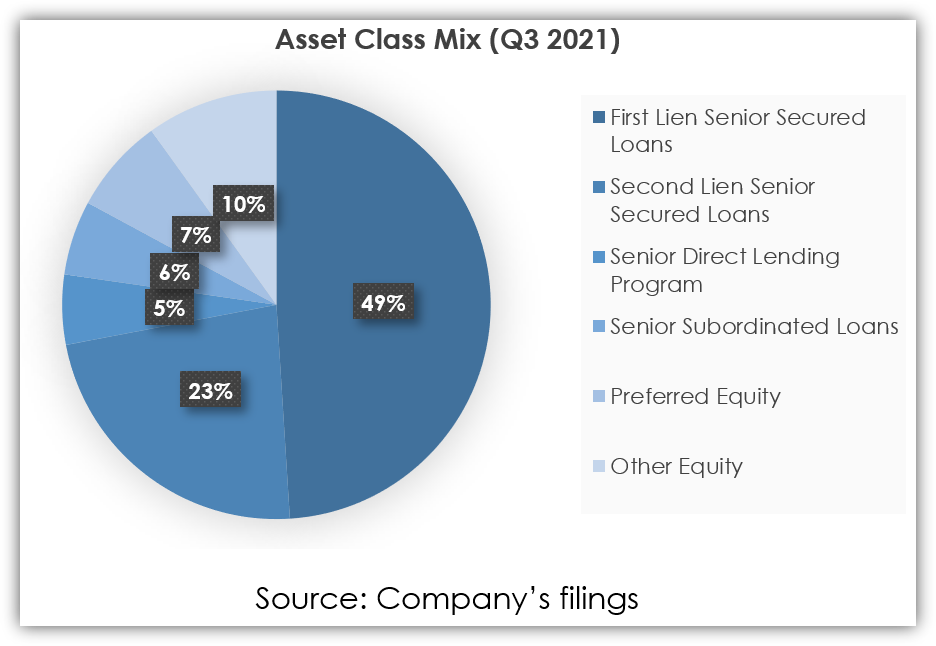

Ares Capital is a big-dividend BDC, and as you can see in our table below (BDCs sorted by market cap), Ares is the biggest.

source: StockRover

For your consideration, here are a few key ARCC highlights; we like it because of its:

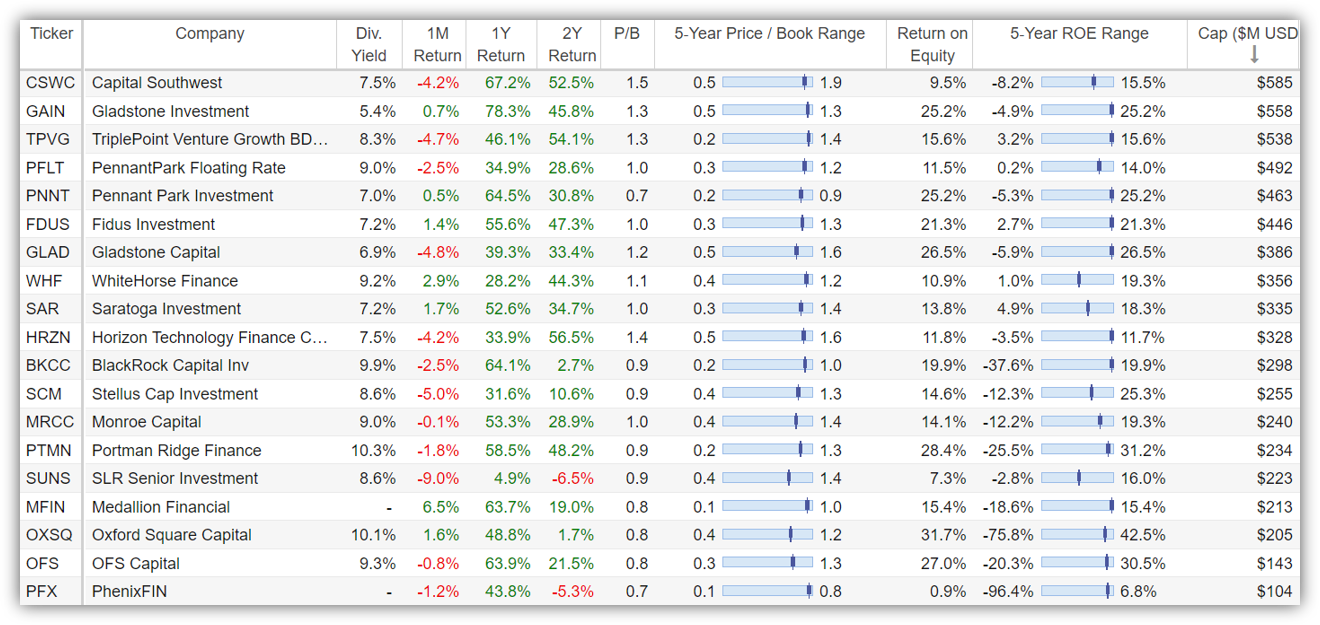

Low exposure to cyclical industries:

source: Company’s filings

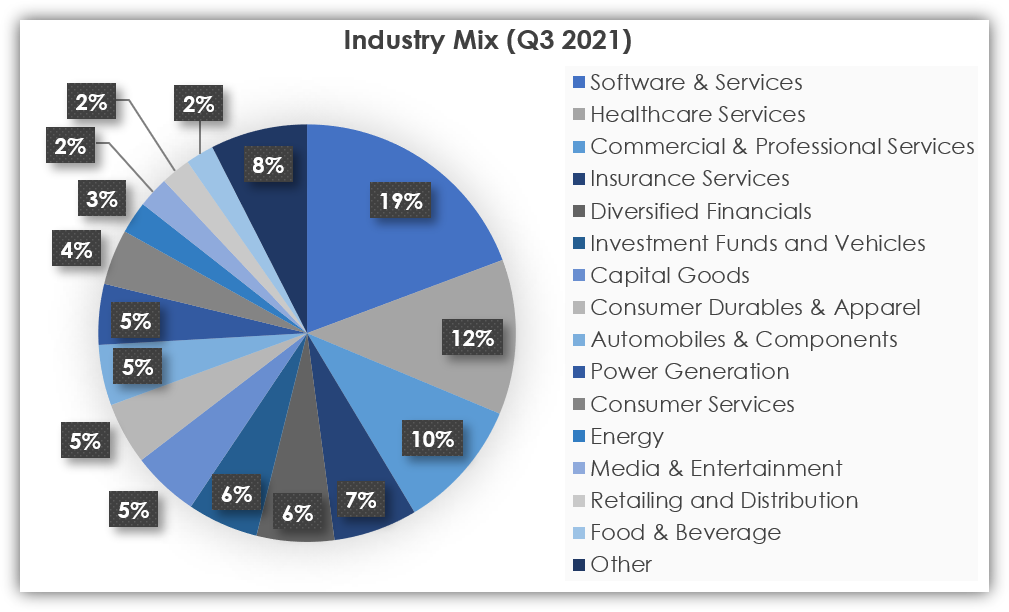

…and impressive portfolio quality:

We also like Ares extensive industry relationships and its conservative balance sheet. Further, we like the powerful economies of scale, highly experienced investment committee and consistent/stable dividends. Not to mention the fact that Ares has continued to deliver impressive performance and demonstrated strong resilience during economic slowdowns.

Ares Annualized Overall Net Realized Gain/Loss Rates (incl. equity gains) Versus Peers, source: Ares’ Q3 Investor Presentation

From a valuation standpoint, Ares currently trades slightly above book value (see our earlier table), but still below historical highs. And even though its big yield is marginally below pre-COVID levels, it is important to note that in the context of a low interest rate environment that is likely to persist for a long time, we consider this yield highly attractive, especially considering the defensive and quality portfolio the firm manages.

Overall, we view Ares Capital as attractive. If you are an income-focused investor, it’s worth considering for a spot in your portfolio.

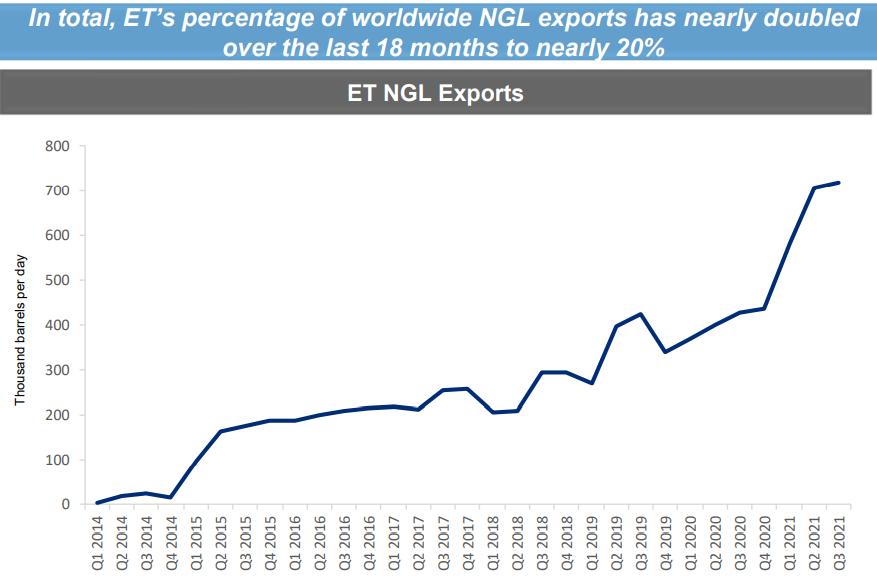

3. Energy Transfer (ET), Yield: 7.5%

Headquartered in Dallas Texas, Energy Transfer is one of the largest and most diversified midstream energy companies in North America. It has approximately 114,000 miles of pipelines and associated energy infrastructure across 41 states transporting the oil and gas products “that make our lives possible.”

Importantly, Energy Transfer is a master limited partnership (“MLP”). This means is has units (not shares) and it pays distributions (not dividends). An MLP is a publicly traded partnership (that facilitates the passthrough of income to its partners), and this essentially avoids double corporate taxation on profits.

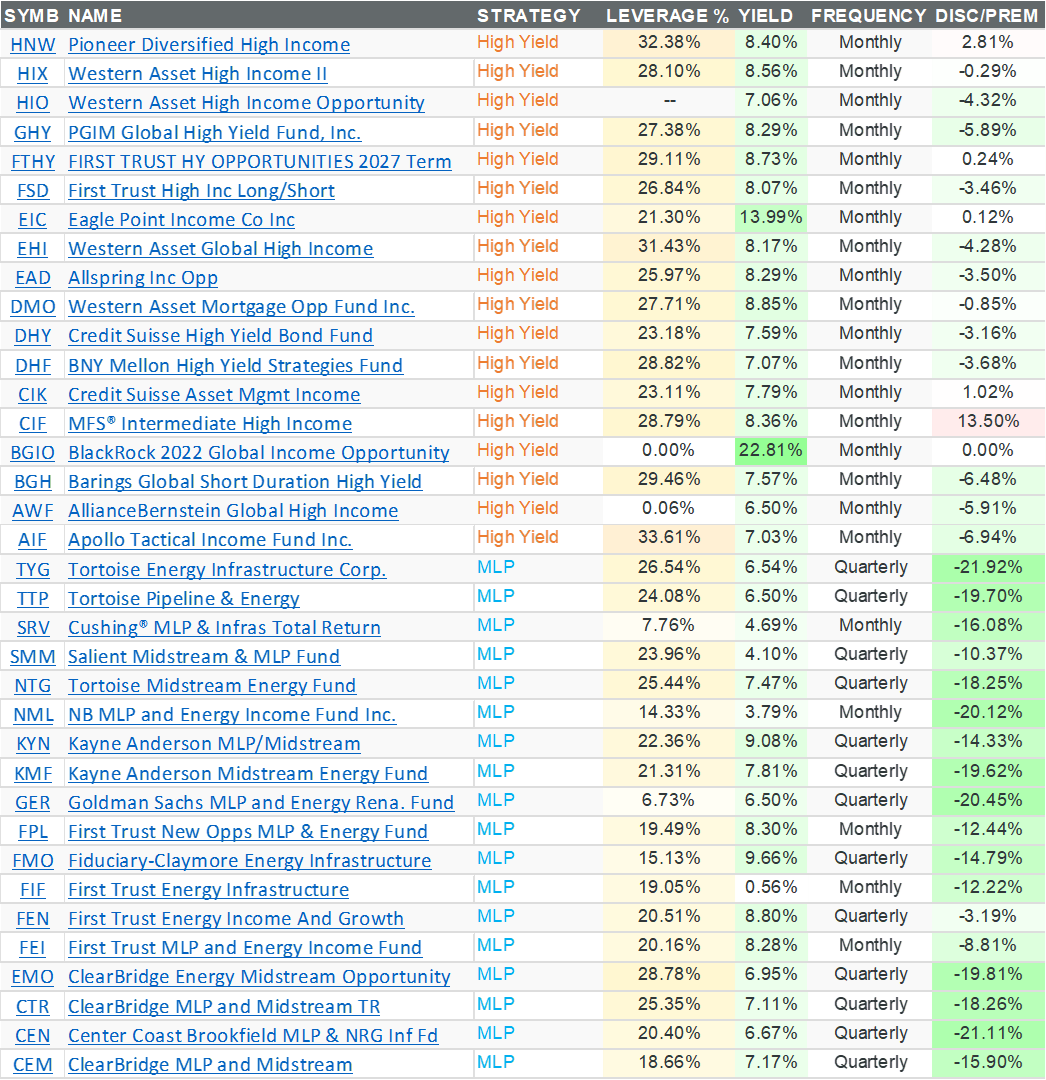

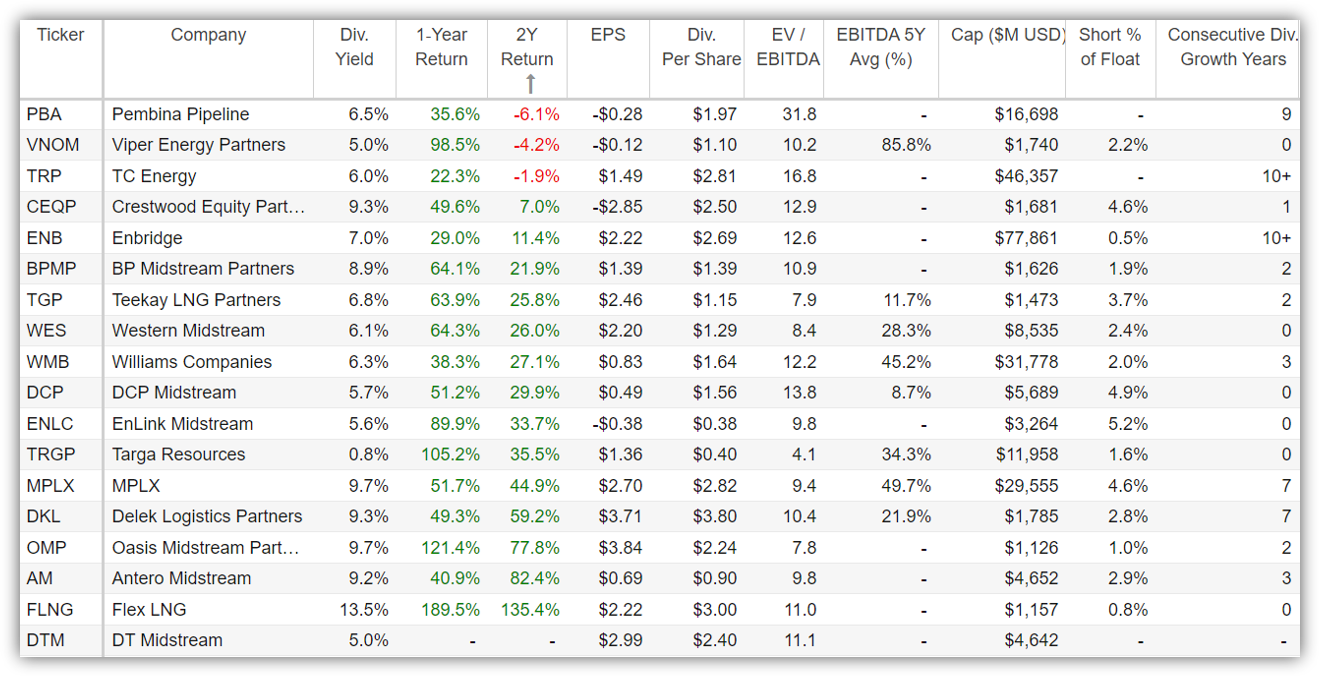

For your consideration, the following table includes data on other MLPs and midstream companies (note: they are NOT all MLPs, but they are all in the same general industry).

Energy Transfer is currently attractive for a variety of reasons, not the least of which is its low valuation (in our view, it is significantly undervalued on an EV/EBITDA basis).

The units have declined for a variety of reasons, while the outlook for the company is generally healthy. For starters, the share price slumped dramatically at the start of the pandemic (as demand and customer “going concern” questions spooked some investors), and the distribution was reduced by 50% in October 2020 in an effort to reallocate capital (the unit price has still not fully rebounded). However, ET continues to have healthy relationships with many large customers (thanks to its large and diversified assets) and demand for natural gas exports in particular is strong and growing (not to mention the benefits of the ongoing US shale oil and gas expansion).

source: investor presentation

On the risk side, the company is plagued by legal battles and challenges, such as those that seek to stop the Dakota Access pipeline, as well as this week’s $410 million fine that must be paid to Williams Companies (WMB). Furthermore, the traditional energy industry (including ET) is in the direct crosshairs of environmentalists, fossil fuel haters and ESG investors in general (despite the fact that traditional energy is absolutely not going away anytime soon).

Overall, and despite the risks and opposing viewpoints, we view Energy Transfer as attractive. In particular, we believe the units could (and should) trade at a significantly higher EV/EBITDA multiple, and we believe the company could consider distribution increases within the next year (following its improved financial condition since the pandemic and the related distribution reduction).

4. AGNC Investment Corp (AGNC), Yield: 9.3%

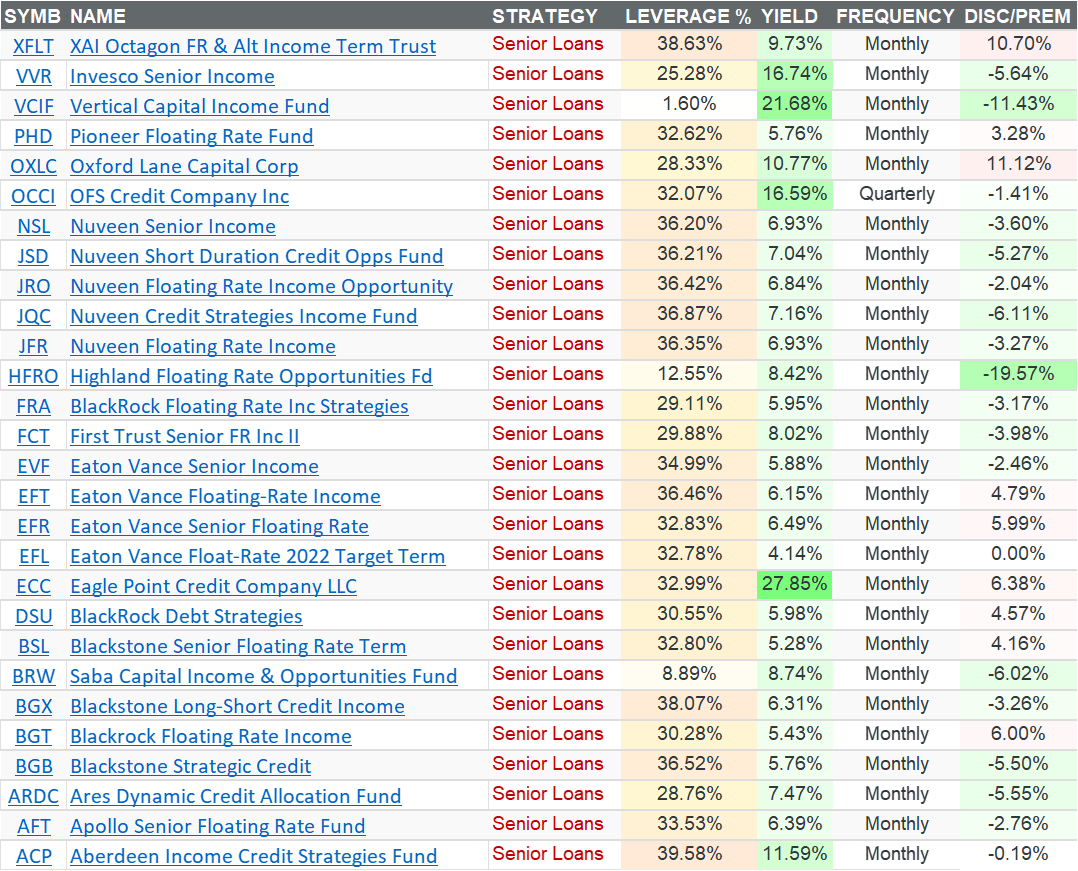

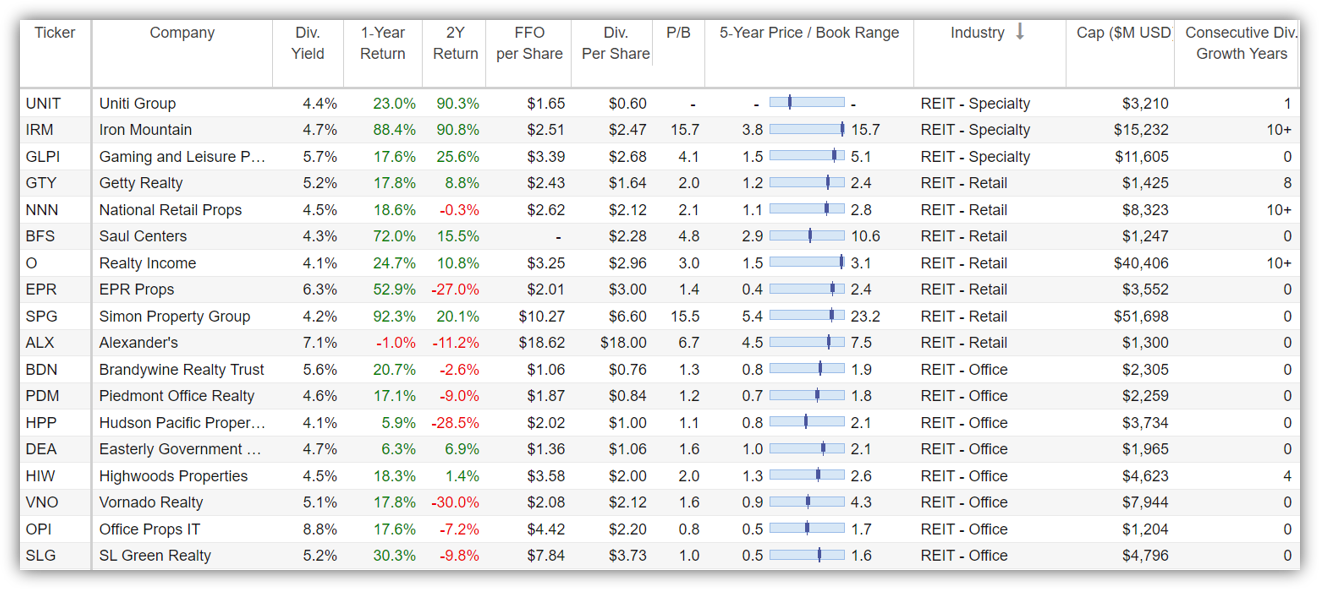

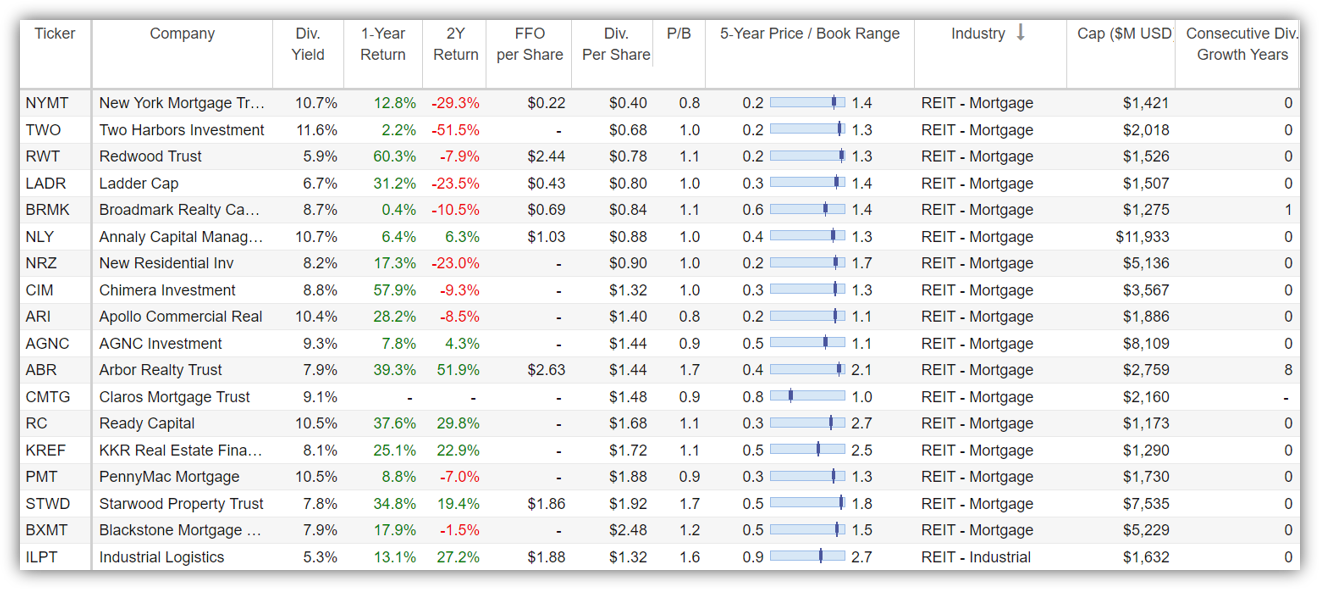

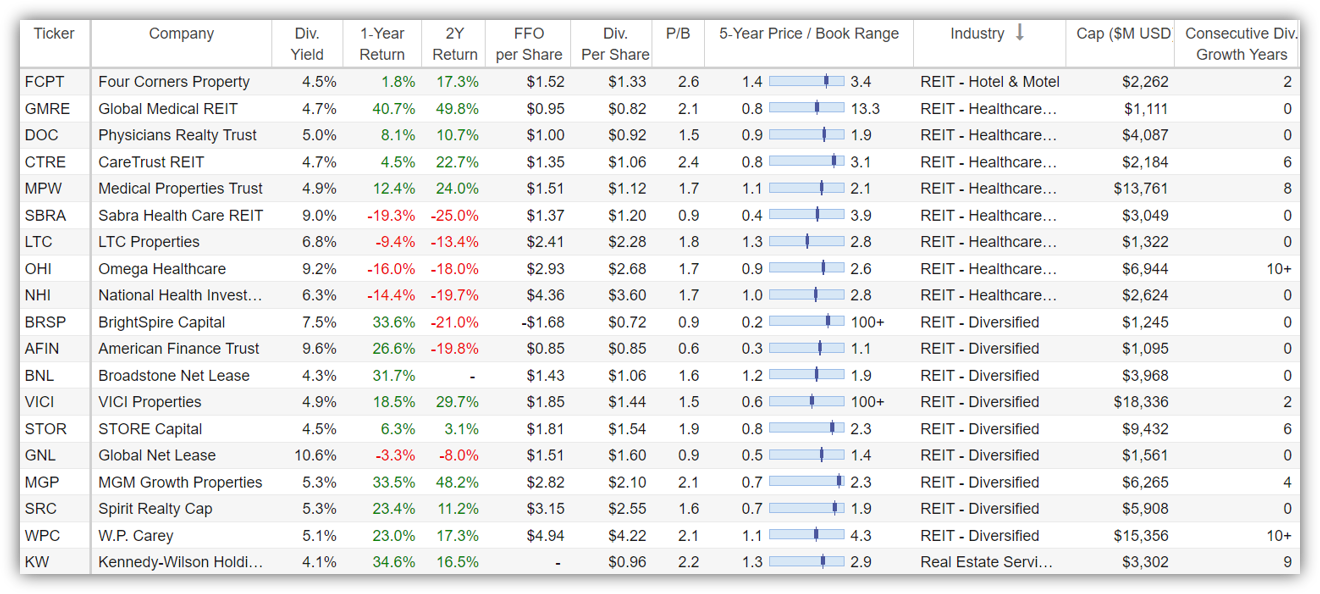

Mortage REITs (such as AGNC) are a lot different than property REITs. But in a lot of ways, mortgage REITs are easier to understand and value, especially in cases such as AGNC where the majority of the company’s investments as Agency Mortgage Backed Securities (Agency MBS) that are essentially backed by the US government (thereby adding a unique level of safety). Before diving deeper into AGNC, let’s first have a look at recent performance and price-to-book value metrics for REITs (sorted by REIT industry).

As you can see in the table above, mortgage REITs have wide ranging performance over the last 1-year, and some of the weakest 2-year performance among all REITs. The reason for the weak 2-year performance is the pandemic distress. In particular, mortgage REITs use a higher level of leverage (or borrowed money) than do many other REITs (and this is fine considering the higher liquidity of the publicly traded mortgage securities many mortgage REITs hold—such as Agency MBS, as mentioned earlier).

However, when the pandemic first hit, there was such an insane demand for low-risk agency securities that liquidity actually dried up (no one was willing to sell). This lack of liquidity forced some mortgage REITs to sell balance sheet assets at fire sale prices to meet margin calls. Ultimately, the Fed stepped in to add liquidity to the bond markets within a matter of weeks, but the damage had already been done; many higher-leveraged mortgage REITs were forced to sell assets at low prices thereby causing permanent damage to their balance sheets and in some cases dividends were cut (this is the big reason so many mortgage REITs have such weak 2-year performance numbers—i.e., the pandemic).

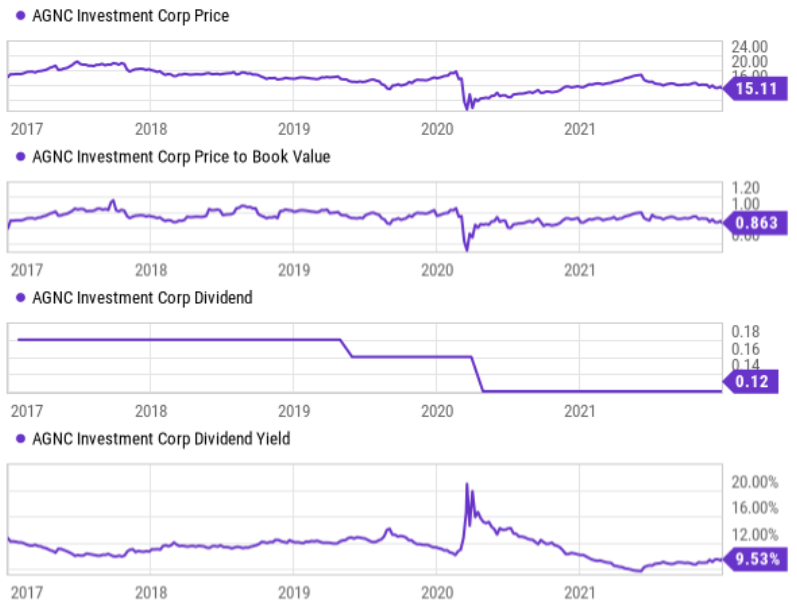

Fast forward to now. The fixed income markets are functioning well again (with a high level of liquidity—thanks to the actions of the fed). And going forward, the fed will be able to act even quicker to solve any potential liquidity crunches (based on what they learned in 2020). Furthermore, if you had bought select mortgage REITs near the bottom (as we strongly recommended to our members) you would have made out like a bandit. For example, here is a look at AGNC’s five-year performance.

source: YCharts

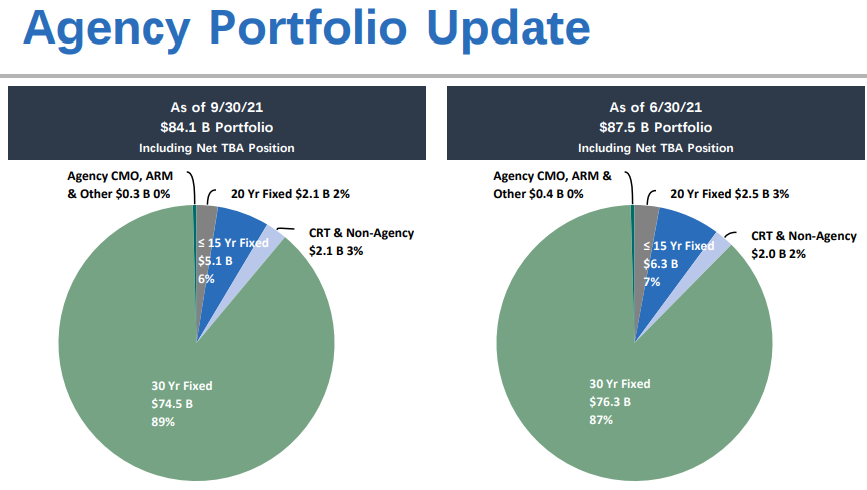

And here is a look at AGNC’s current investment assets.

source: investor presentation

Generally speaking, you can get a decent high level assessment as to whether a mortgage REIT is expensive or attractively valued by comparing its market price to its book value. And in the case of AGNC, it currently trades at a discount, and in our view, this makes it attractive for investment (see earlier price-to-book-value chart).

Also important, financial leverage (risk) is down for AGNC. According to AGNC CEO Peter Federico (during the most recent earnings call):

Given this macroeconomic uncertainty, we continue to favor operating with a more conservative risk profile. Looking ahead, we believe we are very well-positioned for the current environment with a well-balanced asset portfolio, significant hedge protection, and leverage at around 7.5 times.

Basically, we view AGNC’s balance sheet assets as attractive and its share price as compelling. If you are looking for a big dividend, trading at a discounted price, AGNC is worth considering for a spot in your portfolio.

Conclusion:

In our view, all four of the big-dividend opportunities highlighted in this report are attractive and worth considering for investment, depending on your own personal situation. In fact, we currently own three of the four (PDI, ARCC and AGNC). Additionally, we hope the 100+ investment idea data shared in this report is helpful to you. However, before you go investing in any of these ideas, first make sure it is consistent with your own personal investment goals. Disciplined, goal-focused, long-term investing is a winning strategy.

Further, if you’d like to view all 39 of the holdings within our Income Equity Portfolio (including more REITs, BDCs, CEFs, MLPs and attractive dividend stocks that we currently own), consider a membership to Blue Harbinger. You’ll get access to all of our current holdings, including real-time pricing, ratings and “buy under” prices. You’ll also get a steady flow of new investment idea reports for you to consider. Learn more—get instant access.