This week we review how recent market declines have created some very attractive dividend yields, especially for our favorite healthcare REIT (and no, it’s not Omega!). We also provide a review of our favorite industrials stock which happens to be offering an extremely attractive dividend yield right now. Additionally, one of our holdings announces earnings this upcoming week, with many more announcing the week after that. We share our view on how we expect this earnings season to impact the sharp decline in stocks we’ve experienced so far this year.

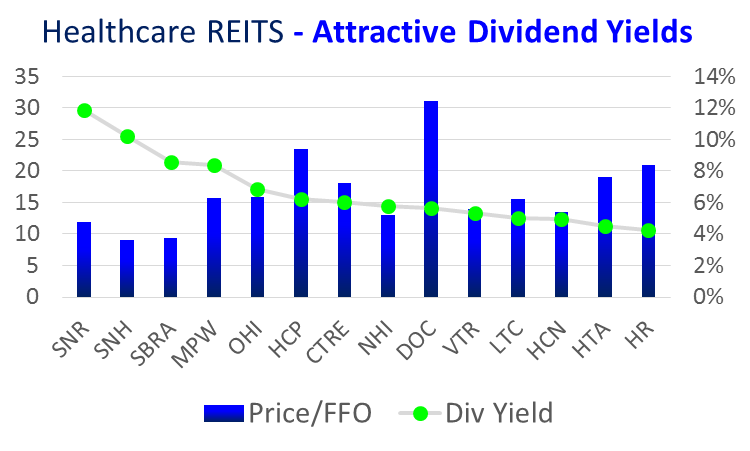

Our most recent stock of the week was Omega Healthcare Investors (OHI). We believe this stock presents tremendous value (albeit with more risk due to potential future healthcare law changes). However, because we’re not entirely comfortable with the high stock-specific risk of Omega, our favorite healthcare REIT is Welltower (HCN).

Welltower is safer (it has more diversified exposure to healthcare real estate), it is has more potential for dividend increases (it currently pays out a much lower portion of its FFO), it’s debt ratios are lower, its Price/FFO valuation is more attractive, it has declined sharply in the last year (creating a margin of safety for buyers), and we can sleep better at night knowing its future is not tied entirely to the healthcare law decisions made by our legislative and executive branches. Plus Welltower currently offers a 5% dividend yield which is absolutely fantastic considering its relative long-term safety.

We don’t currently own shares of Welltower because we already own a different REIT (EastGroup Properties, which is an industrial REIT, you can read our thesis here), and we don’t want to overweight REITs too heavily. We also have exposure to REITs through several of our index funds (the Russell 2000 Value and Russell 1000 Value funds, in particular).

Our favorite Industrials stock is Caterpillar. And based on recent market declines, it is currently yielding over 5.1%. This is a truly amazing yield for an industrial company like Caterpillar, and we do NOT expect this yield to get cut. Caterpillar’s business is highly cyclical, and when it does turn around and rebound, it will do so rapidly and dramatically. You can read our full Caterpillar thesis here. Additionally, Caterpillar announces earnings this week.

As earnings announcement ramp up this week, it will set the tone for the overall market. Our expectation is that the media pundits will pick and choose parts of various company earnings announcements to support the narrative that the market is NOT on stable ground. We’ll likely hear how large cap stocks with international exposure to emerging markets continue to face headwinds as those international markets slow. We’ll also hear media pundits proclaim the fed raised rates too soon (we don’t think so). Our expectation is that volatility will remain high, and we won’t make up all of the value we’ve lost so far in 2016 until later in the year. After this upcoming week, we have a longer list of Blue Harbinger stocks that will announce earnings.

Our advice to any long-term investors this week is don’t do anything rash. If you have a little money that you’d like to put to work, consider purchasing attractively valued stocks like Caterpillar. And if you’re already fully invested, do NOT take any money off the table. All the advertisers and Wall Street banks will be trying to scare you into making a lot of trades (because they make money when you trade). But don’t do it because you’ll end up being out of the market and the worst possible time (the market is humbling, and it will rally big when you least expect it). We have no plans to make any changes to our investment strategy or our investment portfolio this week. Long-term investing is a proven winning strategy.