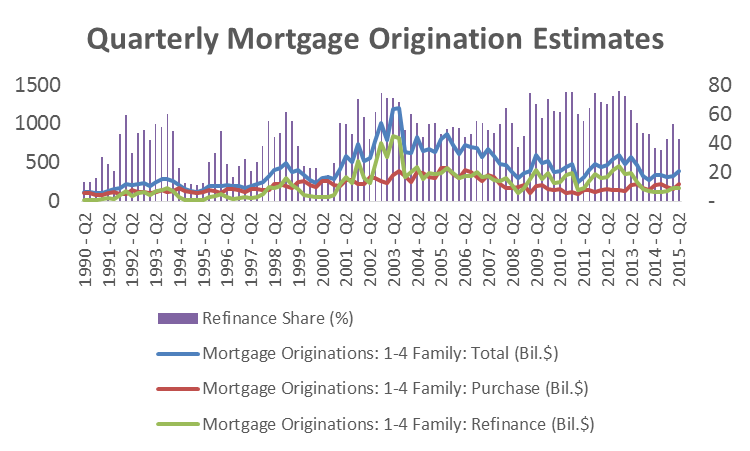

In this installment of our members-only Blue Harbinger Weekly, we review an exciting upgrade to our members-only area that is coming soon. Specifically, we discuss the soon to be released Blue Harbinger “Income Equity” strategy. This new strategy will be available to all existing Blue Harbinger subscribers. We also review one of the holdings within the new strategy that should benefit greatly from where we are in the current mortgage origination cycle.

Coming Soon: Blue Harbinger INCOME EQUITY Strategy:

We’ve been working diligently to meet customer demand for a more heavily focused value investor strategy, and we expect to release our new “Income Equity” strategy within the next few weeks. This strategy (and all the details on the stocks it holds) will be available to all subscribers. You don’t need to sign up for anything additional (your current subscription covers it) and you’ll soon see a new drop down menu option to access it. The strategy will be focused on value stocks with above average dividends. Without further ado, here is one stock that will be included within the new strategy...

First American Financial (FAF)

Rating: BUY

Current Price: $35 per share.

Target Price: $53 per share.

Thesis:

First American Financial (FAF) issues title insurance for commercial and residential properties and issues specialty insurance for residential homeowners and renters. FAF is a small mid-sized company ($3.9 billion market cap) and the business is healthy and growing. The stock is undervalued on a variety of traditional metrics, and its above average dividend has the potential for continued increases. We rate First American Financial a “BUY” and have a price target of $53 per share giving the stock more than 50% upside versus its current price.