You probably know there are different tax brackets for your ordinary income, but here are the 2024 tax brackets for your investment income (capital gains rates, qualified dividend tax rates), plus a few high-level strategies to benefit.

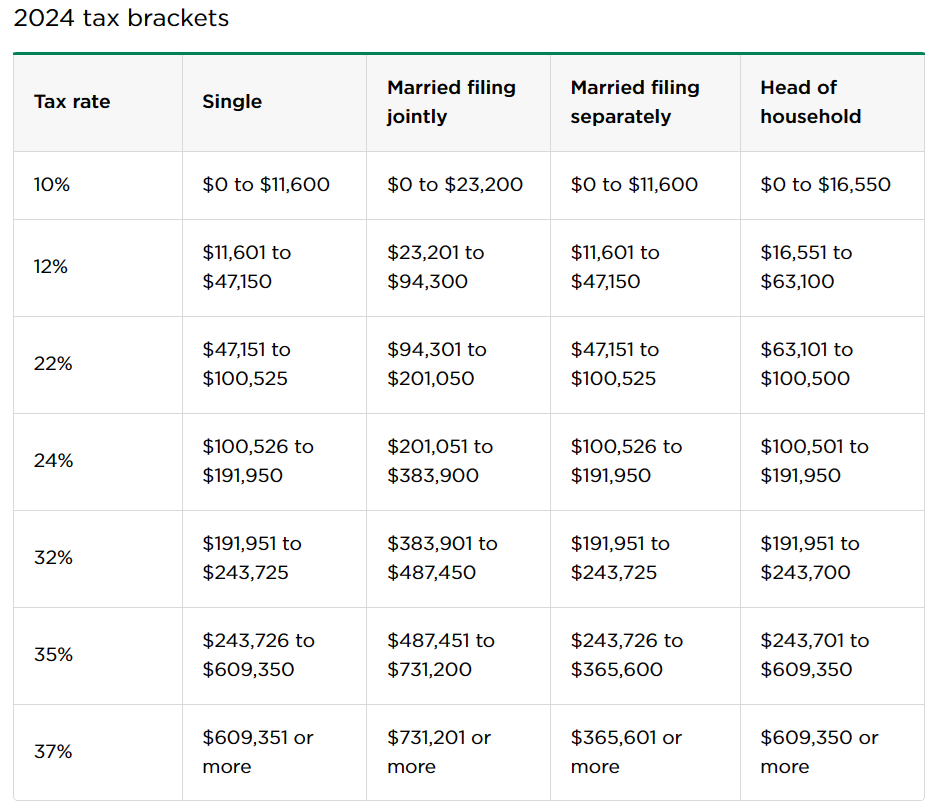

2024 Ordinary Income Tax Brackets

For starters, here is a look at the ordinary income tax brackets for 2024. As you likely know, the rates are progressive (higher income means a higher tax rate) and stepped (you don’t pay one rate, but you pay the rate for your income in each range). This is basically the rate you pay on earnings from your job, for example.

source: Nerd Wallet

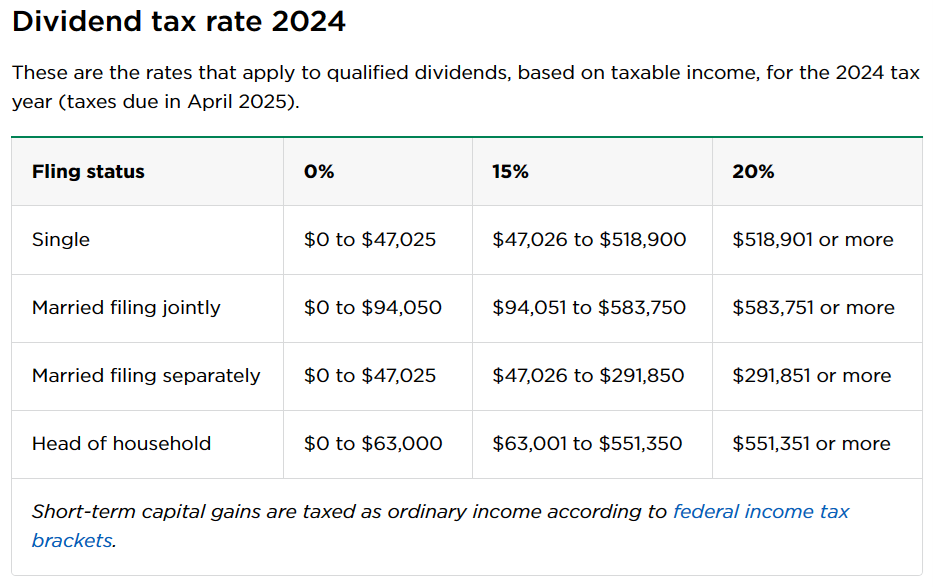

2024 Investment Income Tax Brackets

You pay varying tax rates on your investment income, such as the tax rate on interest income from bonds and dividend income from stocks. Interest income is generally taxed at your ordinary tax rate (see earlier table) unless it is income from municipal bonds, for example (in this case you may be exempt from paying federal tax) or if you hold it in an Individual Retirement Account (in this case you generally won’t pay any tax until you start making withdrawals during retirement).

However, dividend income on stocks may be taxed at a lower rate if the dividends are “qualified.” Here are the 2024 qualified dividend tax brackets.

source: Nerd Wallet

As you can see, you can save money by owning stocks that pay qualified dividends (generally, ordinary common stocks fall into this category). However, some income-producing stocks don’t count as “qualified dividends.” For example, some or all of the dividends on Real Estate Investment Trusts (REITs), Closed-End Funds (CEFs) and Business Development Companies (BDCs) may generally NOT be qualified (and you’ll end up paying your higher ordinary income tax rate.

And if your income is low enough in any given year, you won’t pay any tax on your qualified dividend income.

2024 Capital Gains Tax Brackets

If you sell your investments at a gain then you generally pay capital gains tax, and the capital gains tax rate is different for long-term investors (over a year) and short-term investors (less than a year). For example, if you bought Meta stock ten years ago for $100 and sell it this year for $300, then you pay long-term capital gains tax on the $200 difference, as per the tax rates in the table below.

source: Nerd Wallet

However, if you buy Meta stock this year for $100 and sell it later this year (less than one year) at $300 then it’s a short-term gain and you are taxed on the $200 gain at your ordinary (higher) income tax rate.

Individual Retirement Account (IRA) Tax Rates

Importantly, you generally don’t pay income tax or capital gains tax on money in your IRA until you start taking withdrawals during retirement. This creates a huge tax savings opportunity for those saving for retirement (because the money/ investments can grow tax free for years). However, when you do start taking withdrawals (during retirement) it’s taxed at your ordinary income tax rate (which may be lower during your retirement years, depending on your situation).

Tax Strategies

These different tax brackets open a world of beneficial tax strategy opportunities. For example:

You may want to wait for at least one year before you sell a stock at a gain (so you qualify for the lower capital gains rate).

You may also want to be selective about your dividend stocks (so you get the lower qualified dividend tax rates). Or consider holding non-qualified dividends in non-taxable retirement accounts (depending on your personal situation).

You can benefit enormously by making regular contributions to those retirement accounts (and you may want to be strategic about the size of your IRA withdrawals each year during retirement because it can lower your total taxes, depending on which ordinary income tax bracket you fall into each year).

You may want to be strategic about which years you (and/or your small business) recognize income (because it can impact your taxes and even your cost of health insurance if you have an Affordable Care Act plan).

The Bottom Line

Taxes are one of the biggest expenses you will pay throughout the course of your entire life. Be strategic about it people!