The recent pullback in big-dividend Real Estate Investment Trusts (REITs) may have created the buying opportunity that many income-focused investors have been waiting for. Specifically, REITs have declined 10% since August 1st (as measured by the Vanguard REIT ETF, VNQ) whereas the overall market is down only 1% (as measured by the S&P 500, SPY). Rather than buying the Vanguard ETF (which includes 150 securities), we have compiled a top 10 list of attractive big-dividend REITs that we believe are worth considering.

10. Stag Industrial (6.3% Yield)

If you like big dividends and discounted prices, Stag Industrial (STAG) may have recently caught your eye. Its shares have fallen 12% since August 1st, and its dividend yield (paid monthly) has risen to 6.3% (annually).

And despite Stag’s unique risk exposures (i.e. secondary/tertiary industrial properties), we’ve ranked it #10 on our list because of its diversified approach, relatively attractive valuation, and continued growth opportunities. You can read our full Stag report here:

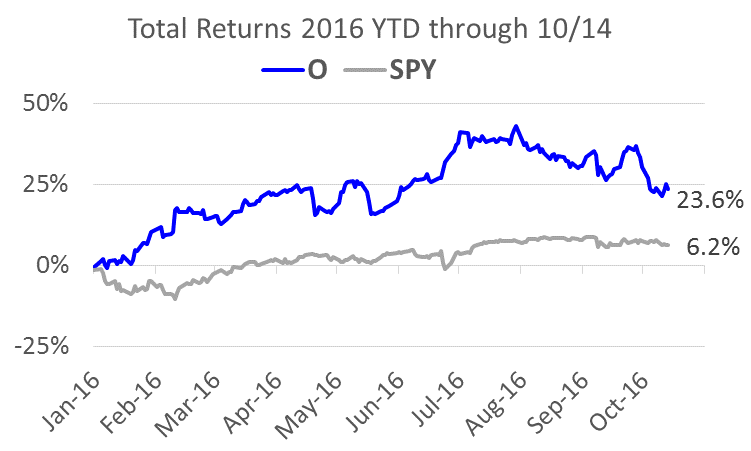

9. Realty Income (3.9% Yield)

Realty income pays a big, steady, monthly dividend (3.9%, annualized), and the shares have declined more than 13% since August 1st. To some, this may be a screaming buy signal.

But before diving in headfirst into Realty Income, we believe there are three big risks worth considering. First, Realty Income’s management team is sending signals of lower growth ahead. Second, share dilution remains a significant risk to shareholders. And third, Realty Income is particularly exposed to accelerating inflation (if it materializes). However, despite these risks, we’ve still ranked Realty Income #9 because of its ability to deliver what many investors want- big, safe, monthly dividends. You can read our full report on Realty Income here:

8. W.P. Carey REIT (6.4% Yield)

If you like big dividends and discounted prices, W.P. Carey (WPC) may have caught your eye. It currently offers a 6.4% dividend yield, and its shares are trading nearly 16% lower than just 2 months ago.

A cursory review of WPC looks promising because of its big growing dividend, healthy dividend coverage ratio, and positive AFFO outlook. And if you can get comfortable with its unique risk exposures (see full report, below) then it may be worth considering.

7. HCP Inc. (6.4% Yield)

HCP Inc. (HCP) is an attractive big-dividend (6.4%) healthcare REIT that has been plagued by ongoing challenges with its largest tenant, HCR ManorCare. HCP plans to spinoff HCR ManorCare (On October 31st) into a separate REIT, Quality Care Properties. We continue to believe the spinoff is a smart decision that will unlock value for shareholders. HCP shares have significantly lagged other big-dividend REITs this year, and we believe they currently offer outstanding value for investors.

You can read our most recent HCP report here:

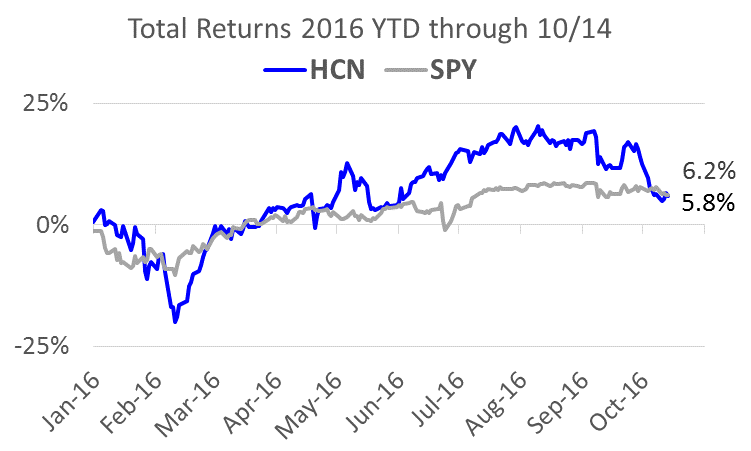

6. Welltower Inc. (5.0% Yield)

Welltower is an attractive healthcare REIT, and the share price has come down significantly over the last two months (as REITs in general sold off).

Welltower is also an income-investor favorite because of its big dividend (5.0%), and the perceived long-term demographic tailwinds at its back. You can read our full Welltower report here: