This week’s Weekly provides a brief overview of what’s likely on tap for this upcoming week in terms of potential new trades in our Blue Harbinger Income Equity strategy. We also share some data, predictions, and high-level perspective on the returns and volatility of high yield bonds.

First the High-Yield (or Junk) Bonds…

This is an asset class that is plush with high income opportunity and high risks. As an asset class (the entire junk bonds market), most of the “experts” expect it to deliver positive returns in 2017. Specifically, according to the Wall Street Journal:

Of six large banks surveyed by The Wall Street Journal, four project positive returns for junk bonds in 2017. J.P. Morgan Chase & Co. is the most bullish, predicting an 8% return. Wells Fargo & Co. is projecting 5% to 6%, while Bank of America Merrill Lynch is estimating 4% to 5% and Goldman Sachs Group Inc. is expecting 3.2%.

However, the returns of individual junk bonds can vary widely. For example, Sprint Corporation has some 7.625% bonds due 2025 (this is a relatively big yield) that recently traded at around 107 cents on the dollar, up from 75 cents on the dollar in June, according to MarketAxess. (source: Wall Street Journal). And while the 7.625% yield is attractive, the large move from 75 cents to 107 is where the real returns generally lie in junk bonds.

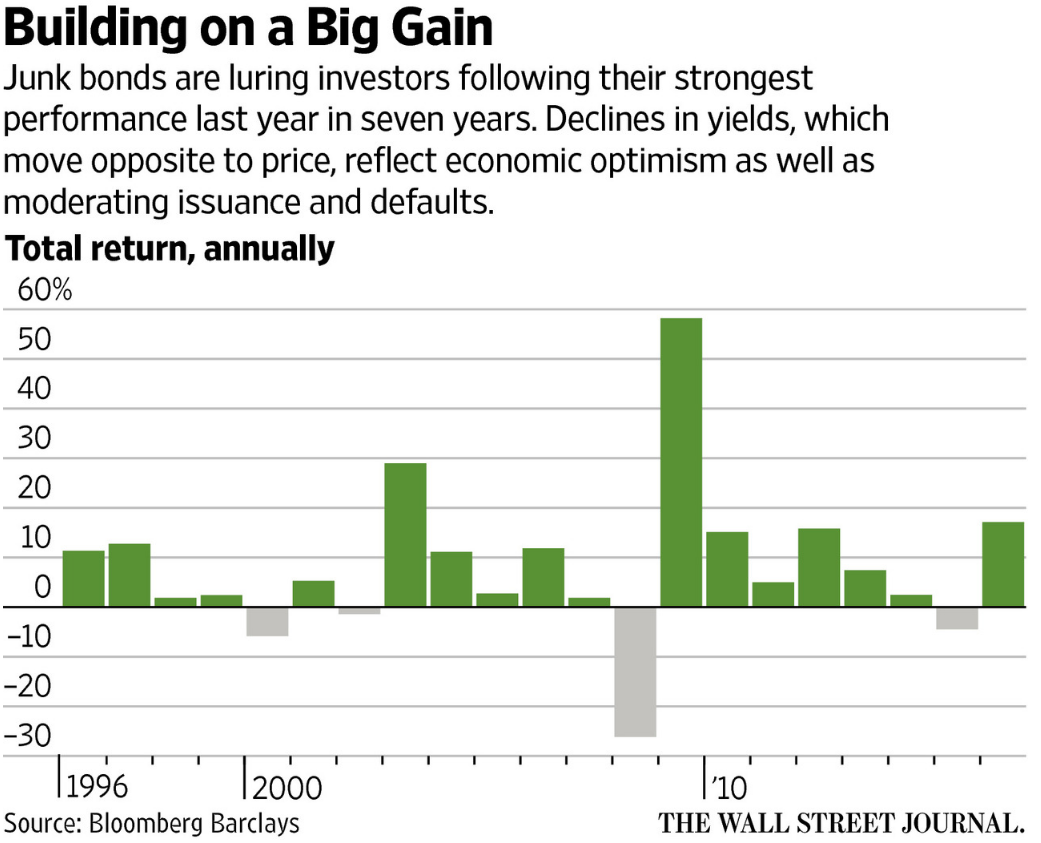

For perspective, the following chart shows returns of the asset class in recent years.

And considering the strong performance last year (2016) it seems unlikely they’ll have a repeat big year in 2017 because in aggregate a lot of distressed junk bonds (such as Sprint) have already rallied and sit at levels that make further significant price appreciation unrealistic.

Our two junk bond takeaways…

1. Don’t get lured into investing in junk bonds by the notion that there is a lot of easy money and big steady interest payments. As the above chart shows, they have good years, and they have bad years, but they also have a lot of risk (i.e. junk bonds can default and/or decline in value quickly whereby you can lose a lot of money). And in particular, as we continue to move farther away from the distress of the financial crisis, and interest rates continue to rise, in our opinion-- the opportunities for big returns are diminished, particularly after a strong 2016.

2. As part of a diversified portfolio, it can make sense to have a small allocation to junk bonds because the asset class tends to have positive returns over time, and the asset class is less than perfectly correlated with other asset classes such as stocks or investment grade bonds (this can help minimize the volatility of your overall portfolio because junk bonds “ebb” a little when other asset classes “flow” (and yes, ebb and flow are technical terms ;)

On Tap for Next Week…

We’ve been digging into a lot of closed-end fund research lately because of their attractive big distribution payments and large discounts to Net Asset Value (NAV). Here a couple examples (with more to come soon)…

As a result of the opportunities we have been seeing, we expect to replace some of the Exchange Traded Fund (ETFs) in our Income Equity Strategy with Closed-End Funds (CEFs). In particular, we’ve been closely reviewing a few that give the same asset class exposure as the ETFs we currently hold, except with much bigger yields, and the potential for strong gains, given current market conditions. Stay tuned…