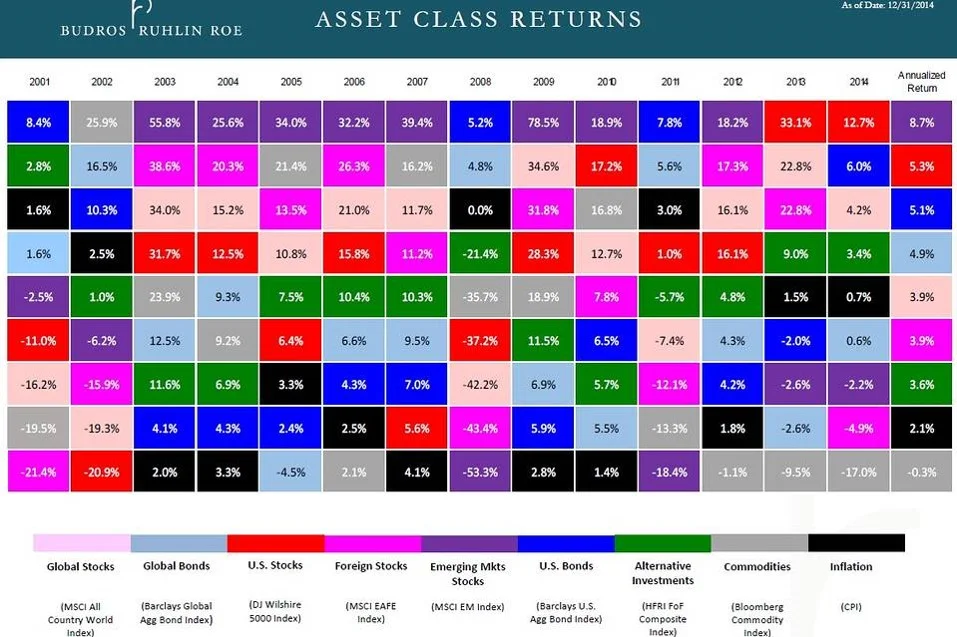

This chart (from yesterday's Wall Street Journal) and charts like it are a financial advisor favorite because they help confuse clients into giving away more of their money.

source: Wall Street Journal

For starters, it is a little silly that they've broken stocks down into Global, US, Foreign and Emerging Markets because these categories are not mutually exclusive. The other three sort of add up to "Global" but they omit Canada, and they're market cap weighted instead of GDP weighted. Further, there are a lot of big US and "Foreign" stocks that get the majority of their revenue in other countries and in some cases mostly from emerging markets. Don't be tricked into paying expensive fees for emerging markets exposure when you can get it less expensively through US stocks and ETFs. In fact, this is one of Jack Bogle's 4 Rules of Investing.

Secondly, it's too short-term. We've been in a declining interest rate environment over the last market cycle and the story will be quite different when central banks eventually become more hawkish.

Further, thinking of commodities as an asset class is expensive and unnecessary. A diversified portfolio of stocks includes many that are highly correlated to the various commodities giving you essentially the same "risk" exposures at a far lower price (investment vehicles that focus on commodities really rip people off).

Lastly, "alternative investments" is just another way of saying "rip off." For example, we just wrote a few days ago about how hedge funds charge extremely high fees and perform worse than a diversified portfolio of stocks such as the ones we identify in our Blue Harbinger Stocks service. Further, this chart is just another example of financial advisors creating unnecessary complexity so they can over charge investors (we commented on this problem here).

If you are a long-term investor, your best option is simply to invest in a diversified portfolio of stocks. And fight like mad to reduce or eliminate investment fees, costs and conflicts of interest.