Small cap stocks provide significant long-term price appreciation potential, but a perennial problem for income-investors is they pay very little in terms of dividends. However, the small cap Closed-End Fund (CEF) we review in this article offers a very attractive 8.0% annual yield (paid quarterly). It also offers a great management team, an impressive long-term track record, and it currently trades at a large compelling discount to its net asset value (NAV) suggesting it has strong price appreciation potential ahead.

Royce Value Trust (Yield 8.0%)

(ticker: RVT)

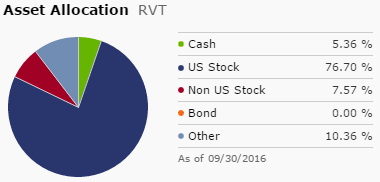

Royce Value Trust (RVT) is a closed-end fund that invests primarily in small and micro-cap companies, and it offers a big 10.4% annual distribution (paid quarterly). As of January 3rd, the fund had a 5.2% leverage ratio (it borrows a small amount of money, as is common for closed-end funds). For reference, the following tables provide a breakdown of the fund’s asset allocation (primarily US stocks).

Worth noting, RVT is the first small-cap closed-end fund, and it has been managed by Royce since its inception in 1986. And even though the fund holds over 400 actively selected small cap stocks, it still maintains a high active share of 89% which means it has only 11% overlap with its benchmark (i.e. it’s not a “closet index” fund, and this is a good thing). Additionally, the fund’s turnover ratio (how often it trades) is very low at only 35% (i.e. 35% of the holdings change in a year), and we consider this a very good thing because it demonstrates management’s long-term view and it also helps keep expenses (trading costs) low.

Also worth considering, the following style box shows the fund is clearly in the “small cap” space.

And while the world "Value" is in the title of this fund's name, it tilts slightly "Growth" which is a good thing considering small cap "value" performed so well in the last two months of 2016 (i.e. this makes "growth" more compelling from a "contrarian" standpoint).

Sources of Income:

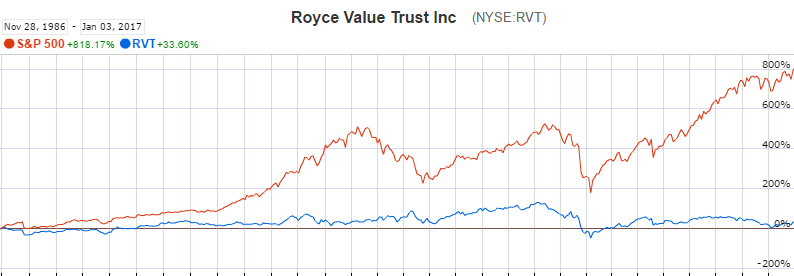

Considering the benchmark Russell 2000 small cap index offers only a 1.7% dividend yield, you may be wondering how the Royce Value Trust is able to maintain its big 8.0% distribution yield. The answer is capital gains distributions. The fund sells shares of its “winners” and uses the proceeds to pay the distribution. For perspective, the following chart show the fund’s long-term price gains (excluding the dividends) and relative to the S&P 500.

At first glance, it may appear that this fund has significantly underperformed the market over the long-term, but remember this chart doesn’t include the distribution payments. For reference, this next table shows the fund’s (RVT) long-term performance (including the distribution payments) versus the Russell 2000 benchmark, and in this chart RVT has outperformed since inception.

The important takeaway is that the Royce Value Trust has provided competitive long-term returns but with huge distribution payments, and this is exactly why you pay Royce to manage the trust: so you can have long-term exposure to attractive small-cap stocks AND collect big steady distribution payments. You’re basically having your cake and eating it too.

For added perspective, here is a recent breakdown of the fund distributions between Net Investment Income (e.g. dividends from the stocks the fund holds) and realized gains (selling some of the funds stock positions that have appreciated in value).

Discount to NAV:

Another extremely important (and in our view attractive) metric to consider is the fund’s current discount to net asset value (NAV). NAV is the value of all the consolidated holdings within the fund if you were to liquidate it, but because the holdings trade as a consolidated basket/fund on an exchange, its market price can deviate (discount or premium) from its NAV. And in the case of the Royce Value Trust, it is currently trading at a huge discount as shown in the following chart.

And while there is no guarantee that the share price will rebound closer to the NAV, they have been headed in the right direction over the last year (the discount shrunk in 2016), and could easily return to a more normal discount of around 10% (instead of the current discount of 16.4% as of 1/3/17). And reaslistically, the shares should have almost no discount in our view as the holdings (NAV) are worth clearly more than the market price at which the fund trades.

Risks:

Important to consider, closed-end funds (and this fund in particular) face unique risks. For example, closed-end funds generally have high expense ratios. At Blue Harbinger, we absolutely despise high expense ratios because they eat into long-term returns. However, we also believe the high expense ratios of CEFs are acceptable to SOME investors. In particular, if you are a mature investor that relies on income from your investments to meet living expenses then CEFs can be worth considering as an important part of your diversified investment portfolio. Said differently, the high fees may be okay if you understand you may be sacrificing some long-term capital appreciation in exchange for the relatively large and steady income payments you need to pay your bills.

On the other hand, if you are a young person still saving for retirement then CEFs are generally NOT prudent for you (i.e. you’re better off investing in very low expense ratio exchange traded funds because you don’t yet need the income).

For reference, RVT’s total adjusted expense ratio was only 0.61% for the last full-reportable year available, which is very attractively low for a closed-end fund. Importantly, this particular CEF (RVT) utilizes a performance fee structure to help align management and customer interests. According to the Royce website:

“A portion of the adviser's fee is "at risk" and is determined by the Fund's performance relative to its benchmark, the S&P SmallCap 600 Index. In general, if the Fund outperforms the benchmark over the measurement period (a rolling 60 months), the fee is increased. If the Fund underperforms, the fee is decreased. This performance based structure can increase or decrease the adviser's base fee of 1.00% by up to 0.50%.”

We believe this incentive structure is prudent, and the 1.00% base fee is appropriate (it’s actually somewhat inexpensive for a small cap fund).

Another risk is that the lead portfolio manager, Chuck Royce, will soon retire. Chuck has lead the fund since its inception in 1986. He is currently 76 years old. In our view, Chuck is supported by a highly competent team (Chris Flynn, David Nadel and Lauren Romeo) that could take over seamlessly in a transition, and realistically they’ll have to carry Chuck out in a pine box before he retires (no offense intended).

Conclusion:

If you are attracted to the long-term growth and appreciation potential of small-cap stocks, but you also want big steady dividend payments, then the Royce Value Trust (RVT) is worth considering. Granted this particular fund is more expensive (see management fees discussed above) than an exchange traded fund (ETF) and more expensive than assembling your own portfolio of individual stocks, but that is the price you pay to have the Royce team manage the investments to prudently generate the big distribution payments you like, while you are able to “sleep well at night.”

We do NOT recommend this investment for young people still saving for retirement because they generally don’t need the big distribution payments, and they’re better off avoiding the management fees of closed-end funds in general. But if you are already retired (or semi-retired) then the Royce Value Trust is one big-distribution (8.0%) CEF that is worth considering (for the reasons described above) for your diversified long-term income-focused portfolio.