This week’s Blue Harbinger Weekly reviews 5 top stock ideas that have been created by the Fed’s tomfoolery (3 are pure-growth stocks and 2 are dividend-growth stocks). The report also discusses a big reason why cryptocurrency popularity continues to grow (hint: more Fed tomfoolery). The conclusion shares some thoughts on how you might want to be positioning your personal investment portfolio going forward.

Is the Fed’s Policy Effective?

Through recent financial crises (such as the ‘08-’09 financial crisis and now the pandemic crisis) the fed has become increasingly emboldened with its sweeping monetary policy actions, thereby causing frustration, creating opportunities and even causing some investors to question the fed’s credibility (for example, CNBC argues that Fed Chair Jerome “Powell’s fourth major shift raises questions about the Fed’s policy cred”).

For some recent perspective, let’s consider the fed’s pandemic-related actions, and consider the impacts on certain types of stocks (pure-growth and dividend-growth), as well as its impact on cryptocurrency growth.

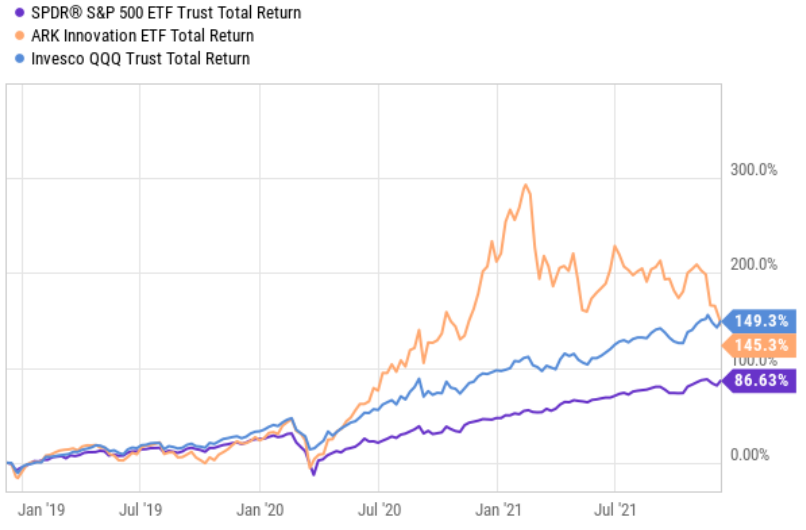

At the start of the pandemic, the Fed cut rates to essentially zero, while everyone was also told to work from home. It makes perfect sense that most high-growth Internet stocks soared in price (regardless of the fact that many had little to no current earnings). It was basically the perfect recipe for an ARKK ETF (ARKK) buying frenzy, as you can see in the following chart.

source: YCharts

To be clear, stocks with higher expected future revenues (such as the internet-heavy stocks held in ARKK) rise in value when interest rates are cut (because the value of future earnings are being discounted back to present values at a lower rate).

Now more recently the Omicron variant has come out, people are largely no longer afraid (for better or worse), and the fed is expected to raise rates more aggressively. This time around, conditions are creating a selling frenzy that is taking high-growth Internet stocks in the opposite direction (for example, see the ARKK ETF’s performance over the last month in the chart above).

And while so many people have been focusing all their attention on volatile high-growth stocks (such as ARKK-stocks), many attractive yet boring dividend-growth value stocks are being ignored—thereby creating a totally different set of opportunities.

Further still, interest in cryptocurrencies continues to grow rapidly, and one big reason is that people are increasingly frustrated with the Fed. Specifically, the Fed’s sweeping monetary policies are impacting the value of the US dollar (through high inflation), punishing savers (bank account yields are practically zero), and driving more people to alternatives, such as gold and cryptocurrencies (because it’s harder for the Fed to manipulate their value).

We’ll dive into each of these (pure-growth stocks, dividend-growth stocks and cryptocurrencies) in the next sections. And for reference, you can read last week’s Blue Harbinger Weekly here, where we questioned how big the current growth-stock selloff might be.

3 Pure-Growth Stocks Worth Considering

As mentioned, a lot of pure growth stocks sailed dramatically higher during the pandemic, and now dramatically lower as market conditions (and Fed policy) are changing rapidly. In our view, the recent sell-off is overdone for some stocks in particular, and we review three specific attractive opportunities below.

1. DermTech (DMTK):

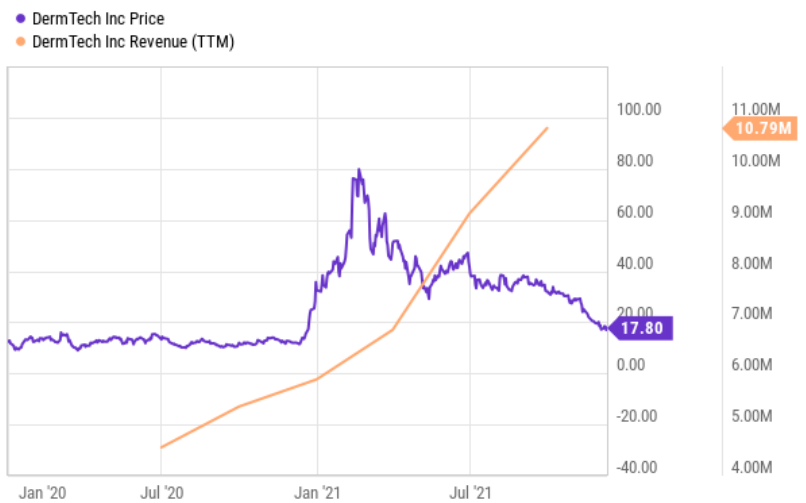

DermTech is an attractive biotechnology company that offers a superior, disruptive, non-invasive product for the early detection of skin cancer. However, the shares have sold off hard in recent months (as the market has indiscriminately dumped many high-growth stocks).

source: YCharts

Specifically, DermTech’s Pigmented Lesion Assay (PLA) product is used for early detection of Melanoma (which is the largest cause of skin cancer in the US). A PLA test involves a non-invasive procedure where an adhesive patch is placed on the suspicious mole or lesion on a patient’s skin and then it is peeled off. The collected samples are then sent to the company’s centralized lab in California for further study; and test reports are generated within three days of receipt of the sample.

DermTech’s non-invasive PLA product is far superior to current clinical procedures which involve a surgical biopsy and a doctor’s subjective judgment.

DermTech shares are attractive because revenue continues to grow rapidly (see chart above) and the total addressable market opportunity is very large (i.e., there is a lot more room for continuing high growth). The shares traded as high as 80x forward sales earlier this year (when growth stocks were peaking), but have recently dropped to around 20x (high, but not as compared to the potential ongoing growth). If you are a patient, long-term, growth investor, these shares are worth considering for a spot in your prudently-diversified portfolio.

2. DocuSign (DOCU):

DocuSign offers an electronic signature (e-signature) tool and other cloud-based solutions for automating the transaction agreement process. Some investors view DocuSign as a pandemic-only stock (it’s not), and the shares have recently sold off hard as the pandemic trade continues to unwind.

source: YCharts

DocuSign announced earnings at the start of this month, whereby the company provided slightly lower forward guidance, and the shares tanked hard (too hard!). This is a powerful, healthy company, with a lot of room for continuing growth, and its forward price-to-sales ratio has recently fallen from around 23x to a very compelling 10x. If you have ever use DocuSign, you know it is not just a pandemic stock—it simply makes getting contracts signed so much easier! Furthermore, the company continues to expand its offerings and grow its already massive total addressable market opportunity. If you are a disciplined long-term growth investor, DocuSign shares are worth considering.

3. Upstart (UPST):

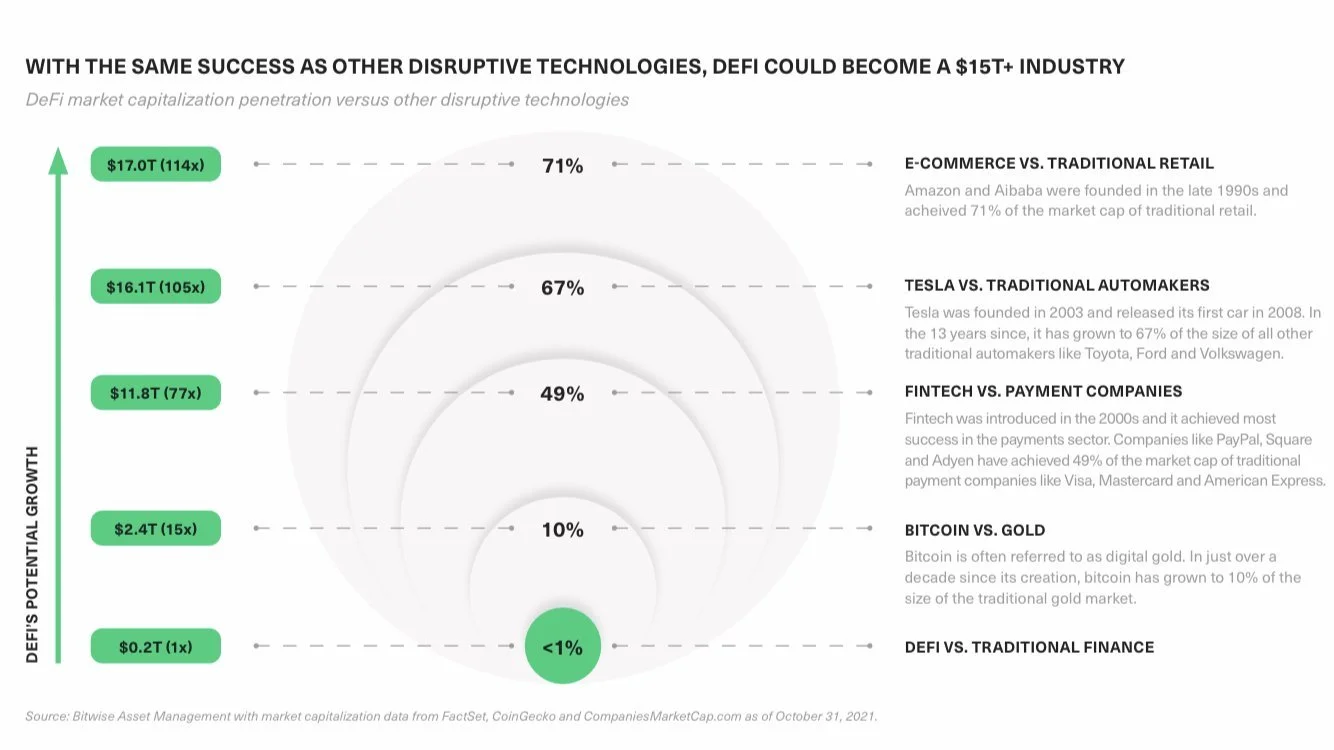

Over the last decade, just about every major industry has been disrupted by the digital revolution except for finance. Here's what it looks like if "DEFI" (such as Upstart) has the same success as other disruptive technologies (i.e., it could be huge!).

Upstart is an Artificial Intelligence (“AI”) lending platform that partners with banks to “improve access to affordable credit,” and it is the only major online lending platform that currently goes beyond the traditional FICO score in making lending decisions. And in general, Upstart is able to approve more loans, faster and with better rates—a win-win for borrowers and lenders.

source: YCharts

Nonetheless, these shares have sold off hard in recent weeks, thereby making for an increasingly attractive entry point if you are a disciplined long-term growth investor.

In our view, DermTech, DocuSign and Upstart are all compelling long-term growth stocks (especially after the recent sell off) and they are worth considering if you are a disciplined long-term growth investor. For your reference, you can view many more growth stock ideas in our detailed 60+ stock growth stock watchlist here.

2 Dividend-Growth Stocks Worth Considering

And while so much investor and media attention has been given to highly-volatile growth stocks over the last two years, many healthy dividend growth stocks have been ignored and now represent attractive value opportunities. Here are two examples.

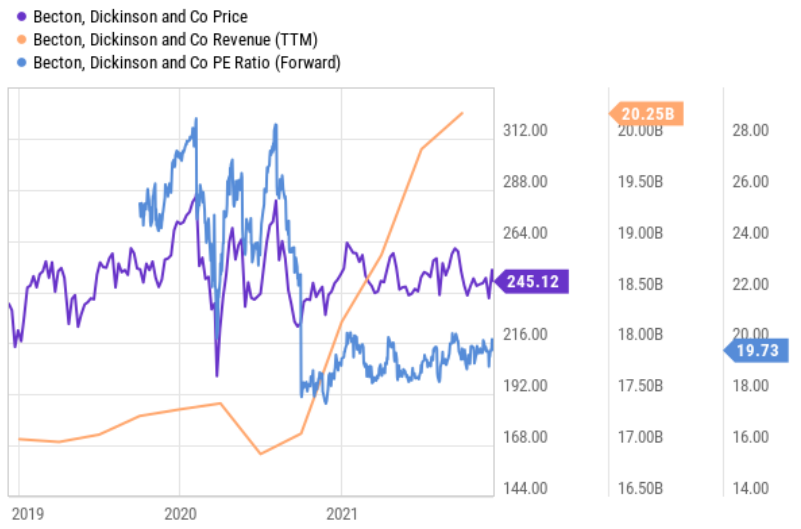

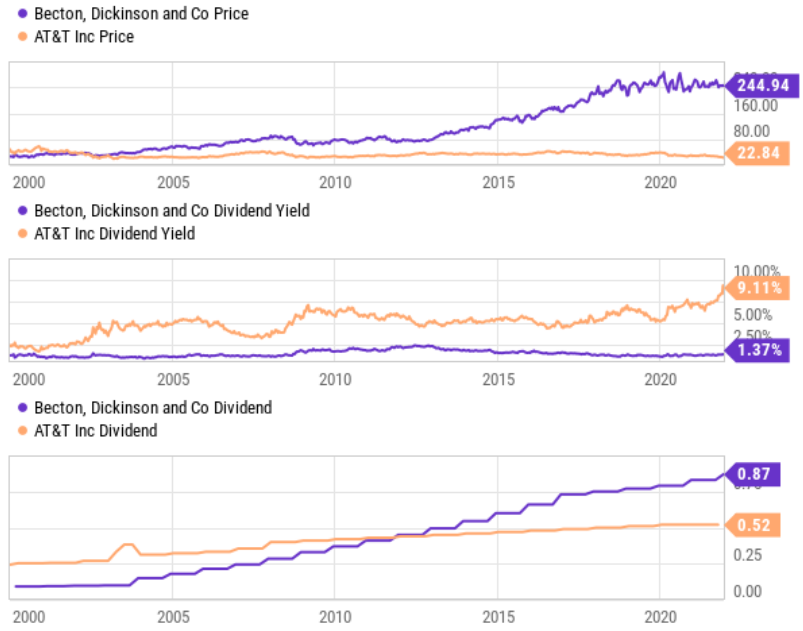

1. Becton, Dickinson and Company (BDX)

To some people, Becton Dickinson is a boring stock, in a boring industry (healthcare equipment), offering a boring 1.4% dividend yield. However, there is actually a lot to like about this contrarian blue chip opportunity. For example, its dividend has been increased for over 40 years straight (its “yield on cost” is huge), the business (revenue and net income) continues to grow, the valuation is attractive (its forward price-earnings ratio is under 20x), and it operates in a steady industry and sector (healthcare) that some argue is due for a contrarian rebound as growth stocks continue to fall out of favor.

source: YCharts

“Yield on Cost” is an important metric to consider when investing in a stock such as Becton Dickinson because helps a lot of investors understand just how massive of an income-generator BDX actually is. For example, here is a chart comparing the historical dividend yield and dividend payment of BDX versus extremely popular big-dividend stock AT&T (T)

source: YCharts

As you can see in the chart above, AT&T has consistently offered a much bigger dividend yield, but BDX dividend has grown much faster (because the company and share price also have growth much faster). And had you invested the same amount of money in AT&T and BDX in 2000, you’d actually be receiving a higher yield on cost on BDX today (i.e., BDX would be paying you more income).

And from a total return standpoint (dividends plus share price gains) there is no question—BDX has been a much better investment. This is why it’s so important to consider total returns (dividends plus price appreciation) and “yield on cost,” instead of just chasing after stocks with the highest current yields.

Further still, BDX has attractive continuing future growth potential as per its attractive industry and healthy growth expectations, as well as its ongoing business optimization (through spinoffs such as embecta and acquisitions such as Tissuemed).

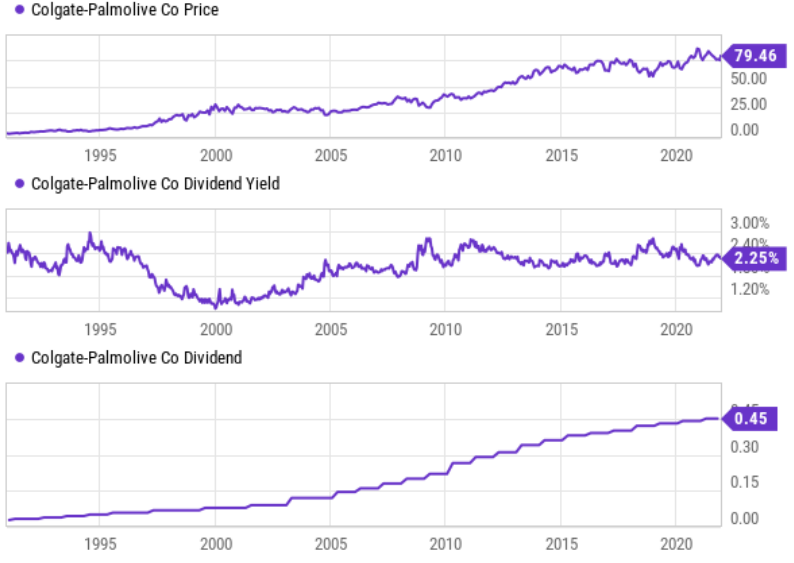

2. Colgate-Palmolive (CL)

Colgate-Palmolive is another powerful dividend-growth stock, in a contrarian value-oriented industry, and trading at an attractive price as compared to its value. Colgate-Palmolive makes consumer staples products (e.g., toothpaste, bar soap, dishwashing detergent). It has also increased its dividend for over 50 years in a row—so even though the current yield of 2.3% may look low, this company’s yield on cost is truly massive, and we believe it will continue to grow.

source: YCharts

Colgate-Palmolive currently trades around 24x forward earnings, which is reasonable. The company’s last earnings report revealed 6.3% y/y revenue growth, including organic growth near 5.0%. The company also reported some negative impacts from inflation (the price of raw materials went up), but these are ultimately costs that can be largely passed through to consumers over the long-term, thereby positioning Colgate-Palmolive for continuing healthy growth.

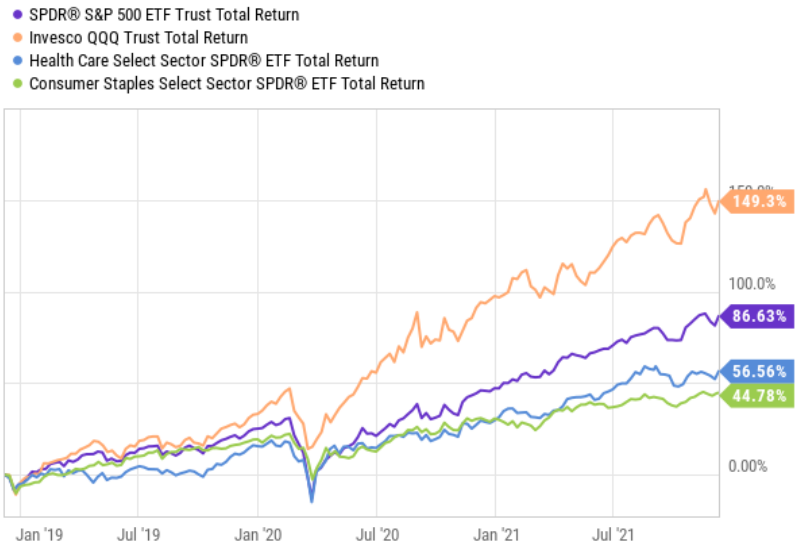

For a little more perspective, here is a look at consumer staples stocks (XLP) performance (the sector Colgate-Palmolive is in) and healthcare stocks (XLV) performance (the sector BDX is in) versus the market (SPY) and the tech-heavy Nasdaq 100 (QQQ). Some contrarians argue value sectors like staples and healthcare are due for a relative rebound.

source: YCharts

Regardless, if you are looking for a powerful, long-term, dividend-growth stock trading at an attractive valuation (relative to its earnings and ongoing growth), Colgate-Palmolive is worth considering.

And if you are looking for more dividend investment ideas in general, our Income Securities Watchlist is available here.

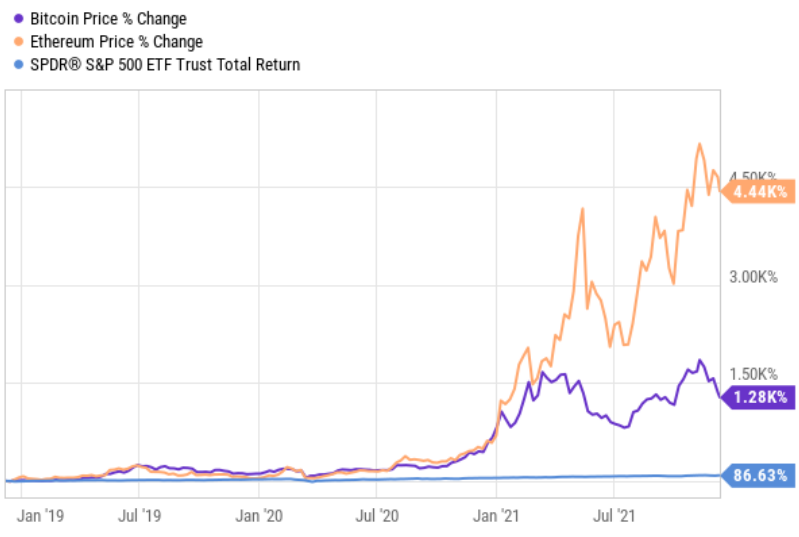

A Note on Cryptocurrency’s Growing Popularity

Here is a chart of Bitcoin and Ethereum (two popular cryptocurrencies) as compared to the S&P 500 (SPY) over the last few years. As you can see, as volatile as the stock market has been (e.g., the S&P 500), cryptocurrencies have been more volatile, and there is good reason.

source: YCharts

Aside from the thrill of something volatile, new and disruptive, investors increasingly look to cryptocurrencies as a way to diversify away from the sweeping monetary policies of central bankers, and the often-painful side effects that come with them (e.g., inflation, and low interest rates).

For perspective, all the bitcoin in the world was worth about $1.03 trillion at the end of November (that’s a lot), but that’s still only about 2.9% of the world’s total money supply (according to investopedia). Further, all cryptocurrencies combined equaled about 7% of the world’s total money supply.

However, before you go out investing in cryptocurrency, keep in mind it is very different than owning a stock. Stocks represent shares of businesses that produce products, revenues, income and sometimes dividends. It is these productive characteristics that allows companies (stocks) to be valued. Cryptocurrencies don’t produce anything.

Earlier this month, famous value investor Charlie Munger called bitcoin “disgusting and contrary to the interests of civilization.” When someone like Munger speaks, it’s worth listening. And we don’t recommend anyone dump their entire nest egg into bitcoin—even though it may seem like an attractive opportunity—thanks in part to the Fed’s monetary policy tomfoolery which often contributes to investors’ interest in cryptocurrencies.

Conclusion

The market has been volatile and wild over the last two-years, and the fed’s monetary policies have had significant impacts, such as the dramatic rise and fall of pure-growth stocks, investor disinterest in many dividend-growth stocks, inflation and even cryptocurrency popularity. We have listed out a handful of attractive stock ideas (including three pure-growth stocks and two dividend-growth stocks).

However, before you go out buying any stocks (or cryptocurrencies), first make sure they are consistent with your own personal investment goals and tolerance for volatility. And certainly don’t let the emotion-driven media headlines distract you from your goals. For example, if you are an income-focused investor, then for goodness-sake don’t go dumping your life savings into volatile growth stocks or cryptocurrencies.

Rather, know your goals as an investor, and stick to your strategy. Disciplined, goal-focused, long-term investing is a winning strategy.