Teekay Offshore Partners is a marine energy transportation, storage and production company, and its preferred units currently offer an attractive 10.1% distribution yield. Teekay’s common units have declined over 70% in the last year, while the preferred units have declined around 12% during that same time period. The common units drastically cut their distribution payment earlier this year due to energy market and liquidity challenges, however we believe the cut is actually a good thing for the preferred units. Specifically, the common unit distribution cut frees up more cash to support the big preferred distribution payments which happen to be cumulative meaning Teekay must backpay unitholders if they ever skip or reduce a distribution payment (this is not the case for the common units). This week’s earnings announcement reinforces our view that Teekay management is taking the necessary steps to drive future success, the preferred units offer compelling income and price appreciation potential, and if you’re an income-focused investor, Teekay is worth a closer look.

Overview

As the following chart shows, Teekay has declined over 70% in the last year, compared to only a 2%, 15% and 12% decline for the S&P 500 market index (SPY), the overall energy sector ETF (XLE), and Teekay Series A preferred units (TOO-A), respectively. There’s obviously been a strong correlation between Teekay’s preferred and the energy sector, whereas Teekay’s common units faced steeper declines as the quarterly distribution payments were recently reduced to $0.11 per unit from $0.56 per unit.

Data Source: Yahoo Finance

To add some color to the energy sector challenges Teekay faces, the company received a termination notice for a large charter contract from Repsol in November 2015. Repsol is a Spanish integrated energy company that has aggressively stepped up cost-cutting efforts as the price of oil has fallen and their profits went negative (EUR 2 billion in Q4). (http://www.marketwatch.com/story/repsol-profit-plunges-more-than-40-2016-05-05) Repsol is just one example of the types of challenges Teekay faces, and we’ll cover risk factors in further detail later in this report.

Teekay’s Cash Flows

Generating strong revenues hasn’t necessarily been the challenge for Teekay over the last several years as they have grown from $901 million in 2012, to $931 million in 2013, to $1 billion in 2014 and $1.2 billion in 2015 (and revenue was a healthy $307 million in Q1 2016 http://www.google.com/finance?q=NYSE%3ATOO&fstype=ii&ei=pjxCV8GFE5PAmAGouJywCA http://www.streetinsider.com/ec_earnings.php?q=too The challenge has been (and continues to be) balancing the cash inflows and outflows. Specifically, Teekay’s business requires heavy capital expenditures, and like other companies in the industry Teekay has used considerable amounts of debt to finance them. The following chart gives some perspective on the capital expenditure and debt balancing challenges Teekay faces in the coming years.

(The baseline versus anticipated demonstrates Teekay’s efforts in managing capital).

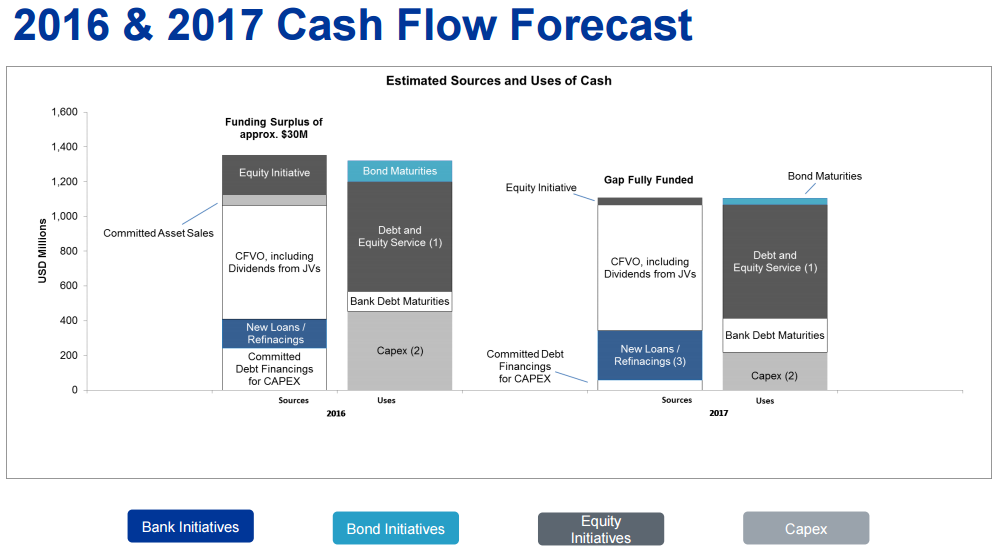

And for more granular perspective, this next chart shows more detailed information on the expected sources and uses of cash flow in 2016 and 2017.

In a nutshell, Teekay is managing a delicate balancing act between sources and uses of cash in the coming years, and it’s becoming increasingly challenging because the cost of capital is rising as risks in the energy sector rise and interest rates are expected to rise too. Teekay describes these challenge in detail in their annual report (p.11) as follows:

Current market conditions limit our access to capital and our growth. We have relied primarily upon bank financing and debt and equity offerings to fund our growth. Current depressed market conditions generally in the energy sector and for master limited partnerships have significantly reduced our access to capital, particularly equity capital. Debt financing or refinancing may not be available on acceptable terms, if at all. Issuing additional common equity given current market conditions would be highly dilutive and costly. Lack of access to debt or equity capital at reasonable rates will adversely affect our growth prospects and our ability to refinance debt, make payments on our Notes and make distributions to our unitholders.

One way Teekay has addressed challenging cash flow needs has been to cut the common equity distribution payments. And as we described earlier, this actually works to the advantage of preferred equity owners because it frees up more cash to support their cumulative distribution payments. For perspective, the following chart shows Teekay’s plan for reducing leverage over the coming years, which will ultimately work to strengthen the company, potentially increase the equity value significantly, and support continued big preferred equity distribution payments.

Why we like the Series A Preferred Shares:

In addition to the big yield (currently 10.1%), we like Teekay’s Series A Cumulative Redeemable Preferred Units for a variety of reasons. For starters, Teekay can’t redeem them until on or after April 30, 2018, which means unitholders will continue to receive the quarterly distribution payments until at least then (assuming Teekay doesn’t default, which we believe they will not) for multiple reasons. For example, the majority of Teekay’s fleet is employed on medium-term stable contracts (Q1 earnings release, p.7) which will help ensure steady cash flows over the coming years. Additionally, Teekay believes it has already secured funding for its $1.6 billion of growth projects through 2018 (investor presentation, p.3). Further, this week’s earnings release explained the company is near completion of financing initiatives to address funding requirements over the next two years (Q1 earnings release, p.1).

Also worth noting, unitholders may receive the quarterly distribution payments beyond April 30, 2018 because Teekay likely won’t pay $25 per unit to redeem them considering they are tight on cash flow, and they’d likely have to raise additional capital at a higher cost just to redeem the units. And if they do redeem the units that means unitholders will receive significant capital appreciation considering the units currently trade at a 28% discount ($18 per unit) to their redemption price ($25). Teekay also offers series B preferred units with a higher current yield of 11% and not redeemable until April 20, 2020. However, we prefer the series A units because we’re more comfortable with the company’s ability to meet liquidity requirements over the shorter time period.

Risk Factors

Teekay’s business is exposed to a variety of significant risk factors that are worth considering. For starters, low oil prices have created challenges across the energy sector. For example, we mentioned earlier how Repsol terminated a large contract with Teekay in November of 2015, and this left Teekay in a tough spot to utilize that capacity.

Also worth noting, Teekay’s client base is somewhat concentrated. According to Teekay’s most recent annual report (p.15):

We have derived, and we believe we will continue to derive, a substantial majority of revenues and cash flow from a limited number of customers. Royal Dutch Shell Plc (or Shell, formerly BG Group Plc), Petroleo Brasileiro S.A. (or Petrobras), Statoil ASA (or Statoil) and E.ON Ruhrgas UK GP Limited (or E.ON) accounted for approximately 26%, 18%, 11% and 11%, respectively, of our consolidated revenues from continuing operations during 2015.

As we described earlier, another big risk is Teekay’s ability to access adequate capital. Teekay describes this risk in its annual report (p.11) as well:

Current depressed market conditions generally in the energy sector and for master limited partnerships have significantly reduced our access to capital, particularly equity capital. Debt financing or refinancing may not be available on acceptable terms, if at all. Issuing additional common equity given current market conditions would be highly dilutive and costly. Lack of access to debt or equity capital at reasonable rates will adversely affect our growth prospects and our ability to refinance debt, make payments on our Notes and make distributions to our unitholders.

Also worth reading, Teekay goes on to explain:

We have limited current liquidity. As at December 31, 2015, we had total liquidity of $282.7 million, consisting of $258.5 million of cash and cash equivalents and $24.2 million of undrawn long-term borrowings under our revolving credit facilities, subject to limitations in the credit facilities. As at December 31, 2015, we had a working capital deficit of $490.0 million. Our limited availability under existing credit facilities and our current working capital deficit could limit our business, ability to meet our financial obligations and growth prospects. We expect to manage our working capital deficit primarily with net operating cash flow and other funding initiatives, including securing debt financing on our under-levered and unmortgaged assets, entering into sale-leaseback transactions, divesting assets, issuing hybrid or other equity securities, reducing our capital expenditures relating to existing projects, accessing the unsecured bond markets and seeking loans from our sponsor, Teekay Corporation. However, there can be no assurance that any such funding will be available to us on acceptable terms, if at all.

Conclusion

Teekay’s big-yield, Series A, preferred units are attractive. And even though Teekay is a partnership that pays distributions (not a stock that pays dividends) we’ve still ranked it #4 on our list of top Five "Good" Big-Dividend Preferred Stocks because of the way management is prudently steering cash flows to support the big distribution payments, and because the units offer significant price appreciation potential. And if you are particularly hungry for income, we believe Teekay could be a valuable addition to your diversified investment portfolio.