Realty income pays a big, steady, monthly dividend (3.9%, annualized), and the shares have declined more than 13% since August 1st. To some, this may be a screaming buy signal. But before diving in headfirst, we believe there are three big risks worth considering. First, Realty Income’s management team is sending signals of lower growth ahead. Second, share dilution remains a significant risk to shareholders. And third, Realty Income is particularly exposed to accelerating inflation (if it materializes). However, despite these risks, we’ve still ranked Realty Income #9 on our recent list of top 10 Big-Dividend REITs Worth Considering because of its ability to deliver what many investors want- big, safe, monthly dividends.

About Realty Income

Realty Income acquires and manages commercial properties that generate rental revenue under long-term net lease agreements. It’s big ($15.9 billion market capitalization and over 4,500 properties in its portfolio), and it’s an income-investor favorite because of its steady monthly dividend payments. And as the following chart shows, its price has recently come down significantly.

The recent selloff was consistent with the overall REIT market which has sold off after being hot earlier this year. The following chart shows how all REITs (as measured by the Vanguard REIT Index ETF) have performed this year.

Realty Income’s Dividend

Just this week, Realty Income declared its 556th consecutive monthly dividend. For perspective, the following chart provides history on the company’s dividend history and growth.

And what makes Realty Income’s track record so impressive is that the stock has actually delivered higher returns with less volatility that major market indexes as the following chart shows.

This track record is remarkable considering the indexes (which include a basket of stocks) usually deliver lower volatility than an individual security such as Realty Income. However, despite this impressive track record, the company is sending signals that we may expect lower growth going forward.

1. Lower Growth Signals

The first signal that management may be expecting lower growth ahead is simply the dividend yield. The following chart shows how management has allowed the dividend yield to decline relative to the S&P 500 in recent years.

Realty Income’s dividend increases (while impressive) have not kept pace with its stock price increase. We interpret this as an indication that management believes the stock price increases will not continue at the same rapid pace as they have in the past, otherwise the dividend yield would have been kept closer to constant. Management teams are careful about setting dividend payment policies so as not to be an outlier relative to peers (after all, it’s the dividend that attracts many investors in the first place), and we believe the fact that management hasn’t raised the dividend more aggressively is an indication that perhaps they expect the yield to normalize (relative to peers and history) as future stock price increases slow (note: we’ll have more on the dividend payout ratio).

Another indication that management expects lower future stock price appreciation is the fact that insider ownership is not significant and it’s declining as shown in the following chart.

If management believed strongly in the company’s future growth prospects they’d likely increase ownership (or not let it fall as is the case with Realty Income).

Further, management has not been buying back shares (they’ve actually been issuing more) suggesting they may believe the shares are overvalued. And in fact they’ve been using ownership to structure deals suggesting they believe the shares are richly valued (and using shares in this way can actually harm existing shareholders by diluting their existing interest in the company- more on this later).

Additional indications of lower future growth are simply Realty Income’s large size. Specifically, it’s larger than many of its peers, and it will take more actual growth for Realty Income to achieve the same level percentage growth as in the past. Additionally, competition is creeping in as management describes in the annual report:

In order to grow we need to continue to acquire investment properties. The acquisition of investment properties may be subject to competitive pressures. We face competition in the acquisition and operation of our properties. We expect competition from: Businesses; Individuals; Fiduciary accounts and plans; and other entities engaged in real estate investment and financing.

2. Shareholder Dilution

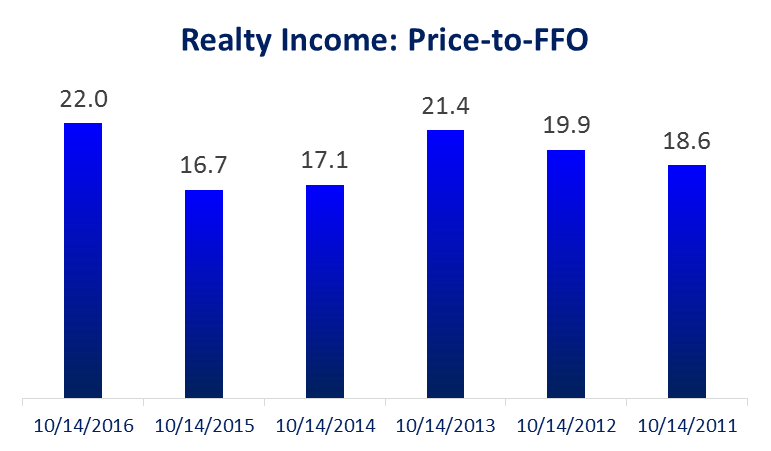

Dilution of existing shares is another lower growth signal by management and a risk to existing shareholders. For example, despite recent price decline, the following chart suggests Realty Income is still not cheap by historical standards.

Note: ratio is calculated as Market Capitalization / Twelve Trailing Months Funds From Operations.

And when a stock price is not cheap it incentivizes management to use the stock (instead of cash) as currency for transactions because theoretically they get more bang for their buck. Said differently, if management thinks they stock is “overvalued” then they should pay with stock instead of cash. And perhaps not coincidentally, that is exactly what Realty Income has been doing. They have issued a lot of new shares of common stock over the last year as the valuation has climbed. For example, on May 24, 2016, Realty Income closes a 6.5 million share common stock offering.

However, the company makes very clear the risks of diluting shareholders with the following two excerpts from the most recent annual report.

Future issuances of equity securities could dilute the interest of holders of our common stock. Our future growth will depend, in large part, upon our ability to raise additional capital. If we were to raise additional capital through the issuance of equity securities, we could dilute the interests of holders of our common stock. The interests of our common stockholders could also be diluted by the issuance of shares of common stock pursuant to stock incentive plans. Likewise, our Board of Directors is authorized to cause us to issue preferred stock of any class or series (with dividend, voting and other rights as determined by our Board of Directors). Accordingly, our Board of Directors may authorize the issuance of preferred stock with voting, dividend and other similar rights that could dilute, or otherwise adversely affect, the interest of holders of our common stock.

And this one…

We may acquire properties or portfolios of properties through tax deferred contribution transactions, which could result in stockholder dilution and limit our ability to sell or refinance such assets. We have in the past and may in the future acquire properties or portfolios of properties through tax deferred contribution transactions in exchange for partnership units in an operating partnership, which could result in stockholder dilution through the issuance of operating partnership units that, under certain circumstances, may be exchanged for shares of our common stock. This acquisition structure may have the effect of, among other things, reducing the amount of tax depreciation we could deduct over the tax life of the acquired properties, and may require that we agree to restrictions on our ability to dispose of, or refinance the debt on, the acquired properties in order to protect the contributors’ ability to defer recognition of taxable gain. Similarly, we may be required to incur or maintain debt we would otherwise not incur so we can allocate the debt to the contributors to maintain their tax bases. These restrictions could limit our ability to sell or refinance an asset at a time, or on terms, that would be favorable absent such restrictions.

And as we mentioned earlier, if the stock was undervalued, prudent management would be less likely to give it away so freely. For reference, here are some Realty Income valuation metrics versus a couple peers.

3. Inflation and Interest Rates

Inflation is another risk. In particular, Realty Income’s pre-agreed upon rent increases may not keep pace with inflation. Consider the following quote from the company’s annual report:

Inflation may adversely affect our financial condition and results of operations. Although inflation has not materially impacted our results of operations in the recent past, increased inflation could have a more pronounced negative impact on any variable rate debt we incur in the future and on our results of operations. During times when inflation is greater than increases in rent, as provided for in our leases, rent increases may not keep up with the rate of inflation. Likewise, even though net leases reduce our exposure to rising property expenses due to inflation, substantial inflationary pressures and increased costs may have an adverse impact on our tenants if increases in their operating expenses exceed increases in revenue, which may adversely affect the tenants’ ability to pay rent.

And while inflation has not been an issue lately, some hawkish Federal Reserve members are increasingly nervous, and markets are increasingly expecting rates to rise which could have significant negative impacts on Realty Income.

Note: Based on CME Group 30-Day Fed Fund futures prices, which have long been used to express the market’s views on the likelihood of changes in U.S. monetary policy, the CME Group FedWatch tool allows you to view the probability of FOMC rate moves for upcoming meetings.

Conclusion

Realty Income has an impressive track record of big safe growing monthly dividend payments, and a stock price that has exhibited lower than average volatility. We believe it has the financial wherewithal to keep paying and increasing the dividend. However, we also believe it is less likely for Realty Income’s dividend and stock price to appreciate as attractively in the future as they have in the past. Despite the risks and challenges, we've still ranked Realty Income #9 on our list of Top 10 Big Dividend REITs Worth Considering because the recent price decline has made the valuation more reasonable, and the big steady dividend is worthwhile for many income-focused investors.