Artificially low interest rates and market uncertainty make it challenging for income-focused investors to find satisfying yield opportunities. Many investors consider "Dividend Aristocrats" to be a good source of relatively safe yield. Dividend Aristocrats are S&P 500 companies that have increased their dividend payments at least 25 years in a row. In this article we highlight 5 Dividend Aristocrats that we believe are worth considering.

Dividend Aristocrats are a rare breed of companies. Not only do they run their businesses well enough to pay nice dividends, they’ve run them well enough to increase their dividend payments for at least 25 years in a row. Given the extensive volatility we’ve seen throughout historical market cycles, maintaining dividend aristocrat status is very impressive, in our view. Without further ado, here is the list...

5. Archer Daniels Midland (ADM, 2.8% Yield)

Not only does ADM pay a big 2.8% dividend, but the shares have under-performed over the last year as global economic conditions have been weak and the strong dollar has been a drag on sales. In our view this is part of the normal economic cycle, and creates an attractive buying opportunity for long-term investors.

If you don’t know, ADM buys agricultural commodities (oilseeds, corn, wheat), processes them, and then sells them as protein meal, vegetable oil, corn sweeteners, flour, biodiesel, ethanol, and other food and feed ingredients. The company has no pricing power (their product is a commodity), but they do have economies of scale based on their global network of processing, storing and transporting capacity. Additionally, the company should benefit from growing worldwide demand for animal feed as emerging markets consume more meat.

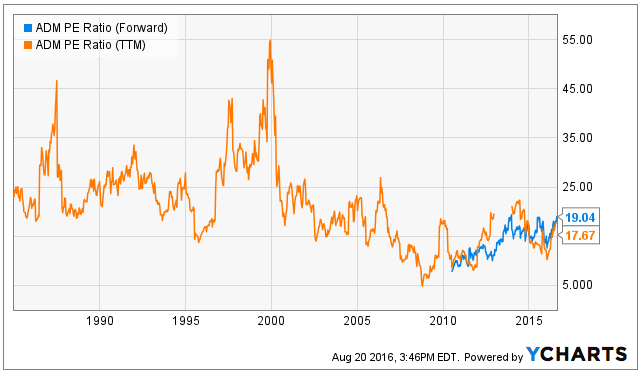

On a price to earnings basis, ADM is particular attractive relative to its own history, especially as we expect the market cycle and economic conditions to improve (i.e. we’re at a low point in the cycle, making now an attractive time to consider a purchase).

4. HCP Inc. (HCP, 5.8% Yield)

As we’ve written in the past, HCP Inc. is an attractive big-dividend (6.0%) healthcare REIT that has been plagued by ongoing challenges with its largest tenant, HCR ManorCare. We recently received new information on HCP’s plans to spinoff HCR ManorCare into a separate REIT (Quality Care Properties). We continue to believe the spinoff is a smart decision that will unlock value by giving HCP shareholders exactly what they want, while simultaneously buying time and options for HCR ManorCare. You can read our full write-up on this very attractive dividend aristocrat here...

Our Top 3 Dividend Aristocrats Worth Considering are available in this week's Blue Harbinger Weekly...

Interested in becoming a Blue Harbinger member?...