Don’t be fooled by the big dividend (11%) and low beta; Annaly Capital is a one trick pony at the mercy of the capital markets. Annaly may have the financial wherewithal to maintain its big dividend for more than the next few quarters, but its asset value and share price are in peril, and so is the company’s long-term dividend sustainability. The recent Hatteras acquisition is an ominous reminder of the atrocious yield curve and Annaly’s shrinking balance sheet. And the upcoming REIT sector creation and the approaching Fed interest rate hike may combine to put a damper on this year’s dividend-stock hype, including Annaly. For your consideration, we have highlighted four, attractive, big-dividend, financial stocks that we like more than Annaly Capital.

About

Annaly Capital Management (NLY) is a Real Estate Investment Trust (REIT) that invests primarily in agency mortgage backed securities (it also has small commercial real estate, residential credit, and middle market lending portfolios as shown in the following graphic).

Annaly uses its own capital (combined with borrowed money) to purchase its investments. Currently, the difference between Annaly’s average yield on interest earning investments (+2.48%) minus its average cost of interest bearing liabilities (+1.68%) is only +0.80% (this is the net interest spread). Additionally, Annaly’s leverage ratio is 5.3x.

At first glance, Annaly’s business appears attractive because of the relatively low risk of agency mortgage backed securities, the company’s positive net interest spread, and its reasonable use of leverage. However, the story is more complicated considering Annaly’s big dividend (which attracts many investors in the first place) and the flattening yield curve (which puts further pressure on Annaly’s net interest spread).

Annaly’s Dividend

The following table (excerpted from Annaly’s recent Q2 earnings release) shows Annaly’s core earnings versus its dividends declared (on a per share basis).

The company is generally generating enough earnings to cover its dividend payments (although the difference dipped to $0.01 negative in the most recent quarter). However, these next two charts give some flavor for the term of its investments versus the term of its borrowings (i.e. it borrows short term at lower rates, and invests longer term at slightly higher rates), as well as the challenge it runs into with a flattening yield curve.

More specifically, this next chart shows how the yield curve has flattened over the last year, and this creates a challenge not only because the cost of short-term borrowing continues to become more expensive, but also long-term rates are falling which means when Annaly’s investments do mature (or get pre-paid) the company is faced with less attractive re-investment opportunities (i.e. they earn lower rates on their re-invested capital). Essentially, the flattening yield curve reduces Annaly’s net interest spread and its earnings.

Annaly’s Net Asset Value:

Annaly’s balance sheet has been shrinking in recent years as investments mature and less attractive opportunities are available. For example, the company’s total assets have fallen from $133.5 billion at the end of 2012 to $77.7 billion at the end of the second quarter. And this table gives some color for the shrinking agency mortgage backed securities portfolio over just the last five quarters.

The shrinking asset value creates two challenges for Annaly. First, less investment assets simply means less opportunities to generate earnings and cash flows to pay dividends. And second, a lower asset value means a lower equity value for shareholders. For example, over the last five quarters, Annaly’s common stock book value per share has steadily fallen from $12.32 to $11.50. And worth noting, Annaly current trades at around $10.94 per share, which represents a very small discount to book value by its own historical standards.

Hatteras acquisition:

The recent Hatteras acquisition is an ominous reminder of the atrocious yield curve and Annaly’s shrinking balance sheet. Specifically, in an effort to grow its business (remember, Annaly’s balance sheet has been shrinking), Annaly purchased mortgage REIT Hatteras last month for $1.5 billion. Annaly used cash and stock to acquire Hatteras at only 85% of its book value which is not an unattractive price. However, the fact that Annaly is forced to look outward for growth combined with the fact that Hatteras was willing to sell, suggests to us that the growth opportunities in the industry are not attractive.

Risks:

REITs (and high-divided stocks in general) have experienced strong price performance this year. However, there may be catalysts on the horizon that could slow or even reverse those gains. For example, the Fed is inreasingly expected to increase interest rates before the end of this year as shown in the following CME FedWatch chart:

And rate hikes may be bad news for REITs for two reasons. First many people have been chasing REIT yields because interest rates have been so low. But increasing yields could mean less craving for REITs. Second, REITs (such as Annaly) rely on heavy borrowing to support their business. And a rate hike makes it more expensive for them to operate (particularly with our flat yield curve as we have discussed previously). And considering the market is hovering around all-time highs and the VIX is very low, we expect rate hike discussions to become a more prominent news narrative as we move towards the end of this year.

Another potential negative catalyst could be the removal of REITs from the financials sector in order to create a new REIT sector. This change is set to occur after the close on August 31st, although it won’t be implemented by indexes until September 16th, and mortgage REITs (like Annaly) will remain in the Financial sector. We suspect there could be some small selling pressure on financials as some investors could reallocate to REITs. But more likely we anticipate the excitement surrounding this upcoming change has already helped increase investor demand for REITs, and we could see the hype finally start to slow following the creation and implementation of the new sector (especially as rate hike discussions become more prominent). These events could be the catalyst for the returns of big yield REITs (like Annaly) to finally slow or even pull back.

Other potential risks for Annaly include a strong housing market (as home prices continue to recover, prepayment speeds could increase, which will force Annaly to reinvest capital at less attractive spreads), and more government intervention in the housing market (recent history has included government mortgage programs which increased mortgage prepayment rates, and exposed companies like Annaly to increased reinvestment risks). For added perspective, the following table gives a general indication on Annaly’s sensitivity to changing interest rates and mortgage backed securities spreads.

Annaly Overall:

Overall, we believe Annaly’s big dividend is likely safe for at least the next few quarters. However, long-term market conditions are not in Annaly’s favor. Specifically, a flat yield curve and the expectation of more short-term interest rate increases by the fed (making the yield curve even flatter) make Annaly’s business more challenging. We’re already seeing this play out as Annaly’s balance sheet shrinks, and the company’s share price and dividend payments have already fallen significantly over the last five years. We’re not suggesting Annaly is the worst investment ever (it’s not), but we do believe there are better dividend-paying financial stock investment opportunities elsewhere, and we’ve highlighted four of them below:

Four Financials We Like More Than Annaly Capital:

Given Annaly Capital’s shrinking balance sheet and challenging interest rate environment, we have highlighted, below, four attractive dividend-paying financials that we like more than Annaly.

Main Street Capital (6.5% yield, 8.1% yield including supplemental dividends)

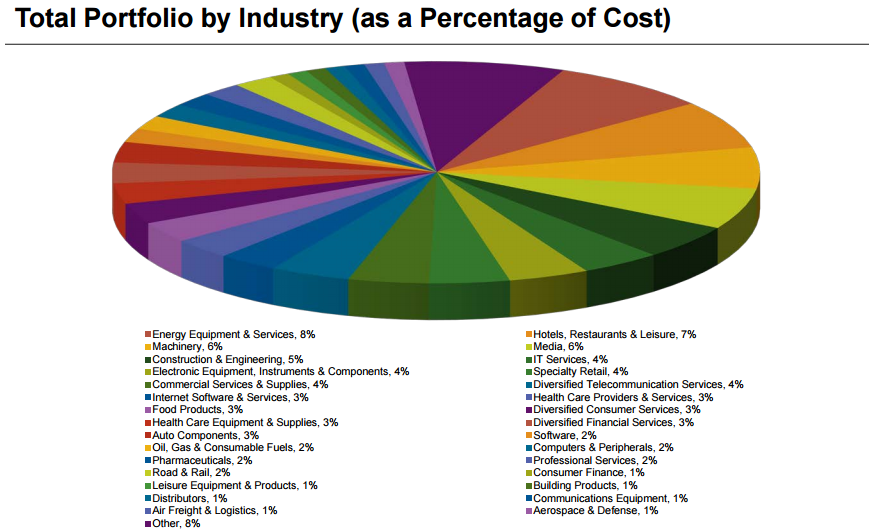

Main Street Capital (MAIN) is a big-dividend business development company that we like more than Annaly Capital. Specifically, it is Main Street’s diversified business model combined with its long-term growth prospects that we believe make it a more attractive big-dividend option than Annaly. For example, while the overwhelming majority of Annaly’s capital is invested in agency securities, Main Street’s investments are diversified across a variety of industries as shown in the following chart.

And unlike Annaly, Main Street’s balance sheet continues to grow as attractive investment opportunities still exist. And importantly, Main Street continues to grow its big ordinary and supplemental dividend payments as shown in the following chart (whereas Annaly has already been forced to cut its dividend in recent years).

Our most recent full report on Main Street is available here...

HCP Inc (5.8% Yield)

HCP (HCP) is a big-dividend financial stock (REIT) that we consider more attractive than Annaly Capital. Despite HCP’s near-term challenges (i.e. its struggling HCR ManorCare business, and upcoming spinoff), its long-term prospect are attractive (it is set to benefit from growing health care real estate demand as the population ages), whereas Annaly Capital’s big-dividend looks good in the short-term, but faces significant long-term challenges (i.e. the flat yield curve is working against Annaly). We believe the market’s fear surrounding the troubled HCR ManorCare business has contributed to HCP being undervalued, and created an attractive buying opportunity. For reference, the following chart shows HCP’s recent price to Funds from Operations ratio (a common REIT valuation metric) versus several of its peers, and based on the mix of skilled nursing exposure among these REITs HCP is not unattractively priced.

Our most recent full report on HCP is available here...

Wells Fargo (3.1% Yield)

Whereas many big-dividend financials have outperformed the market this year, Wells Fargo (WFC) (and big-banks in general) has under-performed, but we believe that may be about to change. Specifically, big banks like Wells Fargo remain under-appreciated since the financial crisis, but with the Fed set to again raise interest rates later this year, Wells Fargo looks increasingly attractive. For example, unlike many big banks, Wells Fargo’s return on invested capital (5.04%) actually exceeds its weighted average cost of capital (4.46%). Additionally, Wells Fargo doesn’t have the same extensive exposure to high risk capital markets instruments that many other big banks are still carrying on their books since the financial crisis. And importantly, an upcoming interest rate hike will benefit Wells Fargo’s net interest margin, but it may also begin to shift market sentiment away from the outperforming big-dividend payers (e.g. certain overpriced REITs) and towards underappreciated opportunities like Wells Fargo.

Our most recent full report on Wells Fargo is available here...

JP Morgan (2.9% Yield)

Like Wells Fargo, JP Morgan (JPM) is an under-appreciated bank with an above average dividend that may be about to benefit from an interest rate hike and a change in market sentiment. Specifically, the interest rate hike will improve JP Morgan’s net interest margin, but may also begin to shift market sentiment away from the hottest big-dividend payers (e.g. certain REITs) and towards the high-quality under-appreciated banks. Like Wells Fargo, JP Morgan also generates a return on invested capital (12.01%) that exceeds its weighted average cost of capital (5.13%) which means it is able to grow profitably. Importantly, almost all of the big banks (including JP Morgan) are passing regulator stress tests with flying colors now, which is an indication that they’re much less risky than they were before the financial crisis, yet leery investors are still overly cautious in our view, which contributes to the creation of this under-appreciated investment opportunity.

Conclusion:

Artificially low interest rates have pushed many income-hungry investors into high yield opportunities such as Annaly Capital. However, many of the most popular high-yield opportunities come with high levels of risk. For this reason, it’s important to consider the underlying fundamentals and to also consider diversifying into other opportunities such as the four we’ve highlighted in this article. Additionally, investors can reduce risk by diversifying into a variety of market sectors (beyond only financials), and for this reason we’ve provided a list of our top 5 Dividend Aristocrats Worth Considering, and only one name on the list is a financial.