The Reaves Utility Income Trust (UTG) is a special, utility sector focused, closed-end fund (“CEF”) offering big, tax-advantaged, monthly income (7.6% yield) and unique exposure to the AI datacenter megatrend, which has just pulled back and thereby offers some compelling price appreciation potential (not to mention it also trades at a small but attractive discount to net asset value (“NAV”)). This report reviews the fund’s strategy, holdings, distribution safety, valuation (and megatrend exposure) and risks, and then concludes with our strong opinion on investing.

Overview:

With an inception date in 2004, and according to the fund’s website, the objective of UTG is (emphasis ours):

“to provide a high level of after-tax income and total return consisting primarily of tax-advantaged dividend income and capital appreciation. The Fund pursues this objective by investing at least 80% of its total assets in dividend-paying common and preferred stocks and debt instruments of companies within the utility industry. Up to 20% of the Fund may be invested in the securities of companies in other industries.”

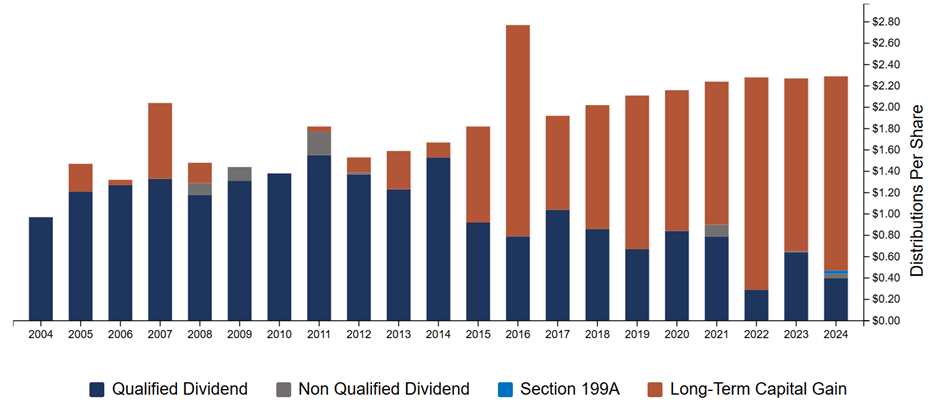

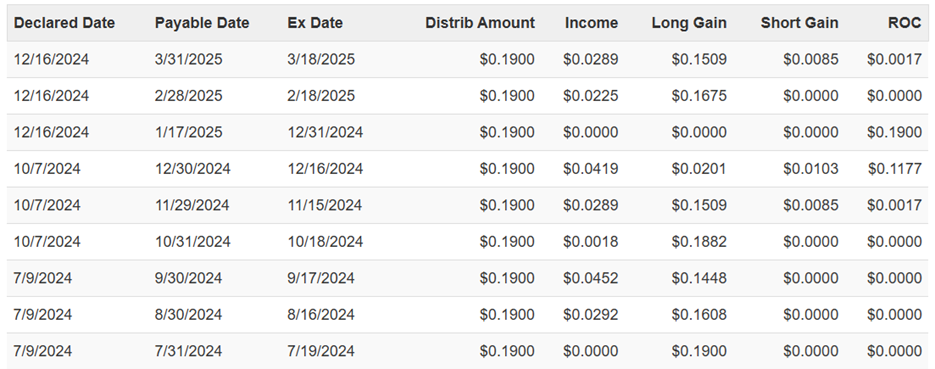

And as you can see in the chart above, UTG has accomplished this objective by delivering steady growing monthly income distributions (“dividends”) to investors through a combination of long-term capital gains (taxed at the lower long-term capital gains tax rate, depending on your personal tax situation) and qualified dividends from its recently 59 underlying holdings (qualified dividends are also eligible for the lower qualified dividend tax rate, unlike some other CEF distributions, and depending on your personal tax situation—such as what is your income tax rate, and do you hold the shares in a taxable account or in a tax-advantaged individual retirement account).

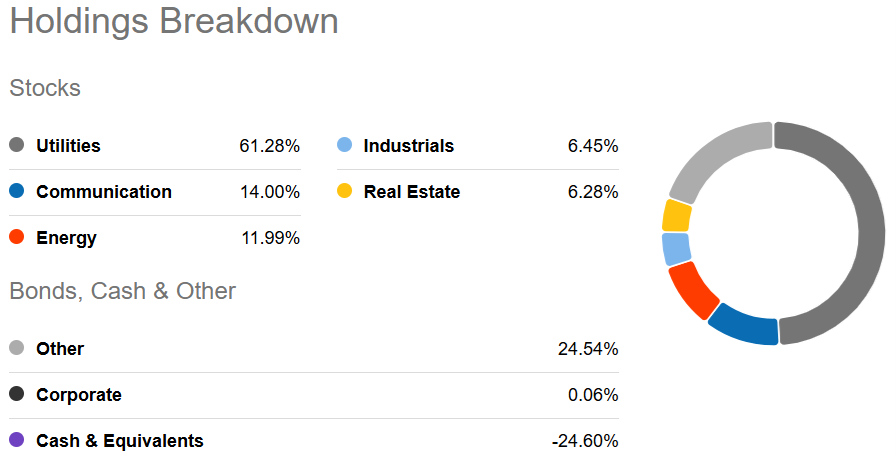

As mentioned above, at least 80% of UTG’s total assets must be invested in dividend-paying common and preferred stocks and debt instruments of companies within the utility industry. Here is a look at the current holdings breakdown (as per UTG’s most recent quarterly fact sheet).

Specifically, the fund had 60.6% of its holdings in the Utilities “industry.” This may seem to violate the 80% utility industry rule mentioned above, but per a previous voice message we received from the company:

"Hey,... calling from Reaves Asset Management, we're the advisor of the Reaves Utility Income Fund. Appreciated your question on utility allocations... We use a utility definition that is a little looser for the bulk of the assets as described in the prospectus."

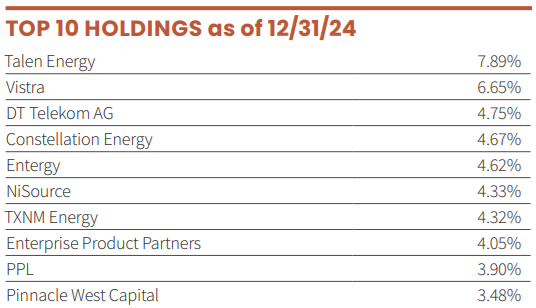

For more color, you can see the fund’s recent top 10 holding below (many of which have attractive exposure to the AI/datacenter megatrend--more on this later).

Also, for more perspective, here is a look at the fund’s recent holdings breakdown across stocks, bonds and cash.

You’ll note in the graphic above, cash is negative, indicating leverage (or borrowed money) a topic we will cover more later in this report.

7 Big-Yield CEF Questions to Always Ask

Before investing in any big-yield CEF, here is a list of seven specific questions you may always want to ask yourself.

Does UTG Match Your Investment Goals:

Every investor is unique, with their own individual goals and situation. UTG can help a lot of investors achieve their goals if the fund’s objectives (i.e. to provide a high level of after-tax income and total return consisting primarily of tax-advantaged dividend income and capital appreciation) matches their personal situation.

For example, if you like big steady monthly income payments, you might consider owning some UTG.

However, it’s important to consider the fund’s specific holdings and megatrend exposure. For instance, in UTG’s case:

Utility Sector: Traditionally, the utilities sector is known for relatively low price volatility and relatively high dividend income. This is because utilities companies (such as the electric company that allows you to keep the lights on) is a steady business (even when the economy gets bad—people still need electricity to keep the lights on, charge their devices, etc.). So in this sense, UTG is a steady business, and that is further supported by the fund’s relatively low 3-year beta of 0.59 (beta is a measure of market risk exposure, whereby the S&P 500, for example, is the baseline with a beta of 1.0, and anything below 1.0 is considered less volatile as compared to the rest of the market, per se).

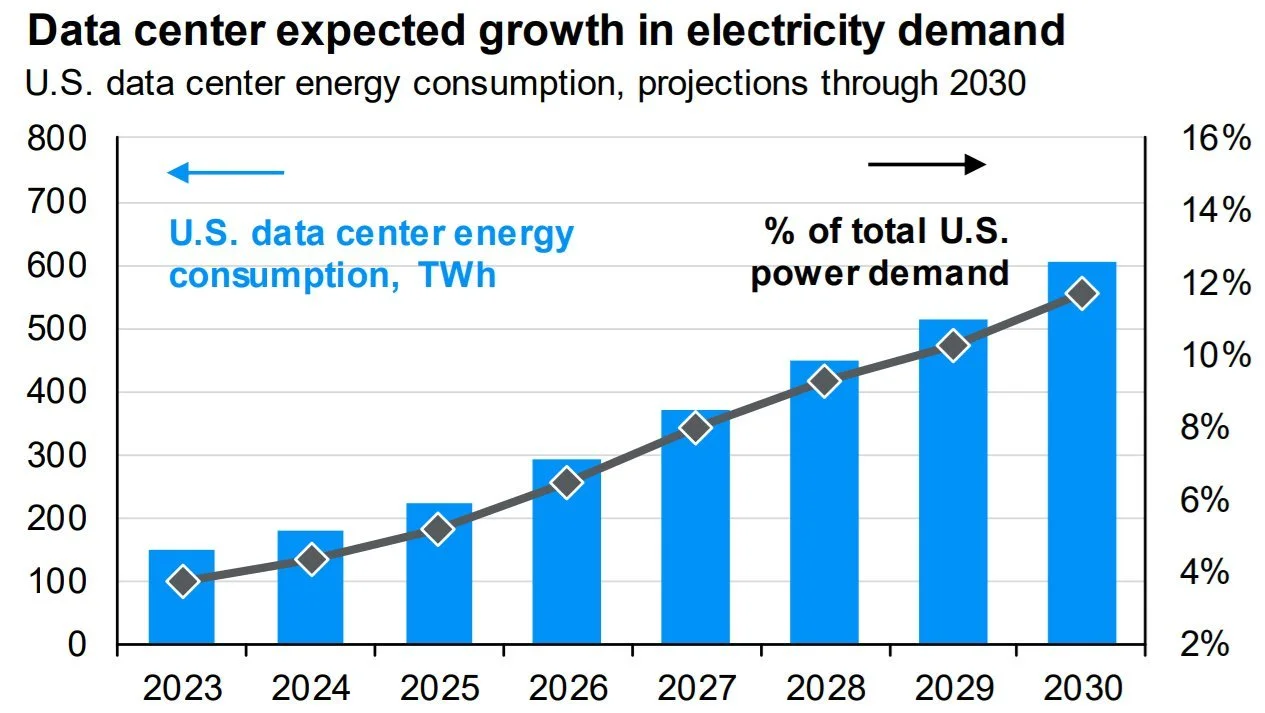

AI/Datacenter Megatrend: Investors is UTG should also be aware of the fund’s exposure to the AI megatrend through datacenter electricity demand. Specifically, the utilities sector is expected to grow significantly over the next decade (a good thing) because of the increasing demand for electricity needed to power AI which is run through offsite cloud-based data centers. To give you an idea of just how large this growing demand is, the following chart suggests datacenter electricity demand (as a percent of total US electricity demand) will grow from around 5% to around 12% over the next decade. This is huge, and good for UTG considering it owns names like Talen, Vistra and NiSource (see our earlier top 10 holdings chart).

Distribution Safety:

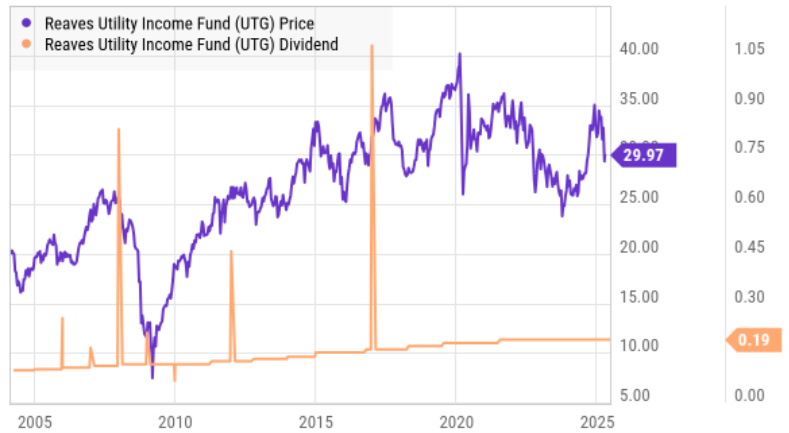

Investors can get a feel for the safety of UTG’s distribution, first by recognizing its consistency (and growth) since the fund’s 2004 inception (see our earlier distribution history chart).

Second, the table below shows the majority of the distribution is from income (received from the funds underlying holdings) and capital gains (again on the fund’s underlying holdings) and includes only a small amount of ROC (return of capital) recently, which is basically when the fund returns some of an investor’s investment dollar just to maintain the distribution (which is totally fine, from time to time, as long as it is not excessive—which it has not been).

Further still, you can see the ongoing dividend growth of the fund’s underlying holdings, using this link, which shows, on average, the underlying holdings increased their dividend payouts by over 10% last year—a good thing!).

Price Discount to NAV

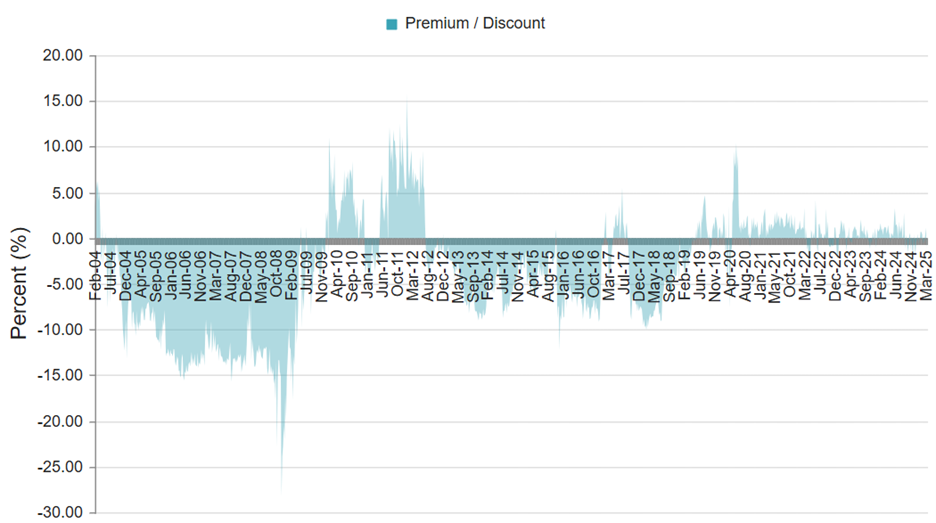

Unlike traditional mutual funds and exchange trade funds, CEFs can trade at large premiums and/or discounts to the aggregate value of their underlying holdings (because there is no immediate mechanism in place to prevent this), and as such this can create significant risks and opportunities.

All else equal, we greatly prefer to purchase attractive CEFs when they are trading at a discount to NAV, which UTG currently is (a small one of ~1.1%).

And for a little more perspective, here is a look at UTG’s share price and dividend paid over time.

As you can see above, the dividend has grown steadily over time (it now sits at $0.19 per share each month) and the price has also grown (although recent price volatility has created a more attractive buying opportunity, especially considering the ongoing utility sector megatrend related to datacenter/AI and considering the underlying holdings have continued to increase their dividends paid over time—especially including over the last year, as mentioned earlier).

Risks:

Before investing in UTG, investors should also consider the risks.

Leverage: Closed-end funds frequently use a little leverage (or borrowed money) to increase the distributions and total returns over time. This can be attractive in the good times, painful in the bad time, but potentially very good over the long term.

UTG recently had around 19.6% leverage, which is very reasonable considering the low volatility and high dividend payout of the fund (remember, utility sector stocks tend to be less volatile, and UTG’s beta is still well below 1.0, even including the leverage).

Further still, the shares have sold off recently (perhaps a bit more than they would have if there was no leverage) and while this creates some pain for existing investors, it also creates a more attractive entry point for new investors, in our opinion.

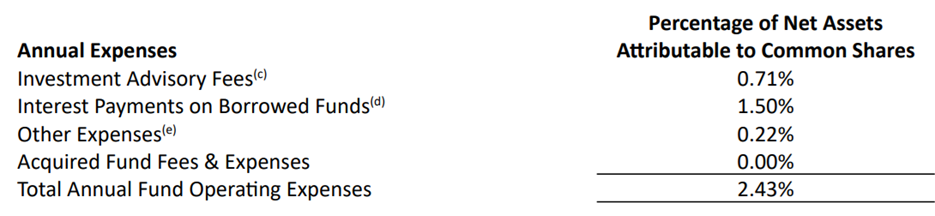

Expenses: CEF expense are a common complaint of CEF investors. For example, some investors are turned off by UTG’s recent expense ratio of ~2.43%.

Important to note, this expense ratio includes the cost of leverage and other operating expenses, plus the investment advisor’s fee. In our view, the total expense ratio of this fund is meaningful, but reasonable and acceptable considering the strategy.

The Management team is another factor (risk) for investors to consider. However, in the case of UTG, we view the management team as reasonably good stewards of capital. For example, they have a well-defined investment philosophy and disciplined investment process. And the management team has an average of 20 years of experience.

The Bottom Line

The current market selloff has pulled down the price of UTG, yet its distribution and holdings remain steady and healthy. We consider this opportunity compelling and worth considering, particularly if you are an income-focused investor. Especially considering UTG trades at a small discount to NAV (attractive), it has exposure to the AI/datacenter megatrend (electricity demand is growing) and it is significantly less exposed to market volatility (it has a low 0.59 beta) as compared to other opportunities (potentially a very good thing in the current market environment, and if you are simply at a point in life where you prefer to focus on steady income above long-term volatile price appreciation).

At the end of the day, you need to do what is right for you. And if you are a disciplined, long-term, income-focused investor, UTG is absolutely worth considering.