This week’s Weekly reviews how the Fed’s monetary policy continues to create winners and losers in the market (such as Palantir). More specifically, by fiddling with interest rates and expanding its balance sheet (in an attempt to address its dual mandate of full employment and moderate inflation), the Fed harshly rewards and punishes market participants. For example, low interest rates punish savers and reward aggressive growth stock investors. This report reviews the Fed’s recent monetary policy actions, shares data on 50 aggressive growth stocks being impacted, dives deeper into a specific attractive growth stock example (Palantir (PLTR)), and then concludes with a strong suggestion on how you might want to “play” current market conditions, especially Palantir.

For reference, you can view last weeks Blue Harbinger Weekly here.

The Fed’s Dual Mandate

In case you don’t know: “The monetary policy goals of the Federal Reserve are to foster economic conditions that achieve both stable prices and maximum sustainable employment.” For better or worse, these are very broad goals that create risks and opportunities for investors. What’s more, the Fed’s main tools to implement monetary policy (i.e. setting interest rates, bank reserve requirements, and more recently purchasing bonds and other assets in the open market to affect the money supply) are also very broad—again contributing to risks and opportunities for investors.

The Fed Moves Markets—A lot!

Relative to the last 30 years, recent inflation numbers have been hot. Very hot!

(source: YCharts)

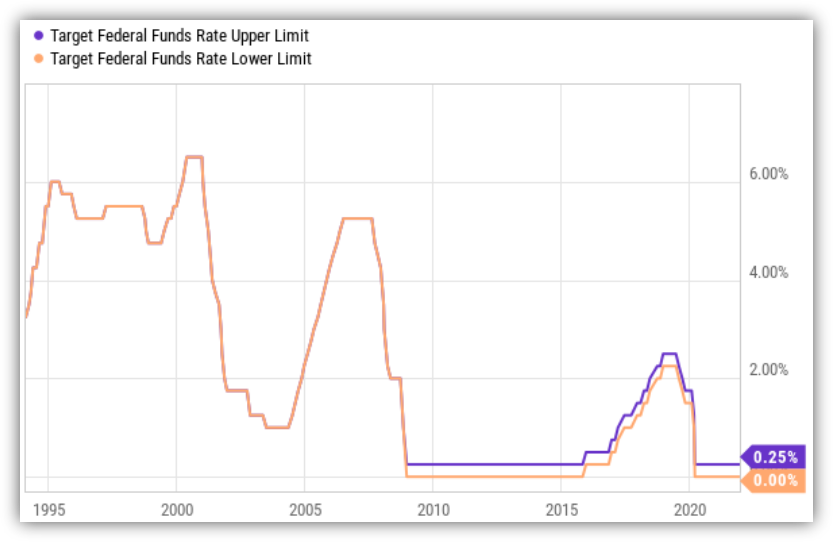

The commonly accepted reason for the spike in inflation is because the Fed lowered interest rates dramatically (and bought a ton of bonds) at the start of the pandemic in order to reduce the unemployment rate by stimulating the economy (i.e. part of its dual mandate).

(source: YCharts)

But now with the unemployment rate “supposedly” back to low levels (a lot of people are just no longer eligible for unemployment benefits so they’ve fallen out of the unemployment count) the Fed is dramatically shifting its monetary policy by raising rates—an attempt to slow inflation (the other part of its dual mandate).

(source: YCharts)

In fact, the Fed is now expected to raise rates 3 times in 2022, and this is having a dramatic negative impact on high-growth stocks. For example, the chart below shows the performance of the S&P 500 (SPY) versus the Nasdaq 100 (QQQ) and the ARK Innovation ETF (ARKK). QQQ is considered more “growthy” than the S&P 500, and ARKK is dramatically more “growthy” than both.

(source: YCharts)

Growthier stocks performed extremely well when the Fed starting cutting rates in 2020 (to fight the pandemic) because growth stocks are valued more based on expected future earnings, and the value of those future earnings increases as interest rates fall because those future earnings are discounted back to the present value using a lower interest rate.

However, with rates expected to rise again, growth stocks have been crashing hard (as you can see in the chart above). Not to mention, investors’ decreasing concern with the pandemic (for better or worse) is adding to selling pressure on high-growth, naturally-socially-distanced, tech stocks.

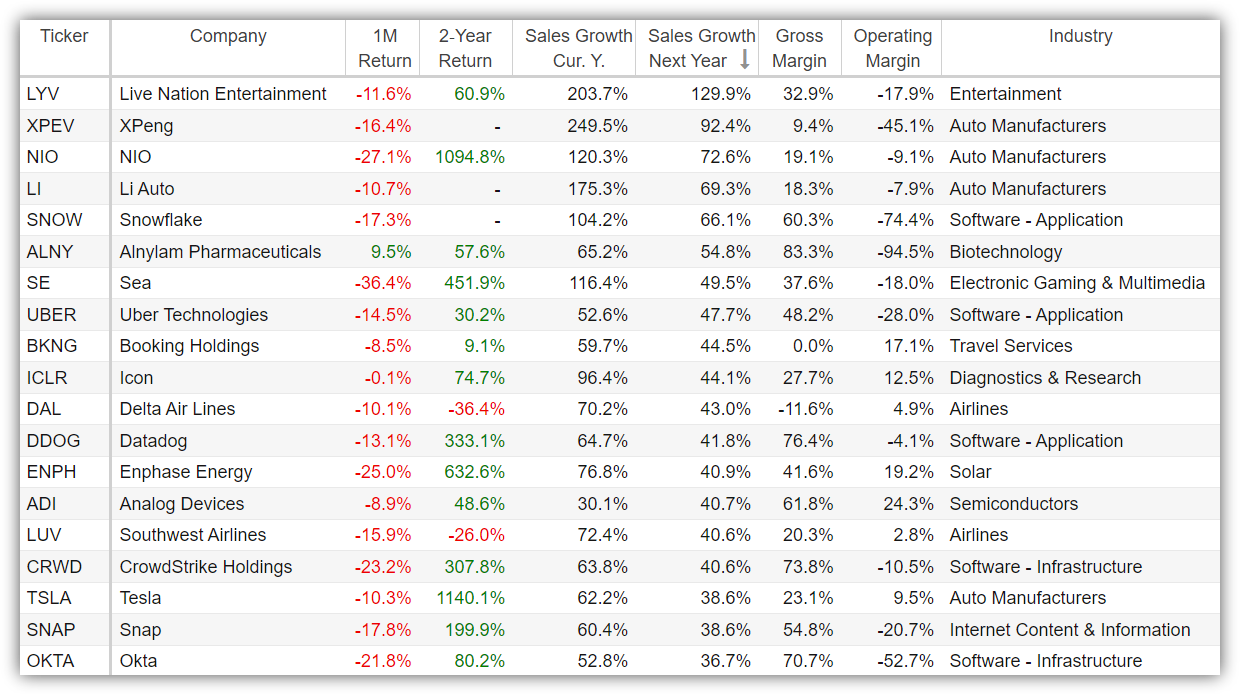

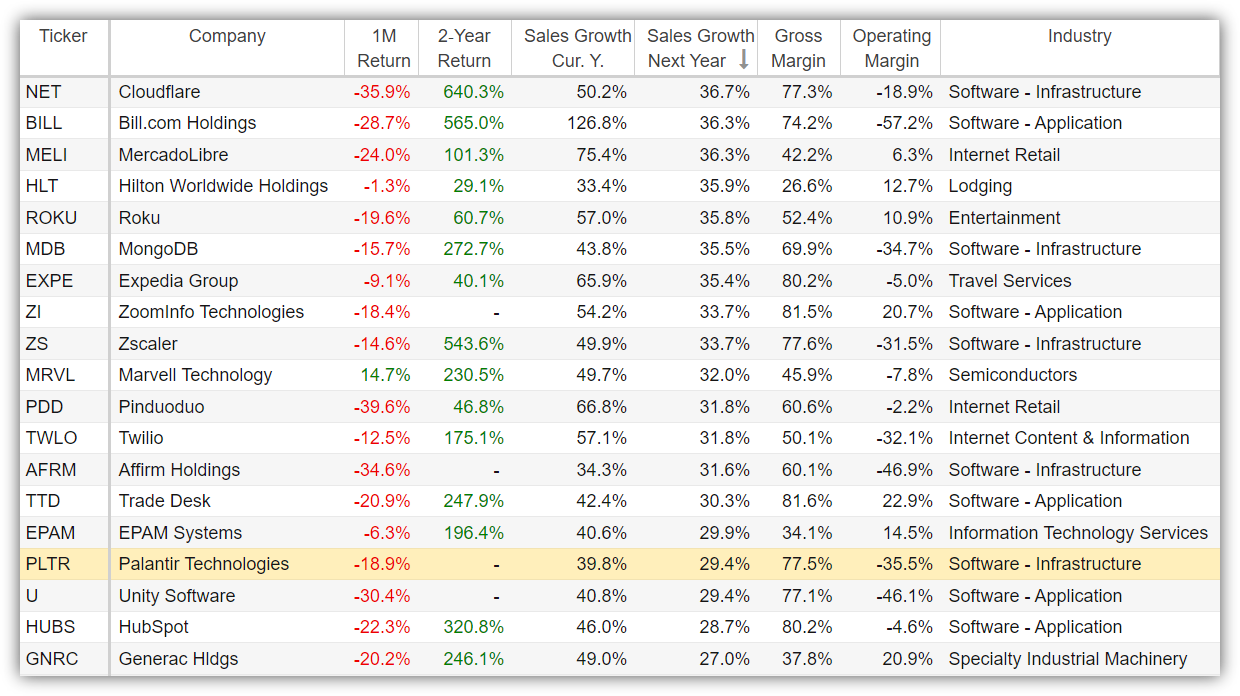

Top Growth Stocks Down Big

For more perspective, here is a look at the recent performance of 38 top growth stocks (those with expected sales growth over 30% this year and over 25% next year), and they are down big (as the market adjusts to the Fed’s new direction towards raising rates three times in 2022). The chart is sorted by expected 2022 sales growth rate.

(source: Stock Rover, data as of 12/17/21)

Again, these stocks are down big because they have high sales growth and high gross margins (an indication that they can be very profitable in the future), but many of them are not yet profitable (as you can see in the often-negative operating margins). These stocks have performed very well over the last 2-years (as the fed was cutting rates), but have been performing very poorly now as the Fed is expected to raise rates 3 times in 2022.

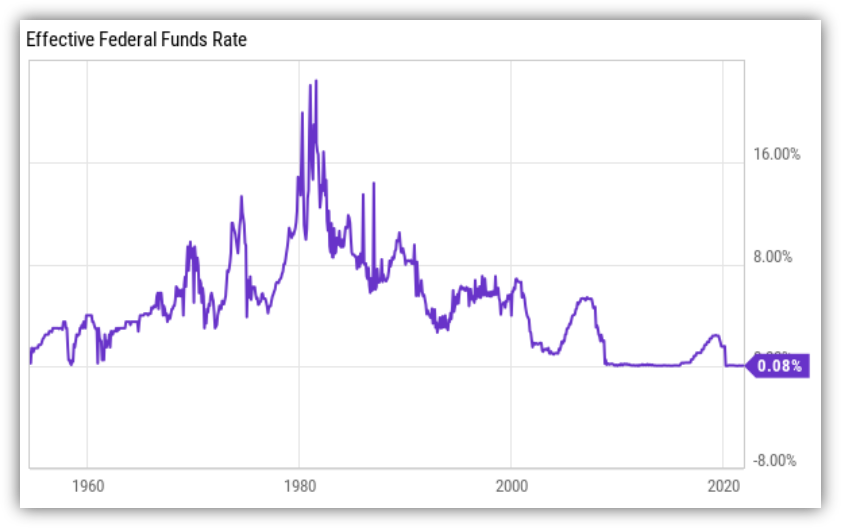

The Fed Won’t Stop Hating Savers

I say the Fed hates savers because the Fed has kept interest rates so low for so low, and this means people who keep their money in bank accounts (i.e. “savers”) aren’t getting paid much in interest, especially as compared to historical interest rate levels. For example, the interest rate on a 10-year US treasury bond was over 15% in the early 1980’s and now it’s below 1.5%. And savings accounts pay even less—close to zero—or even negative when you factor in inflation.

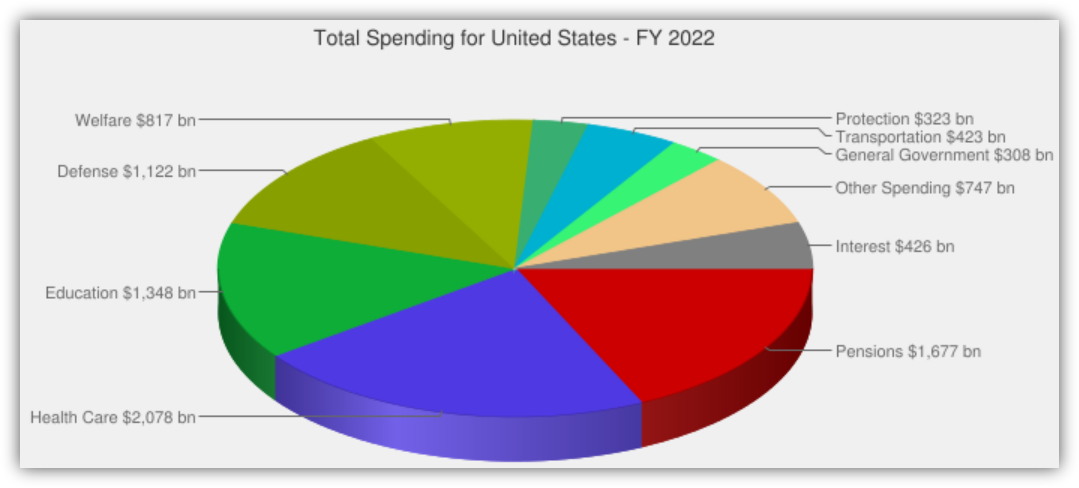

And it seems extremely unlikely that the Fed will stop hating savers anytime soon—simply because they can’t raise rates too high—because that would crush the US government under the weight of the interest payments on its own debt. Specifically, the following chart shows the government current spends nearly half a trillion dollars per year on “Interest” payments. Any significant increase in interest rates will raise this interest payment expense significantly—and that could cause big problems for the government.

More likely, the Fed won’t be raising rates to the high levels we experienced in the early 1980’s, and this means the Fed won’t stop hating savers.

High-Income Alternatives

It’s unlikely the Fed will be raising interest rates into the double digits anytime soon, like they did in the early 1980’s (see chart below).

(source: YCharts)

As such, investors seeking high-income investment alternatives, may want to check out my high-income security watchlist.

The Fed Loves Growth Stock Investors

It might sound odd to say the Fed loves growth stock investors considering the Fed’s recent actions (increased interest rate expectations) have caused many top growth stocks to crash (see our earlier tables and charts), but it’s true. The Fed love’s growth stock investors because they have kept interest rates so low for so long (this benefits high growth stocks), and the Fed simply cannot raise rates too high (because the government would be crushed under the weight of interest payments on its own treasury bonds).

As such, we view the recent “crash” in many top growth stocks as a buying opportunity. More specifically, many top growth stocks will continue to grow rapidly and achieve powerful increasing profitability far in excess of market averages, despite monetary policy changes by the Fed. We’ll review one specific example (Palantir) in a later section of this report. In the meantime, for more high-growth stock ideas, you may want to check out my real-time high-growth stock watchlist here.

The Growth versus Value Debate

Historically, for many decades, value stocks (for example, those with lower expected earnings growth rates and lower price-to-book values) outperformed growth stocks. A lot of investors just assumed this phenomenon would last forever, and they have been very wrong. For the last decade, growth stocks have dramatically outperformed value stocks.

(source: AQR)

Many investors have been calling for a reversal in this trend for years, and they have repeatedly been early (wrong) with their predictions. And with recent Fed monetary policy changes, the calls for a leadership change (from growth to value) arise again.

We can debate the merits of these predictions, but it seems unlikely to happen anytime soon. Sure—we’ll see volatility and leadership changes on daily, monthly and quarterly basis, but over the long-term growth has advantages (such as “perma-low” rates, recurring technology subscription revenues, and the fact that it is now so much easier for promising growth stocks to continue raising capital for many years—regardless of their negative net income status).

Moreover, not all stocks are created equally (in many ways it’s a disservice to group all stocks into either growth or value). And we review one specific example of a growth stock (Palantir) that we expect to dramatically outperform the market in the years ahead, regardless of the Fed’s monetary policies.

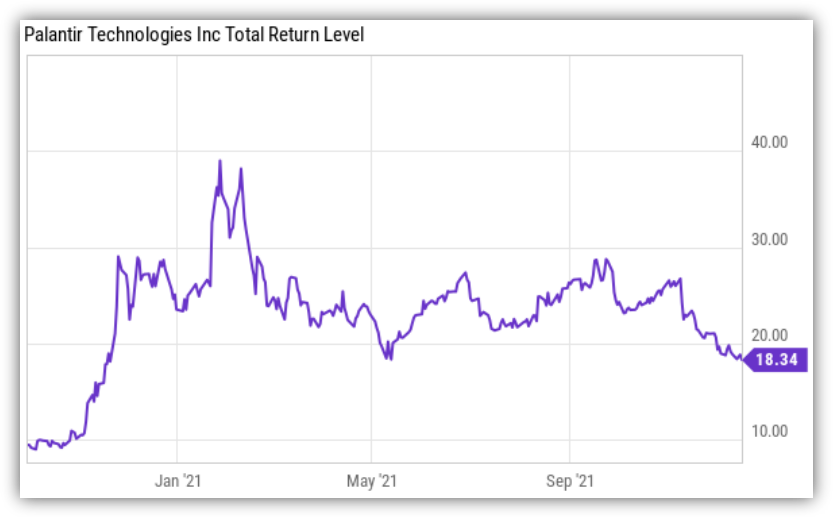

Palantir: The Fed is Doing Investors a Favor

Palantir (PLTR) is an attractive big-data software company, and the Fed’s recent actions have indirectly caused the shares to trade at a dramatically discounted price relative to their long-term value. More specifically, because Palantir is a growth stock (as measured by its high sales growth rate), it has been indiscriminately punished by the market (like other high growth stocks) in recent weeks as a result of the Fed’s monetary policy messaging. However, in reality, Palantir remains a highly-compelling long-term investment opportunity; it’s a baby that has been thrown out with the bathwater.

(source: YCharts)

Palantir Overview:

Palantir’s big data software analytics platforms (such as Gotham, Foundry and Apollo) help organizations (government, and now increasingly commercial) integrate and manage existing disparate data sets to extract meaningful insights. Palantir helps maintain data security and privacy, while also enabling cloud-based access—an area with an explosive long-term growth trajectory (i.e. there is a very large total addressable market for Palantir).

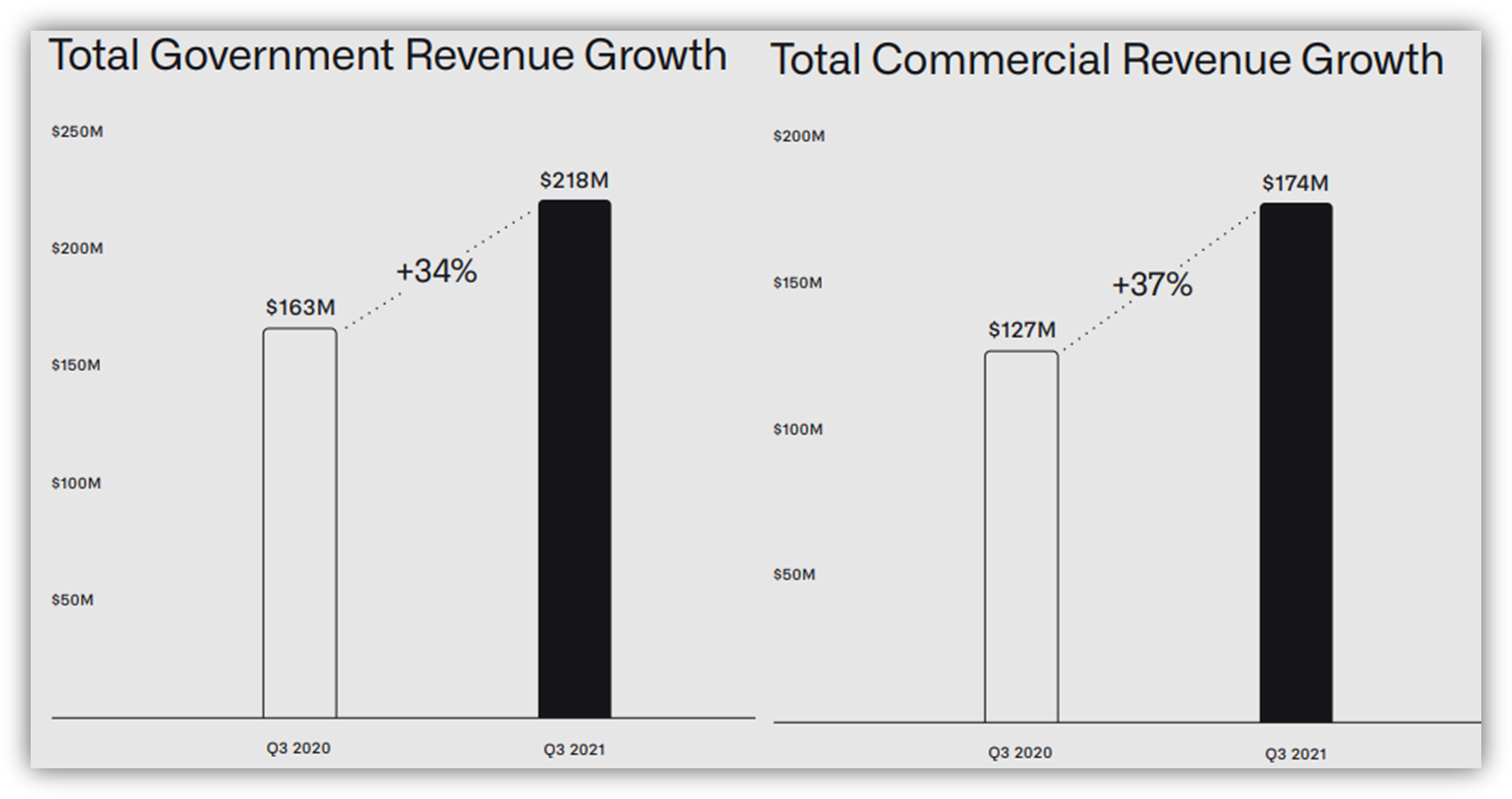

Palantir’s High Growth Trajectory

Palantir’s high growth is attractive. For starters, revenue is expected to grow at 39.8% in 2021 and 29.4% in 2022 (according to data from Stock Rover); these are top-tier growth rates that would make most publicly-traded companies jealous. What’s more, Palantir is growing with high margins (77.5% gross margin) and a very large total addressable market (so it can keep growing at a high rate for a long-time.

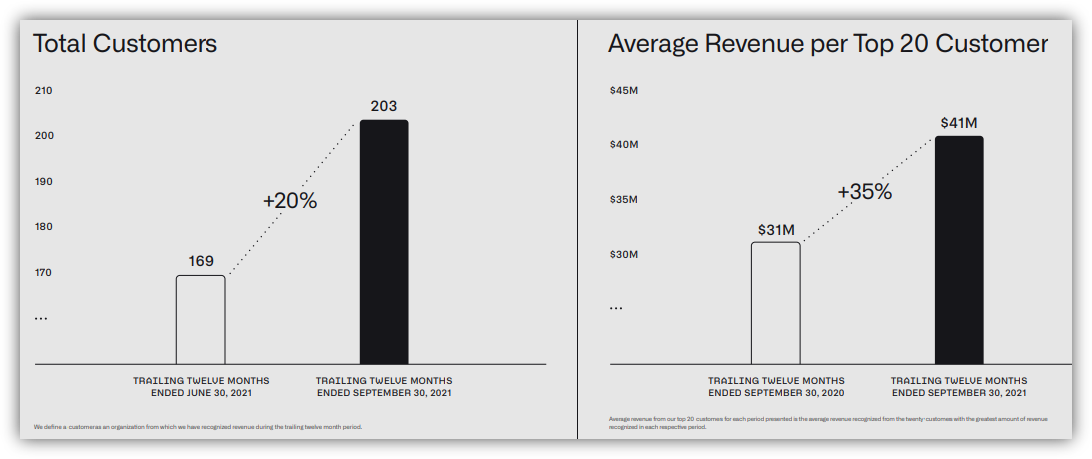

Historically, Palantir has been known for its highly secretive government contract work. Getting government contracts is a very long and challenging process, but once you have established yourself with the government (as Palantir has) it can be an extraordinarily lucrative business. However, more recently, Palantir has also been having high success in the commercial space (an area that we believe the market is not yet giving the company’s valuation credit for). Specifically, in the most recent quarter, commercial growth accelerated to 37% yoy, while government growth was 34% yoy.

We believe Palantir has an attractive value proposition that will help the company continue to grow at a high rate. According to Morningstar analyst, Mark Cash, in a recent Palantir report:

“Uncovering insights and easy integration of data is a largely untapped market, in our view, due to legacy data sets saved in different locations, various data formats, the uptick in cloud-based resources, and the proliferation of the need for real-time access via distributed devices”

Palantir’s Valuation

From a valuation standpoint, Palantir trades at 19.1x forward sales, which is down significantly (as the Fed has increased its interest rate posture) and attractive. Specifically, considering Palantir’s high margins, high growth rate, high customer retention rates and large total addressable market, the shares seem significantly underpriced.

(source: YCharts)

The company is also free cash flow positive, a good sign—especially considering the ongoing high growth trajectory and increasing economies of scale that will build.

(source: Palantir investor presentation)

Palantir's Risks:

Negative Net Income: Palantir currently has negative net income, which is a cause for concern for some investors. However, we view this as attractive as the company continues to scale. Specifically, we’d rather the company continue to spend heavily in order to grow revenues rapidly (as it is) to capture valuable long-term contracts (that can be landed and expanded) instead of foregoing growth to focus on short-term profitability—which is a value destroying activity over the long-term. Nonetheless, negative net income is a risk factor to some investors, and it is part of the reason the shares have recently sold off hard (as short-sighted investors continue to overreact to the Fed’s interest rate posture change). Liquidity is not a challenge for the company as it is free cash flow positive, and as long-term investors continue to line up to fund the company’s valuable long-term growth potential.

Customer Concentration: The company has been working hard to grow its number of customers in order to decrease customer concentration risk (as a large portion of revenue previously came from a small number of clients).

(source: Palantir investor presentation)

Risk of data breach: The data Palantir helps analyze is generally highly confidential (especially for government contracts). And any data breach could lead to a tarnished reputation, thus resulting in the loss of existing and future customers.

Highly competitive industry: Palantir operates in a fiercely competitive industry with the constant threat of new entrants. However, Palantir is helped by its growing existing customer base (with high customer retention) as well as its current focus on high revenue growth (to continue capturing new customers which will also likely have high customer retention rates).

More Fed interest rate hikes: If the Fed continues to become increasingly hawkish, thereby raising interest rates near the levels experienced in the early 1980's that would likely have a significantly negative impact on Palantir's business and share price. However, given US government debt constraints, we view that level of interest rates as unlikely, and we continue to view Palantir's outlook as attractive.

Palantir Bottom Line

If you are a growth-oriented long-term investor that can handle significant short-term share price volatility, Palantir is worth considering for a spot in your portfolio. The Fed’s recent interest rate policy shift is a gift to Palantir investors. Specifically, the Fed has caused growth stock shares (including Palantir) to indiscriminately selloff, thereby creating an increasingly attractive long-term entry point and investment opportunity.

Conclusion

The US Federal Reserve’s recent policy shift (towards higher interest rates and lower balance sheet growth) has created short-term turmoil for high-growth stocks (as they have sold off very hard). However, the turmoil is likely temporary, as interest rate expectations will stabilize. And realistically, interest rates cannot go too high (because the US government would be crushed under the weight of the interest payments on its own treasury bond debt). Likely, the Fed will continue to hate savers (and punish them will relatively low interest rates by historical standards), and continue to reward long-term growth investors (again, with relatively low interest rates as compared to historical levels). Moreover, the recent growth stock turmoil has created opportunity, as attractive long-term businesses (such as Palantir) have indiscriminately sold off hard. The Fed has basically handed a gift to long-term growth investors, in the form of an attractive, lower-price, buying opportunity in Palantir.

Most importantly, if you are a long-term investor, don’t let recent market dynamics cause you to lose sight of your goals and/or make emotional mistakes. For a specific example, if you are an income-focused investor, you don’t have to go dumping your entire nest egg into growth stocks just because they’ve sold off in recent weeks. Rather, stay focused on your own personal investment goals, and stick to your plan. Disciplined, goal-focused, long-term investing is winning strategy.