Call it the unwinding of the pandemic trade, a reaction to inflation fears, or simply noise; the last 30 days has been an absolute bloodbath for many top growth stocks. In this report, we share data on over 40 top growth stocks that are down big, we briefly review potential causes, and then we highlight 3 specific stocks that are attractive and worth considering. We conclude with an important suggestion on how to manage your investments in the current wild market environment.

40+ Top Growth Stocks Down Big

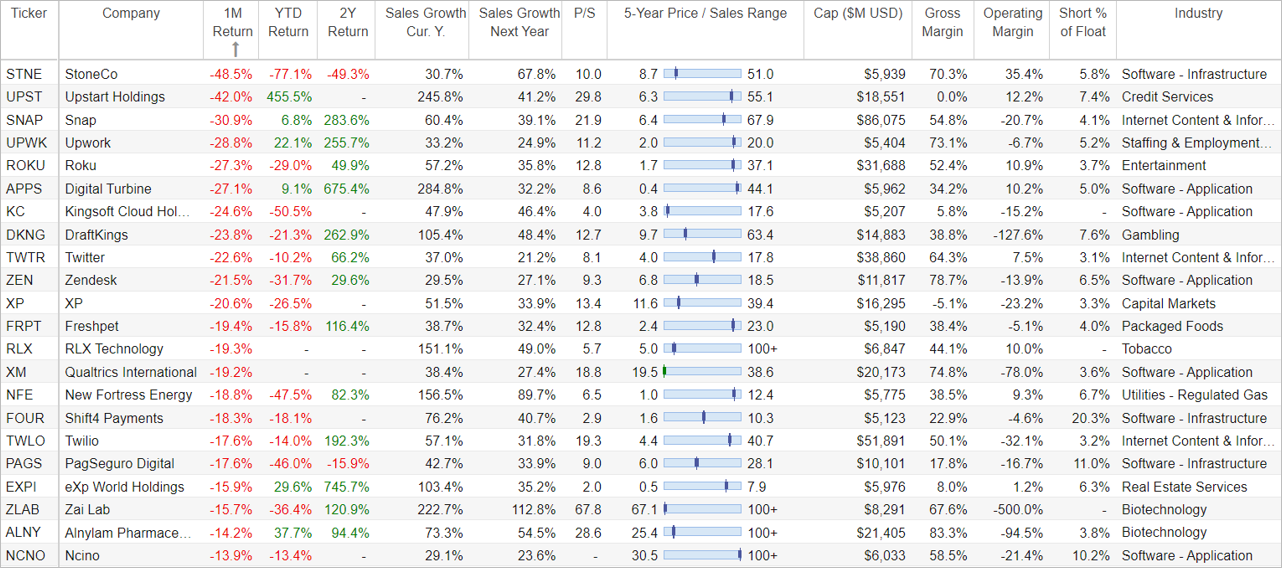

For starters, here is data on over 40 top growth stocks that have sold off hard over the last month. To be included as a “top growth stock” in this table, we require sales growth expectations of at least 20% for this year and next year (that’s a lot) and a market cap of at least $5 billion. And as as you can see (based on all the “red” in the 1-month return column), there has been some pretty terrible performance.

(source: StockRover, data as of 11/18/21)

If you are a growth stock investor, you likely see at least a few names on the list that you recognize. The table is sorted by 1-month returns, but it also includes data on valuation (such as price-to-sales, and each stock’s 5-year range), margins (gross and operating), industry and short interest, to name a few. And for reference, the S&P 500 (SPY) was up 5.4% during this same 1-month period.

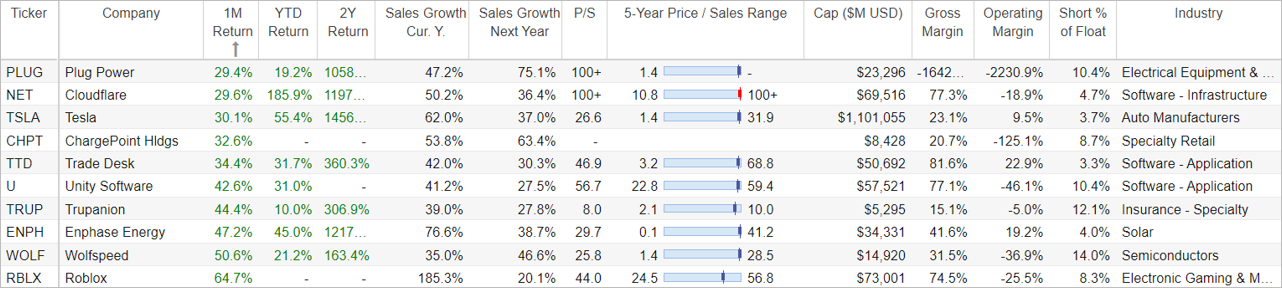

As a side note, not all top growth stocks were down over this period, and here is a look at the top 10 best 1-month performers from this group.

(source: StockRover, data as of 11/18/21)

For reference, we continue to be long-term holders of 4 of these 10 (within our Disciplined Growth Portfolio), and you can view our complete growth stock watchlist here.

Why the Terrible Performance?

Obviously not all top growth stocks were down over the last month (although Cathie Wood’s popular Growth/Innovation ETF (ARKK) was down 1.7% during this 1-month period while the S&P 500 was up 5.4%). There are a variety of explanations ranging from the continuing “unwind" of the pandemic trade (that rocketed many growth stocks higher during 2020), rising interest rates and inflation fears (which put downward pressure on the present values of top growth stocks with high future earnings), to simply noise. In our opinion, rather than trying to assign recent market moves to any of the above factors, it’s better to simply focus on individual stocks that can perform well over the long-term despite broader market conditions. We review three specific examples in the next section.

3 Top Growth Stocks Worth Considering

Without further ado, here are three top growth stocks that we believe are particularly attractive, especially after the selloff.

1. Roku (ROKU)

You’ll notice in our earlier table that Roku has been one of the worst performing top growth stocks over the last month. However the business remains exceptionally attractive, as we’ll get into in a moment.

source: YCharts

If you don’t know, Roku is an extremely rapidly growing streaming TV platform. Viewers either buy a Roku stick to add to their TV or approximately a third of all TVs sold in the US come with Roku already installed. And what is so important about Roku is that streaming TV is a huge market opportunity. Smart TVs gather all kinds of data based on watching habits, and that data is extremely valuable to advertisers. Said differently, Roku’s business is extremely valuable.

And what makes Roku so interesting right now (aside from its amazing, high-growth, large total addressable market opportunity and stalwart leader, Anthony Wood) is that the share price has fallen 50% since July and the valuation is very compelling.

Roku announced earnings earlier this month, and the news was largely positive. However, the company provided slightly lower forward guidance which resulted in analyst downgrades and the share price sell off (since July) has accelerated. However, the analyst and market reaction is too short-term focused (as it almost always is) as the company’s long-term growth and profitability trajectory remain intact as you can see in the following chart (and based on the huge long-term total addressable market opportunity for connected TVs).

source: YCharts

Specifically, the above chart is busy, but Roku’s forward revenue growth rate remains high (as you can also see in our earlier table), profitability remains strong and the valuation (on a price-to-sales basis) is now more attractive. In our opinion, Roku is a highly attractive long-term growth stock.

However, for those of you that are nervous about near-term volatility (and real sticklers on price), you might instead consider playing Roku with options. For example, selling out-of-the-money put options gives you a chance to pick up shares at an even lower price (if the shares get put to you before your option expires), and if they don’t get put to you—you still get to keep the high upfront premium income you generated selling the put options. Worth mentioning, the premium income available in the options market increases when fear/volatility increases—like now. We shared a similar, but slightly more complex income-generating options strategy with members on Thursday. The trade was a well-received “bullish vertical put spread—a strategy you might also want to consider.

Overall, Roku is an extremely attractive long-term business at an increasingly attractive price. We are currently long shares of Roku.

2. Upstart (UPST)

source: YCharts

Upstart has been one of the hottest stocks this year (as you’ll notice in the year-to-date performance column of our earlier table), however the shares have sold off extremely hard over the last month. We purchased shares of Upstart back on September 1st (at a price similar to where it currently trades).

If you don’t know, Upstart is an AI-driven lending platform that is unique because its underwriting process is better, faster and more profitable than the standard, out-of-date, FICO-based lending guidelines that so many old-school lenders continue to rely upon today. Upstart takes a variety of unconventional lending data points into consideration (such as work history, education and more) to approve loans faster, with few defaults and with lower interest rates. This is a win-win for both borrowers and lenders (i.e. borrowers get lower rates and faster loan approvals, and lenders get more business and profits).

And what makes Upstart so interesting is that they are just barely at the tip of the iceberg within a massive total addressable market for lending. Upstart started with personal loans (up to around $50,000), but is expanding into auto loans, and there remains an even bigger opportunity outside of that. The debt markets are simply massive (many many times bigger than the stock market), and as Upstart continues to grow over the long-term, so will its stock price. If you are looking for an impressive growth stock opportunity that just sold off, Upstart is worth considering.

3. StoneCo (STNE)

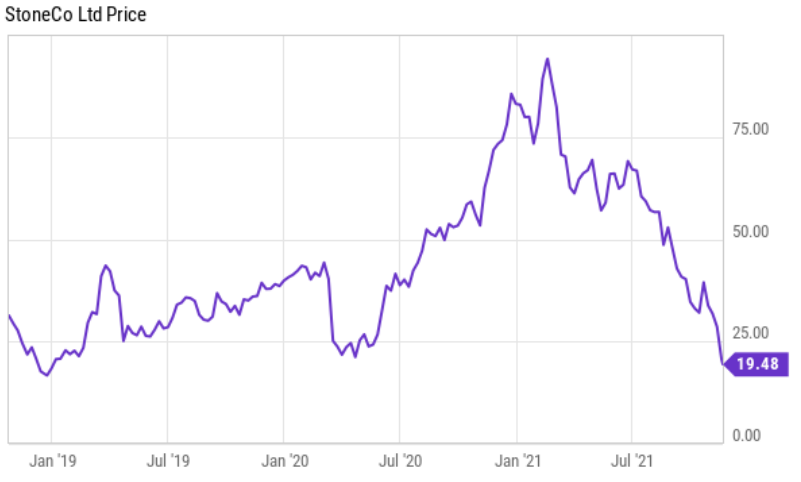

The worst 1-month performer in our earlier table is StoneCo, yet it remains an extremely attractive long-term business. Anytime you are looking for impressive long-term growth opportunities, the businesses are going to have a few warts (if they didn’t, the market would have already “arbitraged” away the most attractive upside). StoneCo has a few, but is an extremely attractive long-term investment.

source: YCharts

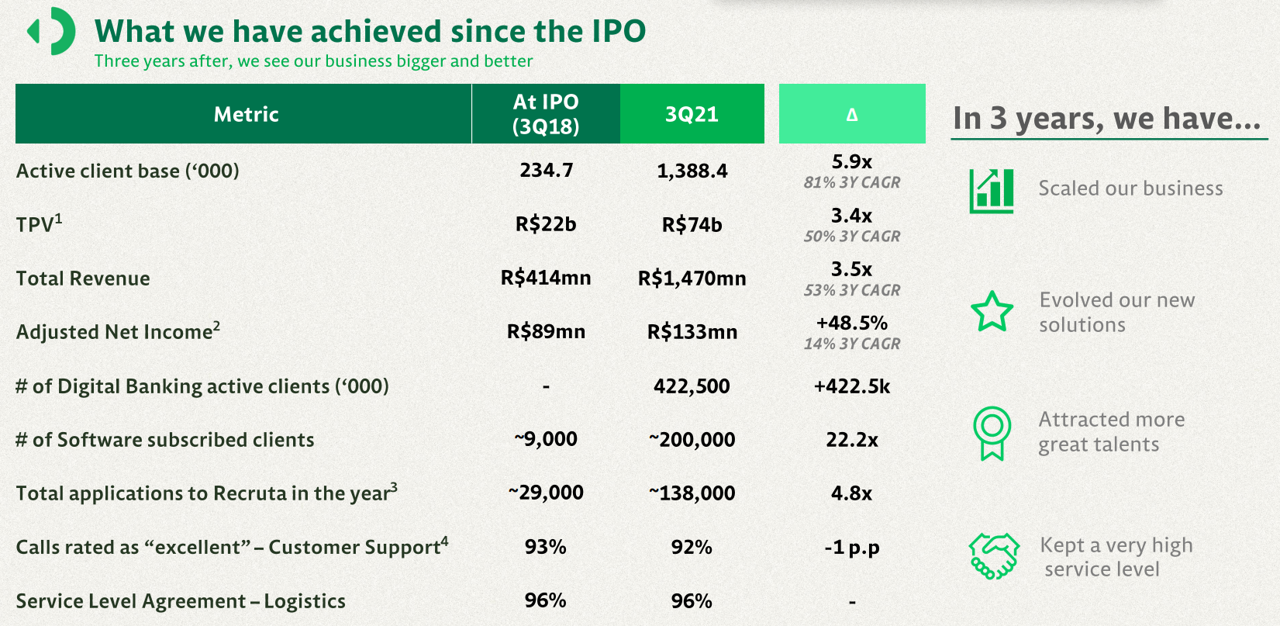

StoneCo is Brazil-based fintech company that provides retail merchants with electronic payment and short-term financing related solutions to manage their businesses across in-store as well as online channels. Its target customers primarily include micro, small, and medium-sized businesses across several industry verticals in Brazil. The company also provides services to nearly 260 integrated partners including global payment service providers, independent software vendors, and digital marketplaces, who embed Stoneco’s payment solutions into their own offerings to enhance the user experience. StoneCo’s business continues to improve since its IPO, as you can see in the graphic below.

source: StoneCo Investor Presentation

However, StoneCo’s business has a few warts on it, including a weakening Brazilian Real currency, interchange fee pressures, covid and now a recent FBI raid of its major POS terminal provider in relation to cyberattacks.

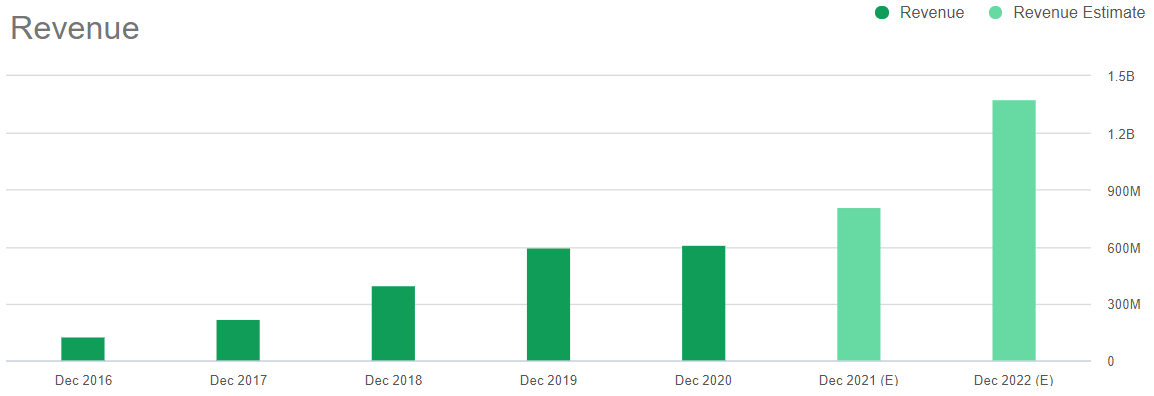

In our view, these challenges are significant, but still largely just short-term noise as compared to the company’s long-term value. For a little perspective, here is a look at StoneCo’s expected revenue growth as well as it’s valuation on a price-to-sales basis.

image source: Seeking Alpha

source: YCharts

Further, StoneCo just announced earnings on November 16th whereby revenues continued to grow rapidly (and on a large scale), but the market reacted negatively because the company has been spending heavily on investments (to fund future growth—a good thing in our view)

Overall, StoneCo represents an attractive long-term investment opportunity, especially after the share price decline in recent months. The company is well-positioned to expand its market share through its broad range of offerings, and it has the balance sheet and cash flows to support significant organic and inorganic growth.

Conclusion

Volatility happens. It’s how you react to it that matters. As investors, we are never in short supply of news flow—much of it sensationalized. Whether it’s stock market euphoria (that caused many investors to “buy high” near the start of this year), or fear-mongering (that is now causing many investors to panic), don’t make rash decisions. Our suggestion is to know your goals as an investor, and then stick to your strategy. Disciplined, goal-focused, long-term investing is a winning strategy.