This week's weekly is a continuation of our free report "Top 10 Big Dividend REITs Worth Considering" except in this members-only edition, we include all the details for the Top 5. We also provide updates on two of our existing REIT holdings (which happen to also be ranked in the Top 5).

5. Ventas, Inc. (4.4% Yield)

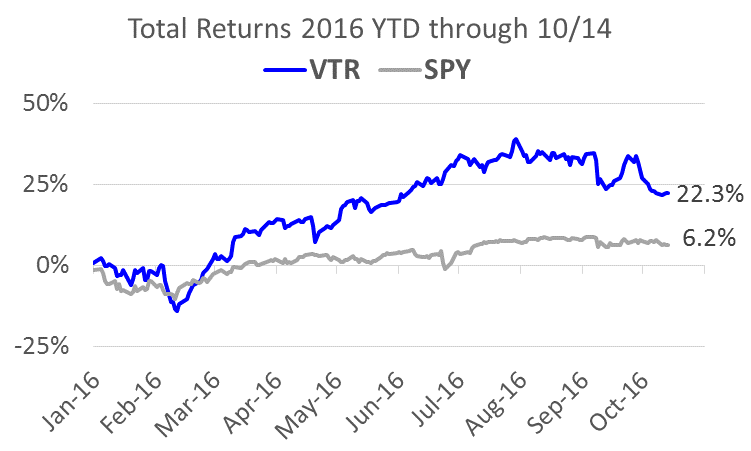

We first added Ventas (VTR) to our watchlist back in late July, and the share price has become increasingly attractive since that time.

Ventas is a healthcare REIT with a diversified investment portfolio, an attractive dividend yield (4.4%), and the winds of an enormous demographic trend at its back. Further, we believe the dividend is quite safe, and this REIT has many years of continued growth ahead. You can read our earlier full report on Ventas here...

4. Starwood Property Trust (8.9% Yield)

Starwood Property Trust (STWD) is a big dividend (8.9%) mortgage REIT that could actually benefit from an uptick in market turmoil. Further, we believe Starwood inappropriately sold off over the last several weeks because it was inappropriately lumped in with other big-dividend payers.

You can read our full report on Starwood here…

3. New Residential Investment Corp (13.5% Yield)

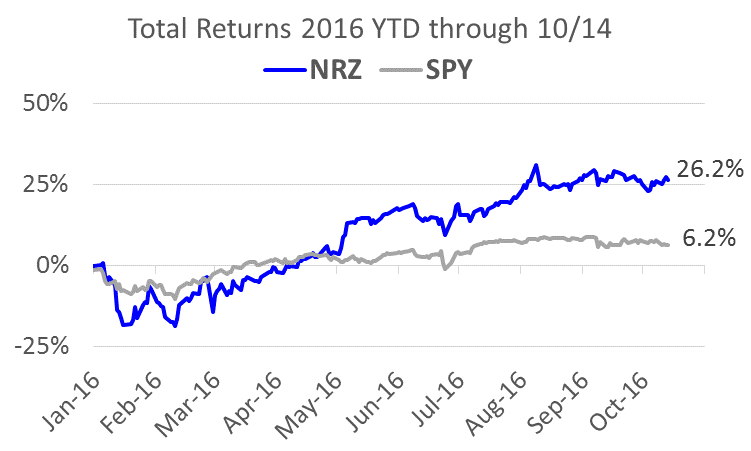

If you like big dividends and discounted prices, mortgage REIT New Residential (NRZ) pays an enormous 13.5% dividend and its shares have declined nearly 8% in the last two months.

We continue to own New Residential as one of our higher-risk / higher-reward allocations within our Blue Harbinger Income Equity portfolio because we believe the company can continue to maintain and grow its profitability via its new growth in MSR states and its growing call rights business. You can read our full report on NRZ here…

2. EastGroup Properties (3.6% Yield)

EastGroup Properties (EGP) is an industrial REIT that offers an attractive 3.6% dividend yield. Additionally, EGP has sold off 9% since September 28th as it got caught up in the indiscriminate selling across the REIT sector (REITs were overheating this year and have recently pulled backed sharply).

We believe now is an attractive time to consider shares if you don’t already have a position. Specifically, the valuation is attractive, the dividend is well-covered (and growing), and the business is relatively stable. You can read our full report on EGP here…

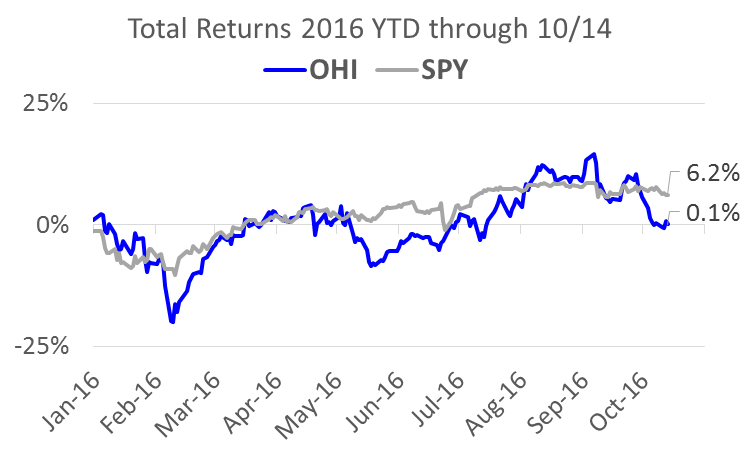

1. Omega Healthcare (7.2% Yield)

Omega Healthcare is exposed to risks (because of its exposure to skilled nursing facilities), but it’s also trading at an extremely attractive valuation (i.e. the market may be overly worried about the risks). It also offers a great dividend yield (7.2%), and the price has come down significantly over the last month. In our view, Omega Healthcare presents an attractive opportunity for income-focused investors as long as it’s held within the constructs of a diversified portfolio.