If you like big dividends and discounted prices, W.P. Carey (WPC) may have caught your eye. It currently offers a 6.4% dividend yield, and its shares are trading nearly 16% lower than just 2 months ago. A cursory review of this REIT looks promising because of its big growing dividend, healthy dividend coverage ratio, and positive AFFO outlook. However, we believe there are some very big, yet less apparent, risk exposures that should be considered before investing such as the upcoming wall of debt maturities, the persistent drag and risks of its foreign currency hedging program, and the obvious conflicts of interest in its growing managed REITs program.

About W.P. Carey

W.P. Carey is a diversified real estate investment trust (REIT) that owns primarily net-leased commercial real estate (net leased means the tenant, not the owner, pays the property expenses). In addition to its owned properties, WPC also manages a series of non-traded publicly registered investment programs. For perspective, in 2015 WPC’s real estate revenues were $735.4 million and its managed program revenues were $202.9 million. For further perspective, WPC’s owned real estate is well-diversified as shown in the following graphics.

Also worth considering, WPC’s share price has sold off nearly 16% in the last two months as it was caught up in the recent REIT selloff (i.e. until the last two months, REITs in general had been performing exceptionally well driven largely by income investors search for yield).

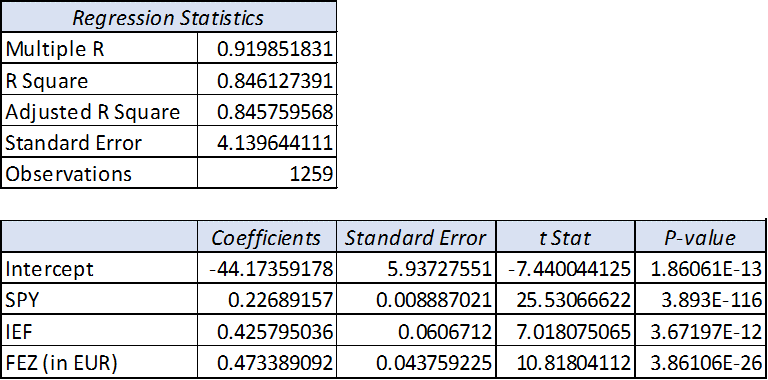

Longer term, WPC’s stock price has been driven mainly by its correlation with the US stock market, interest rates, and the Eurozone stock market as shown in the following regression analysis data:

Specifically, we ran a regression of WPC’s stock price over the last five years against the US stock market (as measured by the S&P 500 ETF, SPY), 7-10 year Treasuries (as measured by ticker IEF), and Eurozone stocks (as measured by ticker FEZ, except we converted FEZ’s price back to EUR instead of USD). What we found is that all three variable (SPY, IEF and FEZ) were highly significant (t-Stats way above 2) in explaining WPC’s stock price over the last five years. More specifically, as interest rates went up, WPC’s price went down; as Eurozone stocks went up (one third of WPC’s properties are in Europe), WPC’s price went up; and as US stocks went up, WPC’s stock price went up. These factors explained roughly 92% of WPC’s stock price moves over the last five years.

W.P. Carey’s Dividend

WPC’s big growing dividend is what drives many investors to the stock. For reference, the following chart shows the steady dividend payments and increases since September 2000.

And worth noting, WPC just recently announced another dividend increase to be paid on October 14, 2016. Further, WPC is a member of the Nasdaq “Dividend Achievers” index (to qualify as a Dividend Achiever, a company must have increased its dividend payout each year for the last 10 or more consecutive years and meet certain liquidity requirements).

WPC also has a healthy dividend payout ratio. For example, the company generated Adjusted Funds From Operations (AFFO) of $1.24 per diluted share in the most recent quarter, and paid only $0.98 per share in dividends, making the payout ratio only 79%. Further, WPC affirmed its total 2016 AFFO guidance of $5.00 to $5.20 per share. It also maintains healthy investment grade BBB/Baa2 corporate debt ratings from Standard & Poor’s and Moody’s.

Also worth noting, from a valuation standpoint, the following chart shows WPC’s FFO per share has been rising, but not quite as fast as the share price has been rising, which is an indication of an increasingly rich valuation.

Risks:

W.P. Carey is not without risks. Not only does it face many of the usual REIT risks (such as the risk of regulatory changes, the potential foregoing of attractive investment opportunities in order to maintain its REIT status, and the simple fact that many investors consider REITs unattractive right now because the category continues to selloff after rallying so hard earlier this year). In addition to these risks, we believe there are three often overlooked but significant risks that are worth considering (i.e. W.P. Carey’s upcoming wall of low interest rate debt maturities, the persistent drag and risks of its foreign currency hedging program, and some significant conflicts of interest in its managed REITs program).

Interest rate risks, and the wall of maturities

We saw in our earlier regression model that WPC’s price tends to be negatively impacted when interest rates rise, but this reaction may soon be magnified by the upcoming wall of WPC debt maturities as shown in the following table.

Specifically, 20% of WPC debt matures in 2019, and this also happens to be the portion of the debt with the lowest interest rate. This means (depending on interest rates at that time) that WPC may have to raise additional capital at a much higher interest rate in 2019 which could have a significantly negative impact on profitability. For example, if WPC has to re-borrow another $845 million at 3.5% (instead of 1.5%) this is potentially an additional $16.9 million of annual debt payments. And considering Net Income was only $51.7 million in the most recent quarter, this increased debt payment is not insignificant. And realistically, if interest rates begin to rise then a higher debt payment burden becomes a risk for all debt maturing in the coming years, not just the 2019 debt.

Non-US exposures and currency hedging costs

WPC’s non-US investment exposures and currency hedging costs are another significant risk factor worth considering. For starters, a third of WPC’s properties are in Europe, and this introduces an entirely different set of risk exposures ranging from regulations to the fact that Europe is at a different point in the economic cycle than the US. And while this is arguably good from a diversification standpoint, it’s also expensive because WPC attempts to hedge its foreign currency exposures. Before getting into some of the details of the hedges, it’s worth acknowledging that the investment banks underwriting these very large forward hedging contracts are getting a large cut in the form of a bid-ask spread on a very regular and repetitive basis (and this cost is a very real and consistent drag on WPC’s profits).

And with regards to the impacts of the hedges, they’ve been working in WPC’s favor, but this won’t always be the case. For example, for the year ended December 31, 2015, WPC recognized $8.0 million in “other income” due to foreign currency forward contracts. And as of June 30, 2016, WPC estimates that an additional $9.9 million will be reclassified as other income during the next 12 months. And while these numbers may appear large (they are certainly significant) they’re relatively small compared to the hundreds of millions of dollars that’s being subtracted annually from retained earnings due to foreign currency translation. Specifically, the following table shows a foreign currency translation adjustment of $125.5 million and $117.9 million in the last two years.

And for additional color, these next tables show the foreign currency translation adjustments and the foreign currency derivatives notional value.

However, until these foreign currency losses are realized, they’re “below the line” recordings in “other comprehensive income” (i.e. they don’t hit net income, but they’re still very real economic losses that do impact the amount of equity on the balance sheet). And importantly, if currency exchange rates move in the wrong direction then these amounts can become very large expenses on the income statement very quickly.

Conflicts of Interest in the Managed REIT business

WPC is often described as a “self-managed” REIT, but realistically its managed investments business is something different and it creates conflicts of interest. Specifically, the fees WPC charges the managed investments are huge, and they create incentive for WPC management to grow the managed investments assets under management instead of its profitability.

For starters, let’s consider the many layers of fees WPC is charging the managed investments. Total Net Investment Management revenue (as shown in the following table) includes structuring revenue, reimbursable costs, asset management revenue, dealer manager fees, and incentives.

And for perspective, in 2015 total managed investments revenues were $202.9 million and assets under management in the program were recently $11.7 billion, for an expense ratio approximation of 1.73% (this is a very significant amount).

And what makes this amount more concerning is that the total management fee amount paid to WPC can be increased dramatically by growing the businesses without concern for profitability because the investors in the program bear the investment risk, not WPC. In a nutshell, even though this business appears lucrative for now, it seems likely to shrink in the future as investors demand lower fees, or competition creeps in. Further, this type of perverse investment incentive seems to invite future lawsuits by the investors in the managed programs.

Also worth noting, there is already a history of WPC purchasing investment from the managed program which creates more conflict of interest. As WPC acknowledges in its most recent annual report: “There may be competition among us and the Managed REITs for business opportunities.” Again, this appears lucrative in the short-run, but may open WPC up to liabilities in the long-run.

Conclusion:

W.P. Carey's recent price decline was consistent with many other REITs (the sector was overheating and due for a pullback). However, the company remains exposed to significant risk factors such as rising interest rates and the upcoming wall of debt maturities, risky foreign currency investments, and the conflicts of interest in its managed programs. We don’t believe WPC is a screaming buy at its current price level, but if you are a long-term income-focused investor, it may be worth considering.