The media seems to give obsessive praise to tech stocks with big market caps (such as here, here and here), yet seems to often overlook the big relentless profits generated by big banks. In this week’s Blue Harbinger Weekly, we review the big banks (with a special focus on Citigroup (C)—currently offering a big 3.4% dividend yield, trading at a big discount versus book value and poised to benefit from the Fed’s 3 expected interest rate hikes in 2022), compare them to top growth stocks (those with the highest sales growth rates—many of which have sold off extremely hard in recent weeks) and share a few specific top investment ideas as we head into the new year (including Citigroup, two high-growth stocks and an important reminder about how you should be positioning your current investment portfolio).

Big Market Cap Tech Stocks Versus High Profit Big Banks

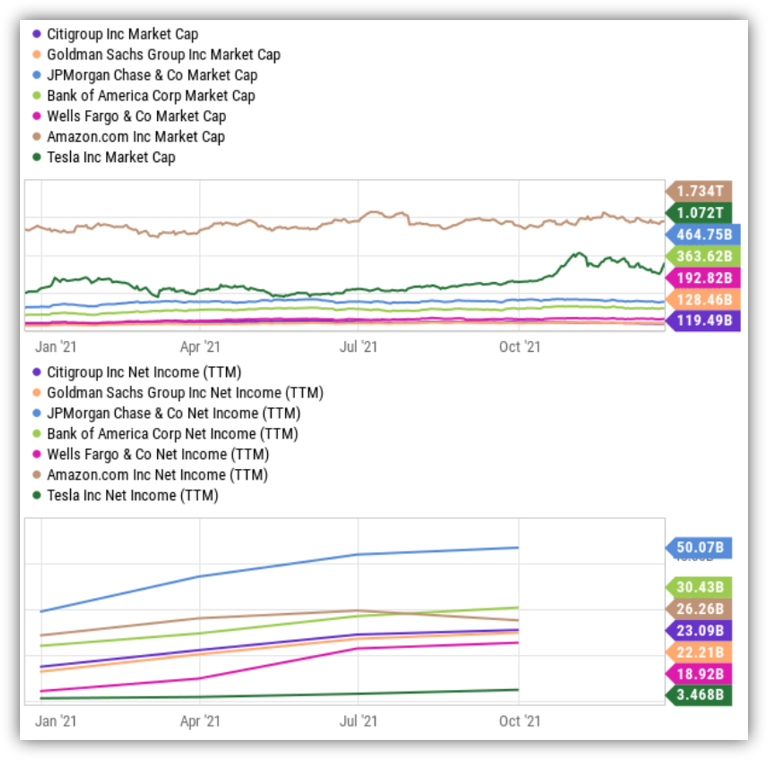

Stocks with high sales growth rates performed extremely well since the start of the pandemic in 2020—regardless of the fact that many of them had relatively small profits (such as Tesla (TSLA) and Amazon (AMZN). On the other hand, big banks have consistently generated big profits, but have received far less attention and have far lower market caps.

source: YCharts, data as of 12/23/21

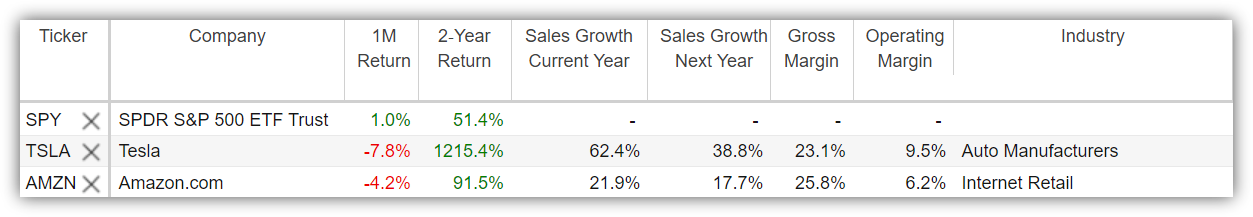

However, we saw steep market declines for most top growth stocks in recent weeks (see table below) as the Fed raised interest rate expectations (bad for growth stocks, as we explained in great detail in last week’s Blue Harbinger Weekly: The Fed Hates Savers) which coincidentally may be a strong positive for big banks (i.e., higher interest rates means bigger net interest margins and bigger profits for big banks).

For a little perspective, here is a look at the 1-month and 2-year performance for top growth stocks (those with expected revenue growth rates over 20% for 2021 and 2022).

source: Stock Rover, data as of 12/23/21

And for more perspective, here is a look at price versus (tangible) book value for the big banks (anything below one is considered a discount and theoretically attractive).

source: YCharts

Where are you putting your money for 2022?

Some investors believe the recent sell off in top growth stocks has created an extremely attractive long-term buying opportunity heading into 2022. While others believe those stocks were just a pandemic trade fluke, and now is the time for value stocks to shine—such as big banks (which will benefit from the fed’s three expected interest rate hikes in 2022).

Arguably, there is room for select winners from both categories (of course depending on your own personal investment goals, timeframe and volatility tolerance), and we’ll review a few specific examples in the remainder of this report, starting with Citigroup.

Citigroup: Dividend Yield: 3.4%

As you saw in the earlier price-to-book value chart, Citigroup trades at a steep discount, especially as compared to other big banks—which currently trade at premiums. Theoretically, the discount makes Citigroup very attractive. However, it would be a bad move to invest in Citigroup simply because it has a low price-to-book value (that was the case for many big banks right before the ‘08-’09 financial crisis, and big banks turned out to be a catastrophically bad investment back then).

3 Reasons Why Citigroup is Cheap:

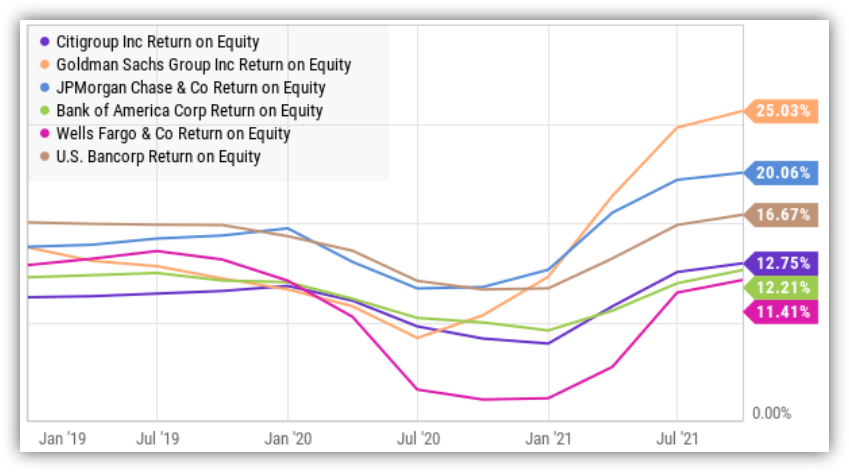

Less Premier Brand Name: Citigroup doesn’t have the same premier brand name as other banks (such as Goldman Sachs (GS) and JP Morgan (JPM)) and it will therefore command a lower price multiple permanently (as it’s simply not able to earn as high of a return on equity as such banks (Citi’s ROE is still strong (+12.75%) just not as strong as Goldman and JP Morgan (+25% and +20%, respectively).

source: YCharts

Big, Diverse and Hard to Manage: Citigroup is very large and diverse and difficult to manage operationally. For example, Citigroup in currently under increased regulatory scrutiny for mistakenly wiring hundreds of millions of dollars to the wrong place.

Legacy of Bad Assets: Following the ‘08’-’09 financial crisis, Citigroup got stuck holding many of the worst assets among big banks. And while the bank currently passes stress tests and meets regulatory capital requirements, that is a tough legacy to shake.

7 Reasons Why Citigroup is Attractive:

New CEO Jane Fraser took the helm in early 2021, and she is on a mission to improve the bank’s operations.

Stong International Operations sets Citigroup apart from its peers, and creates expanded opportunities for growth.

Strong ROE: Despite Citigroup’s discounted price (versus tangible book value), the bank still generates an attractive 12.75% return on equity. The business is very profitable.

Lower Risk: Citigroup is far less risky now than it was going into the great financial crisis in ‘08-’09. For example, Citigroup continues to pass regulatory stress tests and capital ratio requirements, which requires the balance sheet be significantly healthier (and less risky) than it was in decades prior.

Strong Dividend (and share buybacks): Citigroup currently offer the highest dividend yield (3.4%) of the big banks, and this yield is well covered. Specifically, the payout ratio (including dividends and share repurchase) was 92% in Q3 (healthy), despite the fact that buybacks have temporarily been put on hold this quarter.

Rising Interest Rates: The Fed is expected to increase rates three times in 2022, and this is good for Citigroup’s net interest margin and profits.

Contrarian Opportunity: Citigroup is basically the only big bank with room for improvement. Because of its weaker history, weaker brand name, and bigger discount (to tangible book value), Citigroup is arguably the only big bank with significant room available to improve.

3 Citigroup Risks:

Worth mentioning, Citigroup faces significant risks, including the potential for regulatory requirement changes, shifts in Fed policy (and interest rates), and the potential for more operational errors (such as the massive erroneous wires).

Citigroup Bottom Line:

If you are an income-focused, contrarian value investor, Citigroup is worth considering for a spot in your prudently diversified portfolio. It’s profitable, offers a big dividend, trades at a discount, and continues to make strides towards significant improvement. I have added Citigroup to my income securities watchlist. Members can view my full report on Citigroup here.

Growth Stock Ideas for 2022:

Just because Citigroup offers a big dividend and has a lot of attractive value stock characteristics, that doesn’t mean zero-dividend growth stocks can’t also be attractive on a select basis (especially after the recent bloodbath selloff).

I am highlighting two attractive high-growth stock examples below because of their high sales growth, high profitability and recently decreased share prices. The high current profitability is important because as interest rates rise, near-term earnings are worth relatively even more than longer-term future earnings (because higher interest rates means higher future earnings discount rates).

Enphase Energy (ENPH): Enphase makes semi-conductor based microinverters used in solar powered home energy solutions. According to the company’s estimates, its total SAM (Serviceable Addressable Market) stood at $4.1B in 2020 and is expected to reach $14.1B by 2023, thereby growing at a CAGR of over 50%. This expansion in SAM is primarily driven by increasing adoption of the company’s smart AI-based Enphase storage system as well as continuous introduction of additional products. Not to mention, the added interest in alternative energy related to rising traditional energy prices (for example, oil prices have risen dramatically in 2021).

What’s more, Enphase is already significantly profitable (unlike many other high growth stocks), and the share price has recently declined sharply (thereby making for an increasingly attractive entry point). See the earlier growth stock table for Enphase data.

Generac Holdings (GNRC): Generac is known for manufacturing power generators (and related products) but has recently opened up significant growth opportunities in the “clean energy” and “smart grid 2.0” spaces. It has also recently been benefiting from increased demand for standby home generators (due to frequent power outages in the US as a result of harsh weather conditions). Not to mention, the recent California ban of gas-powered generators by 2028.

As an investment, Generac’s comprehensive set of offerings is uniquely positioned to benefit from the large market opportunity ahead. Furthermore, the shares have recently sold off hard (see our earlier table) thereby making for an increasingly attractive entry point for investors. I recent wrote in great detail about Generac’s attractiveness, and you can access that report here.

If you are looking for more top growth stock ideas, you can review the names I follow on my growth stock watchlist here.

Conclusion:

Investors often get narrowly focused on only one type of stock, such as high growth stocks, attractive value stocks or big dividend stocks. However, attractive opportunities can and do arise across different types of investments, and it can be valuable to keep your eyes open.

Importantly, you should be positioning your own personal investment portfolio to meet your own personal needs. That means if you are a low-volatility, income-focused investor—don’t go dumping your entire nest egg into high growth stocks just because they sold off in recent weeks. Rather, stay focused on your goals, and stick to your strategy. Disciplined goal-focused long-term investing is a winning strategy.