Concentration can help you get rich, but diversification helps you stay rich. And if you own 25 different flavors of big-yield mortgage REITs—you’re still not exactly “well diversified.” In this report, we countdown our to 10 big-yield opportunities, with a special focus on diversifying your risks (across different investment types) while simultaneously keeping your income high.

Let’s get into it.

What is the ideal number of Stocks to Own?

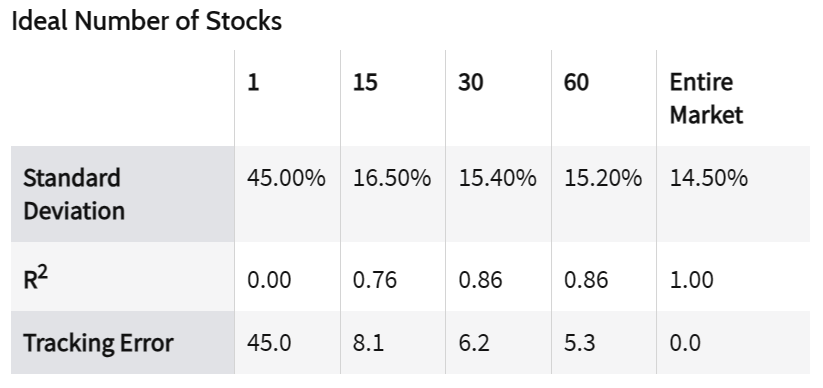

Twenty-five (25) is the magic number to diversify away the lion’s share of your stock-specific risk (according to a popular 1970 study by Fisher and Lorie).

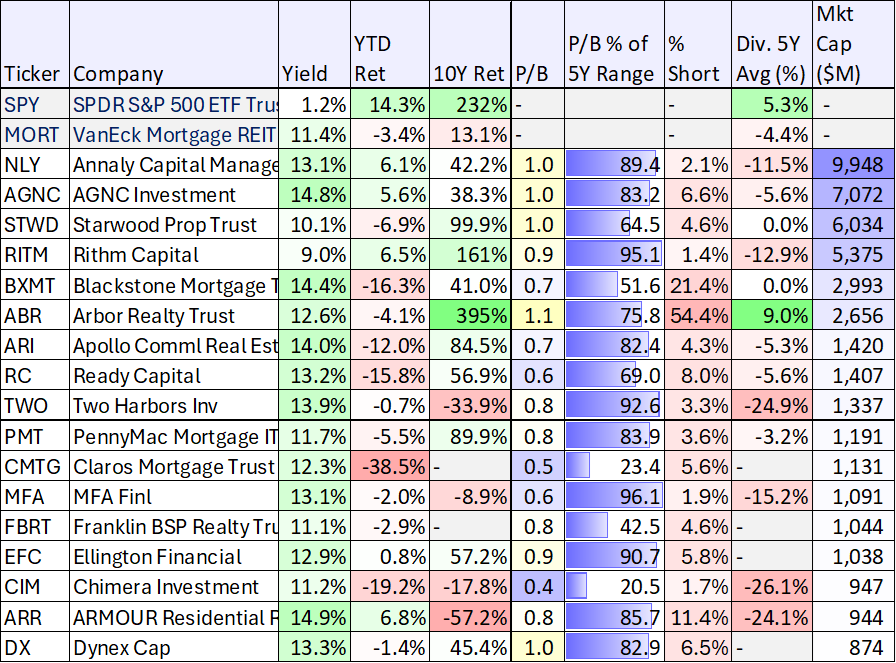

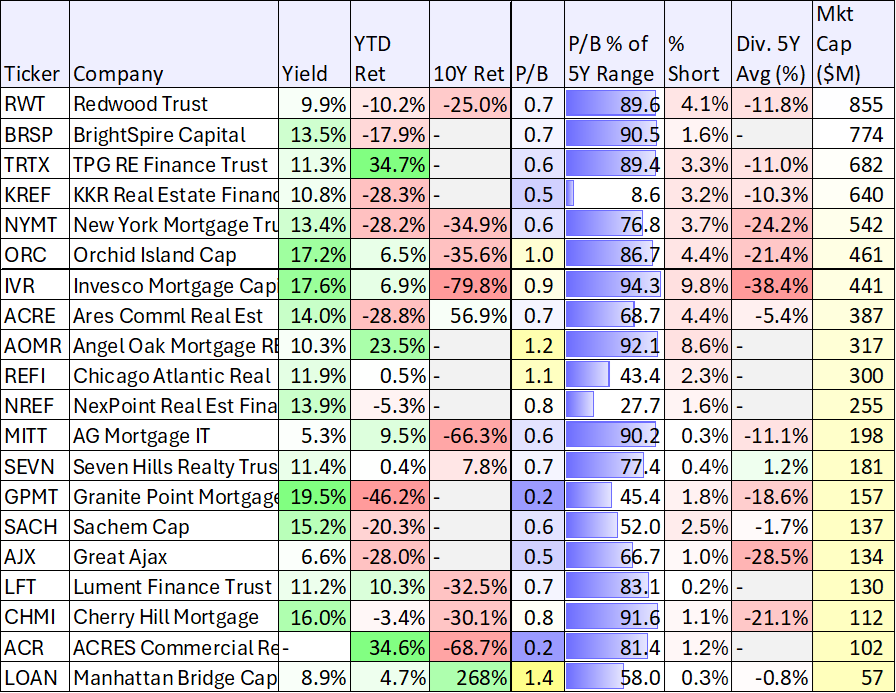

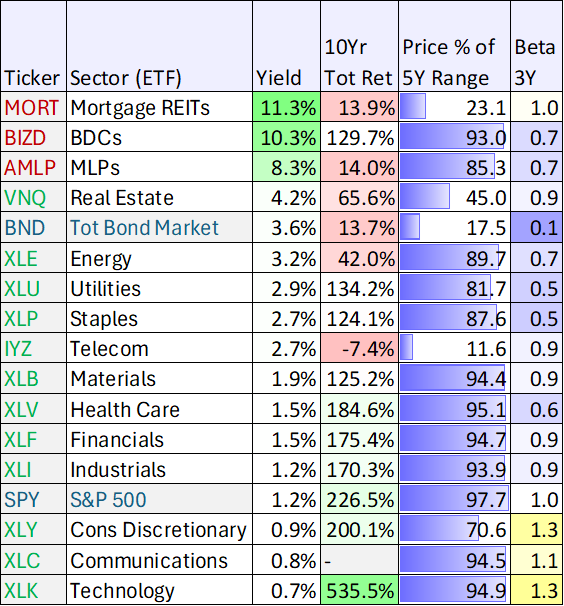

But just because you’ve diversified away most of the stock-specific risk, that doesn’t mean you’ve diversified away most of your sector, industry and style risks too. For example, if you own 25 big-yield mortgage REITs (such as the ones in the table below), you have significantly reduced the chances of any one of them blowing up and sinking your entire passive-income portfolio. However, you have NOT diversified away the risk that the entire mortgage REIT industry might fall on hard times (which has happened historically from time-to-time) and do some serious irreparable damage to the book value of your nest egg.

Mortgage REITs:

What is the ideal number of Sectors, Industries and Styles to Own?

Passive market ETFs (such as Vanguard’s low-cost S&P 500 index fund (VOO)) have become increasingly popular in recent market cycles as “efficient market” evangelists and propagandists claim it’s a better approach (more diversified across every market sector, industry and style) to reducing your risks and keeping your total returns (price gains, plus dividends as if they were re-invested) high.

And while this (passive market ETFs) may be a good solution if you are a 25-year old saving for retirement (VOO will help you avoid silly rookie mistakes, like trying to time the market or chasing after the latest meme stock bubbles), it’s not for everyone. For example, if you’ve already built up your nest egg, there may be dramatically better ways to allocate your investment dollars (besides just VOO), especially if you are focused on high income (which we are in this report).

Goal-Focused High-Income Investing:

If you’ve reached a point in life where you are relying on your investments for income, first of all—congratulations. And second of all, you might not want to have such a high weight (~50%) in the high-flying (and high-beta) technology, discretionary and communications sectors like the S&P 500 (VOO).

In this report, we’ll share examples of high-quality high-income investments that lean heavier into lower volatility high-income sectors and industries, as well as investments that focus on bonds (instead of 100% stocks) because prudent diversification is a good thing.

source: StockRover

This also means we don’t omit technology and growth stocks altogether, but we do invest in them via prudent, measured, high-income strategies.

Taxable Verus Non-Taxable High Income

Before getting into the rankings and countdown, it’s also important to pay special attention to the tax consequences of your investments. For example, some investors own high-income securities in their tax-advantage retirement accounts (such as Roth and Traditional IRAs), and some own them in taxable brokerage accounts. This can make an enormous difference to your bottom line, especially considering things like REITs, BDCs and bonds are often taxed at your ordinary income rate (typically a higher rate), and things like qualified dividends, long-term capital gains and non-taxable municipal bonds are often taxed at a lower rate (that can flow straight through to improving your bottom line). And even the often misunderstood tax implications of “return of capital” (“ROC”) in closed-end funds (“CEFs”) and master limited partnerships (“MLPs”) need to be considered before you go blindly chasing after just any big-yield opportunity.

Top 10 Big Yields

So with that backdrop in mind, let’s get into our rankings and countdown, starting with a few “honorable mentions,” and then moving on to #10 and then down into our very top ideas. To be clear, it’s a great time to be a high-income investor (lots of select attractive opportunities), but only if you know where to look and if you know how to build out your portfolio for your own personal, unique situation.

Honorable Mentions:

*H: Nuveen Quality Muni Bonds (NAD), Yield: 7.8%

Municipal bonds can be a great high-income investment if your own them in a taxable account (NOT an IRA), especially if you are in a high tax bracket. And Nuveen just announced some very large distribution increases in an effort to reduce some historically large discounts to NAV (a good thing). You can read our recent detailed writeup here:

*H: VICI Properties (VICI), Yield: 5.8%

Wall Street rates this experiential REIT (it owns top properties on the Las Vegas strip) a strong buy with 23.7% upside as profitable growth continues and valuation remains low (attractive) at just 11.3 times forward funds from operations. We don’t currently own this one, but it’s high on our watch list and we may add shares soon.

*H: DNP Select Income (DNP), Yield: 9.1%

The Duff & Phelps Select Income Fund (DNP) is a legendary income-investor strategy thanks to its track record of paying big income by investing in the more conservative utility sector. It has 27% leverage (to prudently magnify results) and the premium to NAV has come down significantly (to 7.6%) with negative z-scores (a good thing). We last wrote in detail about this fund last summer, when the premium was much higher. The premium has come down dramatically since then, and we like the fund even more now. You can read our previous report here:

The Top 10:

10. Ares Capital (ARCC), Yield: 9.2%

Ares Capital is the largest publicly-traded business development company (“BDC”), and if you have owned it in recent years you are probably quite happy with the strong performance. BDCs provide financing (mostly loans and sometimes equity) to “middle market” size companies. BDCs have perfomed particularly well following the ‘08-’09 financial crisis as traditional banks largely left this lucrative space due to more stringent regulations.

Some investos worry that performance has been too good, price-to-book values are not particularly attractive, and there are too many BDCs chasing after too few oppoortunities (especially considering credit spreads are not particularly wide right now). However, Ares is the well-managed industry leader, with deep resources (to handle any market corrections) and trades at a reasonable 1.1x price to book. We currently own shares of Ares, and we recently wrote it up in much detail here:

9. British American Tobacco (BTI), Yield: 9.5%

Putting all your eggs in one basked is a bad idea, and British American Tobacco is just one stock (i.e. it’s less diversified than many of the other ideas on this list which are funds). However, as a single stock, British American Tobacco is attractive and worth considering for a spot in your high-income portfolio (if you can get passed the unhealthiness of tobacco).

And from a fundamentals standpoint, BTI is attractive for high-income investors. For example, it has a net profit margin >30% (impressive), and free cash flow per share covers the price in just over 5 years (very impressive!). You can access our previous BTI report here:

8. Main Street Capital (MAIN), Yield: 8.2%

Sticking with our big-yield BDC theme, some investors shun Main Street because its yield appears lower and it price-to-book valuation is higher. But in reality, the dividend is consistently increasing (moreso than other BDCs), and the company frequently pays additional “special dividends” too. Further, the book value (net asset value) steadily rises significantly more than other BDCs over time (thus the higher price-to-book value is warrented). We recently wrote up this attractive internally managed BDC in detail and you can access that report here:

The Top 7:

The remainder of this report is available to members only, and it can be accessed here. The Top 7 includes an attactive mix of bond and stock strategies across a varety of sectors. They all offer attractive big yields, and we currently own all of them.

Conclusion:

The bottom line here is two-fold. First, the market continues to present attractive big-income opportunities, if you know where to look. And second, you need to be sensitive to your own personal situation and opportunities to diversify away a lot of risks by considering various opportunities across market sectors and styles.

At the end of the day, diversified, goal-focused, long-term investing continues to be a winning strategy.