If you think this week’s relief rally (after Trump’s 90-day pause on tariffs) is the end of the trade war—it’s not. And it’s not the end of stock market pain either.

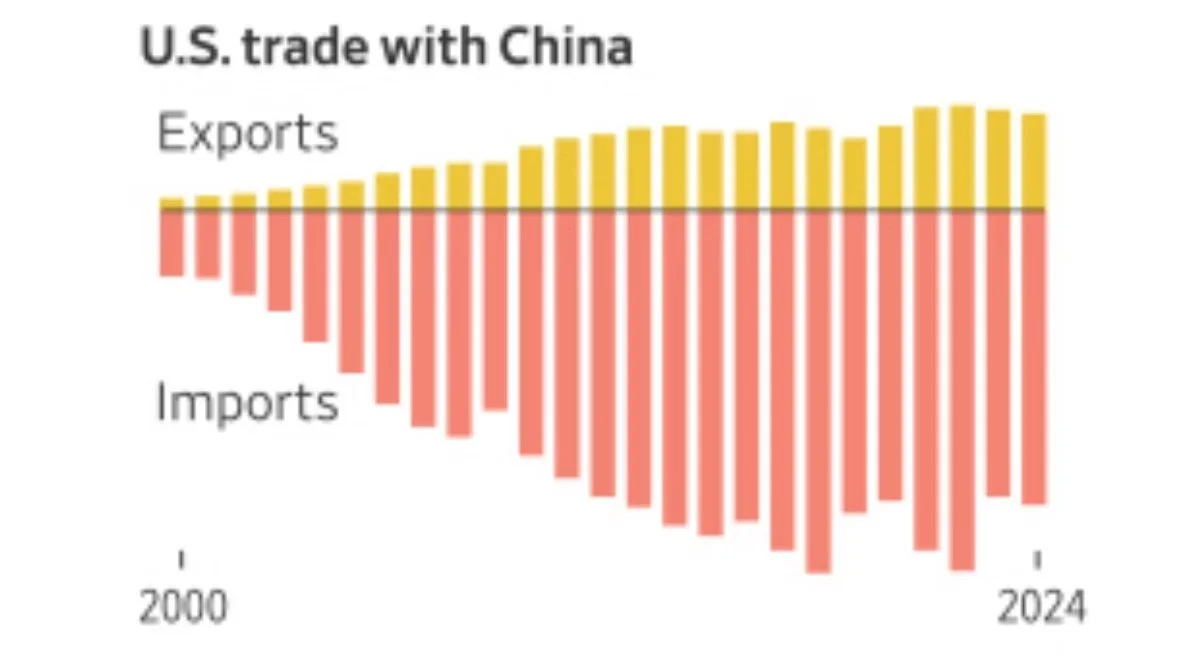

Regarding the trade war, here is another look at the US trade deficit with China. The US is importing a lot more from China than it is exporting to them.

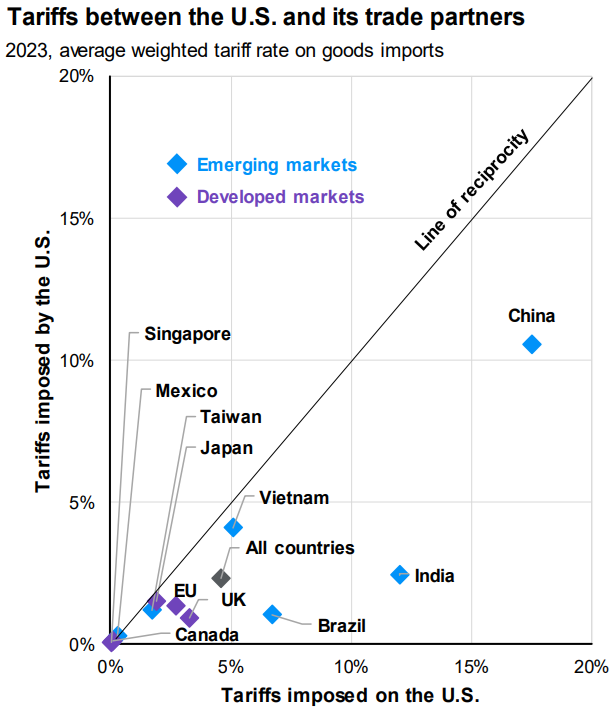

China is also the biggest trade partner with the US in terms of tariffs, and it is skewed in China’s favor, as you can see below.

This is not a problem that will be solved over night, nor will stock market volatility magically disappear—ever.

As long as there is any uncertainty in the world (and the stock market) stocks will be volatile. And it’s this volatility that scares people aways from investing and simultaneously creates attractive long-term investment opportunities for others.

Stop trying to time the short-term market volatility—even if the trade war has elevated volatility leading you to believe you can time the market—you can’t.

Build a disciplined long-term portfolio that is consistent with your goals, and then don’t sweat the day-to-day ups and downs.

Over the long-term, the US and global economies will continue to grow—and stocks will follow the economy much higher.

Long-term compound stock market growth is the eighth wonder of the world, but you screw it up when you try to time the virtually unknowable short-term moves.