Exchange Traded Funds (ETFs) are heaped with praise (and continue to gain market dominance). The popular narrative is they provide dramatically better performance than actively managed funds (due to lower fees and less “unsystematic risk”). But just as Fat Tony called Dr. John a sucker (see ludic fallacy) in Nassim Taleb’s famous Black Swan 100-coin-flip example, I’m saying passive ETFs actually hurt investor returns more often than they help. Here are four big performance problems with passive ETFs, and two bottom-line solutions.

1. Market Timing

ETFs make it easier for investors to trade in and out of the market with their entire portfolio anytime they want, and this “market timing” leads to dramatically worse returns (i.e. market timing is a bad idea). At least that’s what this old school study from 2013 (The Dark Side of ETFs and Index Funds) found. Specifically:

“individual investors worsen their portfolio performance after using these products compared with non-users…”

and the reason:

“is primarily due to bad market timing.”

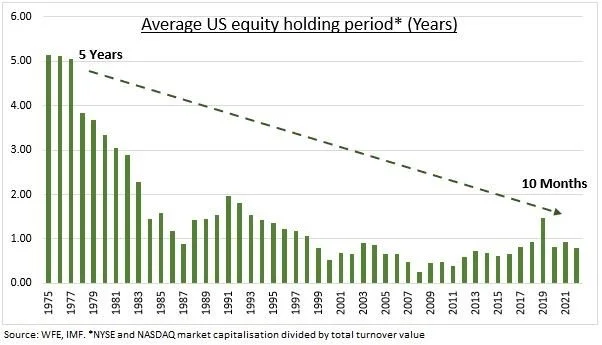

And considering the average investment holding period continues to shorten today (see charts below), I believe the market timing mistake is exacerbated by low-cost passive ETFs.

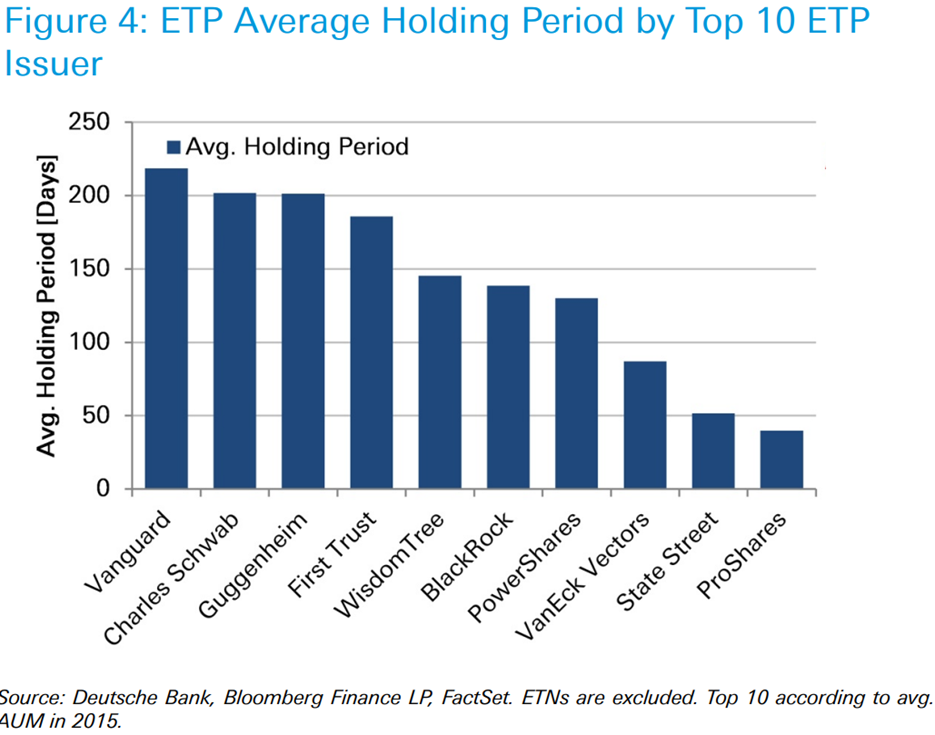

ETP is Exchange-Traded Product. Old data (2015) but still provides important perspective.

So in this case, the problem isn’t the low-cost passive ETF itself, but rather the bad behavior it enables.

2. Advisor Fees

Financial advisors are increasingly using passive market ETFs for clients (which may sound like a good thing), however they also continue to charge high fees.

For example, consider a financial advisor who charges a 1.5% annual fee to invest her clients in low-cost passive ETFs. Now compare that “fee-based” advisor to an old school “commission-only” advisor that uses mutual funds that charge a 0.75% annual fee, plus an upfront 3% sales charge (load) and an additional 0.25% annual sales charge to the advisor. That upfront sales charge might sound draconian, but if you do the math, after about 6 years it’s a wash (in terms of fees, assuming you’re a buy-and-hold investor) and over the long-term (more than 6 years) the mutual fund may actually be dramatically better for that investor’s bottom line (because the client ends up paying much lower fees).

Of course, good advisors do A LOT more than just pick investments (i.e. tax strategies, estate planning, wide-ranging financial discussions), but if they’re charging you much more than 1% per year—they’re probably charging you more than they’re worth (i.e. the passive ETF strategy (of said advisor) is actually hurting your returns again).

3. Niche ETFs

Investors often conflate the benefits of low-cost, passive market ETFs (such as Vanguard’s VOO and VTI) with specialized niche ETFs, and this can be a costly mistake. A lot of niche ETFs are focused on specific industries, styles, or gimmicks, and they typically charge much higher fees. What’s worse, these niche high-cost ETFs typically just provide overlap to what you already hold in VOO or VTI. The contsant loud praise for low-cost passive ETFs, combined with the proliferation of expensive niche ETFs, confuses many investors. It causes many to make bad decisions and often lowers their net returns dramatically.

4. Valuation Dying, Cryptocurrency Rising

A negative externality of passive ETF investing is that fundamental security valuations are increasingly disregarded to the detriment of investors. For example, this Financial Times article explains:

“In a system in which passive funds monopolise investment flows, the price of a security ceases to function as a gauge of a firm’s underlying prospects. This distorts the cost of equity and the price of credit.”

Said differently, when the market rises and falls it drags all securities held within an ETF higher and lower whether or not they are fundamentally good or bad companies. This can lead to bad companies being able to raise capital through debt and equity offerings when they shouldn’t be. And this is bad for the economy (and investors) because it increasingly leads to an inefficient allocation of capital (i.e. more defaults and losses that someone is ultimately on the hook for).

As another example, an entire generation of “investors” has absolutely no idea how to value an investment (because they just buy ETFs), and this disregard for valuation leads to the belief that cryptocurrency is an “investment” (even though it produces no earnings, pays no dividends and has zero physical value).

Further shirking responsibility, passive investing can give a lot of power to the large passive investment companies, such as BlackRock (i.e. iShares ETFs) who faces increasing legal and business pressures for arguably putting their political ESG views ahead of their fiduciary responsibilities (to the detriment of investor returns).

The 2 “Bottom-Line” Solutions:

First and foremost, you need to do what is right for you. That means don’t let your performance fall victim to market timing, don’t pay for an advisor that adds more fees than value, don’t shrink your total returns with expensive niche ETFs, and don’t forget that valuation does matter for investment markets to function efficiently.

And secondly, if you’re not comfortable doing it yourself, then the best investment advice is the same as it’s always been—work with someone you trust.