Welltower (HCN) is a big dividend (4.4%) healthcare REIT that has gained roughly 15% this year versus the S&P 500’s gain of approximately 7%. Welltower is an income-investor favorite not only because of its big dividend (especially compared to artificially low interest rates set by central bankers), but also because of the perceived long-term demographic tailwinds at its back. In this article, we review some of the more significant risk factors that could potentially derail HCN’s outstanding long-term track record including healthcare reform, the company’s already large size, valuation, dividend sustainability, lawsuits and REIT laws.

Demographic Advantages:

You can read the investor presentation of just about any healthcare REIT and quickly get the message that the aging population will fuel healthcare growth. For example, this recent Welltower presentation titled “The Aging Population” provides the following useful chart about the significant expected growth in Welltower’s markets.

And this next chart gives an idea of the amount spent on healthcare by age.

This next chart shows Welltower’s diversification across its various segments. For reference, post-acute care includes high-impact rehabilitation centers that specialize in helping patients recover from illness or surgery with goals of getting them home and healed faster. Senior housing includes independent living, assisted living and memory care communities. And Outpatient medical facilities are growing because a growing number of procedures can be performed outside of hospitals.

Welltower’s diversified segments provide exposure to a range of opportunities, and also help the company reduce its concentration risks.

Risk Factors:

1. Healthcare Reform is one of the biggest risks that Welltower is forced to deal with. For starters they describe this risk in their most recent annual report as follows:

“The requirements of, or changes to, governmental reimbursement programs, such as Medicare or Medicaid, could have a material adverse effect on our obligors’ liquidity, financial condition and results of operations, which could adversely affect our obligors’ ability to meet their obligations to us.”

Welltower’s exposure to post-acute care (or skilled nursing) in particular poses a risks (especially considering it makes up 21% of Net Operating Income as shown in an earlier chart). This segment is greatly affected by healthcare reform via changes to Medicare and Medicaid. In particular, Medicare Advantage laws have resulted in lower reimbursement rates and shorter stays. And any additional changes to these laws could weaken HCN’s profitability. Worth noting, the rate of expansion of Medicare Advantage may be slowing (a good thing for healthcare REITs).

Also worth noting, Welltower depends on Genesis Healthcare (an operator of long-term/post-acute care facilities) for 10% of its revenues. This exposes Welltower to a concentrated risk in a risky business segment. For consideration, Welltower’s competitor, Ventas (VTR), spun off its skilled nursing facilities business into a separate REIT (Care Capital Properties), and HCN’s other competitor, HCP has plans to do the same with its HRC ManorCare skilled nursing business.

2. Welltower is Already Relatively Large. Another risk factor is simply that HCN is already relatively large, and future growth may be more challenging than it has been in the past. For perspective, the following chart shows HCN’s size relative to some of its REIT peers.

Additionally, the supply of senior housing (HCN’s largest segment) has grown significantly, and so has the competition. An oversupply could be a drag on future profitability.

Also worth noting, a significant portion of Welltower’s business is based on acquisitions and dispositions. For example in the most recent quarter, Welltower completed $356 million of pro rata gross investments, and also completed total dispositions of $227 million. As the company continues to gain in size, meaningful acquisitions and dispositions become increasingly challenging.

3. Welltower May Become Overvalued. Considering the growing search for yield (due to artificially low interest rates) and the recent rally in the REIT markets (as described previously), Welltower runs the risk of becoming too richly valued. For some perspective, the following chart shows Welltower’s recent Price to Funds from Operations (FFO) versus its historical level.

As the chart suggests, Welltower’s price to FFO has risen in recent years, but it is not necessarily exorbitantly high relative to history. For some added perspective, the same ratio for Ventas (a Welltower peer) as of the same date in 2016 was 18.7 (however unlike Welltower, Ventas spun of its riskier skilled nursing business last year).

4. Sustaining the Dividend May Become Challenging

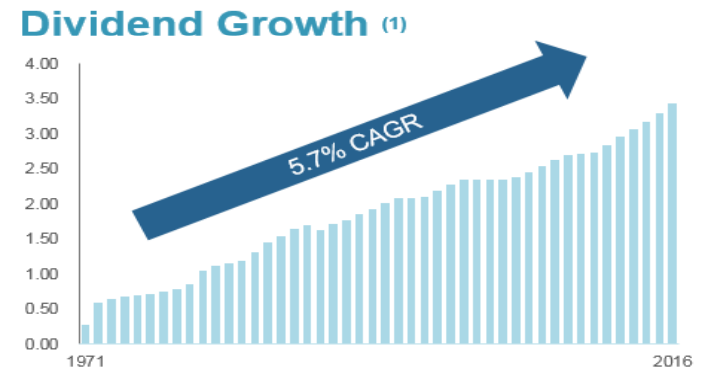

Another ratio worth considering the Funds Available for Distribution or FAD payout ratio. As of Welltower’s most recent earnings release, the normalized FAD payout ratio was 84% year to date suggesting the dividend payout is not unmanageable. For perspective, the same ratio for Ventas was 74%. If this ratio were to rise close to (or above) 100% it would be an indication that the company may be unable to sustain the dividend payments. For consideration, the following chart shows Welltower’s long-term historical dividend growth rate.

Also worth considering, the following chart shows Welltower’s historical growth in NAV has recently outpaced its healthcare REIT peers Ventas and HCP (HCP has very recently faced challenges with its HCR ManorCare properties).

5. Interest Rates May Rise

Low interest rates have benefited Welltower in multiple ways. First, low interest rates have forced many income investors out of traditional fixed income and into higher yielding equities such as REITs. If interest rates were to rise significantly this could cause massive REIT sales by risk averse investors. This scenario seems unlikely in the next few years, but it is possible.

Low interest rates also benefit REITs like Welltower because they borrow capital to fund their investment activities. It could become challenging to fund the business if interest rates were to rise. For consideration, low interest rates have recently helped Welltower to refinance loans at lower rates as shown in the following table.

Worth considering, the following chart shows that Welltower has less debt relative to its EBITDA than its peers.

This is an indication that it will be less affected by any potential interest rate increases. It also suggests Welltower may have more wherewithal to grow its business via debt than its peers. For reference, Welltower’s credit rating is investment grade as shown in the following graphic.

6. Legal Considerations:

Legal considerations are another risk factor for Welltower. As noted in their most recent annual report “Unfavorable resolution of pending and future litigation matters and disputes could have a material adverse effect on our financial condition.” For example, the Department of Justice has been investigating multiple skilled nursing facilities including Genesis HealthCare (Welltower derives 10% of its total revenues from Genesis) with regards to overbilling practices.

Additionally, Welltower faces unique risks due to its REIT structure. For example, they could fail to qualify as a REIT which would adversely affect their tax status. Also, because of the 90% annual distribution requirement their liquidity is decreased, and it could limit their ability to engage in certain profitable transactions.

Conclusion:

Overall, Welltower faces a variety of risks, but many of the more significant risks are not overwhelming. For this reason (and the big dividend) we like Welltower. In fact, we like it so much that we’ve ranked it #9 on our list of top 10 Big-Yield Investments Worth Considering because its dividend is sustainable, its valuation is compelling, and we’re comfortable with the risks. And even though the prices of many REITs (including Welltower) have increased significantly, we still believe they can play a very important role in a diversified, long-term, income-focused portfolio.