It’s a great time to be a big-yield investor (6% to 13% yields). For starters, the aggressive interest rate hike cycle (that pressured the prices of interest rate sensitive securities lower over the previous few years) has now ended (as per fed chair Jerome Powell, it’s unlikely the next interest rate move will be higher). And with interest rates now settling in at their highest levels in over two decades, certain out-of-favor contrarian opportunities are particularly compelling. In this report, we countdown our top 10 big-yield opportunities, including closed-end funds (“CEFs”), business development companies (“BDCs”), real estate investment trusts (“REITs”), dividend stocks and more. Let’s get right into it.

75 Big-Dividend REITs, Down Big

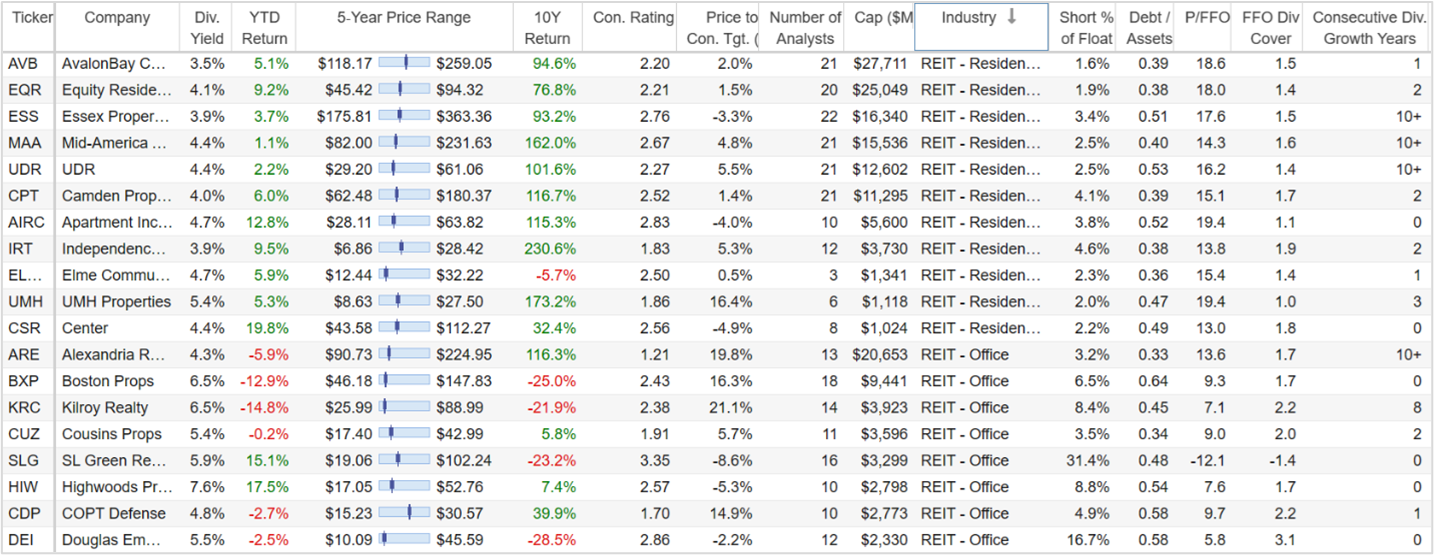

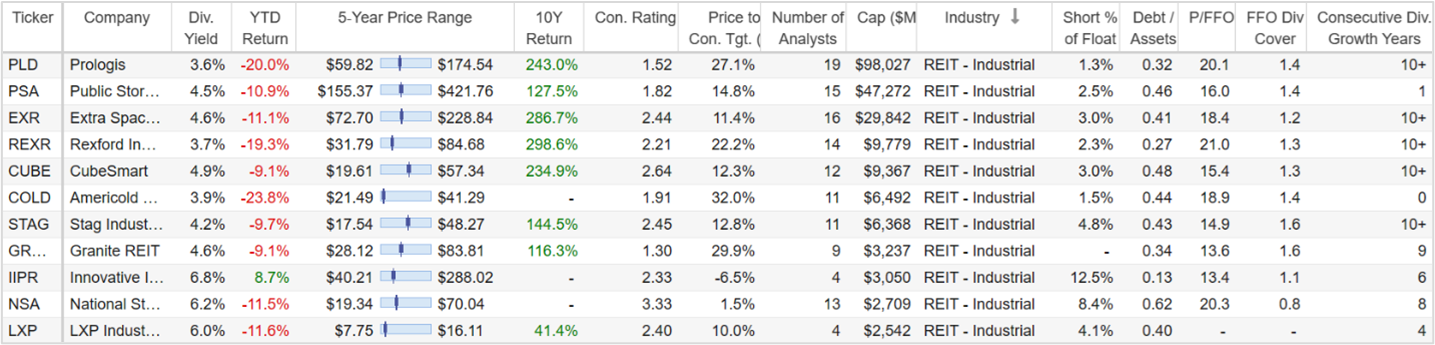

Starting with real estate investment trusts, as you can see in the following table below, performance has been terrible in recent years (for some REIT industries more than others).

Source: Stock Rover (data as of 08-May-24)

For example, industrial and residential REITs have performed particularly poorly over the last two years as they’ve dealt with the double whammy of rising interest rates (which make operations more expensive) and a fed unwinding its balance sheet (which puts added “hawkish” pressure on the economy).

However, in addition to ending the aggressive interest rate hike cycle, fed officials also approved a plan to slow the ongoing reduction of their $7.4 trillion asset portfolio at their latest meeting (another less-hawkish/ more-dovish move for the economy).

Obviosuly, there is a lot more going on in the REIT space besides just monetary policy. For example, secular changes like “work from home” are negatively impacting Office REITs and “online shopping” continues to impact Retail REITs.

Nonetheless, there are attractive big-yield contrarian opportunities in the REIT space, such as the one we discuss in the next section.

Honorable Mention:

VICI Properties (VICI), Yield: 5.8%

Not officially in our top 10 rankings, we are including “Diversified REIT” VICI Properties as an honorable mention because it is an attractive business that has sold off this year, but remains highly ranked among the 20 Wall Street analysts that cover it (i.e. they have an aggregate “strong buy” rating and believe the shares have 25% upside versus their current market price).

source: StockRover

If you don’t know, VICI ows a portfolios of experiential properties (i.e. gaming, hospitality and entertainment destinations), including Caesars Palace Las Vegas, MGM Grand and the Venetian Resort Las Vegas (i.e. iconic properties on the Las Vegas Strip).

VICI announced earnings on May 1st, whereby they exceeded street expectations for earnings and revenue (as the REIT’s revenues continued to rise while expenses remained steady versus a year ago). VICI also recently completed an investment grade bond offering thereby giving it plenty of liquidity to continue on its healthy profitability and growth trajectory.

If you are looking for a compelling big-dividend contrarian opportunity, VICI Properties is absolutely worth considering.

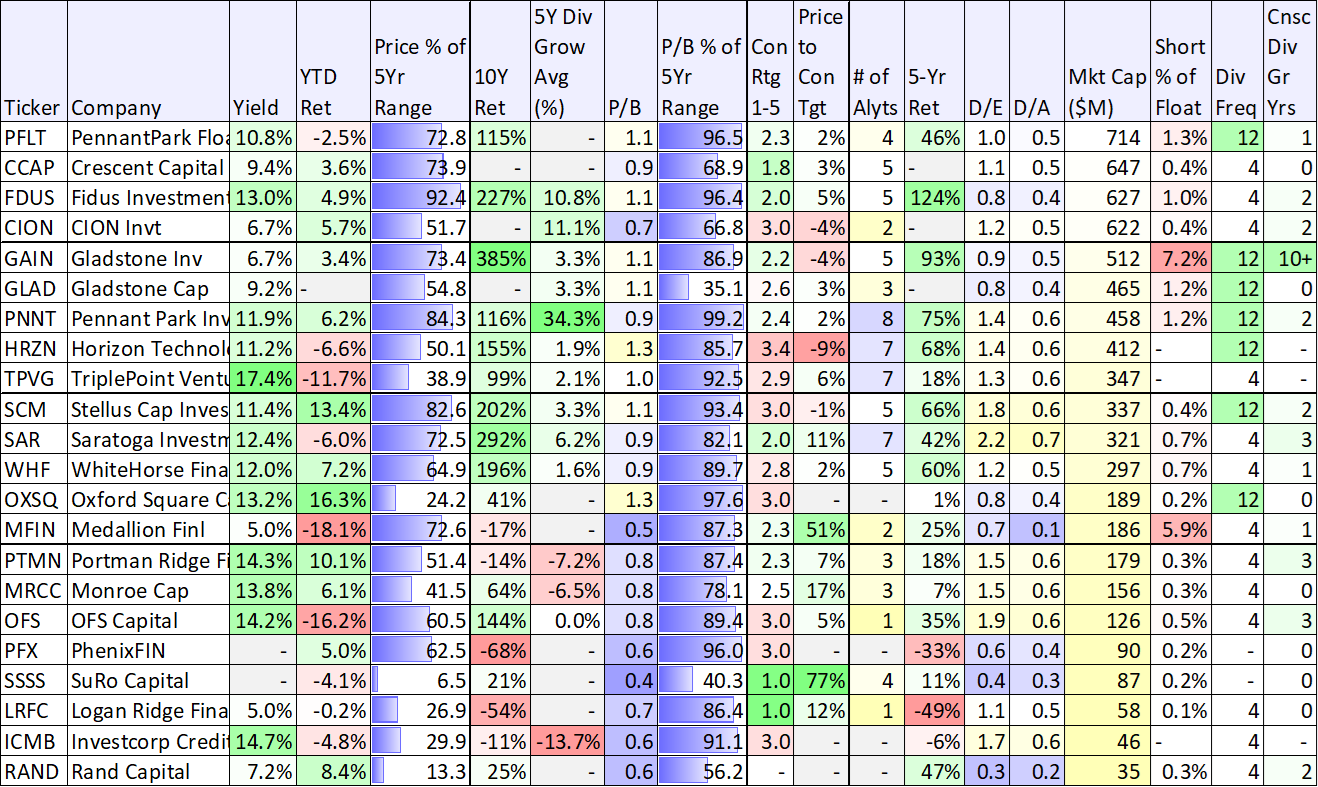

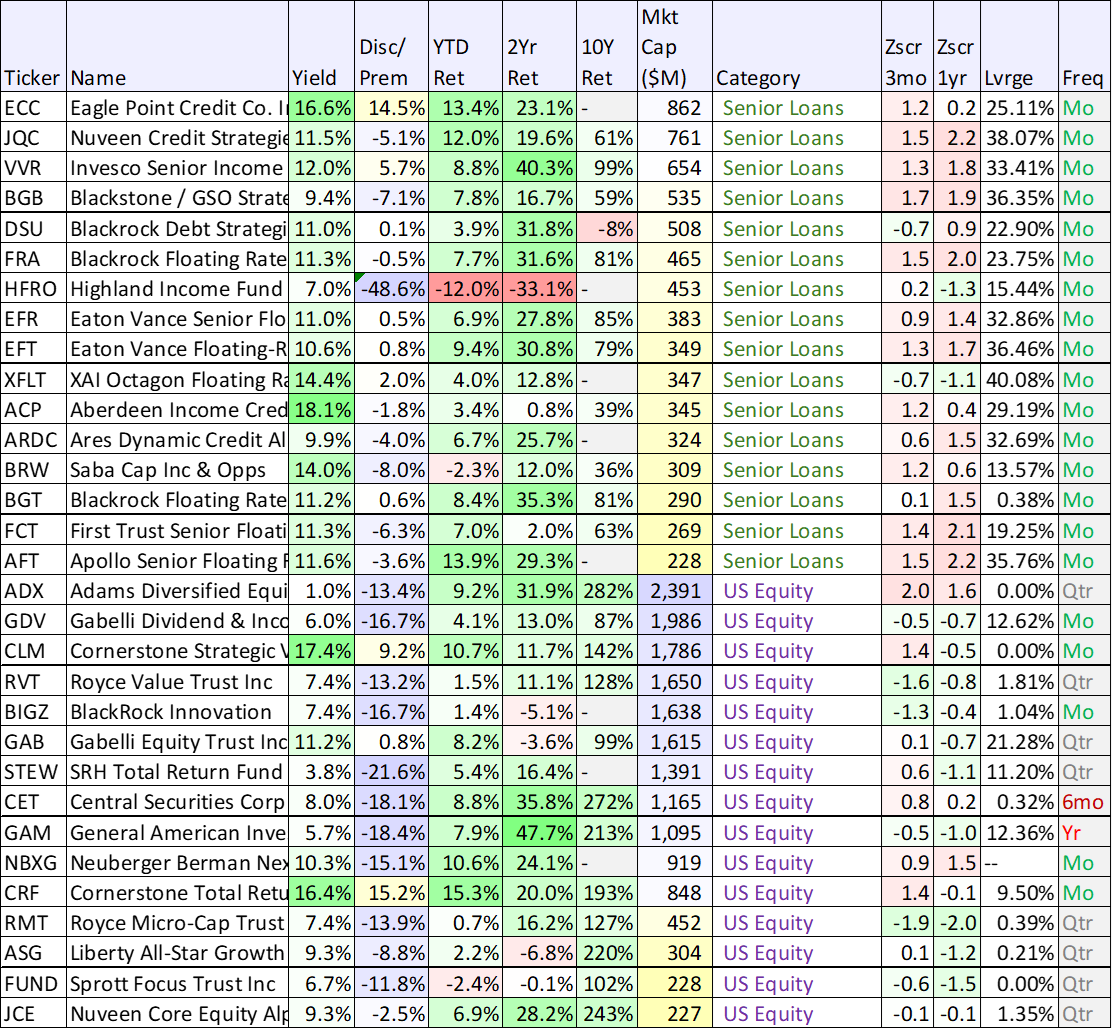

BDCs and Interest Rates

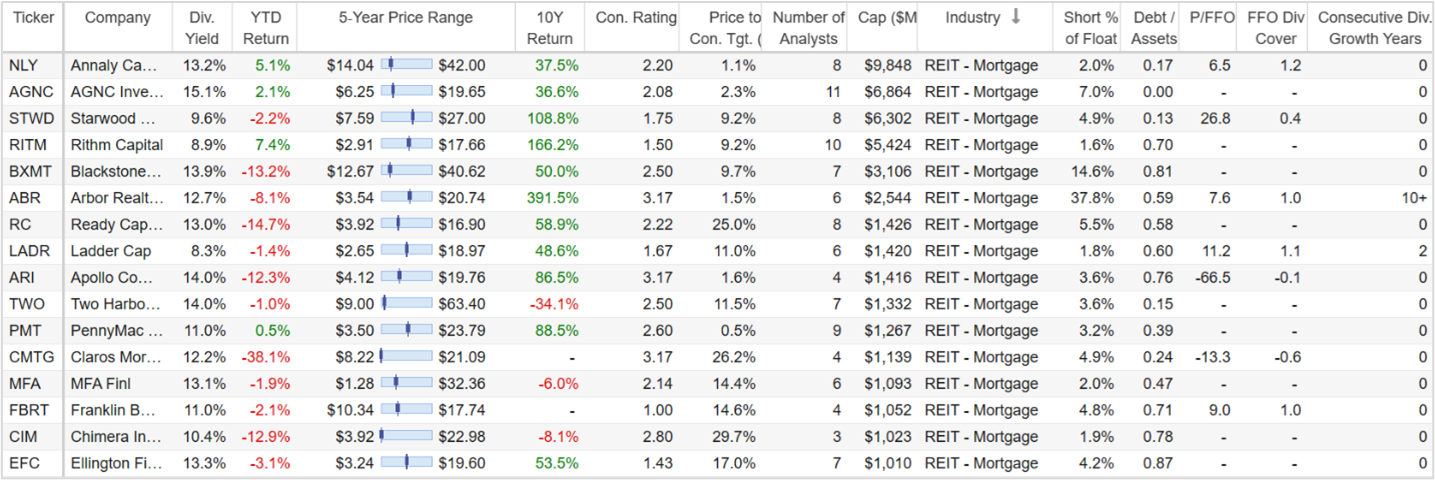

Switching gears to Business Development Companies, there are some highly-compelling big-dividend opportunities in this space. And like REITs, BDCs are also sensitive to interest rates, but in a different way.

BDCs basically make loans to smaller (middle market) companies, and when interest rates rise (like they have in recent years) this can put more stress on the companies receiving the loans (because it becomes more expensive to borrow) and it can put more income in the pockets of the BDCs themselves (because they can earn higher interest income).

As you can see in the table below, BDCs as a group have performed relatively well in recent years (better than most REITs) and valuations (such as price to book value) are not particularly low (anything below “1” is a “discount” to NAV and above “1” is a “premium”).

Data as of Friday’s close 03-May-24, source: StockRover

You’ll also note a variety of potentially useful BDC data points in the table above, including performance, dividend yield, valuation metrics and Wall Street analyst ratings.

So with that backdrop in mind, let’s get into the rankings…

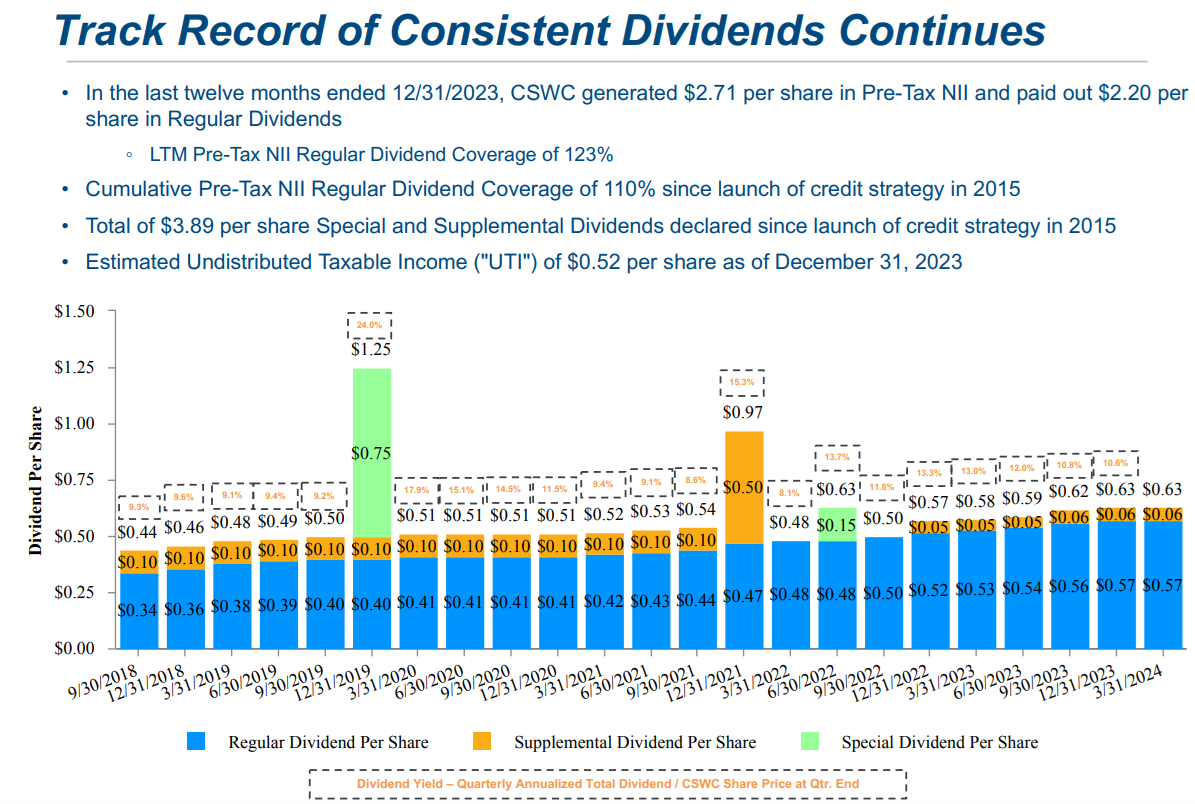

10. Capital Southwest (CSWC), Yield: 9.6%

Capital Southwest is a big-dividend BDC focused on lower middle market companies, providing mainly first lien loans, across a variety of industries. Based out of Dallas, TX, CSWC is internally managed (good for less conflicts of interest for shareholders) and has diversified investments across the US.

Although not particularly compelling from a price-to-book valuation standpoint (few BDCs are right now), Capital Southwest does have a strong track record of success, including consistent dividend growth.

We currently have no position in CSWC (we own four other BDCs, and we own every other name in the top 10 rankings), but CSWC is still attractive and high on our watchlist. You can read our previous full writeup on this one here:

9. Main Street Capital (MAIN), Yield: 5.7%

From a BDC standpoint, some investors scoff at MAIN because its yield is lower than peers and its valuation (price-to-book) is generally higher. However, we are ranking this one at #9 on our list (we do currently own shares) because we’re confident in the long-term dividend strength and because this BDC tends to generate a higher price return (and competitive total returns) versus its peers.

Also worth mentioning, if you own Main Street in a taxable account it may be to your advantage to get more of your return from price appreciaton anyway (because you control when the capital gains are taxed (i.e. when you sell) and those capital gains may be taxed at a lower rate (depending on your tax bracket). For reference, in 2023, approximately 8% of MAIN’s dividend was taxed as qualified and approximately 92% was taxed as ordinary income (qualified dividends are taxed at a lower rate).

You can read our previous writeup on Main Street Capital here:

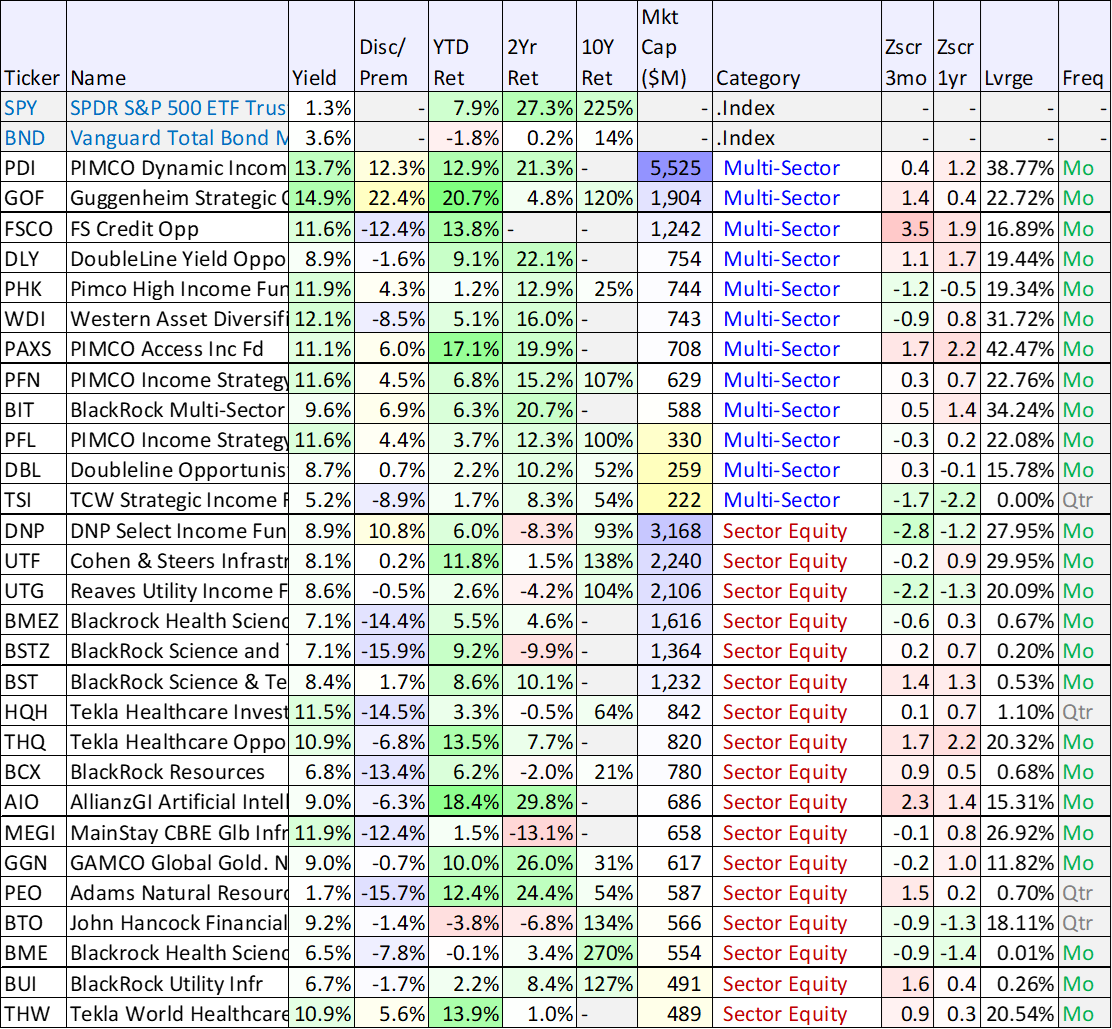

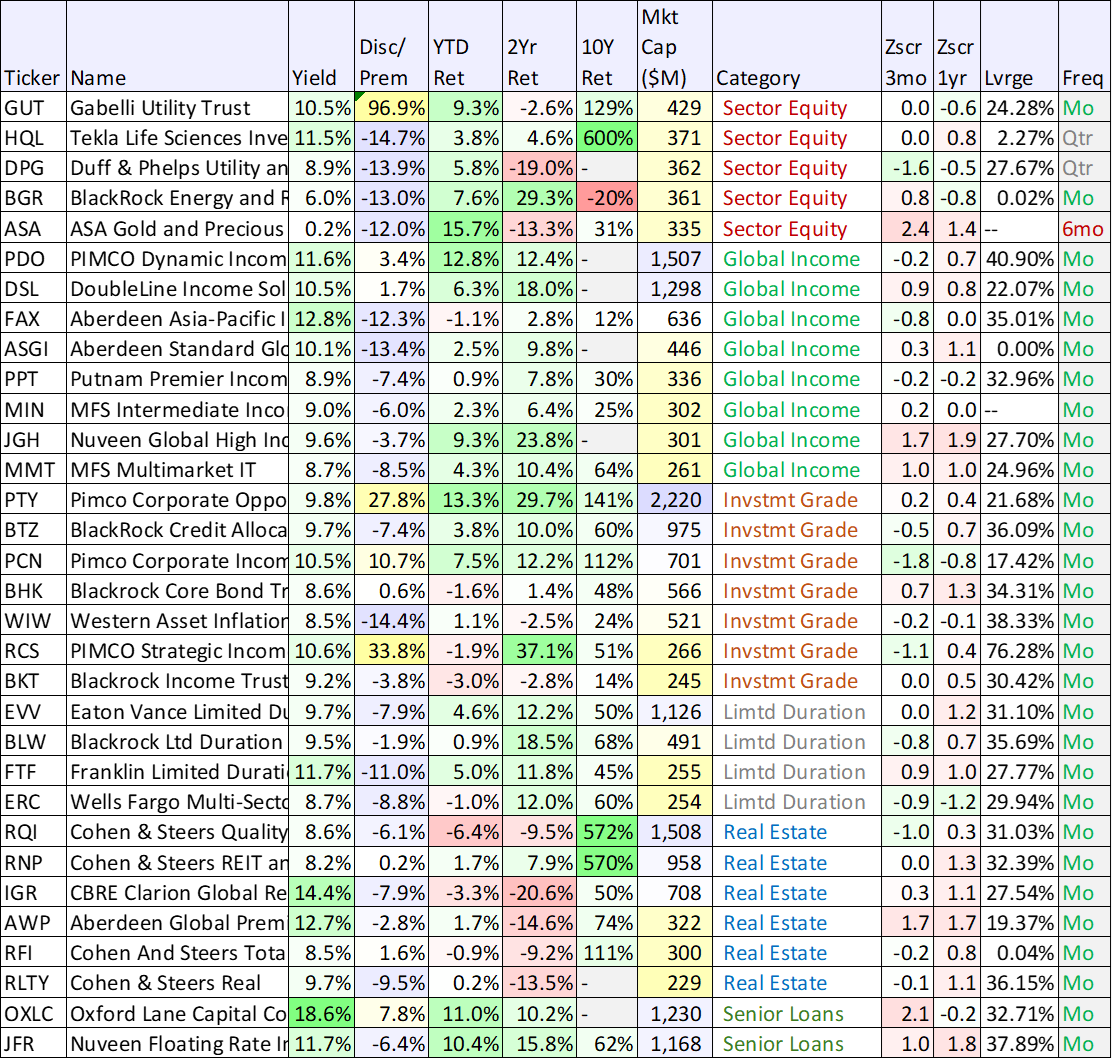

Bond Closed-End Funds

Switching gears to bond-focused closed-end funds (CEFs), it been an extremely wild ride over the last five years as this group was acutely impacted by the dramatical changes to interest rates (i.e. as rates rise, bond prices fall, all esle equal).

Data as of market close, Friday 03-May-24, source: StockRover

You’ll find a variety of useful data in the above table including distribution yields, performance, leverage and z-scores (z-score measure how far a fund’s current discount or premium is from it’s average. Negative z-scores are generally considered better).

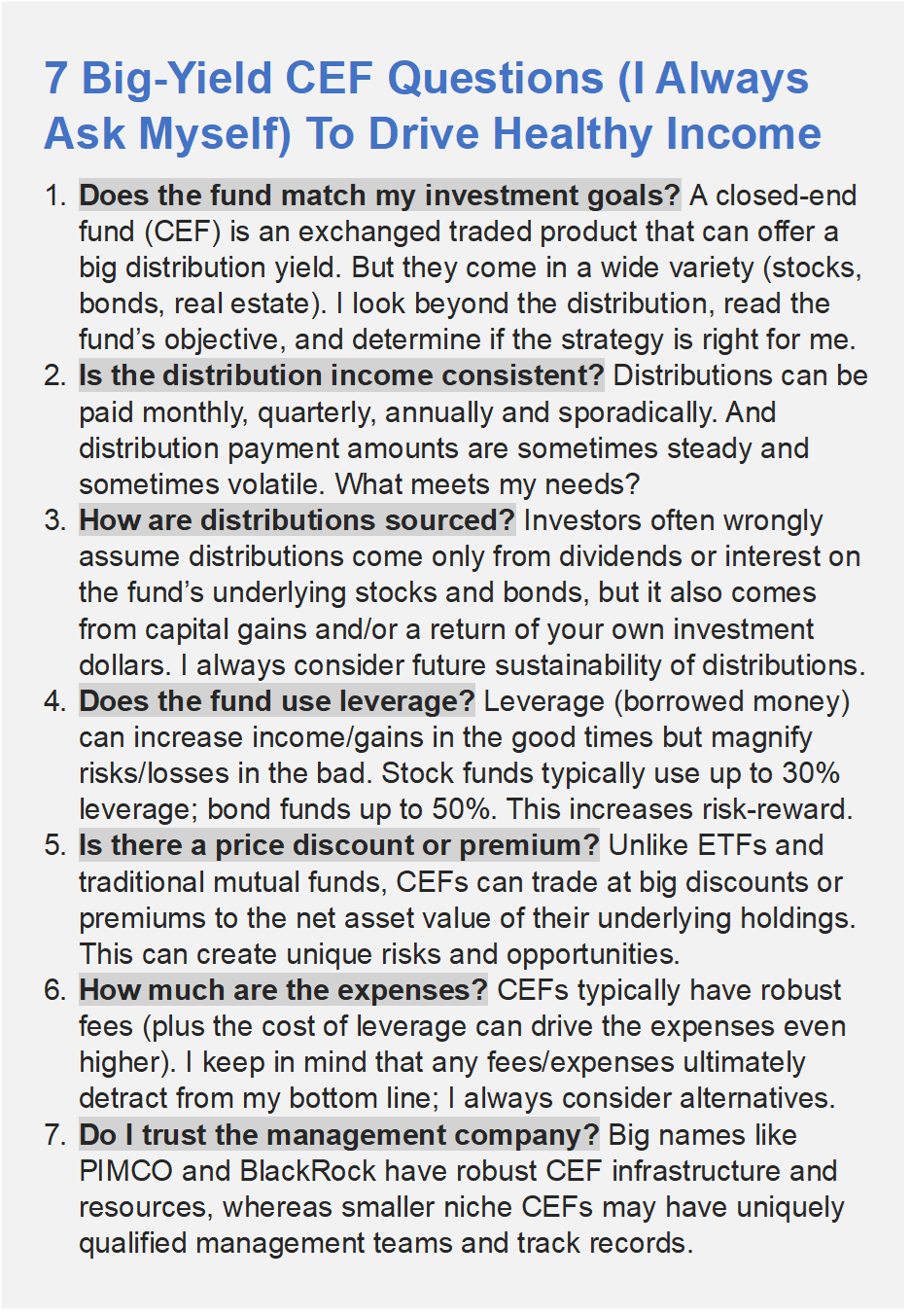

You can also check out a few common questions to ask before considering an investment in any closed-end fund in the following graphic.

So with the backdrop in mind, let’s get into a specific CEF worth considering.

8. BlackRock Multi-Sector Income (BIT), Yield: 9.8%

When it comes to bond CEFs, BlackRock has massive resources and expertise available, but many investors still consider it “second rate” as compared to the industry leader, PIMCO. Nonetheless, this BlackRock bond underdog (BIT) has outperformed one of the most premier PIMCO bond CEFs (PDI) over the last 3-5 years because it was in a better position to deal with interest rate volatility.

Specifically, BIT uses less leverage and less derivatives than many PIMCO funds (such as PDI), and this helped BIT decrease its level of stress as compared to the challenges other funds faced as a result of interest rate volatility.

We continue to own BIT (in part because it is a good diversifying PIMCO alternative), and you can read our full writeup on it here:

7. Ares Capital (ARCC), Yield: 9.4%

Swithing back to BDCs, Ares is the industry leader in terms of market cap and because it has gained the trust of many investors (it has a relatively long and growing track record of success spanning multiple market cycles).

On one hand, Ares may hold more second tier (subordinated) debt than others, but on the other hand the company is so large and well-funded, it has more wherewithall to take on these risks than other BDCs (and it earns them a higher return)

Again, valuations across BDCs are not overly compelling at this point in the cycle, but Ares’ dividend strength is (It just announced another healthy dividend on May 1st).

If you are an income-focused investor, it’s hard to not at least consider owning this one. We are long Ares in our High Income NOW Portfolio. You can read our previous detailed report here.

6. PIMCO Dynamic Income (PDI), Yield: 13.7%

PIMCO is the industry leader when it comes to bond closed-end funds. And while some investors have been traumatized in recent years as the price volatility has been elevated (and as the source of the distributions has been more dynamic) other investors haven’t cared one bit as long as the big monthly distribution payments keep rolling in.

However, it is important to understand how well PIMCO’s investment income is able to cover the monthly distribution payments (it hasn’t been covering in recent years) and what alternative methods the funds have been using to source those distribution payments (becuase it is a significant risk factor).

You can access our recent report (below) on PIMCO’s distributions versus NII to get a better understanding of the risks involved and whether you actually want to be invested in PIMCO (and how much). We continue to own shares of this fund (but have reduced our exposure in light of high leverage, complicated derivatives and volatile interest rates) and rank PDI #6 on our list.

The Top 5:

The remained of this report is available to members only, and it can be accessed here. We currently own all 5 of the top 5 in our Blue Harbinger “High Income NOW” portfolio, and the list includes an attractive mix of big yields CEFs, REITs, BDCs and more.

The Bottom Line:

It is a great time to be a high income investor if you know where to look. The market is coming off a period of historically high interest rate volatility (the fed hiked rates at an unprecedented rate). And now that the rate hikes have paused, investors are left with attractive opportunities including select higher yields and some compelling contrarian prices.

We prefer to get our high yield through a diversified group of opportunities, such as those listed in this report (BDCs, CEFs, REITs). You can view all of the holdings in our Blue Harbinger High Income NOW Portfolio here.