The tech-heavy Nasdaq just closed at a new all-time high. And while this is encouraging to some investors, and discouraging to others, the best bet for long-term investors is to simply own geat businesses (and ignore everything else—it’s just noise). In this report, we countdown our top 10 growth stocks, starting with a few honorable mentions. If you are into day trading, options and crypto—ignore this report—it’s not for you. If you like massive long-term compound growth, continue reading for our top ideas.

Buying at All-Time Highs

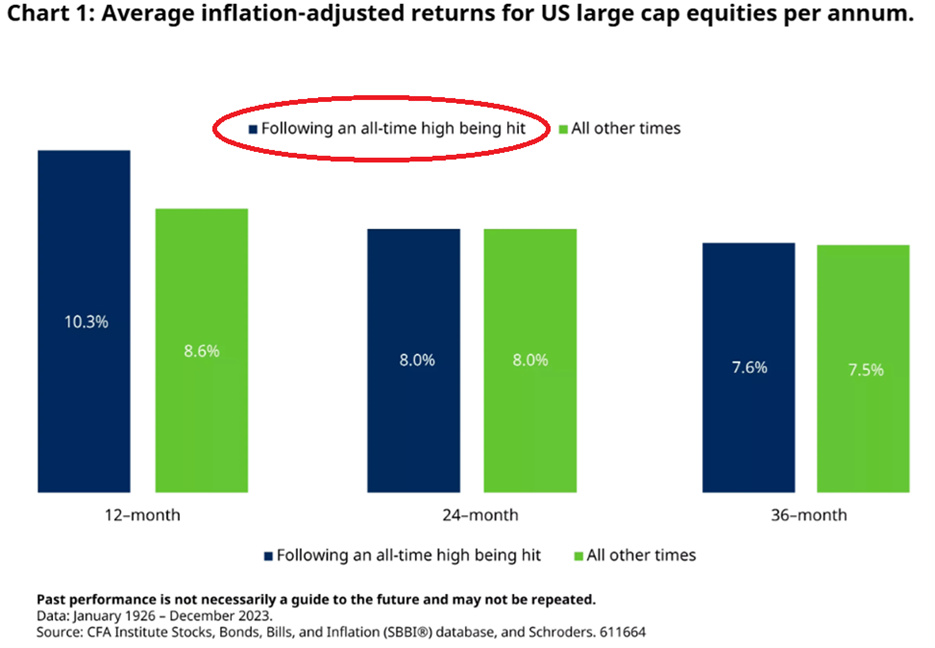

The internet seems full of market statisticians telling powerful stories that depend entirely on whatever time period or data set they choose (to get the data points to support their theme). For example, here is a chart that suggesting it’s a good idea to buy when the market is at all-time highs.

And here is a chart suggesting it’s better to NOT buy at all-time highs.

But while the internet meme stock experts try to “one up” each other with meaningless backward looking statistics, real investors know the incredible power of long-term compound growth (that can be achieved through buying and holding great business for the long-term).

In the following sections of this report, we highlight our top growth stock ideas (supported by powerful megatrends, disruptive ideas and attrative valuations).

*Honorable Mentions:

Before getting into the official top 10 countdown, let’s first consider a few impressive honorable mentions.

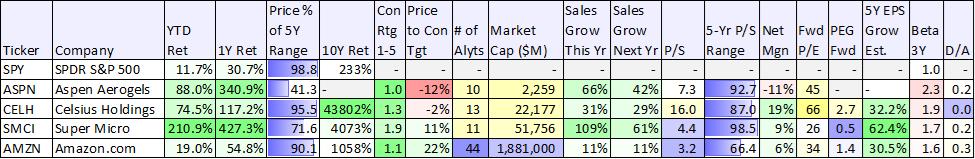

*Aspen Aerogels (ASPN)

This "energy industrials" (materials) business serves oil producers and refiners, but has a powerful recent tie in to electric vehicles with its thermal barriers for battery packs. It has an impressive recent track record of winning deals with major car dealers. We had Aspen ranked at #5 in our previous “top 10 growth stocks” report, but the shares have subsequently spiked over 75% in the last month. We’re still including it as an honorable mention because it continues to have attractive upside (and we continue to own shares). And you can read our previous report on Aspen (from before its recent big rally) here:

*Celsius Holdings (CELH)

This fitness drink company continues grow (and take share from industry leaders Monster and Red Bull) following its distribution deal w/ Pepsi. Now expanding internationally (and continuing to benefit from the growing energy drink market in the US and abroad), Celsius remains highly attractive (we own shares). High growth plus huge operating leverage gives Celsius continuing strength and upside (we are long Celsius in our Disciplined Growth Portfolio). You can view our previous Celsius report (from before its big rally) here:

Data as of Fri 5/24/24, source: StockRover

*Super Micro Computer (SMCI)

No top growth stock list would be complete without including Super Micro Computer. The company produces hardware/servers that house GPUs used for computing, especially AI data center growth. In fact, SMCI continues to be a huge AI beneficiary, thanks in large part to its strong direct relationship with Nvidia (i.e. the leading AI GPU chip maker on the planet). We are long SMCI and you can read our previous SMCI report (from before its latest big rally) here.

Top 10 Growth Stocks

So with that backdrop in mind, let’s get into our official countdown, starting with #10 and finishing with our top ideas.

10. Amazon (AMZN)

Amazon’s economies of scale (in cloud, marketplace and basically anything else it does) allow it to overwhelm competition, and its increasing focus on free cash flow is a good sign. Specifically, Amazon (AWS) is the #1 cloud services provider (ahead of Microsoft and Google), it has finally opened the AMZN Prime ad spigot (a good thing), and it has double digit revenue growth. Further still, Amazon has a huge 28.4% 5-year aveage EPS growth estimate, which makes these shares very attractive. We are long Amazon, and you can read our new report on the opportunity:

The Top 9:

The remainder of this report is available to members-only, and it can be accessed here. The top 9 growth stock opportunities range from multiple sectors and market caps, but they all have dramatic long-term price appreciation potential (and we currently own them all within our Blue Harbinger “Disciplined Growth Portfolio”).

The Bottom Line

The market has been strong this year. And it was strong last year. This makes a lot of investors nervous and afraid to buy. But if you are a long-term investor (which is proven to be one of the most powerful wealth building strategies in the history of the world) it’s always a great time to buy and hold great businesses, such as the ones listed in this report. And you can view all of the holdings (and position sizes) in our entire Blue Harbinger Disciplined Growth portfolio here.