If you like generating a lot of income from your investments then closed-end funds (CEFs) may be worth considering. For example, it’s not uncommon for a CEF to offer an annual yield in excess of 8% paid quarterly (and some CEFs pay monthly). However, there are many hundreds of CEFs to choose from and they can be far more different than apples and oranges. This article highlights seven important considerations when selecting a CEF.

1. What is a Closed-End Fund?

A closed-end fund is an exchanged traded product that can offer a big attractive distribution yield. Its price fluctuates throughout the course of the trading day based on a combination of its net asset value (the aggregated market value of the individual holdings within the fund) and supply and demand. The supply and demand dynamics of a closed end fund can cause it to trade at a significant premium or discount versus its NAV throughout the course of the day (and over time), especially versus exchange traded funds (ETFs). Unlike CEFs, ETFs have creation units where ETF management can create more shares of the ETF through the open market which helps keeps the discount/premium on an ETF small (generally only a few basis points). On the other hand, CEFs have no creation units (they’re closed-end) and therefore CEFs can trade at large discounts and premiums relative to their NAVs thereby creating opportunities and risks.

CEFs come in many shapes and sizes. Examples of CEF categories include diversified equity funds, sector funds, corporate bond funds, commodities funds, and asset allocation funds, to name a few. For example, the following table shows specific examples of a few CEFs and includes metrics like category, distribution rate, and discount/premium (more on this later).

(source: Morningstar)

2. Who Should Invest in Closed-End Funds?

Generally speaking, CEFs are for mature, retired (or semi-retired) investors that need to generate income from their investments, but don’t necessarily have the time or expertise to manage a portfolio of investments so as to efficiently generate that income.

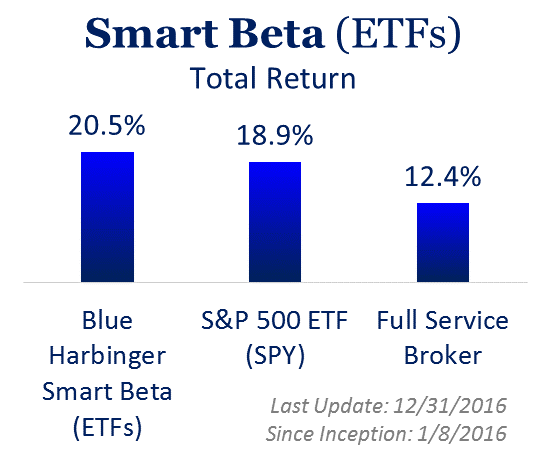

Younger investors, still saving for retirement, should generally NOT invest in CEFs because the fees are too high (more on fees later). Specifically, retired (or semi-retired) people may be comfortable paying the fees in exchange for the steady high income, but younger people are generally far better off avoiding the fees of CEFs and instead investing in lower cost exchange traded funds because that will allow their investments to better compound over a long-time horizon and they don’t yet need the high income generated by CEFs anyway (whereas retirees often do need the high income).

3. Sources of Income

As mentioned earlier (and shown in our earlier table) the yields on CEFs can be large, often in excess of 8% (this is why income-focused investors often like them). However, it is important for investors to understand how CEFs are able to successfully generate these high income payments when the stocks and bonds from which CEFs are often constructed generally offer far lower dividend yields (the S&P 500 dividend yield is only around 2%) and far lower interest payments (10 year treasuries currently yield only around 2.4%). The answer is a combination of dividends, interest, capital gains, capital distributions, and leverage.

4. Leverage

Another feature of CEFs is they can use some leverage (borrowing) to magnify returns and distribution yields. However, keep in mind the leverage is usually very conservative, and regulations generally prevent CEFs from using more than 30% leverage (i.e. they can buy a $1.30 worth of securities for every $1.00 they have). This feature helps the funds cover expenses (so they can maintain market exposure- you don’t want to miss out on returns) and so they can magnify returns (a 1.3x leverage ratio can theoretically increase the distribution by 30%).

5. Discount/Premium

Another important consideration for CEF investors is the discount or premium the fund is trading at. For example, if a CEF trades at a 16.5% discount to its NAV (this is significant, but not that uncommon) then you can buy shares of that CEF for 16.5% less than its Net Asset Value (i.e. the value of all the individual holdings in the fund). A discount is generally an attractive time to buy (because if/when the discount is reduced, investors experience gains). However, it’s important to remember, there is no guarantee the discount will ever go to zero, and it could actually get worse. For example, the following chart shows the recent discount/premium history on a popular CEF (ADX):

(source: Morningstar)

And as a reminder, the discount/premium is caused by supply and demand (CEF’s have no creation unit mechanism to shrink the discount/premium). This means if a particular type of investments is out of favor (for example healthcare stocks) then investors may put such strong selling pressure on a healthcare CEF that its price will fall far below its net asset value (and in theory, from a contrarian standpoint, this may be a very good time to buy).

6. Distribution Sustainability

JP Morgan’s long-term capital market assumptions suggest large cap equities will deliver a total return (dividends plus price appreciation) of 7.25%, on average, over the next 10 to 15 years. Therefore, a reasonable assumption is that a large-cap equity CEF can afford to pay a 7.25% distribution yield over the long-term without destroying its long-term net asset value. If the fund uses 10% leverage, then that long-term 7.25% target may increase by 10% to almost 8%. And if the fund currently trades at a 10% discount to net asset value then that’s another 10% of long-term capital appreciation potential. All in, a large cap equity CEF, using 10% leverage, and trading at a 10% discount, might reasonably be able to deliver a distribution of a little less than 9% per year, on average, over the long-term. However, in this situation, if your large cap CEF is offering a 12% distribution yield then that is a red flag and an indication that a distribution cut may be coming. The point is simply that CEF investors need to be cognizant of their CEFs sources of income, and they need to be reasonable about setting their distribution yield expectations (i.e. if a particular CEF’s yield looks too good to be true, then it probably is).

7. Management Fees

Management fees are another important consideration when investing in CEFs. At Blue Harbinger, we generally despise management fees (because they detract from long-term performance), and we work very hard to eliminate or minimize management fees as much as possible. However, in the case of CEFs, some investors are comfortable paying the fees in exchange for the high income and “sleep well at night” peace of mind that CEFs can offer.

For example, it’s not uncommon for CEF management fees to hover around 1.25%. If this were an ETF fee, we’d say it is way too high, and we’d advise investors to stay away. However, because it’s a CEF we acknowledge that it may be acceptable to some investors, particularly those that are already retired (or semi-retired) and need the steady income to meet ordinary living expenses (i.e. they are less concerned with maximizing long-term capital appreciation because they’re already retired and need the distributions). And as a reminder, CEFs are generally NOT a good investment for younger people still saving for retirement because of the high fees (i.e. young people shouldn’t be paying high fees for big distributions, they should be reinvesting at low costs so they can maximize long-term growth and compounding).

Conclusion:

Closed-end funds can be a very attractive source high yield for retired (or semi-retired) investors, but they are not for everyone (e.g. CEFs are generally NOT prudent for young investors). It’s important to understand how CEF’s generate income (as described in this article) so investors can set reasonable expectations and avoid red flag risks. CEFs can be used to gain broad market exposure or they can be used to make “bets” on certain sectors and asset classes. However, returns are determined by far more than just broad market or sector movements (for example, leverage, premium/discount, and distribution sustainability).

Want access to Blue Harbinger's current holdings and 100% of our members-only content?

Consider a subscription...