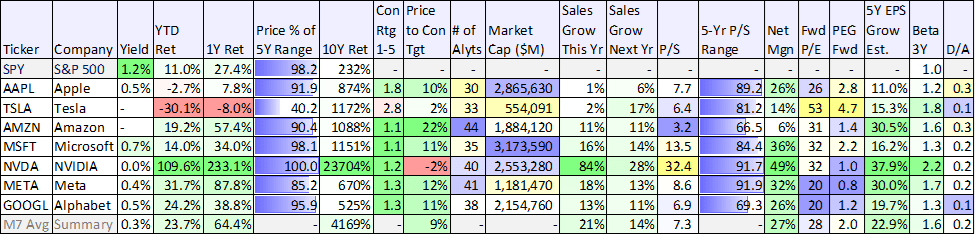

If you like long-term growth, Amazon shares are worth considering. Despite having the lowest net profit margin of any “Magnificent 7” stock, Amazon has the highest rating and most upside as per Wall Steet analysts (see table below). In this report, we review Amazon’s business, four main growth drivers (i.e. AWS, Prime video ads, AI capex and free cash flow), valuation and risks. We conclude with our strong opinion on investing.

Overview:

Many people think of Amazon as the website where you search for whatever you want, click "buy," and then it shows up at your home or office some days later. And while that part of its business (online stores and third-party seller services) generates the majority of its revenues (62%), most of the profits come from its cloud-data hosting service (Amazon Web Services, AWS), which makes up only 17% of the revenues.

For a little more perspective, Amazon's total operating income in the first quarter of 2024 was $15.3 billion, but $9.4 billion of that came from AWS. Said differently, 61.4% of the company's operating income comes from 17% of the revenues (i.e., AWS).

Amazon's 4 Big Growth Drivers

So with that high-level backdrop in mind, let's get into the four big factors that we see driving growth for Amazon for the remainder of this year and beyond.

1. Amazon Web Service ("AWS"), Despite Competition

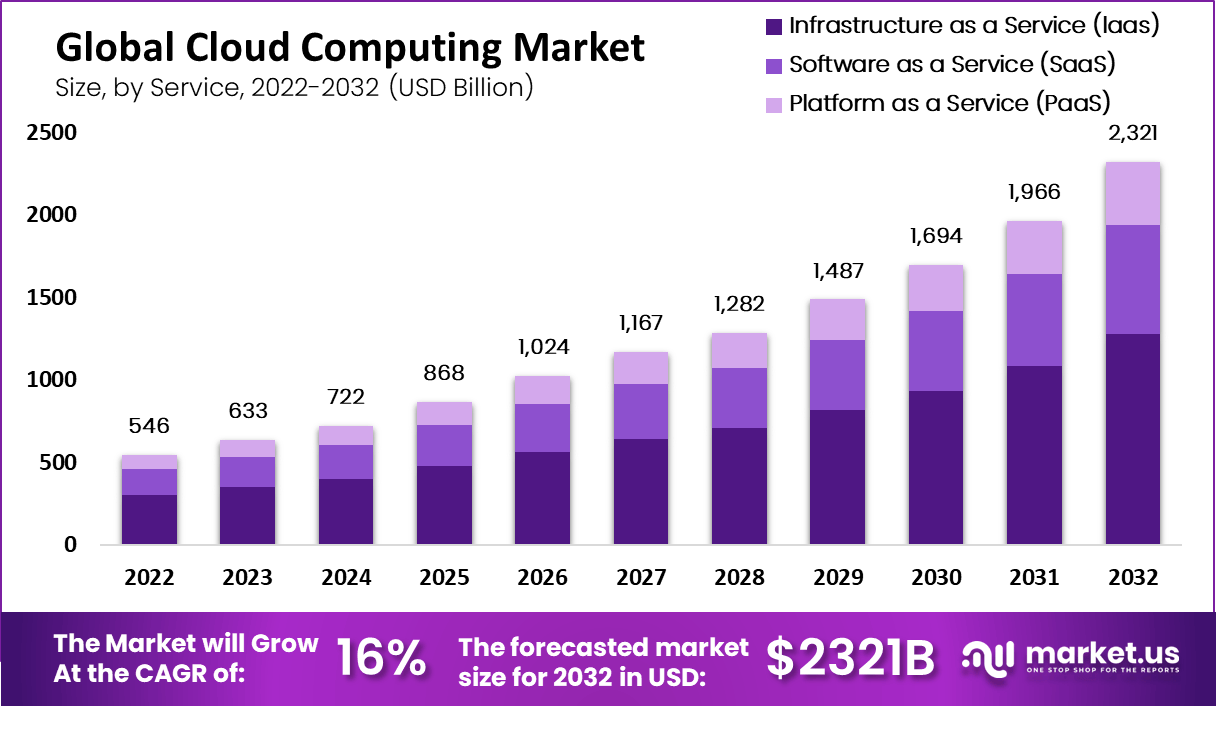

Amazon Web Service is the leader in the cloud market because Amazon had the foresight to recognize the massive secular opportunities ahead of the traditional big boys, like Microsoft, Google and the others (and because Amazon had an infrastructure head start via its online marketplace). For perspective, you can see the recent worldwide cloud market share (for the big players) in the following graphic.

However, Microsoft and Google have been gaining on Amazon in this space. For example, according to estimates from Synergy Research Group:

Amazon's market share in the worldwide cloud infrastructure market amounted to 31 percent in the first quarter of 2024, down from 32 percent a year earlier. Meanwhile, Amazon's main rival Microsoft slowly edges closer, growing the market share of its Azure platform to an all-time high of 25 percent in Q1 2024. Combined with Google at 11 percent market share, the "Big Three" now account for two-thirds of the ever-growing cloud market, with the rest of the competition stuck in the low single digits.

Cloud competition is absolutely a concern for Amazon, but it is important to keep it in perspective. Specifically, Amazon is still the worldwide cloud leader, it is very profitable in this space, and it is still growing rapidly. Moreover, the cloud opportunity (and the digitization of everything) remains perhaps the biggest technology secular trend in the world, expected to continue growing rapidly for many years, and recently being accelerated by Artificial Intelligence (more on Amazon AI later).

Said differently, "the cloud" continues to present massive growth opportunities for Amazon (for many years to come).

2. Ads Have Arrived for Prime Video

In late January of this year, Amazon began advertising on Prime Video (a huge and previously untapped revenue opportunity). Amazon Prime is a subscription service that gives users access to additional services (including faster delivery, streaming music and videos and more).

According to this article, customers can pay an additional $2.99 per month to avoid ads (a prime membership costs $14.99 per month or only $139 if you pay annually). And according to Amazon:

"We aim to have meaningfully fewer ads than linear TV and other streaming TV providers. No action is required from you, and there is no change to the current price of your Prime membership."

Considering the large size of Amazon Prime (over 200 million customers worldwide), ads have the potential to meaningfully move the revenue needle for the company. And according to CEO, Andy Jassy, during the Q1 conference call:

We still see significant opportunity ahead in our sponsored products, as well as areas where we're just getting started like Prime Video ads.

Prime Video ads offers brands value as we can better link the impact of streaming TV advertising to business outcomes like product sales or subscription sign-ups, whether the brands sell on Amazon or not. It's very early for streaming TV ads but we're encouraged by the early response.

3. Artificial Intelligence CapEx is a Good Sign

With technological advances in artificial intelligence, it has become a major theme (and growth driver) across businesses in every sector. And Amazon is also looking to capitalize on AI opportunities. According to Amazon's latest Q1 earnings call:

The number of companies building generative AI apps in AWS is substantial and growing very quickly, including Adidas, Booking.com, Bridgewater, Clariant, GoDaddy, LexisNexis, Merck, Royal Philips and United Airlines, to name a few. We are also seeing success with generative AI start-ups like Perplexity.ai who chose to go all in with AWS, including running future models in Trainium and Inferentia. And the AWS team has a lot of new capabilities to share with its customers at its upcoming AWS re:Invent conference.

Given the profound impact AI is expected to have on the economy, it's important that Amazon stays at least on pace with the curve so as not to be left behind (as many slower movers inevitably will be). The company says it also uses AI beyond AWS, including helping customers better discover products that meet their needs, forecasting inventory levels and improving delivery, to name a few. As an example, Andy Jassy explained on the latest quarterly call:

"We've recently launched a new generative AI tool that enables sellers to simply provide a URL to their own website, and we automatically create high-quality product detail pages on Amazon. Already, over 100,000 of our selling partners have used one or more of our GenAI tools."

And very importantly, Amazon's capex spending in this area is encouraging:

"We expect the combination of AWS' reaccelerating growth and high demand for gen AI to meaningfully increase year-over-year capital expenditures in 2024, which given the way the AWS business model works is a positive sign of future growth. The more demand AWS has, the more we have to procure new data centers, power, and hardware."

And for a little more color, according to CFO Brian Olsavsky:

"As I mentioned, we're seeing strong AWS demand in both generative AI and our non-generative AI workloads, with customers signing up for longer deals, and making bigger commitments. Still relatively early days in generative AI and more broadly, the cloud space, and we see a sizable opportunity for growth."

And with regard to capital expenditures (as a good sign for growth), Olsavsky explained:

"in Q1, we had $14 billion of CapEx. We expect that to be the low quarter for the year. As Andy said earlier, we are seeing strong demand signals from our customers and longer deals and larger commitments, many with generative AI components. So those signals are giving us confidence in our expansion of capital in this area."

Capex spending (on AI) is a good sign for Amazon's continuing future growth.

4. Free Cash Flow for Innovation Investments

Since it first started trading publicly, Amazon has not focused on short-term profitability. However, it is a good sign for the company to be focusing its efforts more on the long-term goal of optimizing free cash flows. More specifically, Free Cash Flow has been on the rise (a good thing) as you can see in the following chart.

And growing free cash flow is particularly important in the current market environment (i.e., as interest rates have risen) because it is an indication of a healthy company that can continue to fund its own growth in any market environment.

Amazon's Valuation

As you can see in the comparison table below, Amazon is currently the highest-rated stock (of the Mag 7) by Wall Street analysts, and it has the most price upside versus analyst targets. Also, Amazon has an attractive 11% expected revenue growth rate for this fiscal year and next.

However, the metric that stands out the most about Amazon is its expected earnings per share ("EPS") growth rate for the next five years. Specifically, Amazon currently has the lowest net profit margin of the group, but this is by design (the company has always focused on spending for innovation and growth, not quarterly profits). But with free cash flow on the rise, and the company's high economies of scale and operating leverage, Amazon likely has more room for EPS growth than other Mag 7 stocks (with the exception of possibly Nvidia and maybe Meta).

In a nutshell, Amazon has operating leverage to drive earnings dramatically higher in the years ahead, and this bodes well for shareholders and the stock price.

Amazon's Risks

Amazon (and most of the Mag 7) are financially strong businesses that can be profitable in virtually any market environment. However, that doesn't mean they don't face risks.

Volatility: For example, Amazon shares fell dramatically in 2022 (before rebounding in 2023 and so far, in 2024), however price volatility remains a risk factor in the near term.

Prime Ad Risk: Another risk is that new Amazon Prime ads could backfire (causing the company to lose customers to streaming competitors). Additionally, Amazon needs to continue delivering streaming content that keeps users on the platform.

Cloud Competition is also a risk. For example, Microsoft and Google Cloud are both chipping away at Amazon's lead in the space. The good news is that the cloud is so large that there is room for multiple winners. Nonetheless, competition is a risk.

Increasing Capital Expenditures also pose a risk. Even though Amazon views capex as a good sign (i.e., they see high demand and growth opportunities), if commensurate revenue and operating income don't materialize, the company could end up destroying value by overspending on capex.

The Bottom Line

Even though a lot of people still think of Amazon as simply an online store, it has massive long-term upside from its four main growth drivers ((1) AWS/Cloud, (2) Prime Video Ad revenue, (3) AI capex and (4) free cash flows). And the company’s current low profit margin leaves plenty of room for improvement through operating leverage, espcially considering it has a double digit revenue growth trajectory and such a high 5-year average EPS growth consensus.

We are currently long shares of Amazon, and we have ranked it #10 in our new report, Top 10 Growth Stocks: