This chart shows the returns on the 10 stocks and 3 ETFs we purchased in our Income Equity strategy on January 8th of this year (the names are reserved for members-only). The only other trades we've done this year in the Income Equity strategy were on May 6th when we purchased 6 additional stocks which have also performed very well. This week’s Weekly provides our view on when to take profits versus when to let your winners run!

Blue Harbinger "Income Equity" Strategy

In this installment of our members-only Blue Harbinger Weekly, we review an exciting upgrade to our members-only area that is coming soon. Specifically, we discuss the soon to be released Blue Harbinger “Income Equity” strategy. This new strategy will be available to all existing Blue Harbinger subscribers. We also review one of the holdings within the new strategy that should benefit greatly from where we are in the current mortgage origination cycle.

First American Financial (FAF) – Thesis

First American Financial (FAF)

Rating: BUY

Current Price: $35 per share.

Target Price: $53 per share.

Thesis:

First American Financial (FAF) issues title insurance for commercial and residential properties and issues specialty insurance for residential homeowners and renters. FAF is a small mid-sized company ($3.9 billion market cap) and the business is healthy and growing. The stock is undervalued on a variety of traditional metrics, and its above average dividend has the potential for continued increases. We rate First American Financial a “BUY” and have a price target of $53 per share giving the stock more than 50% upside versus its current price.

About FAF:

First American Financial has been a leader in title insurance for over 125 years, and currently has a 27.6% market share in the US (FAF is #2 in US market share behind #1 Fidelity National Financial (FNF)). FAF offers its products and services directly and through its agents and partners throughout the United States and in more than 60 countries. In June 2010 First American Corporation split into two companies, First American Financial (FAF) and CoreLogic (CLGX) which is a provider of property information, analytics and data-enabled services. FAF’s market share is split between agent and direct sales.

FAF’s Competitive Advantage:

First American Financial’s main competitive advantage is that is has aggregated unique sets of data that are compelling to customers. Specifically, FAF claims to have the #1 property information database, they believe they are #1 in title plants, and #1 in land recovery documents. And having the most comprehensive data is critical in the title search business because it enables better underwriting and reduces costly claims (lenders demand “defect free” mortgages). As an example, FAF’s DataTree.com is compelling to customers because if conveniently offers more comprehensive data, highly valuable “FlexSearch” options and valuable analytics. And unlike other companies, FAF is exclusively focused on real estate finance, the company has a highly experienced team and they’ve built widely expansive customer relationships in key markets.

Why is FAF's dividend above average?

First American Financial currently offers a 2.79% dividend yield (this is higher than the S&P 500 dividend yield which is currently just above 2%). FAF is able to pay a strong dividend because it generates lots of steady free cash flow.

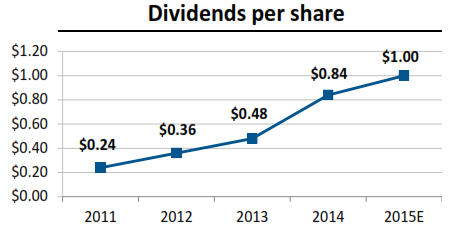

FAF has been able to increase its dividend significantly in recent years as shown in the following chart:

And as a percent of net income, the dividend payout ratio is sustainable, and there is room to continue to increase the dividend in the future:

Source: FAF

What is FAF Worth?

First American Financial is currently undervalued based on a variety of traditional valuation metrics. For starters, the company’s price to earnings ratio is only 13.5 which is low compared to the S&P 500 (which is almost 22), and it’s low compared to the financial sector (for example, the iShares Dow Jones US Financial ETF PE ratio is 14.75).

FAF’s PEG ratio (price/earnings/growth) is only 1.24 which very compelling because it suggests the stock is cheap for the amount of growth that is expected. The average PEG ratio for FAF’s industry and sector are 2.92 and 2.54, respectively, suggesting FAF is offering an attractive price. According to the nine professional analysts covering the stock (as listed on Yahoo Finance http://finance.yahoo.com/q/ae?s=FAF+Analyst+Estimates ) the company is expected to grow its earnings at an average annual rate of 11.3% over the next five years (and this rate is higher than the S&P 500 for example). The PEG ratio suggests FAF is attractively priced given its expected growth.

A basic discounted cash flow model suggests FAF is undervalued and that its stock should be trading at a significantly higher price. For example, assuming FAF generates $300 million of free cash flow in 2015 (they’ve already generated $260 million through the first nine months), a 7.2% weighted average cost of capital (WACC), and 0% growth rate, then FAF should be trading at around $38 per share (it currently trades at around only $35 per share). However, the company is expected to growth at a faster rate as we mentioned above (and as we’ll discuss more below). If we assume the company’s long-term growth rate is 2% per year, then the stock should be trading around $53 per share. This suggests the stock has over 50% upside. This is significant.

Why is now a good time to buy FAF?

For starters, management believes mortgage originations we’re at a low point in 2015, and they expect growth in 2015 and beyond (investor presentation, p.4). For reference, the following chart shows recent origination data.

An increase in originations suggest an increase in FAF business which should add to the company’s bottom line. Additionally, revenues (and earnings) should increase over time simply through ordinary long-term economic expansion.

Another reason to buy now is because the price has declined over the last several month providing some margin of safety. The price has declined because the company missed earnings expectations by 6 cents per share on October 22nd due to weakness in FAF’s specialty insurance business because of claim losses due to California wildfires. However, the company improved during the quarter in other categories across the board including overall revenue increases, improved margins in title insurance and average revenue per order, for example. Additionally, the company’s overall valuation (as described previously) is attractive.

What are the Risks?

First American Financial faces a variety of risks that could negatively affect its business. For example, higher payouts in its specialty insurance business (as described above with California wildfires) can negatively impact earnings. There is always uncertainly with future claims payouts. All the underwriting sophistication in the world still cannot predict the future. Fortunately for FAF, specialty insurance is only a small percent (usually less than 10%) of the company’s overall business.

Regulations are another significant risk. In its annual report, FAF explains that changes in government regulation could prohibit or limit the Company’s operations, make it more burdensome to conduct such operations or result in decreased demand for the Company’s products and services. For example, new TILA-RESPA disclosure laws released in October will impact the way FAF does business.

Another risk is simply the overall conditions in the real estate market. These conditions generally impact the demand for a substantial portion of FAF’s products and services and its claims experience. As discussed previously, mortgage origination activity can have a very significant impact on the company. As mentioned previously, FAF management believes we’re at or near a low-point in originations, and there is more origination activity and transactions expected going forward.

Conclusion:

First American Financial is underpriced and offers significant upside price appreciation. The stock also offers an attractive dividend payout ratio with the potential to grow. We believe activity in the mortgage origination market is closer to the lower end of the cycle, and this gives FAF more upside than down in this regard. We also believe the company offers competitive advantages (mainly its expansive easy-to-use data). Additionally, we believe the recent decline in stock price (due to a short-term 6 cent miss at its last earnings announcement) provides some margin of safety. We rate First American Financial (FAF) a BUY.