Source: Main Street Capital website

Main Street Capital (MAIN) announced positive first quarter earnings this week, and declared that it will maintain its big monthly dividend payment, currently equal to a 6.9% yield on an annualized basis. And factoring in the company’s semiannual supplemental dividend payments then the yield jumps to over 9%. Valuing the company based on its monthly dividend alone (excluding the semiannual supplemental dividends), Main Street is worth significantly more than its current market price suggests; and if you factor in the possibility of supplemental dividends, the strong internal management team, the diversified risk exposures and the low volatility, then Main Street becomes an extremely attractive option for long-term income-hungry investors.

About Main Street’s Big Dividends

For starters, Main Street’s dividend is large because it has elected to be treated as a Regulated Investment Company (RIC) and a Business Development Company (BDC). This means Main Street generally pays no federal income tax on any ordinary income (or capital gains) that it pays out as dividends to its shareholders. Many other companies retain a significant portion or their earnings for future growth, whereas Main Street has structured its entire business to distribute earnings to shareholders in the form of big dividends.

(Source: investor presentation p.20)

Main Street’s business is focused on providing debt and equity financing to smaller mid-sized companies (companies with revenues between $10 million and $150 million). Subsequently, Main Street funds its monthly dividend payments with cash from secured debt investments, and it funds its supplemental semi-annual dividend payments with realized gains on its equity and debt investments. We believe Main Street’s monthly dividend payments are extremely safe (and its semiannual supplemental dividends are fairly safe), but we’ll dive deeper into the risks later in this report. For reference, the following chart shows Main Street’s historical growth in dividends, distributable net investment income (DNII) and net asset value (NAV).

(source: investor presentation, p.8)

Valuing Main Street’s Big Dividends

Using a basic dividend discount model, and considering only Main Street’s monthly dividends (excluding supplemental dividends for now), Main Street is worth $37.05 per share, or approximately 10% more than its current market price. To arrive at this value we simply discounted the dividend payment ($0.18 X 12) by Main Street’s cost of equity (9.83% using the reasonable assumptions at GuruFocus) minus a conservative 3.5% growth rate (for reference, the six professional analysts survey by Yahoo Finance expect Main to grow by 7% each year for the next five years). And if we add in the supplemental dividends then the same model assigns Main a $41.81 per share valuation, or approximately 38% upside. In our view, Main Capital offers safe dividend payments and plenty of price appreciation potential.

Main Street’s Internal Management Team

The fact that Main Street is internally managed is important. Conflicts of interest may exist when BDCs are run by external management teams, and data suggest internally managed BDCs are better. For example, external managers are often compensated as a percent of assets under management, so they are incentivized to take on new business (whether or not it is profitable business) because it increases the amount they get paid. Whereas internally managed BDCs (such as Main Street) are (if incentivized properly) driven to create profitable growth. The following chart shows new equity issuance for internally managed (blue dots) versus externally managed (green dots) BDCs.

The noticeable observation is that internally managed BDCs have a track record of issuing new shares at a premium to their net asset values (suggesting investors expect a strong return on assets) whereas externally managed BDCs have a track record of issuing new shares at a discount to their net asset values (suggesting they’re more interested in growing assets under management instead of profitability).

Another reason why internally managed BDCs are often more profitable is simply because their expenses are lower. For example, the following chart show the operating expenses of Main Street (an internally managed BDC) versus other BDCs (a mix of internally and externally managed). Main Street has a clear advantage.

Investor presentation, p.36

Further, Main Capital’s management has a significant ownership interest in the company. For example, at year end Main’s management (executive and senior management and Board of Directors) owned more than 5% of the shares outstanding. These shares are currently worth approximately $89 million, not an insignificant amount.

Diversification Benefits

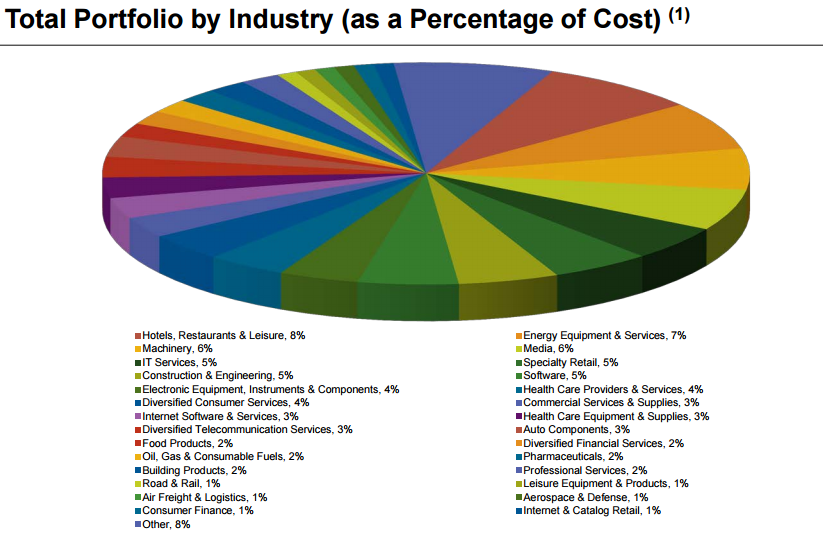

Two fronts on which Main Street enjoys diversification benefits are the way its business is diversified across industries, clients and geographies, and secondly the risk-management diversification benefits Main Street can add to an income-focused investment portfolio. The following charts gives an idea of Main Street’s industry, client and geographic diversification.

(Investor Presentation, p.22-23)

Main Street can also add important diversification to an income-focused investment portfolio because of its low correlation with debt and equity markets, and its high risk adjusted returns. For example, the following table shows show the correlation between Main Street and a variety of other BDCs and macroeconomic factors.

(Data source: YahooFinance, 1-Year as of May 3, 2016)

As the table shows, Main Street has a much lower correlation with short-term treasuries (SST), 7-10 year treasuries (IEF) and high yield bonds (JNK) than do other BDCs as measured by a BDC index (BIZD). This is potentially an important diversification benefit within a larger income-focused portfolio. Also worth noting, other BDCs tend to have a much stronger correlation with treasuries and high yield debt. Specifically, other BDC’s do well in “risk-on” environments and do poorly in “risk off” environments, whereas Main Street is less affected.

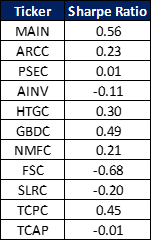

Also worth noting, Main Street management explains in their most recent investor presentation (p.10) that their investments have low correlation to the broader debt and equity markets (as we’ve shown in the correlation table above) and attractive risk-adjusted returns. To measure risk-adjusted returns, we’ve calculated Sharpe Ratios for Main Street and many of its peers over the last three years as shown in the following table.

(Data source: YahooFinance, 3-Years as of May 3, 2016)

And while Main Street does have an attractive Sharpe Ratio (i.e. high returns relative to its volatility) past returns are not a guarantee of future performance.

Risks

Main Street has many positive things going for it, but it is also faces significant risks as we’ve highlighted below.

Perhaps the biggest risk for Main Street is the overall economy. If the market crashes, Main Street’s debtors may not be able to make debt payments, and Main Street’s equity holdings will decline in value. Granted Main Street is well-diversified as we’ve described previously, and this protects them somewhat from sub-market challenges such as oil prices. For example, even though Main Street is based in Houston, they don’t appear to be over-exposed to the perils of potential oil company bankruptcies considering their diversified industry and geographic exposures. However, a broad market decline would impact Main Street negatively.

The market cycle poses another significant risk for Main Street. For example, much of Main Street’s equity and debt-related capital gains over the last five to seven years occurred because the market was rebounding off the lows of the financial crisis. Considering the markets won’t likely continue to climb as quickly as they did following the financial crisis, Main Street may not experience the same types of gains. As shown in a previous pie chart, 40% of Main Street’s invested capital has been deployed to “Recapitalization/Refinancing” activities, and these same types of opportunities may not be available going forward considering where we are in the current market cycle (i.e. the financial crisis is further in the rear view mirror, and interest rates are starting to rise). And all of this could put strains on Main Street’s ability to pay supplemental dividends in the distant future considering they’re largely derived from capital gains (we believe supplemental dividends [and obviously monthly dividends] are safe in the near term.

Perhaps in an effort to address the possibility of less market cycle related capital gains going forward, Main Street continues to nurture its growing asset management business. According to Main Street’s investor presentation (p.15), in May 2012 Main Street entered into an investment sub-advisory agreement with HMS Income Fund. This relationship contributed $6.5 million to net investment income for 2015, and it had $27.3 million of cumulative unrealized appreciation as of the end of 2015. This type of arrangement has the potential to distract Main Street’s management, and possibly create conflicts of interest considering Main Street sources investments for itself and for the fund.

The burdens of being an RIC and BDC create regulatory risks for Main Street. For example, according to Main Street’s annual report: “Because we intend to distribute substantially all of our income to our stockholders to maintain our status as a RIC, we will continue to need additional capital to finance our growth, and regulations governing our operation as a BDC will affect our ability to, and the way in which we, raise additional capital and make distributions.” Further, Main Street explains: “We may have difficulty paying the distributions required to maintain RIC tax treatment under the Code if we recognize income before or without receiving cash representing such income.”

Conclusion:

We like Main Street Capital because of its big dividend and relatively low volatility. We’ve ranked it number eight (8) on our list of Nine Big Dividend Stocks Worth Considering because its Distributable Net Investment Income consistently exceeds its dividend payments, and because its Net Asset Value continues to enable supplemental dividend payments. We also believe it’s worth significantly more than its current market price. If you are a long-term investor, Main Street Capital could be a valuable addition to your diversified income-focused portfolio.