In case you have been living under a rock, the stock market is down big, thanks (in large part) to turmoil caused by President Trump's new tariffs. Without arguing the pros and cons of these draconian tariffs, it has most certainly created a lot of fear. And fear creates opportunity. Like every other market crisis, we believe this too shall pass. But before it does, investors may want to take advantage of the attractive "buy low" sales prices it has created (in select big yield opportunities). This report ranks our top 7 big-yield investment opportunities (currently on sale) starting with #7 and counting down to our very top ideas.

So without further ado, let's get into it...

7. Capital Southwest (CSWC),Yield: 13.6%

CSWC is a big-yield (double-digit) middle-market lending firm (it’s a BDC) focused on supporting the acquisition and growth of middle-market companies across the capital structure. Based in Dallas and with only 33 employees, it's internally managed (this is important) and it has total balance sheet assets of around $1.8 billion.

Importantly, Capital Southwest has a strong history of creating value for investors through both a healthy net asset value and strong, growing dividend payments.

CSWC also has an investment-grade credit rating (Baa3 from Moody's and BBB- from Fitch) which is better than the companies it lends to, but also a benefit of being a diversified BDC with a strong balance sheet (and loans heavily tilted towards first lien, safer, at 98%).

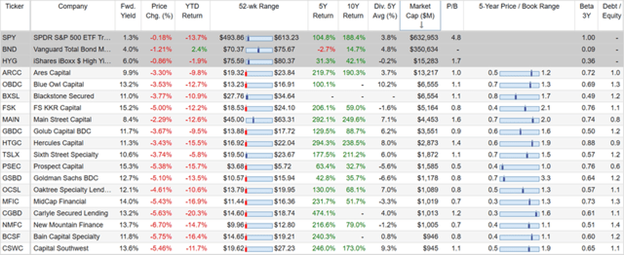

From a valuation standpoint, the shares are down over the last month (as investors react to net valuation write-downs of $0.54 cents per share to the debt portfolio, as several of its 118 portfolio companies were moved to tier 3 and 4 ratings, despite steady new deal flow continuing), and the shares now trade at only 1.1x book value, which is low by historical standards for this healthy internally managed BDC (see historical book value range in our earlier table).

If you have been waiting for a pullback in share price and price-to-book-value (“NAV”) for this healthy, long-term BDC, the recent market price declines provide you with some additional margin of safety.

6. Reaves Utility Income (UTG), Yield: 7.6%

The Reaves Utility Income Trust (UTG) is a special, utility sector focused, closed-end fund (“CEF”) offering big, tax-advantaged, monthly income (7.6% yield) and unique exposure to the AI datacenter megatrend, which has just pulled back and thereby offers some compelling price appreciation potential (not to mention it also trades at a small but attractive discount to net asset value (“NAV”)). This report reviews the fund’s strategy, holdings, distribution safety, valuation (and megatrend exposure) and risks, and then concludes with our strong opinion on investing.

5. AGNC Investment (AGNC), Yield: 16.0%

To be clear, mortgage REITs (such as AGNC) are very different than property REITs. Specifically, where property REITs own mainly physical real estate properties, mREITs own real estate securities (such as those issued by US federal government agencies to fund home ownership).

Mortgage REITs generally offer higher yields than property REITs, but they also come with unique risks (such as higher leverage, or borrowed money).

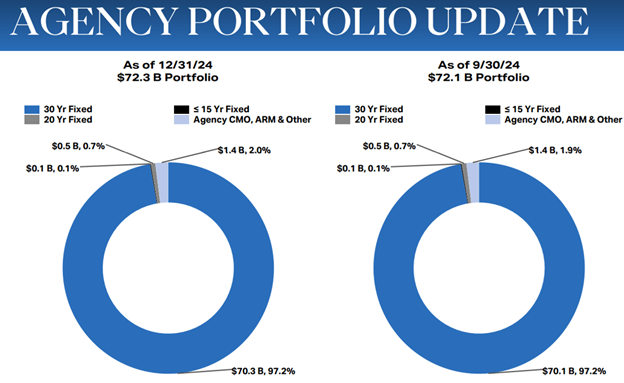

In the case of AGNC, this mortgage REIT invests mainly in Agency Mortgage Backed Securities, which are considered particularly safe (they’re guaranteed by US government-sponsored agencies). However, AGNC uses significant leverage (recently 7.2x) to magnify the otherwise low returns on these securities, which also magnifies the risks (particularly when interest rates get choppy or when credit spreads widen).

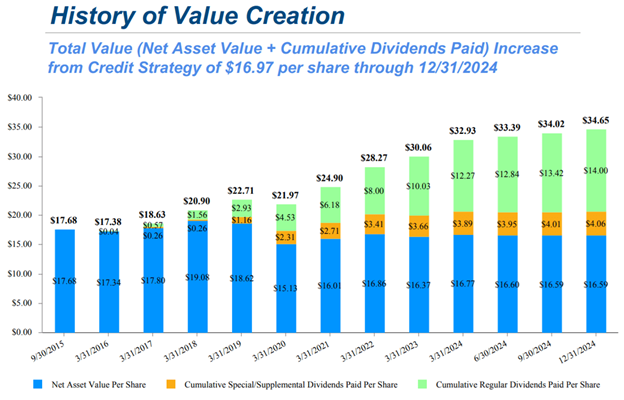

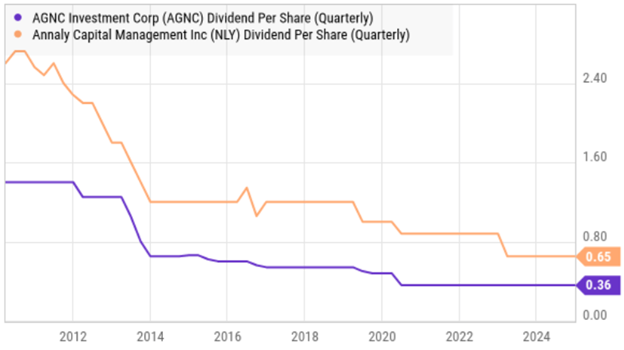

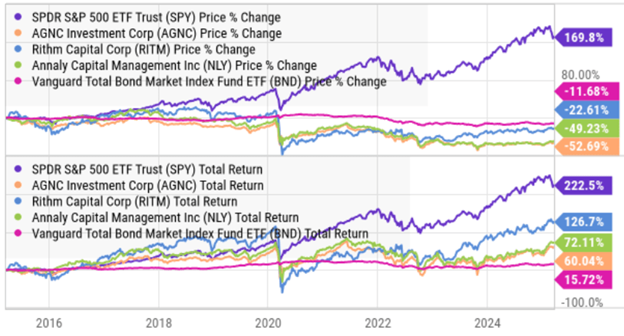

As you can see in our earlier tables, AGNC (and other mREITs) offer attractive double-digit yields, but they also have a history of declining prices and dividend cuts over time.

So if you're going to invest in mREITs, be aware of the dividend and price dynamics (which are totally fine to some investors who just want the outsized dividends, despite the potential for declines over time), whereas others are turned off by the price declines and relatively lower long-term total returns.

A lot depends, of course, on market conditions and valuations (such as price-to-book values, which are currently attractive - sub-1.0x multiples - following the latest market "flash crash").

4. PIMCO Dynamic Income Opportunities (PDO), Yield: 12.5%

When it comes to closed-end funds, PIMCO is the premier industry leader, and its Dynamic Income Opportunities Fund stands out right now for big, steady, well-covered, monthly income and its negligible price premium (0.7%) for a top PIMCO fund.

In addition to its very attractive monthly income payments, this fund also has risks investors should consider (such as leverage, expenses, price volatility, interest rate risks and the potential for ongoing returns of capital, as we recently wrote about in great detail here).

But at the end of the day, if you're looking for a big steady income, PDO is absolutely worth considering.

3. Main Street Capital (MAIN), Yield: 8.2%

Main Street is legendary in the Business Development Company (“BDC”) space for its internal management team (eliminates a lot of conflicts of interest), steady NAV growth over time, and very strong history of steady growing big dividend payments, plus additional occasional special dividends (extra) too. Main Street sold of hard following the tariff announcement as its exposure to higher-yielding loans sold off in lock-step (knee jerk) with widening credit spreads (as described earlier). Main Street has been through challenging markets before, and has a strong history of coming out stronger. Normally, Main Steet trades at one of the highest price-to-book value multiples in the BDC space (because of its strong history of growing NAV), but the recent post-tariff-announcement selloff has increased the attractiveness, now trading at just under 1.6x book value (attractive for Main Street Capital). If you are an income-focused investor, this BDC is absolutely worth considering.

2. Ares Capital (ARCC): 9.7% Yield

Ares Capital offers a big 9.7% dividend yield, and the shares just sold off sharply (and the price-to-book valuation has come down to approximately 1.0x or par—a good thing).

Ares basically makes loans to private companies, and the Trump trade war threatens this business because an economic slowdown increases the chances that the private companies Ares lends to won’t be able to pay back the loans. For example, credit spreads (or the difference in interest rates between safe loans, such as treasuries, and riskier high-yield loans, such as the ones Ares makes) just widened significantly. However, as a general rule, this makes Ares a more attractive investment opportunity because widening spreads have caused the valuation and price to fall (buy low) as long as you don’t think the sky is falling (i.e. as long as the Trump tariffs don’t completely destroy the economy—which we are banking on “they will not”). Said differently, the sell off in Ares just created a more attractive opportunity to pick up shares of this big-yield BDC (if you are into big yields).

1. PIMCO Access Income (PAXS), Yield: 12.3%

Another very attractive big-yield bond fund (PIMCO is the premier, best-in-class leader in this space) that was doing great all year, but sold off hard after “Liberation Day” because of its exposure to some riskier high-yield bonds (credit spreads just widened) and the threat of slower interest rates from the Fed (which truthfully seem unlikely—the rate cuts are coming). PAXS is newer than other big-yield PIMCO bond funds and has less legacy derivatives baggage left over from the fed’s post-pandemic interest rate hike frenzy. Trading at only a 2% discount to NAV (extremely attractive for PIMCO), and offering a compelling 12.3% yield (paid monthly) this one is compelling if you are a high-income focused investor.

The Bottom Line

If you like big steady income, and you are looking to take advantage of the current market turmoil, the big yield opportunities in this report are particularly attractive right now.

Of course there will be more volatility, but focusing on big yields can help you sleep better at night.

At the end of the day, you need to do what is right for you. And if you are a disciplined, long-term, income-focused investor, the big yields in this report are attractive and absolutely worth considering.