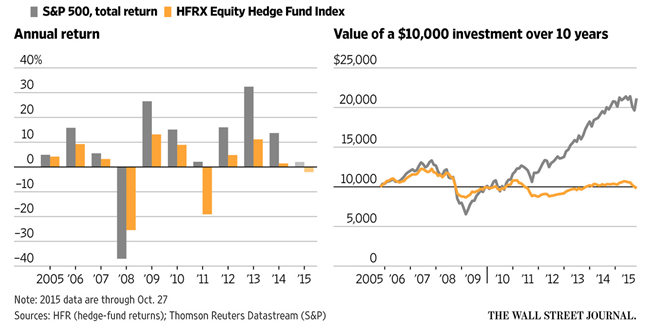

We love this chart because it shows yet another example of how high fees don’t necessarily lead to better performance. In fact, according to the HFRX Equity Hedge Fund Index, these hedge funds (which typically charge very high fees) have been completely crushed by a simple passive equity ETF (in this case the S&P 500) over the past decade.

Source: Wall Street Journal

It's not uncommon for hedge funds to charge an exorbitant 2% annual fee plus keep 20% of your profits. However, you can generate far better returns simply by purchasing low-cost ETFs. For example, check out Blue Harbinger Stocks to learn how to construct a low-cost ETF portfolio (see our "Lazy Person Portfolio") or a well-diversified portfolio of long-term stocks (see our "Blue Harbinger 15"). We strongly believe both Blue Harbinger strategies will greatly outperform hedge funds over the long-term with less risk and lower fees. Be smart and prosper.