If you are an income-focused investor, you may get some satisfaction seeing the now dramatically deflated growth stock bubble (and knowing you dodged a bit of a bullet on that one!). However, you may also be well-served to take advantage of the significant opportunities it now presents. In this report, we share data on 50 top growth stocks that have sold off extremely hard, dive into more details on three names from the list that are particularly attractive (with a special focus on disruptive financial-services company, SoFi (SOFI)), and then explain why it could make sense to generate a small portion of your required investment income from long-term price gains on top growth stocks (instead of relying exclusively on dividend income) as well as reviewing the high-income options-trade opportunities the deflated growth stock bubble currently presents (i.e. fear is creating opportunity). We conclude with a couple very important takeaways for long-term investors to keep in mind.

The Deflated Growth Stock Bubble

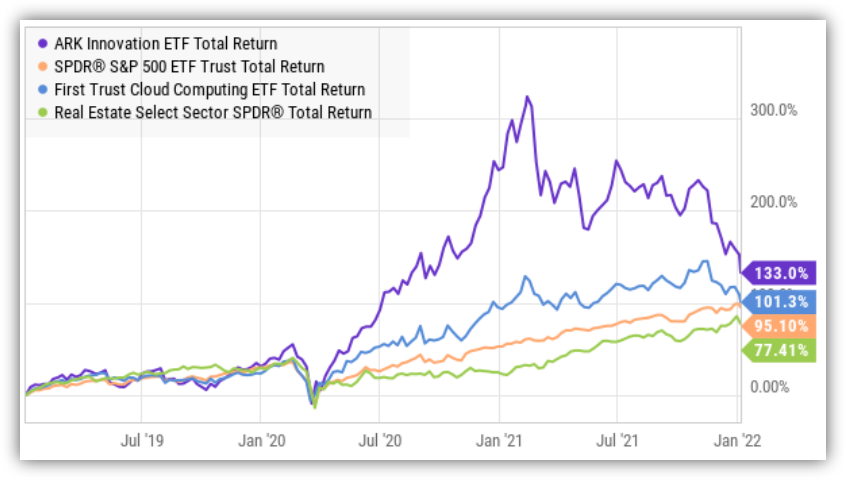

To put this deflated bubble into perspective, here is a look at the poster child of the so-called “growth stock bubble,” Cathie Wood’s ARK Innovation ETF (ARKK) versus the S&P 500 (SPY) and the First Trust Cloud Computing ETF (SKYY) (another pandemic-trade darling). We’ve also included the Real Estate Investment Trust ETF (XLRE) to provide a little perspective on how a popular income-investor sector has done during the same time period (these are total returns: dividends plus price appreciation).

Two key takeaways from the above chart are that (1) what went up (top growth stocks) have since come down (during this particular time period), and (2) the often considered “safe” income-investment sector (“REITs”) has lagged over this time period (although there are obviously select REITs that have done very well—such as certain industrial REITs—but that is a topic for another report).

50 Top-Growth Stocks Down Big

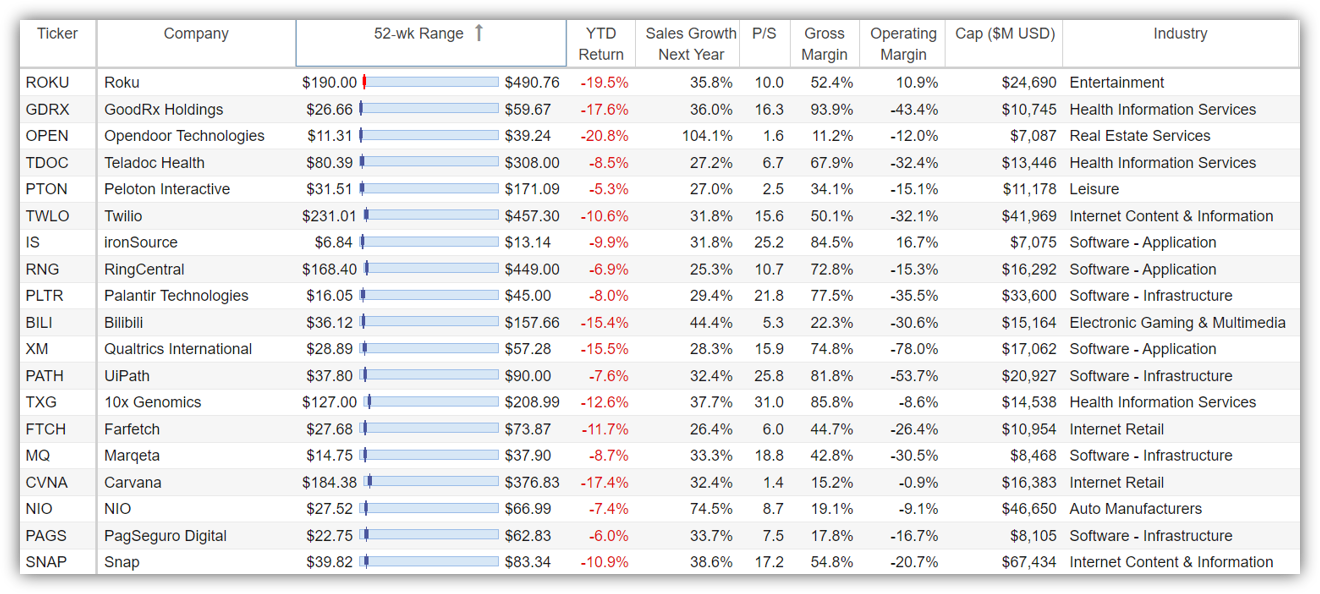

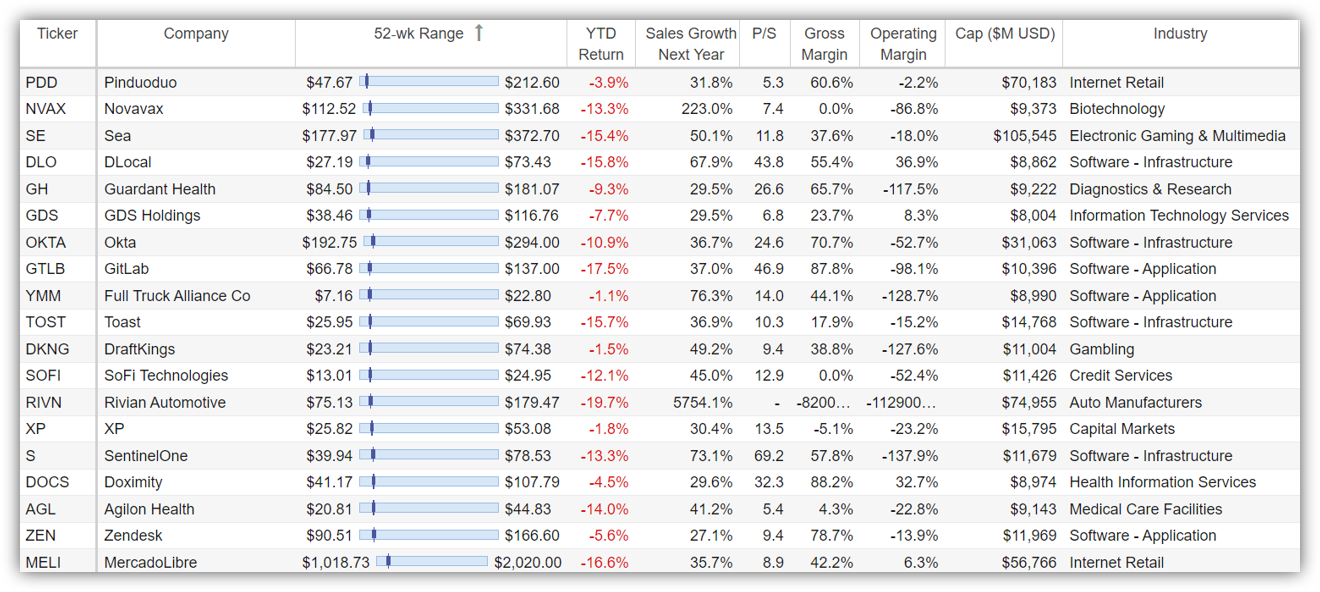

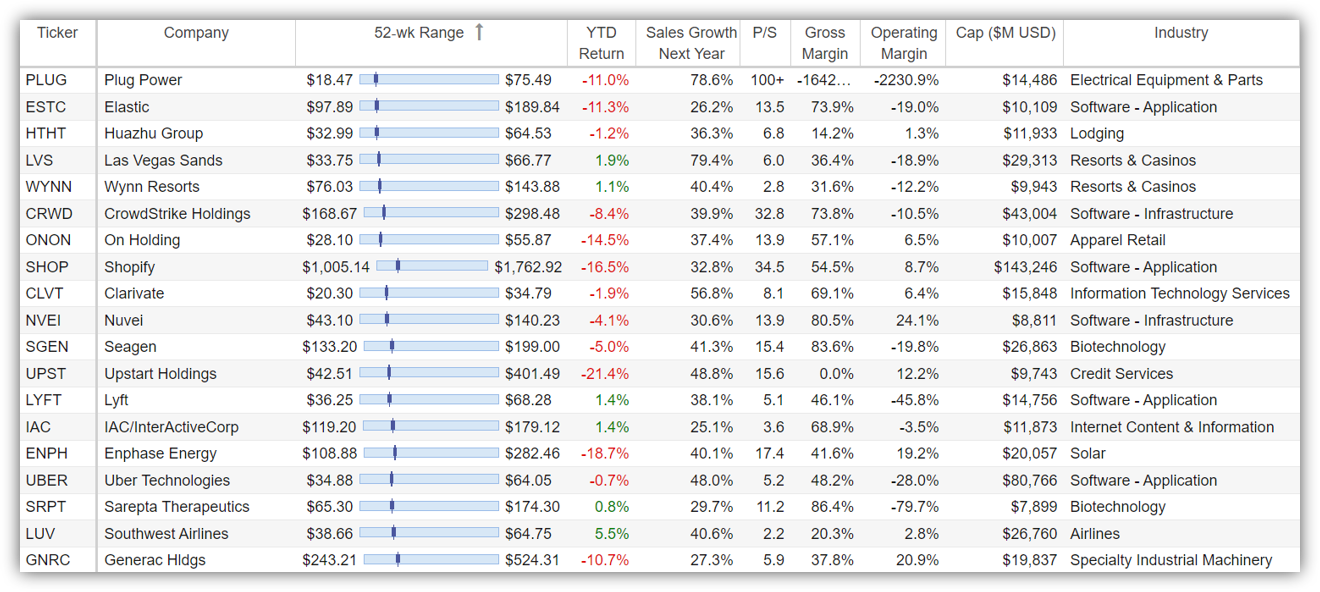

For the purposes of this article, we are defining top growth stocks as those with expected sales growth of over 25% for next year (which is a very big number—a lot more than the average stock) and a market cap of at least $7 billion. We’ve also included additional data in the table, such as gross margins (lots of attractive big numbers here), operating margins (often negative as many high-growth companies choose to forgo near-term profitability, in an effort to maximize growth and long-term value), price-to-sales ratios and industry.

Perhaps the most glaring metrics in this table is how many of these names are near the very bottom of their 52-week price ranges (they have been selling off hard!), and the often-large negative year-to-date price performance (we’re barely 1-week into this year—yikes!).

The terrible price performance of these stocks are confirmation (and perhaps a source of satisfaction) for some investors that have been warning how overpriced they have been. But while they are taking victory laps, this recent performance creates some interesting opportunities to: (a) buy select names at low prices, and (b) generate high-income with some income-generating options trades. Let’s start with SoFi, for example.

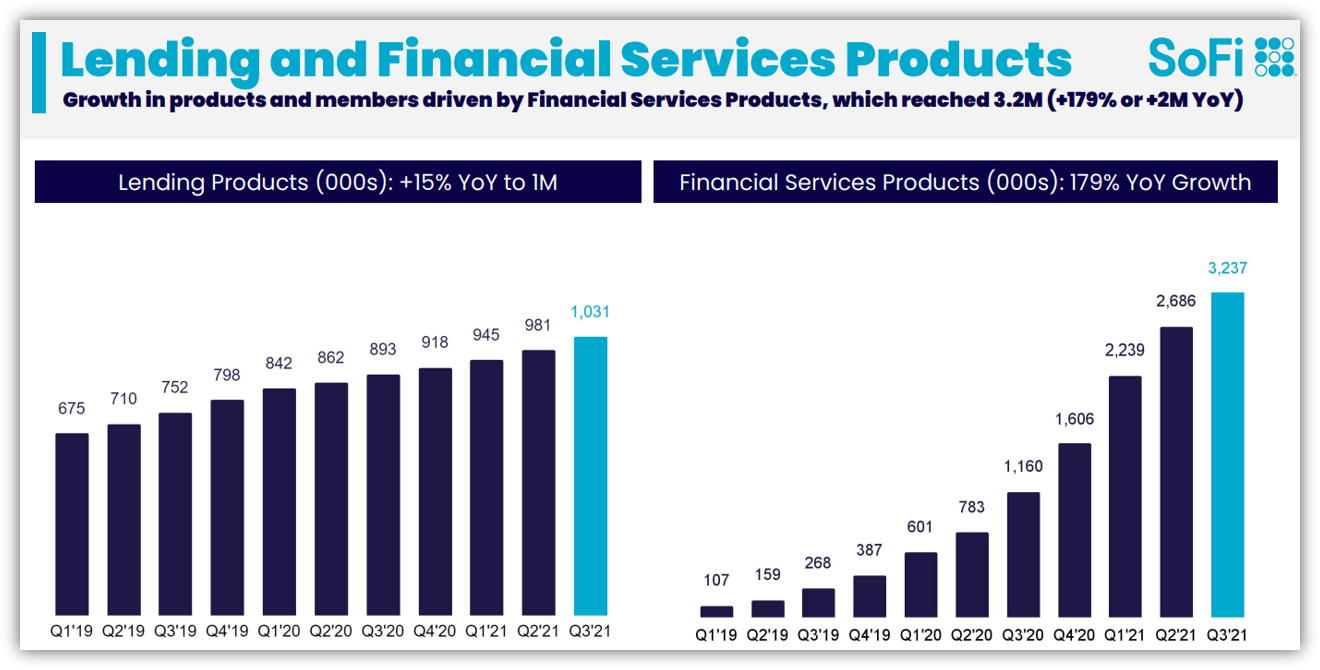

1. SoFi Technologies (SOFI)

If you don’t know, SoFi is a disruptive financial services company that is growing rapidly. Furthermore, it has a truly massive total addressable market opportunity as “financial services” is one of the few remaining large industries that has yet to be disrupted by the digital revolution (i.e., Big Banks are still running the industry the same way they have for decades—yuck!).

For some background, SoFi was founded by students at the Stanford Graduate School of Business in 2011 and was a disruptive business from the start. They aimed to provide more affordable lending options for student borrowers (and lower default rates for lenders) by getting alumni of the school to loan money to students to pay for tuition. This was disruptive in the industry because the underwriting methodology departed from traditional big bank underwriting rules and instead focused on work history and educational background as indicators of success and ability to repay the loans.

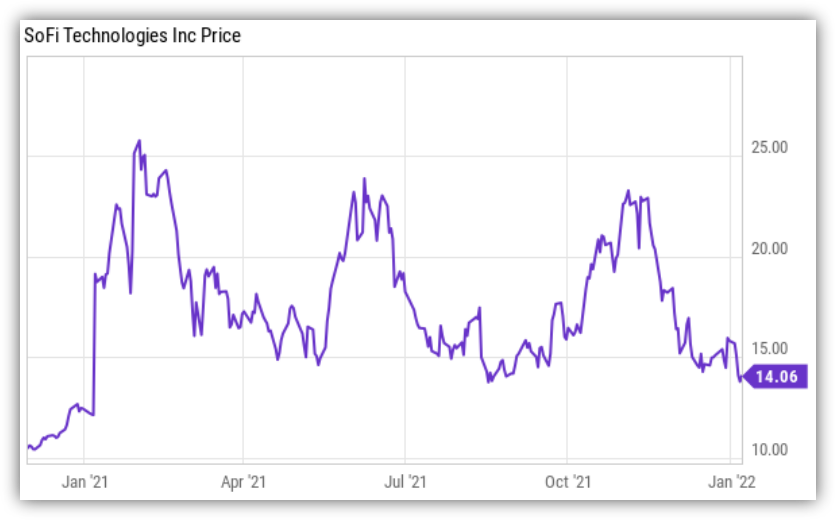

SoFi’s successful disruptive lending program quickly expanded to other schools, and then away from alumi-funded programs to other types of loans (e.g. personal loans, home loans), but continued to use non-traditional, disruptive underwriting criteria. And as you can see in the following graphic, SoFi’s business continues to grow and expand rapidly.

source: SoFi

Today, SoFi divides its business into three segments, including Lending ($715.3 million in revenue over the last 12 months), Technology Platform ($178.4 million in revenue LTM) and Financial Services ($40.2 million in revenue LTM). And despite the recent negative share price performance (see chart above), all segments continue to have very high growth trajectories.

Another big catalyst on the horizon for SoFi is its aspirations to gain a national bank charter in order to start accepting deposits that can be used to make loans. In fact, the company is waiting on regulatory approval to complete its acquisition of a small bank (Golden Pacific Bancorp) in order to backdoor its way into a national bank charter. Approval could come soon and be a major catalyst driving these shares higher.

However, despite SoFi’s rapid expected growth (see our earlier table) and enormous potential, some investors still will not invest because it is not yet profitable (i.e. it is spending heavily on rapid growth in order to maximize future value and profits), and it is simply too volatile. That viewpoint is fine because every investor has different goals. However, if you are an income-focused investor, it may make sense to allocate some amount of your investment dollars to disruptive growth opportunities in order to generate some of your long-term income needs from price gains (instead of relying exclusively on dividends). This has some risk-reducing diversification advantages and the potential to increase your long-term income significantly (especially after the recent sell off).

SoFi Income-Generating Options Trade

If you are still not willing to purchase SoFi shares straight out, you might instead consider an income-generating options trade on SoFi. For example, by selling out-of-the-money, cash secured, put options on SoFi—you can generate attractive upfront premium income, plus you may get the chance to own the shares at an even lower price (if they get put to you before expiration). And depending on your situation, this strategy may be particularly attractive to implement on SoFi because it has been so volatile (upfront premium income available in the options market is higher when volatility (fear) is higher), and because the share price of SoFi is relatively low thereby requiring less upfront income to secure the trade (options contracts trade in lots of 100, so you’d need to set aside an amount of cash in your account equal to the SoFi share price times 100 (in order to keep this trade simple).

For example, a long-term income-focused investor might consider selling put options on SoFi with a strike price of $12.50 (~10.7% out of the money, it currently trades at ~$14), and an expiration date of February 18, 2022, and for a premium of at least $0.77 (or $77 because options contracts trade in lots of 100). This comes out to approximately 6.16% of extra income in about 42 days—which may not sound like a big return—but it is very significant for such a short time frame (it’s approximately 53.5% of extra income on an annualized basis, if you could implement similar trades throughout the year). And this trade not only generates attractive upfront premium income for us now, but it gives us a chance at buying shares of this attractive long-term company at a significantly lower price ($12.50—the strike price) if the market price falls below $12.50 and the shares get put to us before this option contract expires on February 18th. And we get to keep the upfront premium income the trade generates, no matter what.

Important to note, you can adjust the strike price of this trade (for example to $10) or the expiration date (for example to January 21st) depending on how badly (and at what price) you want the shares put to you, and to generate a different amount upfront income).

*Also note, market prices are constantly moving, and you will have to “work” this trade a little to get a price you like. Regardless, the current high premium income is attractive.

Important Trade Considerations:

Two important considerations when selling put options are ex-dividend dates and earnings announcements because they can both impact your trade. In SOFI’s case, the ex-dividend date is not a factor (because it doesn’t pay a dividend), but SoFi is expected to announce earnings again in early to mid February, and this could significantly move the share price thereby impacting this trade (which expires after earnings). Nonetheless, we view the significant upfront premium income as more than enough to compensate us for this trade.

SoFi Bottom Line

Despite the near-term price action, SoFi remains a very attractive long-term business that is growing rapidly and has a massive total addressable market opportunity (to keep growing) thanks for the potential to disrupt big banks and traditional finance. And if you are too worried about near-term volatility to purchase the shares outright, you might consider the income-generating options trade discussed above because it gives you a chance to pick up shares at an even lower price and because it puts attractive upfront premium income in your pocket that you get to keep no matter what.

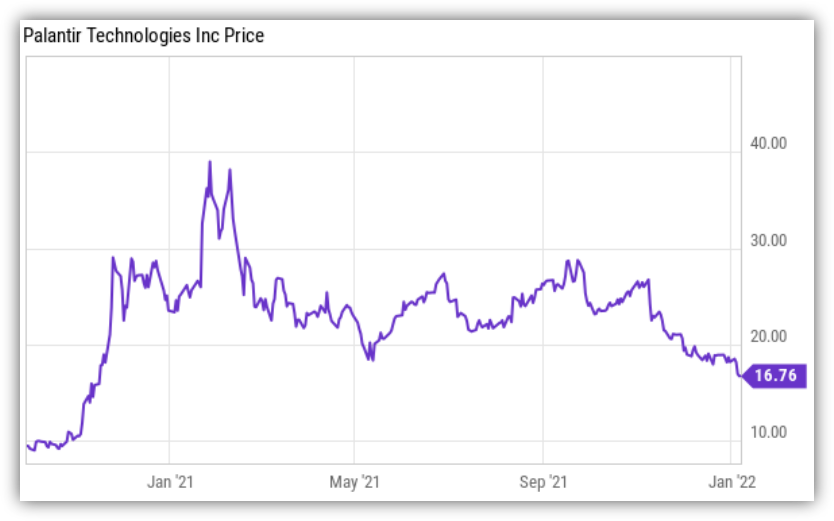

2. Palantir (PLTR)

Palantir is another top growth stock that we recently wrote about (for example here) that has sold off far too much, in our opinion.

Basically, Palantir is a big data company that is known for its highly secretive work with the US government. Palantir also has a massive total addressable market opportunity, and its government work (which is very hard to get, but great if you can get it—like Palantir) is growing rapidly. However, more recently, the company’s new non-government initiatives are growing even faster than its “bread and butter” government work, yet the share price has slumped significantly (it’s basically caught up in this growth stock selloff).

In our view, Palantir is now simply trading far too inexpensively (relative to its ongoing and long-term growth potential), and the shares are worth considering for purchase. However, if you are still uncomfortable with the short-term volatility, you might consider implementing an income-generating options trade strategy (similar to the one we described for SoFi above). In fact, we just released a new Palantir income-generating options trade idea report for members here.

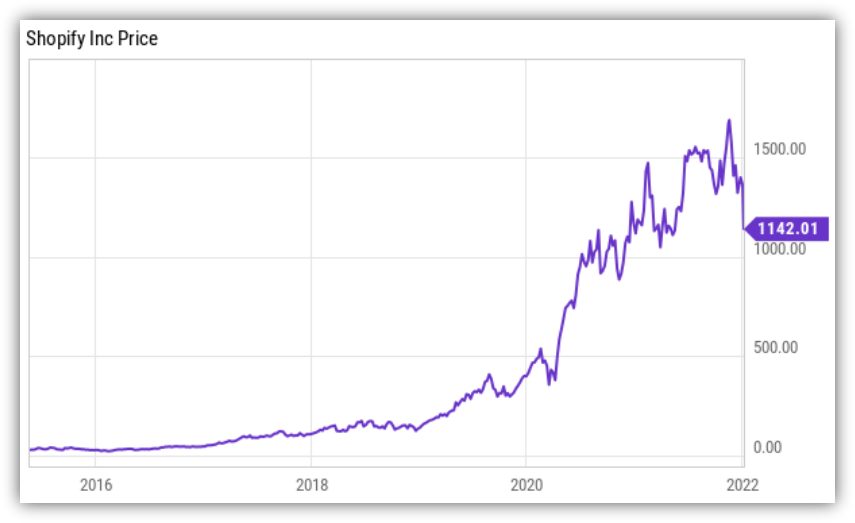

3. Shopify (SHOP)

It would be a mistake to consider Shopify as simply a flash-in-the-pan pandemic stock, yet that is the way the market is treating it lately. Despite the recent downward price action (see chart below), this is a high margin business, that is growing (at scale) at over 30% per year, and it still has a big runway for long-term growth.

For some background, Shopify is a platform that helps merchants run their businesses by providing support (in the form of web and mobile storefronts, mobile apps, inventory and shipping management tools, analytics, reporting and finance functions). In a lot of ways, Shopify is basically the anti-Amazon (AMZN) because it helps small (mid and large) businesses grow, instead competing against them and trying to crush their margins, steal their business, stymie their brands and basically put them out of business, like Amazon).

We have owned Shopify since 2018 (we bought at a very tiny fraction of the current price), and this is what we had to say about it in our August 2018 report:

“Naysayers believe Shopify’s valuation is way too high, but they are making the classic Wall Street mistake of being way too shortsighted. The recent sell-off has created an attractive entry point.”

“Shopify is a rare and very powerful growth opportunity. It’s growing rapidly, and it is expected to keep growing rapidly considering its very large total addressable market (TAM) and its complete lack of any formidable competition. This is a powerful company in the right place at the right time. The shares can be volatile, and we just purchased shares on this latest pullback because we expect the price to increase dramatically in the years ahead.”

In our view, Shopify remains attractive today, especially after the latest price pullback, and it is worth considering for investment. Even if you are an income-focused investor, it can make sense to sprinkle a few top growth stocks into your long-term portfolio to provide a diversified source of high income (i.e. generating high income by selling some of your winners).

Conclusion:

Growth stocks have gotten slammed. Hard. In some cases it has been warranted, but it in others it has simply created a more attractive entry point for long-term investors. Even if you are an income-focused investor, it can make sense to consider generating a small portion of your income needs through long-term capital gains on top growth stocks (i.e. selling some of your winners) because the diversification can help reduce volatility risks (in aggregate) and because select top growth stocks have recently become a lot less expensive relative to their long-term value.

And if you are a real stickler on price, you might also consider the income-generating options trades discussed in this report because they will put attractive upfront premium income in your pocket (that you get to keep no matter what), and they give you a shot at picking up attractive shares at an even lower price.

However, at the end of the day, you need to know your own personal goals as an investor, and then stick to a strategy that will help you meet them. For example, if you are a 100% dividend-focused investor, you might want to bypass the top growth stock ideas in this week’s report and refer to last week’s Blue Harbinger Weekly: “100 Big-Dividend REITs, CEFs, MLPs, BDCs: These 4 Are Worth Considering.” Just remember that disciplined, goal-focused, long-term investing is a winning strategy. Know your goals, stick to your plan.

Lastly, if you liked the ideas presented in this report, you might also consider a membership Blue Harbinger. We share a steady flow of top investment ideas for you to consider, plus the current holdings in our Disciplined Growth Portfolio and our Income Equity Portfolio. We’re currently offer a 10% discount to all new members as part of our Welcome to 2022 sale. Learn more—get instant access.