If you like big dividends and discounted prices, you may have noticed that mortgage REIT New Residential (NRZ) pays an enormous 13.5% dividend and its shares have declined nearly 8% in the last two months. NRZ emerged following the financial crisis as banks had to shed risk and mortgage markets became more complex. NRZ continues to generate big profits with its mortgage servicing rights (MSR’s) business. The company is also using heavy leverage (to magnify returns), and expanding its call rights securities strategy. But the big question… is it safe?

What Does NRZ Do?

As we wrote earlier this year…

NRZ is a leading capital provider to the mortgage industry, including investments in three core business segments:

1) Excess Mortgage Servicing Rights: A mortgage servicing right ("MSR") provides a mortgage servicer with the right to service a pool of mortgage loans in exchange for a fee. Banks currently own 74% of the $10 trillion MSR industry, and NRZ expects this percentage will decline as banks face pressure to reduce their MSR exposure as a result of heightened reserve requirements, regulations and simply a more challenging servicing environment. This creates opportunity for NRZ. According to NRZ's website:

An MSR is made up of two components: a basic fee and an Excess MSR. The basic fee is the amount of compensation for the performance of servicing duties, and the Excess MSR is the amount that exceeds the basic fee. As the owner of an Excess MSR, we collect monthly cash flows from the MSR, but do not assume any servicing duties, advance obligations or liabilities associated with the portfolios underlying our investment.

Investments in Excess MSRs make up just under 50% of NRZ's business, and the company believes these investments can provide 12-20% net yields.

2) Servicer Advances: Servicer advances are generally reimbursable cash payments made by a servicer when the borrower fails to make scheduled payments due on a mortgage loan or to support the value of the collateral property. These investments are considered very safe, they make up 12.7% of NRZ's total investment portfolio, and they believe they can provide 20-25% net yields.

3) Non-Agency Securities & Associated Call Rights: NRZ acquires and manages a diversified portfolio of credit sensitive real estate securities, including non-Agency Residential Mortgage Backed Securities (RMBS) and call rights on select RMBS. These investments make up 15.5% of NRZ's total investments. NRZ believes these investments complement their excess MSRs.

How is the business changing?

NRZ has been able to grow as it expands its mortgage servicing rights business into more states as shown the following two maps (the first one is the most recent, and the second is from earlier this year):

It has also been able to grow through acquisitions. For example, the company grew cash flows through its $1.4 billion acquisition HLSS in 2015 as shown in the following chart.

However, with eligibility into all 50 states nearly complete, and with the opportunities created by the financial crisis moving further into the rear view mirror, NRZ is expanding by growing another line of its business: Residential securities and call rights. For example, the following two charts show the changes in this business segment (as a percentage of the company) just this year:

For perspective, NRZ owns clean-up call rights on ~30% ($175B) of the Non-Agency mortgage market and will continue to focus on accelerating call timelines. Specifically, NRZ increased its Non-Agency RMBS net equity from $374 million as of 4Q15 to $715 million as of 2Q16, as part of an effort to accelerate its call rights strategy. The following graphic gives and illustration of a call rights opportunity.

Why is NRZ a high risk/high reward investment?

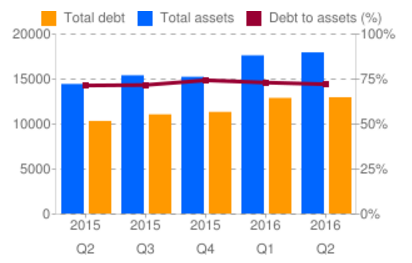

New Residential is a higher-risk higher-reward investment because it is basically doing many of the profitable things the banking industry was doing before the financial crisis hit and new regulations were imposed to prevent them for taking these higher risks. Specifically, NRZ uses high leverage (as shown in the following chart) to invest in the higher risk mortgage industry. And they’ll likely continue to maintain a high level of profitability until another extreme market event occurs, such as the financial crisis.

Additional risks that NRZ faces include the counterparty risk concentration. For example, NRZ may suffer materially if one of its counterparties becomes the subject of regulatory actions, defaults on debt agreements, is downgraded by the credit ratings, or if they file for bankruptcy. Further, if one of NRZ’s mortgage servicers files for bankruptcy that could materially impact NRZ’s business.

With regards, to interest rates, NRZ believes they are appropriately managing their exposures as shown in the following graphic.

However, any extreme moves in interest rates or the mortgage market could materially impact NRZ in a negative way such as we saw during the housing crisis (2008-2009).

Why do we own NRZ?

We continue to own New Residential as one of our higher-risk / higher-reward allocations within our Blue Harbinger Income Equity portfolio. We believe the company can continue to maintain and grow its profitability via its new growth in MSR states and its growing call rights business. The high level of leverage makes us nervous, but we also suspect this will not be an issue as long as we don’t experience another housing crisis, and as long as there are no dramatic changes in interest rates (we suspect the fed will move very gradually, if at all). NRZ is taking on the similar types of risks (leverage, higher-risk mortgage securities) that made many of the big banks extremely profitable for many years before the financial crisis finally hit. We continue to monitor NRZ closely, and we continue to expect it to deliver high levels of profit for years to come.