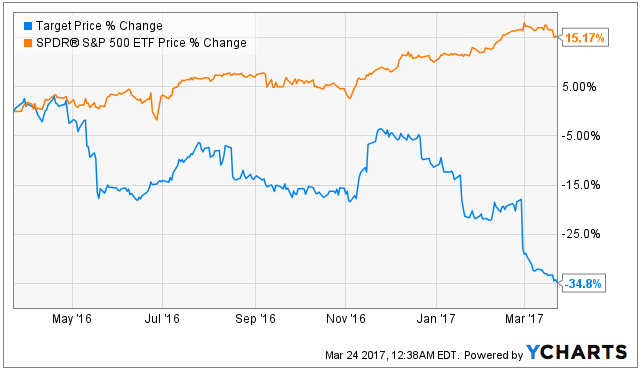

As income-focused contrarian investors, we like to buy high-yield stocks when they are out of favor. However, this is a guideline, not an absolute rule. Case in point, Target (TGT). Despite this company's relatively high yield (4.5%) and significant underperformance (see chart below), we are not interested in owning shares, and that includes not owning them just to sell covered calls on them as any many other income-focused investors seem to think is attractive. This article explains why we are not interested in Target covered calls, and then highlights three specific option trades that we consider far more attractive for generating high income and achieving exceptional long-term total returns.

According to Warren Buffett...

"If you aren't willing to own a stock for ten years, don't even think about owning it for ten minutes. Put together a portfolio of companies whose aggregate earnings march upward over the years, and so also will the portfolio's market value." - source: Warren Buffett.

According to data from Stock Rover, Target's earnings growth estimate over the next five years is negative (-0.6%). And according to Morningstar, "we don't have confidence that the firm will be able to out earn its cost of capital for at least the next 10 years." These outlooks don't sound indicative of the "earnings upward march" that Buffett was talking about.

In our view, Target faces challenges. For example, it's not the cost leader and its products are not differentiated. And even though its gross margins are higher than Wal-Mart (NYSE:WMT) and Costco (NASDAQ:COST), they're coming down (as shown in the following chart), and this is a trend we expect to continue (mainly because its products are not differentiated, and additional competition from online retailers will continue to grow).

Additionally, Target's revenues are not growing as shown in the following chart.

Further, Target has a relatively high level of short interest (6%), as many investors are betting against the company already.

Target Options (Selling Puts and Calls)

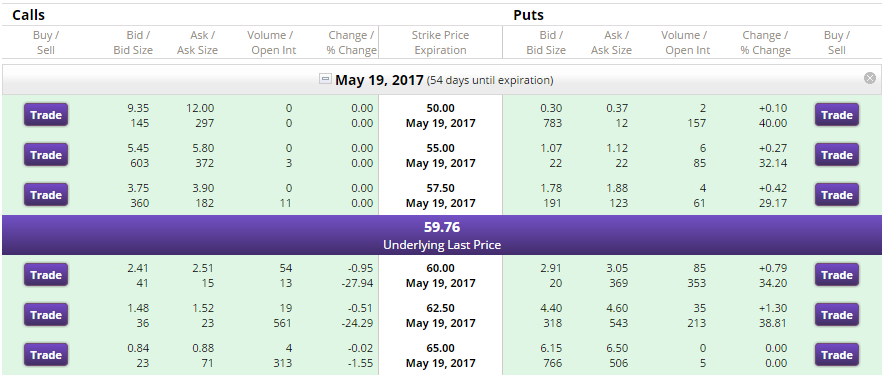

Considering the challenges and uncertainty facing Target, it's not surprising that investors can earn some decent premium for selling Target options, both puts and calls, as shown in the following table.

For example, an investor can earn $0.94 for selling put options with a strike price that is $3.12 (5.9%) below Target's current market price and that expires in just 54 days. Despite this decent amount of premium, we are not interested in the strategy because we don't want to own the shares in the first place. In our view, the premium is not worth the risk of being forced to buy the stock (even at a lower price) because the company will face significant challenges over the long-term, in our view. Per the earlier Warren Buffett quote, "if you aren't willing to own a stock for ten years, don't even think about owning it for ten minutes."

With regard to selling Target covered calls (i.e. owning the shares and selling call options on them), this is not attractive to us either. Given the decent premium available for selling Target calls, some investors argue that the big 4.5% dividend yield, combined with a few extra percent per year for selling calls, makes for a very attractive income stream. However, if the shares keep falling, it will more than offset your income. And more importantly, the opportunity cost of owning Target is too expensive, in our view. Why lock your capital up in shares of a company that faces significant challenges ahead, when there are better investment opportunities available? For example, we have listed below a variety of options opportunities that we consider more attractive than selling puts or calls on Target.

High Income Options Trades Worth Considering

"The time to buy is when there's blood in the streets." - Baron Rothschild, 18th century British nobleman and member of the Rothschild banking family.

Even though overall market volatility remains relatively low (as measured by the VIX, see chart below), there are pockets of high volatility where fear and selling is quite high (i.e. "blood in the streets").

In our view, these pocket of high volatility are attractive places to look for compelling value stocks that can also generate a high amount of income. For example, we have listed a variety of examples below.

Omega Healthcare Investors (NYSE:OHI)

Uncertainty is high with regard to healthcare reform (i.e. "repeal and replace"), and this has created some attractive contrarian opportunities within the healthcare space. For example, we believe selling put options on high dividend yield (7.7%) healthcare REIT, Omega Healthcare, is an attractive options strategy for two reasons. First, we like Omega. It's an attractive contrarian opportunity for diversified long-term, income-focused investors. Specifically, we believe Omega's share price has sold off too much because investors are overly afraid of the potential negative impacts of "repeal and replace" on Omega's skilled nursing facilities reimbursement levels. We currently own shares of Omega, and if the shares fall much lower, then we're interested in buying more. And this is exactly what selling put options on Omega does (it obligates us to buy more shares if the price falls below a certain level).

Per the above chart, we like the May 2017 $30 OHI puts. This contract pays us $0.40 now (we keep this amount no matter what), and if the shares fall below $30 on or before May 19th, then we get to buy them at $30 if the counterparty (the put buyer) puts them to us. This is a win-win situation because the premium (income) is attractive and so are the shares (we like OHI more than TGT, and we'd like to buy more OHI at a lower). You can read our previous report about Omega's attractive demographic tailwinds and compelling valuation here.

Nucor (NYSE:NUE)

We believe selling put options on steel manufacturer Nucor is a more attractive way to generate high income than selling puts or covered calls on Target because the premium (income) on Nucor is attractive and so is the stock (i.e. we'd like to own Nucor at a lower price).

As we wrote in our recent article, 10 High-Yield Dividend Aristocrats Worth Considering…

If you believe in the United States infrastructure growth story (and you like big growing dividends), Nucor is worth considering. Nucor uses electric arc furnaces (EAFs), which are significantly more efficient than the blast furnaces used by most of the global steel industry, thereby giving NUE a cost advantage.

And according to analysts covering the company … Nucor has very high earnings per share growth expectations over the next one (+7.3%) and five years (+24.6% annually).

Yet, despite the Nucor "positives," the stock still faces a lot of uncertainty which keeps the premiums on its options attractively high as shown in the following table.

Nucor is a stock that soared following the election in November, but has started to pullback recently as shown in the following chart.

The recent pullback may be indicative of growing concerns that the "Trump rally" is starting to fade, but it is also creating an increasingly attractive opportunity to sell puts in our view.

U.S. Steel (NYSE:X)

If you like the infrastructure story of Nucor, you may like selling puts on U.S. Steel even more. Both companies produce steel, but U.S. Steel pays a lower dividend, thereby contributing to its higher volatility - which means the market is offering significantly higher premiums (income) for selling puts on U.S. Steel, as shown in the following table.

Also like Nucor, U.S. Steel's stock price soared following the November election in response to the then president-elect's pro-US growth story.

However, U.S. Steel has since pulled back (even more so than Nucor) as the Trump rally begins to face more skepticism. We like U.S. Steel because the blast furnaces it uses (unlike Nucor's electric arc furnaces) allow it to ramp up quickly and profitably should the market cycle turn up in favor of steel producers. There is a high degree of uncertainty with U.S. Steel so we prefer puts that are further out of the money. Specifically, we like the $0.58 premium on the May 19, 2017 puts with a strike price of $26. This is far enough out of the money (nearly 21%) to account for U.S. Steel's volatility, but still pays a high enough premium to make it worthwhile, in our view.

Conclusion

If you are an income-focused value investor, selling puts on attractive value stocks when there is "blood in the streets" can be a very attractive strategy. And even though overall market volatility and fear remains relatively low, there are pockets within the market where uncertainty is high (such as certain healthcare-related stocks and some basic materials companies, as described in this article). Further, the growing uncertainty surrounding healthcare reform (i.e. "repeal and replace") and the fading "Trump rally" may continue to add to market fear and a larger overall pullback that many investors believe we are due for. It may make sense to dip your toe into selling insurance (put options) now considering the select pockets of high volatility and attractive options premium (income). And when overall market fear and volatility do spike (i.e. when there is "blood in the streets") that is the time when even more of the best investment opportunities will become available.