As smart phone energy demands grow (especially with the proliferation of AI apps), Enovix is working to scale its disruptive battery architecture to improve efficiency and capacity. And the company’s total addressable market (“TAM”) is enormous, expanding beyond just smart phones and into wide-ranging Internet of Things (“IoT”) devices and electric vehicles. In this report we review the Enovix solution, TAM, progress, valuation and risks. We conclude with our strong opinion on investing.

Enovix (ENVX) Overview:

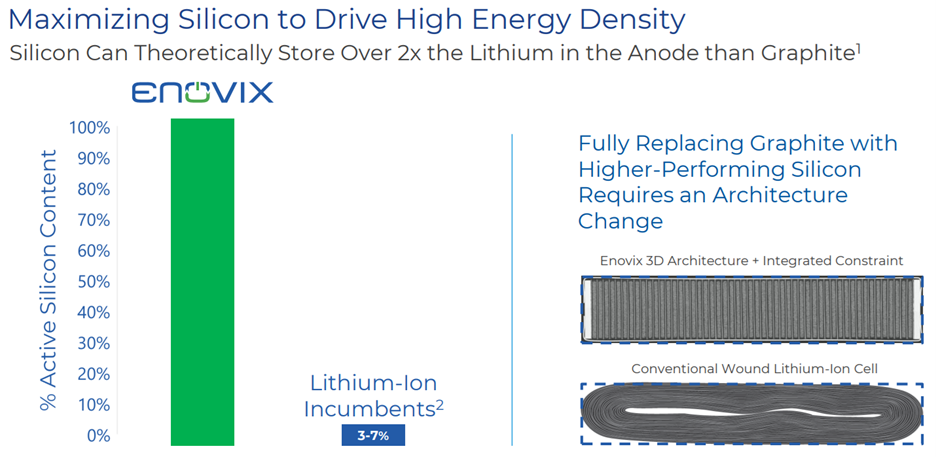

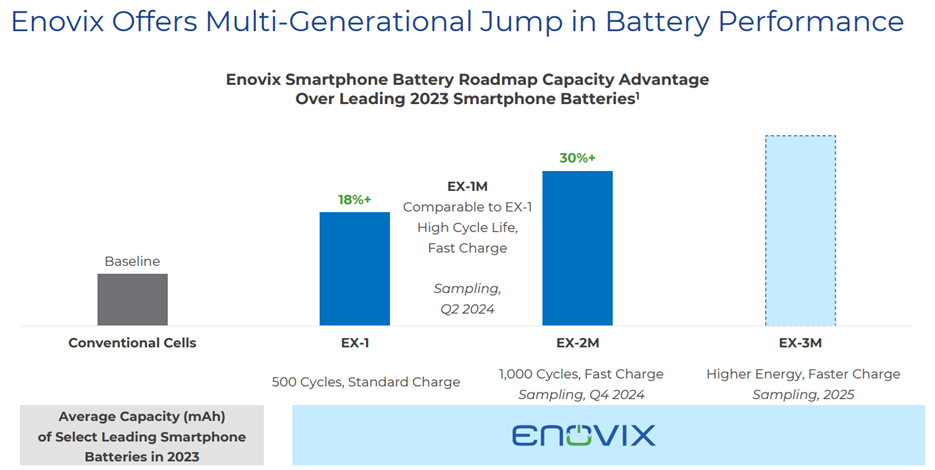

Founded in 2007, Enovix Corporation (ENVX) is engaged in designing, developing, manufacturing, and commercializing advanced Lithium-ion batteries. It has developed a proprietary three-dimensional ("3D") cell architecture that allows higher energy density, longer cycle life, and superior safety compared to conventional wound lithium-ion cell battery architectures. Enovix's unique approach involves using a 100% active Silicon Anode, which is a significant departure from the historical practice of combining only a modest amount of silicon with graphite at the anode. This approach enables the company to produce smaller, cheaper, and more efficient lithium-ion batteries at scale, making them a compelling alternative to current battery options.

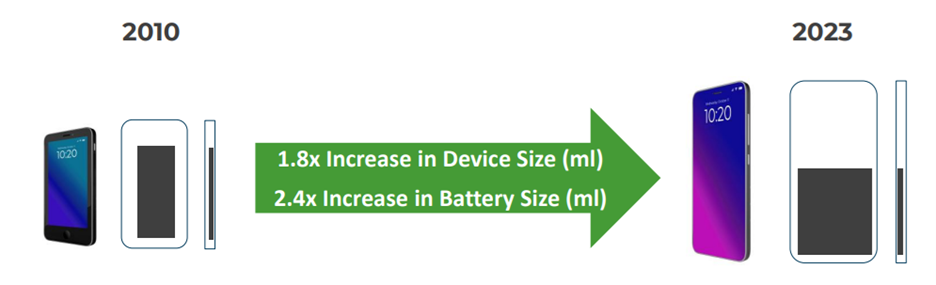

The use cases for Enovix batteries are wide ranging (we’ll get to Total Adressable Market opportunities momentarily), but the company’s battery architecture is particularly compelling with regards to smartphones.

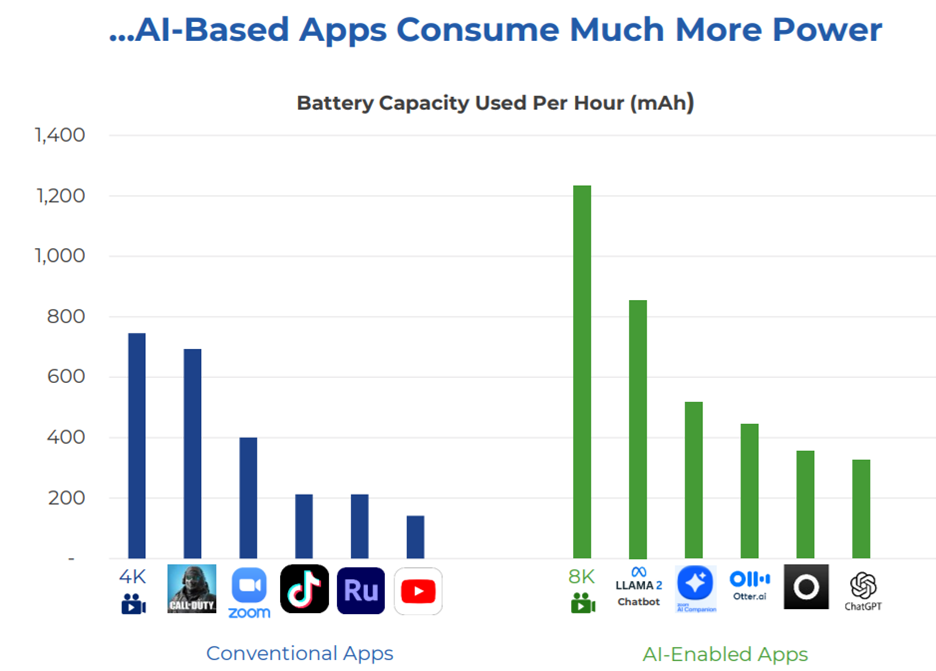

For example, one of the problems of running new Artificial Intelligence (“AI”) apps on a smartphone is it drains battery life rapidly.

This makes the Enovix solution increasingly compelling in the marketplace (as the demands placed on smartphones increases, so does the need for better battery solutions).

And worth mentioning here, Enovix’s product strategy is attractive (i.e. working closely with customers to understand key requirements then building batteries at different sizes to accommodate customer requirements).

Total Addressable Market (“TAM”) Opportunity:

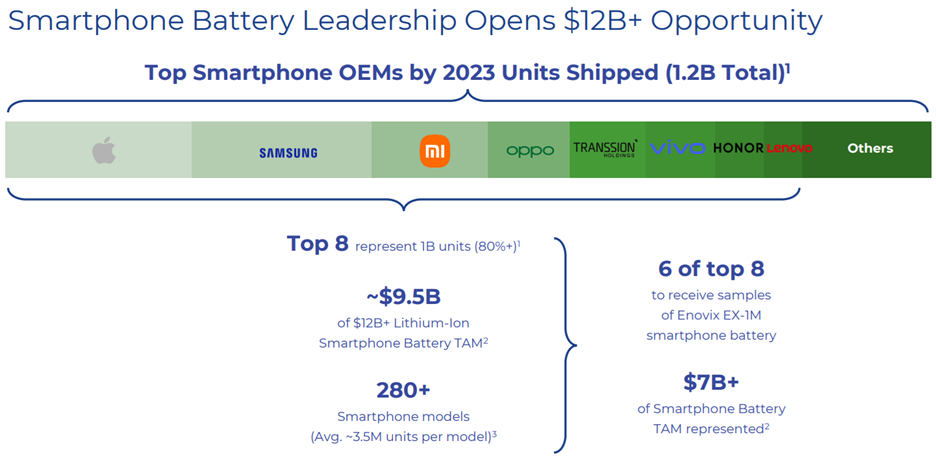

The TAM for Enovix is large, starting with $12 billion from top Original Equipment Manufacturers (“OEMs”) in the smartphone space.

And winning in smartphones opens another $12 billion in TAM from other “Internet of Things” (“IoT”) devices and computers, which also have an increasing need for better batteries.

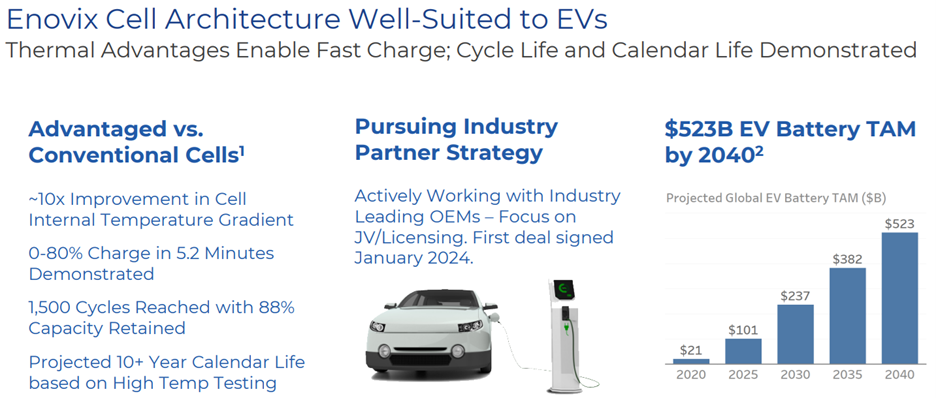

And at some point down the road there is additonal potential from the electric vehicle market.

However, all of this TAM opportunity is in the future, and has not been realized thus far (more on company financials later).

Enovix Progress, So Far:

Enovix is still very nascent as a business, but is working towards the type of scale that will allow it to capiture the massive TAM opportunity as it continues to emerge.

Also, the company continues to announce encouraging small wins (with the potential for big upside) as described in the “win” examples below:

Enovix Signs MOU with Leading Consumer Electronics Battery Pack Manufacturer | Enovix June 26, 2024

Enovix Signs Agreement to Deliver High-Performance Batteries for Mixed Reality Headset | Enovix June 25, 2024

Enovix Reaches Development Agreement with a Leading Smartphone OEM | Enovix May 1, 2024

And while these types of wins are encouraging (and frequently move the volatile stock price), the financials tell the story of an extremely nascent business (working towards scale).

Financial Condition:

As an emerging business, Enovix is not yet profitable. For example, you can see in the chart below that revenue is virtually non-existent at this point. And net income is quite negative. Further still, capital expenditures have been a small drain, but so has an increasing number of shares outstanding (dilutive but also par for the course at this point in an emerging business lifecycle).

The company also has significant debt on its balance sheet ($176 million as of last quarter). And despite the $262 million in cash and short-term investments, cash burn may increasingly become a challenge for Enovix if it is not able to keep achieving small win milestones.

To cut costs, Enovix recently laid off ~170 workers at its Fremont, California, factory, which appeared to be part of a larger initiative larger initiative to reduce annual operating costs by $35M before the end of the year. And the layoffs come approximately seven months after the company laid of 185 engineers and other staff in Fremont. Important to note, these actions appear to make sense as the company has shifted operations to Malaysia (lower labor costs, and target customers are in that geography).

Valuation:

Considering Enovix is not yet profitable (as it works towards scale), traditional valuations don’t make a lot of sense (i.e. it has no earnings, so a price-to-earnings ratio, for example, makes little sense). Nonetheless, Wall Street analysts rate the shares very highly (“strong buy”) and suggest there is significant price appreciation potential.

However, the shares continue to be highly volatile (see the 52-week price range in the table above), and the shares have dramatic short interest (suggesting a lot of investors also believe the shares have significant downside potential in the near term).

At this point in time, an investment in Enovix is highly speculative. If the company is able to scale successfully (or at least continue to make progress in that direction) the upside potential is dramatically more than the downside (consider the attractive large market opportunity).

Risks:

Not Profitable: Perhaps the most obvious risk is Enovix is not profitable and continues to burn through cash. This is normal for a company in Enovix’s nascent position, but if it cannot achieve progress in scale (and profits) then the shares could be worth very little, especially as liquidity could become an increasing challenge over time.

Competition remains a constant threat for Enovix. Per the company’s annual report:

“We will need to improve our energy density, cycle life, fast charging, capacity roll off and gassing metrics in order to stay ahead of competition over time, which is difficult and we may not be able to do.”

Futhermore:

“The battery market continues to evolve and is highly competitive, and we may not be successful in competing in this industry or establishing and maintaining confidence in our long-term business prospects among current and future partners and customers.”

However, Enovix also has competive strengths (as per its annual report) including its 100% Active Silicon Maximizes Anode Energy Density and Battery Capacity; its Proprietary Manufacturing Process; Full-Depth of Discharge Cycle Life; Architecture Enables Safety Innovation; Architecture Enables Fast Charge; Customer Tested in Multiple Form Factors; Practical Path to EV Market; and its Home Grown IP

Social Media Following: We’d be remiss to not at least mention Enovix’s large bull following on social media. The story (better batteries) is easy to understand and many accounts (on “X” for example) are quick to view and “like” positive posts about the company. However, this also has the potential to add to short-term volatility and risk for investors.

Conclusion:

Enovix is a highly speculative investment opportunity. The business is nascent, but the market demand is increasing as current battery architectures approach their limits in meeting the needs of new technologies. Despite negative profits (normal for many emerging businesses), Enovix is highly rated among Wall Street analysts (they believe the shares have significant upside), and the company continues to achieve small but encourging wins on their mission to scale. If you have room in your long-term growth portfolio for a high risk opportunity, Enovix has massive upside potential, and the shares are worth considering.