After a strong 2015, health care stocks are leading the way lower in 2016. And it’s been an even uglier year for biotechnology company Gilead, which is down 25.2% (Note: our complete sector/industry performance rankings are available here). This article provides a review of why we believe owning Gilead is a high risk Hail Mary pass (i.e. Gilead’s growth prospects are not good), and we then review three stocks we consider more attractive.

Gilead’s Profits Are Evaporating:

Gilead is a research-based biopharmaceutical company. It has several blockbuster drugs within its two largest product lines that treat hepatitis (Harvoni and Sovaldi) and HIV/AIDS (Truvada and Altripa). Impressively, the company has a large profit margin (close to 50%), it offers an attractive 2.6% dividend yield, and its dividend payout ratio is amazingly low at only 16.4%. However, growth is slowing and competition is beginning to creep in. Specifically, Gilead will experience a couple big patent expirations in 2018 and 2021, generic competition is on its way, and revenues are already declining as shown in the following chart.

Making matters worse, Gilead’s pipeline is being nurtured, but it is highly uncertain, and the company may need to look to costly inorganic acquisitions to achieve significant growth. For reference, the 5-year EPS growth estimate for Gilead is negative 0.7% (this is especially unattractive compared to some of Gilead’s peers as we’ll cover later). For reference, the following table shows Gilead’s declining sales and large dependence on hepatitis (HCV) and HIV drugs.

Also, this next charge provides details on Gilead’s pipeline.

For reference, Gilead spent $1.1 billion on research and development last quarter versus a net income of $3.3 billion.

The bottom line with Gilead is that its revenues and profits will continue to decline at an accelerating rate if it cannot find a way to move beyond its existing drugs. We’re not saying Gilead won’t be successful (and its forward price-to-earnings ratio is very compelling relative to peers at only 6.9x). However, there are no guarantees Gilead will find success, and there are safer alternatives that are also trading at discounted prices given the recent declines in the sector. For example, here are three attractive alternatives worth considering…

Three Attractive Alternatives Worth Considering:

Pfizer (PFE) – Honorable Mention:

Pfizer is an attractive, research-based, global biopharmaceutical company. It did not make our “top 3” list, but it’s worth mentioning and considering because it has a higher dividend yield (4.0%) than Gilead, better growth prospects (its 5-year EPS growth estimate is 6.8%), and its forward PEG ratio (price-to-earnings/growth) is attractive at only 2.0x (Gilead’s forward PEG is meaningless given it negative expected growth rate). We would have added Pfizer to our top 3 if it hadn’t already rebounded significantly (+8.0%) since the election. Last spring, the Obama administration put the kybosh on Pfizer’s efforts to lower its taxes by merging with Ireland-based Allergan, but apparently the market believes the incoming administration may be more helpful in making US tax rates more competitive globally.

Amgen (AMGN)

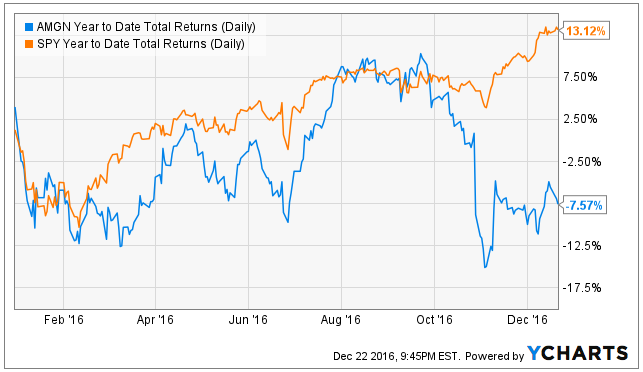

Rather than the high uncertainty (and negative growth) of Gilead, contrarian, value-focused investors that like dividends may want to consider Amgen. Amgen is a biotechnology company with a higher dividend yield (3.2%), a low dividend payout ratio (37.5%), an attractive growth rate (the 5-year EPS growth estimate is 7.3%), and its PEG ratio is only 1.7x. Amgen has a variety of products that are growing (as shown in the following table), and it has been enjoying recent success in improving margins with cost cutting and operational efficiencies.

Amgen still spends heavily on research and development at $990 million last quarter versus net income of $2 billion. Additionally, Amgen shares have declined 7.6% this year as health care (and biotechnology, in particular) has sold off, making for a more attractive opportunity for contrarian investors.

Elli Lilly (LLY)

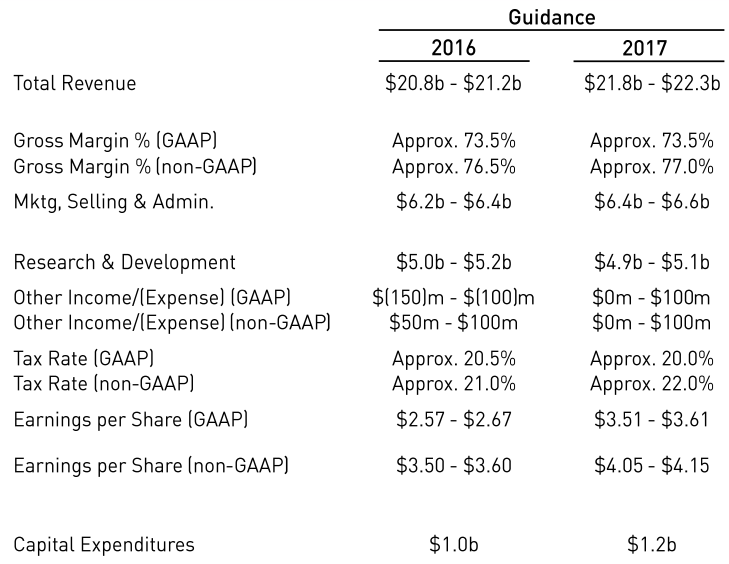

Eli Lilly and Company is engaged in drug manufacturing business, and unlike Gilead it is growing not shrinking. For example, the five year EPS growth estimate is a strong 9.8%, and the following table shows the company’s expected growth from 2016 to 2017.

Eli Lilly discovers, develops, manufactures and markets products in two segments: human pharmaceutical products and animal health products. And Lilly has multiple tailwinds at its back including the uptake of newer products as shown in the following graphic.

And for example, new immunology drugs including Baricitnib and Taltz may eventually reach multi-billion dollar annual sales (Lilly’s sales were $5.2 billion in the most recent third quarter).

Also attractive, Lilly has a big 2.8% dividend yield, with a healthy 87.5% payout ratio, and an attractive PEG ratio of 2.1x. Further, Lilly’s shares have been dragged lower this year as the overall sector has come down due to regulatory uncertainty and because healthcare (and biotechnology and pharmaceuticals, in particular) performed very well in the prior year (2015). Given Lilly’s diversified, growing, product line and valuation, we consider it more attractive than Gilead.

Bristol-Meyers Squibb (BMY)

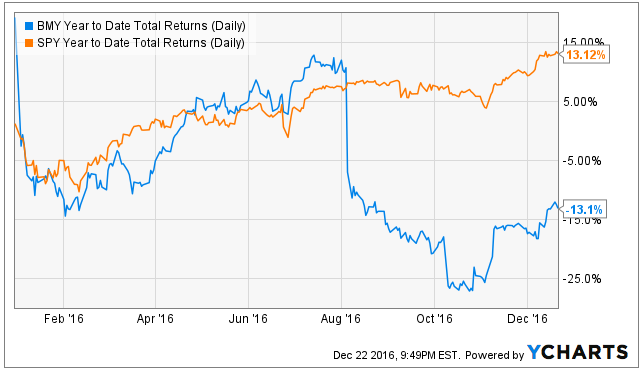

Despite its post-election pop, Bristol-Meyers Squibb’s shares are still down for the year, and they’re still trading at an attractive valuation. For example, the company’s 5-year EPS growth estimate is an impressive 18.0%, and its forward PEG ratio is only 1.1x. The company is getting through several patent losses over the next couple years, but its cancer drug, Opdivo, is expanding into new markets and has significant growth potential. Worth noting, during its recent third quarter earnings release,

“the company raised full-year guidance for 2016 and provided guidance expectations for 2017, announced a new $3 billion share repurchase authorization, and announced an evolution of the company’s operating model to focus resources behind the company’s highest priorities, accelerate its pipeline and simplify infrastructure.”

Also worth noting, Bristol-Meyers has a healthy 2.7% dividend yield (the payout ratio is only 75.3% and earnings are expected to grow significantly). We consider Bristol-Meyers Squibb more attractive than Gilead for contrarian, dividend-focused, value investors.

Conclusion:

Health Care stocks (and drug companies, in particular) have performed very poorly this year as uncertainty in the sector has remained high. We believe this uncertainty and under-performance have created attractive opportunities for contrarian value-focused investors, such as the three opportunities described in this article. For additional contrarian opportunities, consider this week’s members-only investment idea (it’s a small cap software company), as well as our more comprehensive ranking of opportunities within the healthcare sector and across industry groups.