In this week’s Weekly, we review the Blue Harbinger stocks that announced earnings last week (they completely knocked it out of the ball park), and we explain why we believe they’ll continue to deliver very big gains going forward. We also review the Blue Harbinger stocks that will be announcing earnings over the next two weeks, and why we believe they too will deliver terrific results. Also worth noting, this weekend Barron’s announced it is “Time to Buy Bank Stocks.” We highlight our favorite bank stock in particular.

Are You Diversified? Appropriately?

Long-term investors should not forget the risk-reward tradeoff. For example, if you were diversified into investment-grade bonds over the last year then your account balance probably hasn’t suffered as much as if you’d invested entirely in stocks. However, over the long-term, we expect stocks to significantly outperform less-risky bonds. This week’s Weekly highlights some extremely attractive stock-specific opportunities that have been created by 2016’s recent market volatility.

Attractive Dividend Yields: Healthcare REITS

This week we review how recent market declines have created some very attractive dividend yields, especially for our favorite healthcare REIT (Hint: It's one of the REITs in this table, and no, it’s not Omega!). We also provide a review of our favorite industrials stock (not a REIT!) which happens to be offering an extremely attractive dividend yield right now. Additionally, we share our view on how we expect this earnings season to impact the sharp decline in stocks we’ve experienced so far this year.

Attractive Dividend Yields: Industrial REITS

We have released some exciting updates in our members-only area this weekend. Specifically, our high dividend “Income Equity” strategy is now available to all subscribers. Also, we have renamed our ETF strategy; it’s now called “Smart Beta” because that is a more accurate description of what it really is. Additionally, we review one of our latest holdings, a high-divided REIT (Hint: it’s one of the REITs in this table, and no it’s not Stag Industrial!).

Automatic Data Processing (ADP) - Thesis

Automatic Data Processing (ADP) – Thesis

Rating: BUY

Current Price: $78.13

Price Target: $114

Thesis:

Automatic Data Processing (ADP) is an attractive stock to own. It’s a stable, highly profitable, human capital management (HCM) company with a large and growing dividend. Additionally, ADP is developing and growing its cloud-based HCM solution to meet customer needs and to keep ADP an attractive and relevant investment for years to come.

ADP is stable, highly profitable, and offers an attractive dividend.

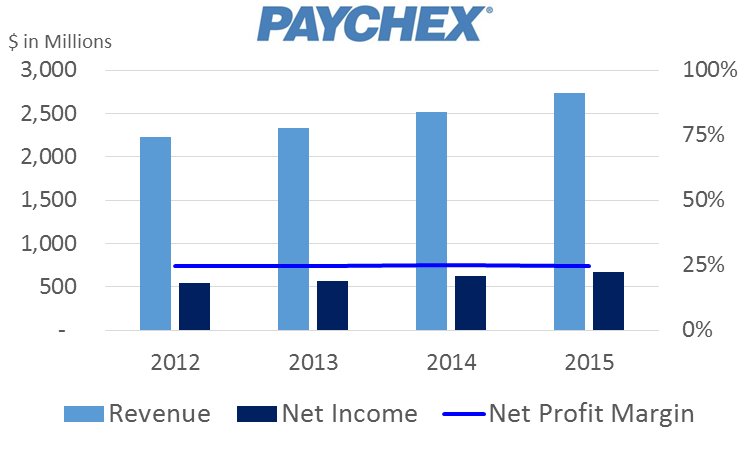

If you’re not familiar, ADP provides a range of software and services to help companies recruit, staff, pay, manage and retain employees. And as the following chart shows, ADP’s revenues and profits are very large and fairly stable:

A big reason for the stability is the high customer retention rate. For example, ADP’s worldwide client revenue retention was 91.4% in fiscal 2015 (Annual Report, p.26). This steady stream of business helps reduce the company’s volatility, and it also helps the company pay a healthy dividend (i.e. ADP has an above average 2.5% dividend yield).

Additionally, ADP’s stable business generates lots of free cash flow so it can continue to increase the dividend as well as repurchase shares. The following chart shows ADP’s free cash flow over the last several years:

Specifically, in fiscal 2015 ADP paid dividends of $927.6 million and returned $1,557.2 million in cash through their share buyback program (ADP Annual Report, p.20). The company also has a track record of increasing the quarterly dividend for 40 consecutive years.

ADP is able to increase the amount of cash retuned to shareholders because it is growing at only a moderate pace. Sources of growth for ADP include economic growth (ADP generally grows as the economy grows), international growth (the company is working to expand outside the US), and rising interest rates (management estimates that a change in both short- and intermediate-term interest rates of 25 basis would result in approximately a $12 million impact to earnings from continuing operations) (Annual Report, p.33). However, ADP would not be returning any cash at all to shareholders if they had the same aggressive growth opportunities as some of their smaller competitors (more on this later).

Valuation:

A basic discounted free cash flow model suggest the market is expecting ADP to grow at an annual rate of about 4.4% (we divided fiscal 2015 FCF by the WACC [8.4%] minus the growth rate to back into the current share price). A 4.4% growth rate is not unrealistic given the company’s growth opportunities. And realistically, ADP will likely achieve a higher growth rate given its current trajectory. For example, analysts surveyed by Yahoo Finance expect earnings to grow at an annual rate of 10.4% over the next 5 years, and management has already provided guidance for 7-8% revenue growth in 2016 (ADP Earnings Release). For example, if ADP grows at 8% for the next five years, and then reverts to a lower 4% growth rate thereafter, the stock is worth $114 per share.

ADP’s Competition:

Like ADP, Paychex (PAYX) is an HCM company with large and fairly stable profits. And while Paychex market capitalization is smaller than ADP’s ($19B vs $39B), the following chart shows Paychex’s profit margin is higher:

Like ADP, Paychex also generates an impressive stream of FCF that can be used to grow the business or return to shareholders (i.e. share repurchases and dividends).

For example, Paychex used it’s FCF to repurchase shares ($182.4 million in FY 2015) and pay dividends ($551.8 in FY 2015). And specifically, PAYX dividend payments amount to an impressive 3.2% dividend yield (significantly higher than ADP).

However, Paychex doesn’t have great organic growth opportunities, and they are reverting to inorganic growth instead. Inorganic is generally less profitable and less desirable than organic growth. Regardless, Paychex explains that it seeks inorganic “growth through strategic acquisitions” (GoogleFinance description). This is in contrast to ADP’s strategic goal to grow organically (one of ADP’s three strategic pillars is to “grow a complete suite of cloud-based HCM solutions, Annual Report, p.3). Paychex’ interest in strategic acquisitions may include aggressive growth cloud-based competitors Paycom (PAYC) and Ultimate Software (ULTI), but more on these companies later.

A basic discounted free cash flow model suggest the market is expecting PAYX to grow at an annual rate of about 4.9% (we divided fiscal 2015 FCF by the WACC [9.1%] minus the growth rate to back into the current share price). A 4.9% growth rate is not unrealistic given the company’s growth opportunities. Somewhat similar to ADP, Paychex growth opportunities include economic growth, aggressive sales initiatives, strategic acquisitions (Paychex, not ADP), and rising interest rates. And realistically, Paychex may achieve a higher growth rate given its current trajectory. For example, analysts surveyed by Yahoo Finance expect earnings to grow at a rate of 9.5% over the next 5 years, and management has already provided revenue and earnings growth guidance of 7-8% and 8-9%, respectively, for fiscal year 2016 (Q1’16 Earnings Release, p.3). However, we believe Paychex does not offer a risk/reward profile that is as attractive as ADP, and for this reason we do NOT own Paychex.

If you like more risk, ADP’s cloud competition may offer a more reward.

ADP and Paychex are experiencing increased HCM competition from cloud-based software companies such as Paycom (PAYC), Paylocity (PCTY) and Ultimate Software (ULTI). These cloud based companies offer solutions that are often better suited for smaller companies. Unlike ADP, the cloud-based software competitor solutions require no customization and are maintained in a single database for all HCM functions. This is particularly attractive to newer (and usually smaller) companies because they’re not bogged down by legacy systems and databases that they must maintain. However, for larger companies they cannot offer the same level of sophistication as ADP.

However, if you do like a higher risk/reward profile with no dividend, we do own Paylocity (PCTY) in our “Dividend Growth” strategy. Like Paycom and Ultimate Software, Paylocity is spending heavily to grow its business and will likely experience much higher volatility than steady ADP. Paylocity is not a good fit for our lower risk, higher dividend “Income Equity” strategy.

Conclusion:

We like ADP. It’s a steady growth business, it has significant price appreciation potential, and it offers an above average dividend. Also, we believe Human Capital Management is a steady growth industry that will benefit from a secular trend towards cloud based solutions. Additionally, because of the amount of client payroll cash on ADP’s books, a rising interest rate environment will be a helpful tailwind. Even though we believe some of ADP’s cloud competitors (for example Paylocity) offer higher risk-reward profiles, we also know they are not a good fit for “Income Equity” investors (they’re high risk and they don’t offer a dividend). ADP’s above average dividend is very safe, and the stock offers continued steady capital appreciation as well.

Caterpillar (CAT) - Thesis

Caterpillar (CAT) - Thesis

Rating: BUY

Current Price: $63.28

Price Target: $97 per share

Caterpillar (CAT) stock has fallen 43% since July of 2014, and it has a large 4.9% dividend yield. Additionally, the company has plenty of cash to continue its track record of dividend increases, and the stock also offers significant opportunity for capital appreciation. Despite dramatic declines in Caterpillar’s mining business, significant weakness in energy, a strong US dollar, and a declining outlook from management, CAT is still worth more than its current market price. Further, the company has ample financial wherewithal to weather intermediate-term challenges, and we believe Caterpillar will eventually revert to moderate growth making now an exceptional buying opportunity for long-term dividend investors as well as those seeking capital appreciation.

Why has Caterpillar’s stock price declined?

CAT’s stock price has declined because of sharp declines in revenues and future revenue forecasts. Specifically, CAT management expects total sales and revenues for 2015 to be $48 billion. This is down from $55 billion in 2014 and $66 billion in 2012. Further, management expects sales and revenues to decline another 5% in 2016.

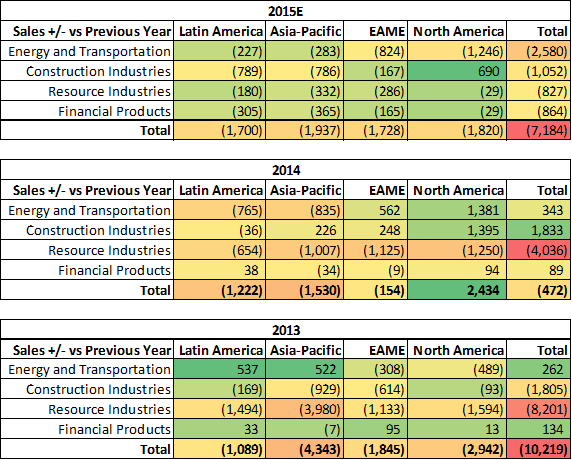

The following table estimates the breakdown of the full-year 2015 $48 billion guidance from management based on trending sales volumes across business segments and regions. For reference, we’ve also included 2014 actuals.

As the above table shows, “Energy and Transportation” and “Construction Industries” are the two largest business segments (by revenue) for CAT. However, as recently as 2012, “Resource Industries” contributed over $21 billion in annual sales and revenues. For further context, the following tables show the increase/decrease (sales in dollars) for each business segment and region since 2012.

The table shows the dramatic decline in “Resource Industries” since 2012. This is the segment of CAT’s business that builds and supports machinery for the mining industry. The mining industry has been decimated in recent years as demand and prices have significantly declined. For example, the SPDR S&P Metals and Mining ETF (XME) has declined over 70% in the last five years.

Caterpillar’s “Energy and Transportation” business segment has also declined in 2015 and is expected to decline further in 2016. According to the company’s third quarter earnings release: “Energy & Transportation’s sales are expected to be down 5 to 10 percent [in 2016] as a result of continuing weakness in oil and gas coupled with a weaker order backlog than in 2015.” For reference, Energy & Transportation supports customers in oil & gas, power generation, marine, rail and industrial applications.

In addition to challenges across business segments, CAT has also been negatively impacted by the strong US dollar. For example, in the most recent third quarter 2015, currency detracted $466 million from sales versus the third quarter of 2014. (quarterly earnings release, page 5) This is significant considering net income for Q3 2015 was only $368 million.

What is Caterpillar Worth? (Bear Case Valuation):

Our bear case valuation uses a discounted cash flow (DCF) model and forward price-to-earnings (PE) estimates. Our DCF model assumes cash from operations shrinks by 25% in 2015 (versus 2014), and then shrinks by another 5% in 2016, and then finally remains flat thereafter. The 25% decline in 2015 is based on current market conditions and declines through the first nine months of the year. We assume capital expenditures decline by 5% this year and next year, and then remain flat thereafter. We also assume a weighted average cost of capital (WACC) of 5.98% and we assume a zero percent growth rate after 2016. In this scenario, Caterpillar is worth around $77 per share (more than its current stock price):

Using PE multiples as a second check, Caterpillar’s stock currently trades at about 15.54 times management’s 2015 earnings guidance (excluding restructuring costs). This is consistent with year-end 2014 when the ratio was 15.58. For reference, the following chart provides recent history of CAT’s price-to-earnings ratio, and 15.54 is not dissimilar from the recent past.

We exclude restructuring costs (because they are not permanent) but we also exclude the eventual benefits of restructuring (which management expects will be around $1.5 billion per year when restructuring is complete in 2018, Q3 earnings release, p.1).

For 2016, management hasn’t yet provided earnings guidance, but they expect sales to decline another 5%. Assuming the same 5.6% profit margin that management provides for 2015 implies earnings of $4.47 per share (excluding restructuring costs) in 2016. And applying the same 15.54 multiple gives us a price per share value of $69 (which is not dissimilar to the current stock price). However, this methodology ignores the full benefits the company will achieve when restructuring is complete. If we apply the full $1.5 billion in expected future savings, then EPS rises to $4.61 per share, and the stock is worth $72 per share (slightly above its current market price). However, this valuation still ignores the likelihood that Caterpillar will eventually return to growth at some point in the future. Averaging our DCF and PE valuations gives CAT an overall a bear case valuation of around $74 per share, which is slightly above its current market price. And remember, this bear valuation assume CAT declines significantly through 2016, and then never grows again thereafter.

What is Caterpillar Worth? (Bull Case Valuation):

Our bull case scenario DCF model makes the same assumptions as the bear case, except we assume a 2% growth rate after 2016. Two percent is not unreasonable considering the company may stabilize after the large business declines in 2013 – 2016, and begin to grow at a rate consistent with the overall economy. Said differently, there is likely a floor to CAT’s sales declines which we expect the company to approach in 2016. Using these assumptions gives CAT a value of around $116 per share. And realistically, we may see growth higher than 2% for a variety of economic reasons that would result in a value for CAT that is even higher than $116 per share.

Our bull case price-to-earnings assumes the company eventually completes its restructuring and market conditions result in profit margins returning to historically higher levels of around 7%. A 7% profit margin applied to $45.6 billion in sales equals $5.48 in earnings per share. Applying a 15.5 multiple gives CAT a value of around $85 per share. Realistically, sales could be dramatically higher than $45.6 billion if the international resources business picks back up or if US Energy and Transportation increases. As recently as 2012, CAT had revenues of $66 billion, and applying a 7% profit margin and a 15.5 multiple gives the stock a value of over $122 per share. Averaging our DCF and PE valuations gives CAT a bull case value in excess of $100 per share with the potential to climb even more significantly higher.

Is Caterpillar’s Dividend Safe?

Even in our bear case scenario, Caterpillar’s dividend is very safe. CAT generates an enormous amount of free cash flow, and it has over $6 billion of cash and short term investments on its balance sheet. For perspective, CAT paid $1.3 billion in dividends through the first nine months of this year, and has generated $2.7 billion of free cash flow. This means CAT generates plenty of cash to cover the dividend, and they have ample cushion to keep paying (and increasing) the dividend in the future. Worth noting, CAT has increased its dividend 83% since 2009 (Q3 Earnings Release, p.1), and we believe the company has the wherewithal to continue this trend.

Are Caterpillar’s Share Repurchases Prudent?

Given its extra cash, Caterpillar has accelerated the repurchase of its own shares in 2013-2015. For example, the company’s net issuance of shares was positive in 2011 and 2012 ($123 million and $52 million, respectively), but in 2013 they retired (bought back) nearly $1.9 billion, in 2014 they bought back nearly $4 billion, and through the first nine months of 2015 they’ve bought back almost $2 billion. As we’ve written before, public companies have accelerated share repurchases in recent years, and the value of the repurchases is hotly debated by investors. In the case of Caterpillar, we believe the shares are currently undervalued (based on our valuation above), and the share repurchases are prudent and value adding.

Is Caterpillar’s Debt Appropriate?

Caterpillar’s debt load is reasonable, and it is unlikely to hamper the company in the future. For example, the company’s debt-to-assets ratio is a manageable 47.5%. This allows Caterpillar to lever returns for shareholders, and realize tax advantages based on its estimated annual tax rate of 27%, without unnecessarily increasing its risk. For reference, CAT’s debt ratio is lower than its competitor, Deere (Deere has a high 63.6% debt ratio, which may create higher capital costs and increase risk for that company). Additionally, Caterpillar has the ability to retire debt if needed based on its strong cash position.

Is now a good time to buy value stocks with high dividends?

Some investors make the case that it is always a good time to buy value stocks with high dividends. However, given current market conditions, we believe now is a particularly good time to buy value stocks with high dividends (such as Caterpillar). There is a long history of mean reversion in the stock market (recent examples include REITs under-performing by a lot in 2013 and then out-performing by a lot in 2014, and aggressive growth stock Amazon under-performing by a lot in 2014 and now outperforming by a lot in 2015). And recent performance suggests high dividend value stocks are increasingly due for better relative performance. The following chart shows the recent returns of various equity styles and allocations.

Large cap value stocks (such as Caterpillar) as represented by the Russell 1000 Value index have underperformed in recent periods. This is largely due to the accommodative monetary policies of the US Federal Reserve which have favored growth stocks. However, the Fed is widely expected to turn more hawkish in the near future, and this may favor value stocks on a relative basis. Of course predicting the exact timing and speed of the Fed’s policy shift is impossible, but the odds are increasingly favoring value stocks. Additionally, the above chart also suggests dividend stocks are due for better relative performance. For example, the highest dividend yield sectors in the above chart have been the worst performers. And even if the Fed does begin slowly raising interest rates (which is bad for bond prices in general) it will still take years before US treasury yields can compete with attractive dividend yields, especially considering the capital appreciation opportunities of high dividend yield stocks like Caterpillar.

Conclusion:

We like Caterpillar. Its dividend is big, safe and growing. Management is appropriately allocating the company’s ample free cash flow and maintaining an appropriate level of debt. Additionally, Caterpillar’s stock offers considerable opportunity for capital appreciation. Even if Caterpillar’s business shrinks significantly over the next two years and then never grows again, it is still worth more than its current stock price. However, we believe the market is too bearish and too shortsighted in its view of Caterpillar. Rather than never growing again, we believe the company will eventually revert to growth and the stock will be worth dramatically more than its current market price.

International Business Machines (IBM) - Thesis

International Business Machine (IBM) – Thesis

Rating: BUY

Current Price: $131.57 per share

Price Target: $205 per share

Thesis:

To say the least, IBM has been beat up over the last several years. Revenue has declined in 14 consecutive quarters and the stock price has lost a third of its value. Media pundits decry things like “IBM missed the cloud opportunity,” and “it’s a dinosaur kept alive with financial engineering.” But the reality is that IBM is a cash generation machine. It is currently significantly undervalued by the market, and it has a clear path to increasing its intrinsic value even further.

Why has IBM’s stock price declined? For starters, IBM’s stock price has declined because revenue, profits and guidance are declining. And IBM looks even worse when compared to some of its hyped-up peers that are receiving all sorts of cloud glorification (e.g. Amazon Web Services, more on this later). However, IBM’s declining revenues and profits are not entirely due to bad decisions by the company. In addition to bad decisions (such as their cloud strategy, more on this below) the declines are also due to the same macroeconomic headwinds that other companies are facing, as well as spending by IBM to reposition itself for more profits in the future. It is worth reviewing some of these factors to help shed light on the partially-false narrative that IBM’s revenues and profits are declining simply because it is a horrible company (IBM is not a horrible company).

IBM’s legacy businesses are shrinking: IBM’s largest business segment, Global Services (which is a combination of Global Technology Services and Global Business Services) has a shrinking backlog of work. Approximately 60 percent of the segment’s external revenue is annuity based (annual report, p.29) coming primarily from outsourcing and maintenance arrangements. This is a very nice revenue stream for IBM, but it creates a challenge for the company because the backlog is shrinking. For example, IBM’s backlog was $118 billion at the end of the third quarter (third quarter results) , down from $128.4 billion at the end of 2014 and $142.8 billion at the end of 2013 (annual report, p.35). To prevent further valuation declines, IBM will need to find a way to replace this shrinking backlog (we’ll talk more about the company’s “strategic imperatives” later).

IBM continues to divest of some businesses altogether: IBM gave up approximately $7 billion of revenue in 2014 as it divested of businesses that no longer fit its strategic profile (annual report, p.3). For example, IBM announced the divestment of industry standard servers, customer care business process outsourcing services and its microelectronics business. These were unprofitable businesses, but they are still a significant part of the reason IBM’s top line revenues continue to decline.

IBM’s nuanced cloud strategy is weak: IBM is supposed to be a nice safe company, and many investors buy the stock because of this and its attractive dividend. However, it is this nice safe approach to running the business that caused IBM to essentially miss the boat with regards to the cloud. Rather than aggressively pursuing industry-wide cloud, IBM chose a nuanced hybrid-cloud approach whereby they fuse new client solutions with their existing systems. IBM believes they are uniquely qualified to bring value to clients via this hybrid approach, and it also fits nicely with the company’s long-term story of evolving from a hardware company, to a software company, to a services company (annual report, p.28). However, if IBM senior management was more aggressive they would have recognized they were also uniquely positioned a few years ago to aggressively pursue the cloud because of the company’s huge free cash flows, strong brand name, and long history of hardware, software and services. Instead, IBM chose the “safe” approach, and more aggressive firms like Amazon (Amazon Web Services) and Microsoft (Azure) stepped in and are now emerging as the dominant players in the space. Even from a cloud services approach, IBM is getting out hustled by Accenture because of that firm’s agility and willingness to adapt to newer opportunities. For example, Accenture recently purchased Cloud Sherpas and has also formed a strategic alliance with Amazon Web Services (Amazon Q3 release, p.3).

In IBM’s defense, its shareholders would probably not have tolerated a halt in share buybacks and a halt in divided growth in order to use free cash flows to more aggressively pursue the cloud. By comparison, Jeff Bezos over at Amazon doesn’t pay a dividend, halted share buybacks, and allowed the company to generate negative net income in order to aggressively pursue growth opportunities such as the cloud via Amazon Web Services. This behavior simply would not fly among IBM’s shareholders who prefer a nice “safe” company with an attractive dividend yield.

IBM’s growth markets have declined: Not unlike other companies, IBM’s revenues have declined in emerging markets. For example, revenue from the BRIC countries (Brazil, Russia, India and China) decreased 10.7% in 2014 (they decreased only 5% adjusted for divestitures and currency, annual report, p.24). These declines have more to do with global economic conditions than anything IBM did in particular, but they are still detractors, and they help explain why IBM’s overall revenue continues to decline.

Foreign currency continues to negatively impact IBM: Declining revenues are not appealing, but in the case of IBM it is not entirely because of bad decisions by management. For example, IBM’s net income fell 13.9% during the most recent third quarter versus the same quarter a year ago. However, 12.9% of the decline was due to foreign currency impacts. It’s important to understand the impact of FX because without doing so it’s easy to mistakenly assume all of IBM’s declines are due to poor management decisions. Currency exchange rates are out of management’s control (and hedging is expensive and imprecise). Absent FX, IBM’s declines are not as bad as they seem.

IBM is spending now for future growth and profits. Despite IBM’s sub-par cloud strategy, they are still spending heavily to implement it, and it may contribute to increased profitability in the future. The risk is that IBM’s cloud strategy may cannibalize its existing business more than it creates new business. For some color, in 2014 IBM spent approximately 6 percent of its revenue on research and development (R&D) and invested approximately $4 billion on capital investments, largely cloud related. For example, IBM launched Bluemix, the company’s cloud platform-as-a service for the enterprise. It also invested to globally expand its SoftLayer cloud datacenters. Additionally, IBM introduced cloud application innovations around Watson Analytics and Verse (annual report, pp 4-5). IBM believes spending on R&D will help the company succeed in the future.

What is IBM worth?

A basic discounted cash flow model suggests the market is expecting IBM to shrink about 3.3% per year into the future. For example, over the 12-month period ended September 30, 2015 the company generated $17.8 billion in cash from operations, and spent $3.7 billion on capex (IBM Q3-15 and Q4-14 reports), yielding a simplified free cash flow of $14.0 billion (for reference, over the last several years IBM has consistently spent between 20% - 25% of its cash flow from operations on capex). Assuming the firm’s weighted average cost of capital is 7%, we can back into IBM’s current stock price by assigning the company a negative 3.3% annual growth rate. And while IBM’s absolute free cash flows have actually shrunk about 3.3% per year over the last several years, it seems unlikely that they will continue to shrink at this rate indefinitely into the future considering the unique circumstances over the last several years such as strong foreign currency headwinds, divesting of unprofitable businesses, weak emerging market conditions, and spending on initiatives that are expected to yield future growth. Even if IBM were to simply sustain its current business (0% growth) our discounted cash flow model suggest the stock is worth around $205 per share, roughly 45% higher than its current price. And if the company were to grow at all then it would be worth even more.

Another approach to valuing IBM is to compare it to Accenture, which is essentially its closest competitor in terms of the types of business and technology services revenues the two companies generate. The following table compares Accenture to IBM’s Global Services segment (the company’s largest segment by revenue and pre-tax income at around 60% and 48%, respectively).

Source: Google Finance and IBM Q3-15 and Q4-14 reports

And while IBM’s Global Services revenues are more than 50% higher than Accenture’s, the margins are very similar (although IBM’s are slightly better). And considering Accenture trades at roughly 16.1 times its pre-tax income (which seems reasonable), IBM’s Global Services segment should command a stock price of around $146 per share. And $146 per share is slightly higher than IBM’s actual stock price, and it completely excludes the value of IBM’s other business segments: Software, Systems and Technology, and Global Finance. Granted this is not exactly an apples-to-apples comparison (for example Accenture has been experiencing higher growth than IBM), but it still suggests IBM may not be receiving a high enough valuation from market.

IBM and Financial Engineering

Other companies (e.g. Amazon, Microsoft, Accenture) are suffering the same headwinds as IBM (e.g. foreign currency challenges and weak emerging markets) but they’ve more than offset them with growth. By comparison, IBM has not grown and has attempted to satisfy shareholders with dividends and share buybacks. A common complaint against IBM is that these uses of cash are just financial engineering techniques used to boost earnings per share (and to some extent its stock price). We tend to believe these things are more an indication of good stewardship by management, but they are certainly no substitute for good old fashioned organic growth.

But again, in IBM’s defense, investors are attracted to the company’s low-beta stability. Part of the reason IBM is able to consistently return so much cash to shareholders (dividends and share buybacks) is because of its steady backlog of business. And as IBM continues to pale in comparison to its glamorized cloud competitors, its stock price has fallen, and its dividend yield has increased to historically high levels. This should attract more “safe-dividend” type investors to IBM because the dividend is not in jeopardy of being cut based on IBM’s large free cash flow generation.

How can IBM reverse its decline?

If IBM only maintains its current level of business (i.e. it neither shrinks nor grows) then it is still worth significantly more than its current stock price suggests (as noted in our valuation analysis above). We believe the declines in revenue and profits will likely cease for a variety of reasons. For example, the rate of IBM’s significant divestment activities will slow as the company finishes purging its unprofitable and non-strategic businesses. As this happens, revenue declines will cease, and the profitability of the remaining revenue will be higher. Next, the significant declines IBM has experienced due to foreign currency headwinds will likely stabilize, and perhaps even work in IBM’s favor in the future. Further, the declines in emerging markets will likely slow and perhaps even reverse as those economies stabilize. In fact, IBM will likely experience future growth as the overall economy grows. Also, IBM has a variety of “strategic imperatives” that will replace declines in legacy businesses and perhaps even add significantly to future growth.

IBM’s strategic imperatives include data, cloud and engagement (annual report, p.26). IBM believes these imperatives are transforming the IT industry, and that they are uniquely positioned help clients and to profit. Specifically, IBM believes data is the world’s new “natural resource,” and their unique capabilities (such as Watson) will enable them to help clients by refining it. Regarding the cloud, IBM believes they are poised to help enterprises reinvent their entire business models with their cloud computing strategies (again, note IBM’s strategy is about helping large enterprises with hybrid-cloud rather than pursuing newer opportunities with newer companies). And with regards to engagement, including mobile and social technologies, IBM believes they will be a part of fundamentally changing how people interact and get work done (said differently, IBM has vast relationships with existing clients that will ask for help in these areas). Certainly these strategic imperatives provide growth opportunities for IBM, but the extent to which the company succeeds in implementing them will determine if IBM is able to grow enough to offset their declining legacy businesses and perhaps even grow overall.

Conclusion:

IBM is enormously profitable. Its revenues are enormous, its margins are high, its cost of capital is low, its cash flows are steady, its future prospects are looking up, its dividend yield is attractive, and the stock is currently on sale. And while IBM’s cloud business pales in comparison to some of the high-flying glamorized cloud solutions offered by companies like Amazon Web Services and Accenture’s “Cloud Sherpa,” that’s totally fine. IBM’s shareholders don’t want these high-risk high-volatility opportunities. They want IBM.

Phillips 66 (PSX) - Thesis

Phillips 66 (PSX) – Thesis

Rating: BUY

Current Price: $75.20

Price Target $96.00

Thesis:

Phillips 66 (PSX) is the most diverse of the major refining companies, but you wouldn’t know it based on the way the stock trades. Specifically, the market has assigned PSX a valuation similar to other refiners, and the stock trades in lock step. However, the company’s chemicals and midstream businesses warrant a different valuation multiple, and the stock price shouldn’t be quite as highly correlated with other refiners. We believe PSX offers a decreasingly volatile but growing earnings stream and deserves a higher stock price based on its attractive free cash flows that are used to profitably grow the business and reward shareholders with stock buybacks and increasing dividends.

Phillips 66 Overview and Outlook:

The following table from the company’s latest Investor Update shows the earnings (before interest, taxes, depreciation and amortization) of Phillips 66 over the last five years as well as the company’s expectations for 2018.

Fast growing midstream and chemicals businesses will generate a significant portion of EBITDA growth, but refining and marketing & sales will also contribute. Refining and marketing & sales are the main business activities of most refining companies, but Phillip’s 66 is unique in the large (and growing) portion of earnings from other businesses (i.e. midstream and chemicals).

Valuation:

This next table shows the typical EV/EBITDA valuation multiple assigned to the various business activities in which PSX is involved (EV is enterprise value, and it’s basically a summation of a company’s total debt and equity value with some minor adjustments). The PSX valuation is higher than its refining peers, but the market is still not giving the company enough credit for the size and growth potential of its chemicals and midstream businesses. Midstream businesses receive a significantly higher multiple due largely to the very stable earnings they generate from long term fee agreements.

If PSX were to receive full credit for its various business segments then its stock would trade significantly higher (around $93 per share) based on its current business mix as high as $100 per share based on its expected 2018 business mix. However, even without this business mix multiple expansion, the stock has significant upside from the large expected EBITDA growth between now and 2018. And unlike its refiner peers, this growth will be generated largely by midstream and chemicals (as well as some growth contributions from refining and marketing & sales). For added perspective, if PSX achieves its expectation of around $2.3 billion of midstream EBITDA in 2018 then the midstream business is worth around $34 billion as a stand-alone company (we used a 14.5x multiple), not far below what the entire company is worth now.

PSX will spend heavily to generate the midstream and chemicals growth, but the company generates more than enough cash to fund the growth and to also reward shareholders with share buybacks and increasing dividends. The following charts show the mix of capital spending as well as the breakdown of cash returned to shareholders.

Conclusion:

PSX is offers an attractive dividend yield and significant capital appreciation opportunity. And if PSX meets its growth expectations and generates $9.3 billion of EBITDA in 2018 then the company is worth significantly more than its current stock price suggests. Further, the stock has even more upside if the market starts giving it credit for its midstream and chemicals businesses instead of just lumping it in with other large (less diversified) refiners.

Small Cap Value (IWN) - Thesis

iShares Russell 2000 Value ETF (IWN)

Expected Return: 9.0% per year

Expected Volatility: 22.0% per year

Rating: BUY

Thesis:

As long-term investors, we believe the equity markets will increase over time, and the small cap value portion of the equity markets will increase more than other styles (e.g. large cap growth), albeit with more volatility. The iShares Russell 2000 Value ETF (IWN) offers reliable exposure to the returns of the small cap value portion of the U.S. equity market while avoiding the many pitfalls that are common among other ETFs and among other equity investments in general.

Holdings:

IWN generally invests at least 90% of its assets in securities of the Russell 2000 Small Cap Value Index. The fund may invest the remainder of its assets in certain derivatives such as futures, options, swap contracts and cash equivalents. The index is one of the most commonly followed equity indices in the U.S., and is largely considered the standard benchmark for small cap value stocks. The performance of IWN has historically matched the performance of the Russell 2000 Small Cap Value Index very closely, and it should continue to track closely in the future because of its construction methodology. Investors cannot purchase the actual index (the Russell 2000 Small Cap Value Index), and IWN is the next best thing.

Volume and Liquidity:

As the standard small cap value ETF in the US, IWN has significant volume and liquidity (total IWN assets exceed $5.5 billion). Because of the volume and liquidity, the bid-ask spread is small (the bid-ask spread is the difference in price at any given time for someone buying the security and someone selling it. There is a difference because the middle man takes a very small cut). A small bid-ask spread is good because it saves you money when you trade. Second, IWN trades very close to its net asset value (NAV) because of the large volume and liquidity. NAV is the actual value if you add up the value of all the securities held within IWN. For many less liquid ETFs, the NAV may vary from its actual market price (the price the ETF trades at in the market). This makes IWN much less risky for investors compared to other ETFs that may vary widely in price versus NAV. Additionally, small investors don’t have to worry about some big investor coming in, buying or selling an enormous amount of IWN, and subsequently adversely moving the market price away from its NAV because the volume of IWN is already so great that this risk is essentially non-existent. Additionally, the fund manager, iShares has the ability to take open-market actions to virtually eliminate the potential price impacts of large trades.

Low Fees:

The net expense ratio on IWN is currently 25 basis points (0.25%). This is extremely low for small cap value market exposure; it is good for investors because it allows them to achieve better returns on their investment. For comparison, small cap mutual funds (a common competitor to ETFs) may charge over 200 basis points (2.0%) per year, and they tend to deliver worse performance over the long-term. Additionally, there is no expensive sales charge or separate investment advisor fee because IWN can be purchased directly through a discount broker (e.g. Scottrade, E*TRADE, TD Ameritrade, Interactive Brokers, etc.). The discount broker may charge you a one-time trading fee of $8 or less, but this is much better than the 2-5% sales charge/management fee you’d get charged by a full service financial advisor. Additionally, there is no hidden 25 basis point (0.025%) annual 12b-1 fee paid to someone for “servicing your account.” The bottom line here is that IWN is a very low cost way to get great exposure to the equity market and to build considerable wealth over the long-term.

Dividend Reinvestment:

One last point of consideration, IWN pays a quarterly dividend (around 2.16% per year), and this dividend is NOT automatically reinvested back into IWN (this is standard protocol for ETFs and stocks). This mean you’ll build up a cash balance in your account if you don’t withdraw it or manually reinvest it. As a long-term investor, cash is generally a drag on investment performance. Unless you plan to withdraw and use the cash, we highly recommend you develop a process to reinvest it. Most discount brokers (Scottrade, Interactive Brokers, etc.) offer automatic dividend reinvestment programs. We highly recommend you sign up for these programs to avoid the situation where cash builds up in your account and becomes a drag on your long-term investment performance. Reinvesting dividends is important.

Conclusion:

IWN is a very low cost, relatively low risk, security that allows investors to build significant wealth over the long-term. We consider IWN to be a basic building block for long-term wealth, and we rate IWN as a “Buy.” For more information, you can view the IWN fact sheet here.

International Stock ETF (IXUS) - Thesis

iShares Core MSCI Total Int'l Stock ETF (IXUS)

Expected Return: 9% per year

Expected Volatility: 25.0% per year

Rating: BUY

Thesis:

As long-term investors, we believe the equity markets will increase over time, and the international (non U.S.) developed and developing (emerging) markets (countries with developed and developing economies) portion of the equity markets will increase at a slightly better rate than the U.S. market, albeit with higher volatility. Non-US exposure also provides very important diversification benefits that are not available by investing in U.S. markets alone. The iShares Core MSCI Total International Stock ETF (ticker: IXUS) offers reliable exposure to the returns of international markets while avoiding the many pitfalls that are common among other ETFs and among other equity investments in general.

Holdings:

IXUS invests in over 3,300 non-U.S. stocks from over 40 developed- and developing-market countries. At least 90% of its assets are invested in securities of the underlying index (MSCI ACWI ex U.S. IMI). The “IMI” portion of the index is important (it stands for Investable Market Index) because in addition to large cap and mid cap stocks, it also includes the small cap portion of the market (the version of the index without the “IMI” is only large cap and mid cap). The fund may invest the remainder of its assets in certain depository receipts and derivatives such as futures, options, swap contracts and cash equivalents. The index is one of the most commonly followed equity indices in the World, and is largely considered the standard benchmark for non-U.S. developed and developing market stocks. The performance of IXUS has historically matched the performance of the MSCI ACWI ex U.S. IMI very closely, and it should continue to track closely in the future because of its construction methodology. Investors cannot purchase the actual index, and IXUS is the next best thing.

Volume and Liquidity:

As a standard ETF, IXUS has significant volume and liquidity (total IXUS assets exceed $1.7 billion). Because of the volume and liquidity, the bid-ask spread is small (the bid-ask spread is the difference in price at any given time for someone buying the security and someone selling it. There is a difference because the middle man takes a very small cut). A small bid-ask spread is good because it saves you money when you trade. Second, IXUS trades very close to its net asset value (NAV) because of the large volume and liquidity. NAV is the actual value if you add up the value of all the securities held within IXUS. For many less liquid ETFs, the NAV may vary from its actual market price (the price the ETF trades at in the market). This makes IXUS much less risky for investors compared to other ETFs that may vary widely in price versus NAV. Additionally, small investors don’t have to worry about some big investor coming in, buying or selling an enormous amount of IXUS, and subsequently adversely moving the market price away from its NAV because the volume of IXUS is already so great that this risk is essentially non-existent. Additionally, in the extremely rare case where a big trade could cause a big discount or premium, the fund manager (iShares by BlackRock) has the sophistication to engage in open market trading activity to avert the large mispricing relative to the NAV (some other ETF managers do not have this same level of sophistication).

Low Fees:

The net expense ratio on IXUS is currently 14 basis points (0.14%). This is extremely low for international market exposure; it is good for investors because it allows them to achieve better returns on their investment. For comparison, international mutual funds (a common competitor to ETFs) may charge over 300 basis points (3.0%) per year, and they tend to deliver worse performance over the long-term. Additionally, there is no expensive sales charge or separate investment advisor fee because IXUS can be purchased directly through a discount broker (e.g. Scottrade, E*TRADE, TD Ameritrade, Interactive Brokers, etc.). The discount broker may charge you a one-time trading fee of $8 or less, but this is much better than the 3-5% sales charge/management fee you’d get charged by a full service financial advisor. Additionally, there is no hidden 25 basis point (0.025%) annual 12b-1 fee paid to someone for “servicing your account.” The bottom line here is that IXUS is a very low cost way to get great exposure to the equity market and to build considerable wealth over the long-term.

Dividend Reinvestment:

One last point of consideration, IXUS pays a quarterly dividend (around 2.57% per year), and this dividend is NOT automatically reinvested back into IXUS (this is standard protocol for ETFs and stocks). This means you’ll build up a cash balance in your account if you don’t withdraw it or manually reinvest it. As a long-term investor, cash is generally a drag on investment performance. Unless you plan to withdraw and use the cash, we highly recommend you develop a process to reinvest it. Most discount brokers (Scottrade, Interactive Brokers, etc.) offer automatic dividend reinvestment programs. We highly recommend you sign up for these programs to avoid the situation where cash builds up in your account and becomes a drag on your long-term investment performance. Reinvesting dividends is important.

Conclusion:

IXUS is a very low cost, relatively low risk, security that allows investors to build significant wealth over the long-term. We consider IXUS to be a basic building block for long-term wealth, and we rate IXUS as a “Buy.” For more information, you can view the fact sheet for this ETF here.

Blue Harbinger "Income Equity" Strategy

In this installment of our members-only Blue Harbinger Weekly, we review an exciting upgrade to our members-only area that is coming soon. Specifically, we discuss the soon to be released Blue Harbinger “Income Equity” strategy. This new strategy will be available to all existing Blue Harbinger subscribers. We also review one of the holdings within the new strategy that should benefit greatly from where we are in the current mortgage origination cycle.

EastGroup Properties (EGP) - Thesis

EastGroup Properties (EGP)

Current Price: $55.63 per share

Price Target: $62.34 per share

Rating: BUY

Thesis:

EastGroup Properties (EGP) is an industrial Real Estate Investment Trust (REIT), and we like it despite its negative 8.4% total return in 2015. It declined in 2015 for a variety of reasons including lackluster overall market performance, slightly lower occupancy rates, lower year-over-year third-quarter earnings, fear that company’s Houston area properties will suffer from a challenged local energy market, and fear that rising interest rates will pressure the business. However, we believe EGP’s poor 2015 performance is temporary, and it provides an excellent buying opportunity for long-term value investors that seek above average dividends.

About EGP:

EastGroup Properties, Inc. (EastGroup) is an industrial equity REIT focused on the development, acquisition and operation of industrial properties in Sunbelt markets throughout the United States. EastGroup holds its properties as long-term investments. The Company owns approximately 307 industrial properties and one office building. These properties are located in the states of Florida, Texas, Arizona, California and North Carolina. The Company has developed approximately 37% of its total portfolio (on a square foot basis), including real estate properties and development properties in lease-up and under construction. The Company's focus is the ownership of business distribution space (80% of the total portfolio) with the remainder in bulk distribution space (16%) and business service space (4%). EastGroup competes on location (not rent), and clusters properties around a variety of transportation features.

EGP’s business is healthy and growing:

EGP’s business is strong for a variety of reasons. For example, occupancy rates remain high. Specifically, properties were 96.6% leased and 95.8% occupied as of September 30, 2015 (this is down very slightly from 96.7% leased and 96.3% occupied on December 31, 2014). Additionally, EGP’s balance sheet remains strong and flexible. Its debt-to-total market capitalization is low especially compared to peers:

As of the end of the last quarter, ESG had both interest and fixed charge coverage ratios of 4.6x and a debt to earnings before interest, taxes, depreciation and amortization (EBITDA) ratio of 6.30x. Further, EastGroup’s customer base is large and diverse. At year-end 2014, EGP had over 1,400 customers with an average size of 23,000 square feet and a weighted average lease term of 5.6 years. (2014 Annual Report)

Addtionally, EastGroup is growing. For example, EGP’s development program consists of 21 projects (2.1 Million Square Feet) at September 30, 2015 with a projected total investment of $157 million. Additionally, Funds from Operations (FFO) attributable to common stockholders were $.94 per share at the end of the third quarter up from $.89 per share for the same quarter of 2014, an increase of 5.6%. Also, same property net operating income increased 1.3% for the quarter ended September 30, 2015, compared to the same quarter in 2014.

EGP’s dividend is attractive and safe:

EastGroup has increased or maintained its dividend for 23 consecutive years. This is important for dividend investors, especially considering many of EGP peers had to cut their dividends during the recession of 2007-2009. EGP’s dividend to FFO ratio (over the last 12 month) is also relatively low compared to peers (this is a sign of safety).

Further, the dividend has increased in each of the last four years. For reference, EGP historical dividend to FFO ratio is included in the following chart:

What is EGP Worth?

On a price-to-earnings basis, EGP looks expensive (36.6 times), but a more relevant REIT valuation metric is price-to-FFO. FFO stands for Funds from Operations, and it is calculated as Net Income adjusted for Depreciation, Amortization, and Property Sales. Depreciation has a big impact on REITs considering their business is real estate. On a price to FFO ratio, EGP is trading around 15.4 times, a much more reasonable metric than the PE ratio. This price to FFO ratio is below EGP’s recent historical multiple indicating the stock is priced attractively based on this metric.

If EGP FFO multiple were to return to the 17.1 average from 2011-2014, then the stock would trade around $62.34, 11.3% higher than its current stock price. And 11.3% capital appreciation combined with a 4.3% dividend yield is an attractive proposition for a relatively lower risk REIT. And while full-year 2015 results won’t be released until February 1st, management expects FFO between $3.66 and $3.68 per share. Applying the same 17.1 multiple suggests a stock price of $62.75.

Further, industrial REITS will grow as the economy grows. No one has a crystal ball, but we believe the economy will continue to grow over the long-term. Plus, EGP’s properties are highly valuable as they’re located in primary industrial locations relative to transportation features that are important to industrial companies. We believe the combination of lower debt, lower dividend payout ratios (meaning more safety and growth potential), and primary industrial locations makes EGP a lower risk investment with more upside compared to many of its peers.

Real Estate Sector:

Worth noting, we may see some additional demand and volatility for REITs later in 2016 as Real Estate is set to get its own official sector classification after market close on August 31, 2016.

Conclusion:

We believe EastGroup Properties is an attractively priced industrial REIT with an above average (and growing) dividend. The stock adds important diversification to our long-term investment portfolio. The company obviously faces many of the industry specific risks that other REITs face (such as general economic and real estate market risks), but this is why we own EGP as only one part of our diversified long-term portfolio. Most importantly, relative to other REIT options, we believe EastGroup Properties provides a very attractive risk-reward tradeoff. We rate EGP a BUY, and we own shares of the stock.

First American Financial (FAF) – Thesis

First American Financial (FAF)

Rating: BUY

Current Price: $35 per share.

Target Price: $53 per share.

Thesis:

First American Financial (FAF) issues title insurance for commercial and residential properties and issues specialty insurance for residential homeowners and renters. FAF is a small mid-sized company ($3.9 billion market cap) and the business is healthy and growing. The stock is undervalued on a variety of traditional metrics, and its above average dividend has the potential for continued increases. We rate First American Financial a “BUY” and have a price target of $53 per share giving the stock more than 50% upside versus its current price.

About FAF:

First American Financial has been a leader in title insurance for over 125 years, and currently has a 27.6% market share in the US (FAF is #2 in US market share behind #1 Fidelity National Financial (FNF)). FAF offers its products and services directly and through its agents and partners throughout the United States and in more than 60 countries. In June 2010 First American Corporation split into two companies, First American Financial (FAF) and CoreLogic (CLGX) which is a provider of property information, analytics and data-enabled services. FAF’s market share is split between agent and direct sales.

FAF’s Competitive Advantage:

First American Financial’s main competitive advantage is that is has aggregated unique sets of data that are compelling to customers. Specifically, FAF claims to have the #1 property information database, they believe they are #1 in title plants, and #1 in land recovery documents. And having the most comprehensive data is critical in the title search business because it enables better underwriting and reduces costly claims (lenders demand “defect free” mortgages). As an example, FAF’s DataTree.com is compelling to customers because if conveniently offers more comprehensive data, highly valuable “FlexSearch” options and valuable analytics. And unlike other companies, FAF is exclusively focused on real estate finance, the company has a highly experienced team and they’ve built widely expansive customer relationships in key markets.

Why is FAF's dividend above average?

First American Financial currently offers a 2.79% dividend yield (this is higher than the S&P 500 dividend yield which is currently just above 2%). FAF is able to pay a strong dividend because it generates lots of steady free cash flow.

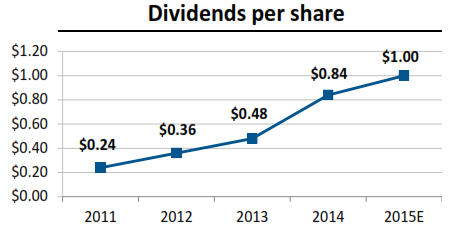

FAF has been able to increase its dividend significantly in recent years as shown in the following chart:

And as a percent of net income, the dividend payout ratio is sustainable, and there is room to continue to increase the dividend in the future:

Source: FAF

What is FAF Worth?

First American Financial is currently undervalued based on a variety of traditional valuation metrics. For starters, the company’s price to earnings ratio is only 13.5 which is low compared to the S&P 500 (which is almost 22), and it’s low compared to the financial sector (for example, the iShares Dow Jones US Financial ETF PE ratio is 14.75).

FAF’s PEG ratio (price/earnings/growth) is only 1.24 which very compelling because it suggests the stock is cheap for the amount of growth that is expected. The average PEG ratio for FAF’s industry and sector are 2.92 and 2.54, respectively, suggesting FAF is offering an attractive price. According to the nine professional analysts covering the stock (as listed on Yahoo Finance http://finance.yahoo.com/q/ae?s=FAF+Analyst+Estimates ) the company is expected to grow its earnings at an average annual rate of 11.3% over the next five years (and this rate is higher than the S&P 500 for example). The PEG ratio suggests FAF is attractively priced given its expected growth.

A basic discounted cash flow model suggests FAF is undervalued and that its stock should be trading at a significantly higher price. For example, assuming FAF generates $300 million of free cash flow in 2015 (they’ve already generated $260 million through the first nine months), a 7.2% weighted average cost of capital (WACC), and 0% growth rate, then FAF should be trading at around $38 per share (it currently trades at around only $35 per share). However, the company is expected to growth at a faster rate as we mentioned above (and as we’ll discuss more below). If we assume the company’s long-term growth rate is 2% per year, then the stock should be trading around $53 per share. This suggests the stock has over 50% upside. This is significant.

Why is now a good time to buy FAF?

For starters, management believes mortgage originations we’re at a low point in 2015, and they expect growth in 2015 and beyond (investor presentation, p.4). For reference, the following chart shows recent origination data.

An increase in originations suggest an increase in FAF business which should add to the company’s bottom line. Additionally, revenues (and earnings) should increase over time simply through ordinary long-term economic expansion.

Another reason to buy now is because the price has declined over the last several month providing some margin of safety. The price has declined because the company missed earnings expectations by 6 cents per share on October 22nd due to weakness in FAF’s specialty insurance business because of claim losses due to California wildfires. However, the company improved during the quarter in other categories across the board including overall revenue increases, improved margins in title insurance and average revenue per order, for example. Additionally, the company’s overall valuation (as described previously) is attractive.

What are the Risks?

First American Financial faces a variety of risks that could negatively affect its business. For example, higher payouts in its specialty insurance business (as described above with California wildfires) can negatively impact earnings. There is always uncertainly with future claims payouts. All the underwriting sophistication in the world still cannot predict the future. Fortunately for FAF, specialty insurance is only a small percent (usually less than 10%) of the company’s overall business.

Regulations are another significant risk. In its annual report, FAF explains that changes in government regulation could prohibit or limit the Company’s operations, make it more burdensome to conduct such operations or result in decreased demand for the Company’s products and services. For example, new TILA-RESPA disclosure laws released in October will impact the way FAF does business.

Another risk is simply the overall conditions in the real estate market. These conditions generally impact the demand for a substantial portion of FAF’s products and services and its claims experience. As discussed previously, mortgage origination activity can have a very significant impact on the company. As mentioned previously, FAF management believes we’re at or near a low-point in originations, and there is more origination activity and transactions expected going forward.

Conclusion:

First American Financial is underpriced and offers significant upside price appreciation. The stock also offers an attractive dividend payout ratio with the potential to grow. We believe activity in the mortgage origination market is closer to the lower end of the cycle, and this gives FAF more upside than down in this regard. We also believe the company offers competitive advantages (mainly its expansive easy-to-use data). Additionally, we believe the recent decline in stock price (due to a short-term 6 cent miss at its last earnings announcement) provides some margin of safety. We rate First American Financial (FAF) a BUY.