Frontier Communications (FTR) is a big dividend (8%) telecom company that is currently trading at an attractive price, especially considering its nearly 6% decline so far this month. Frontier paid out $576 million in dividends last year (Google Finance), and it also received $500 million in government subsidies (Annual Report, p.22). Said differently, Uncle Sam pays 87% of Frontier’s dividend. Frontier has created a niche for itself by operating in regions that are heavily subsidized, and they deepened their foothold in that space with their April 1st $10.5 billion acquisition of assets from Verizon. We believe Frontier’s niche is attractive, the company easily covers its dividend payments, its current valuation is compelling, and the recent acquisition will give Frontier the cash flow to pay down debt and ultimately position for continued long-term success.

What is Frontier’s Niche?

Frontier provides phone, Internet and other data services to three million residential and 300,000 business customers across 28 states.

The company has carved out a niche for itself by operating in small markets and rural areas where competition is less intense and often non-existent. The economics of operating in these markets is often unattractive to bigger players (e.g. Verizon and AT&T) however Frontier’s existing infrastructure combined with government subsidies has allowed Frontier to operate successfully while paying a big dividend to its shareholders.

About Government Subsidies

$500 million, or 9%, of Frontier’s total revenues in 2015 (7% or $319 million in 2014) were derived from federal and state subsidies for rural and high-cost customer support via the Universal Service Fund (Annual Report p.22). The Universal Service Fund (USF) is a system of telecommunications subsidies and fees managed by the United States Federal Communications Commission (FCC) intended to promote universal access to telecommunications services in the United States (Wikipedia). USF is considered controversial by many because it is intended to help, but it may also discourage competition and prove inefficient and costly over the long run. Regardless, it benefits Frontier to the tune of hundreds of millions of dollars per year.

About Frontier’s Dividend

Frontier’s dividend yield has recently climbed to 8.0% as the stock price has fallen nearly 25% in the last year and almost 6% this month following its deal to acquire Verizon assets for $10.5 billion and its May 3rd earnings announcement. For reference, here is a chart of Frontier’s historical dividend payments.

As the chart shows, Frontier has cut its dividend payments in the past (largely the result of a poor integration of a previous acquisition). However, Frontier has recently raised its dividend (as the chart also shows) demonstrating strength and confidence in the dividend payment going forward. Additionally, Frontier currently only pays out around 56% of its free cash flows as dividends as shown in the following chart.

This relatively low payout ratio demonstrates strength in the dividend while still retaining cash flows to grow the business. And the amount of free cash flow is expected to grow significantly following the recent acquisition of assets from Verizon.

About the Verizon Asset Acquisition

On April first, Frontier completed it $10.5 billion acquisition of Verizon assets. According to Frontier’s CEO Daniel J. McCarthy:

"This is a transformative acquisition for Frontier that delivers first-rate assets and important new opportunities given our dramatically expanded scale. It significantly expands our presence in three high-growth, high-density states, and improves our revenue mix by increasing the percentage of our revenues coming from segments with the most promising growth potential."

Worth noting, Frontier management has provided full-year 2016 free cash flow guidance (including the Verizon acquisition) of $800 to $925 million. This represents a significant increase over previous years (i.e. free cash flow was $438 billion and $582 billion in 2014 and 2015, respectively) (Google Finance). And this increased free cash flow will allow Frontier to pay down debt (more on debt later) and improve the business via needed upgrades and expansion beyond landlines.

What is Frontier Worth?

A basic dividend discount model suggests Frontier is worth significantly more than its current stock price. Specifically, if we discount Frontier’s annual dividend payment amount ($0.42 per share) by its cost of equity (6.67% using the reasonable assumptions at GuruFocus) and we assume a 0% growth rate, then Frontier is worth $6.30 per share, or roughly 22% more than its current share price. Said differently, we have to assume a negative 1.5% growth rate to back into Frontier’s current market price which seems unreasonable considering Frontier’s low dividend payout ratio (see previous chart) and the new growth opportunities created by the Verizon asset acquisition.

Similarly, if we discounted the low-end of Frontier management’s $800 million of expected 2016 free cash flow by Frontier’s 6.16% weighted average cost of capital (again using the reasonable assumptions at Guru Focus to calculate weighted average cost of capital) and we assume a 0% growth rate, then Frontier is worth nearly $13 billion, or roughly twice it current market capitalization.

What are the Risks?

Despite Frontier’s big dividend and its attractive valuation, the company faces a variety of significant risk factors as we have highlighted below.

For starters, Frontier’s effort to combine their business and the business acquired from Verizon may not be successful. Specifically, Frontier may not realize the cost synergies that are anticipated from the Verizon transaction.

Another big risk is that customers will continue to “cut the cord” on wireline connections. The following table from Frontiers annual report shows the declining trend in voice services revenues, and much of the decline comes from customers terminating their landlines. According to the Risk Factors section of Frontier’s annual report, “we may be unable to stabilize or grow our revenues and cash flows despite the initiatives we have implemented.”

Competition is another risk for Frontier. Even though Frontier is the leading provider in many of the markets it serves, some of Frontier’s competitors have superior resources, which may place Frontier at a cost and price disadvantage. Further, Frontier acknowledges in their annual report that “some of our competitors have market presence, engineering, technical, marketing and financial capabilities, substantially greater than ours. In addition, some of these competitors are able to raise capital at a lower cost than we are able to.”

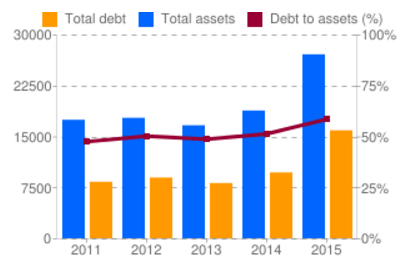

Debt load is another risk factor for Frontier. The company took on more debt to fund the Verizon asset acquisition, and as the following chart shows, the debt level has been increasing.

However, following the acquisition of Verizon assets, Frontier has more free cash flow which they may use to pay down some of the debt. According to Frontier’s annual report “we currently have a significant amount of indebtedness and we may still be able to incur substantially more debt in the future. Such debt and debt service obligations may adversely affect us.”

Another big risk for Frontier is that they are reliant on support funds provided under federal and state laws. As mentioned previously, a significant portion of Frontier’s total revenues (9%, in 2015 and 7% in 2014) are derived from federal and state subsidies. Significant changes to these laws could result in a dramatic reduction to Frontier’s revenues and profits.

Conclusion

We like Frontier because of its big dividend and its recent price decline. Specifically, we’ve ranked it number nine on our list of Nine Big Dividend Stocks Worth Considering because of its attractive niche, its healthy dividend coverage ratio, its compelling valuation, and the positive trajectory we believe will ultimately emerge from the Verizon asset acquisition. If you are a long-term investor, Frontier could be a valuable addition to your diversified income-focused portfolio.