Verizon is big dividend (6.5% yield) blue chip that is dying very slowly. Specifically, wireline revenue continues to shrink and wireless revenue isn’t growing. Further, higher interest rates spell double trouble as interest expenses are up and as now higher bond yields provide an increasingly compelling alternative for investors. Further, the valuation isn’t particularly compelling. Yet there are still good reasons why some investors may want to own these shares. Let me explain.

Big Steady Income

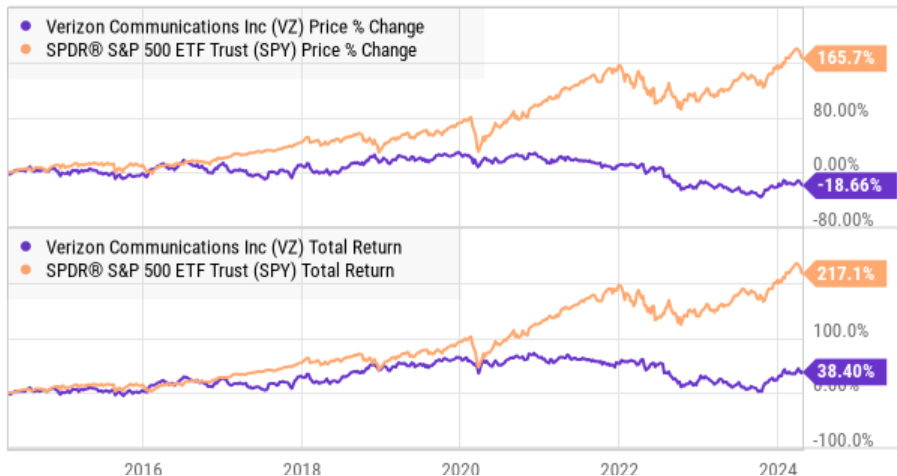

Some investors compete for the sake of competition, and they won’t be satisfied unless their returns are greater than (or at least as good as) the overall market (such as the S&P 500). Verizon’s long-term total returns, on a go-forward basis, have very little chance of matching the returns of the S&P 500. However, Verizon provides something different. Specifically, it provides big steady income.

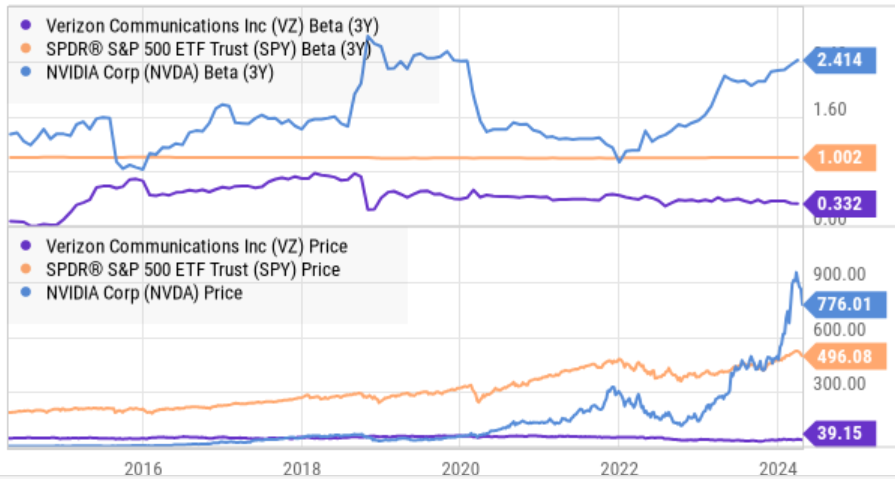

Even though Verizon rival, AT&T (T), was forced to cut its dividend a few years back, and Verizon may eventually be forced to do the same, it will continue to pay a big dividend, with a relatively steady share price (as compared to the overall stock market) for years (and decades) to come (Verizon has a low “beta”). And for some less competive investors, that’s really all they want.

Some investors view Verizon as a steady way to meet their income needs and as a way to add some diversification and stability to their long-term income portfolio. And they are perfectly satisfied with returns that don’t have the same dramatic upside (or the dramatic downside) as some of the popular high-growth stocks (such as Nvidia (NVDA), see above) that often capture media attention.

Financially Speaking

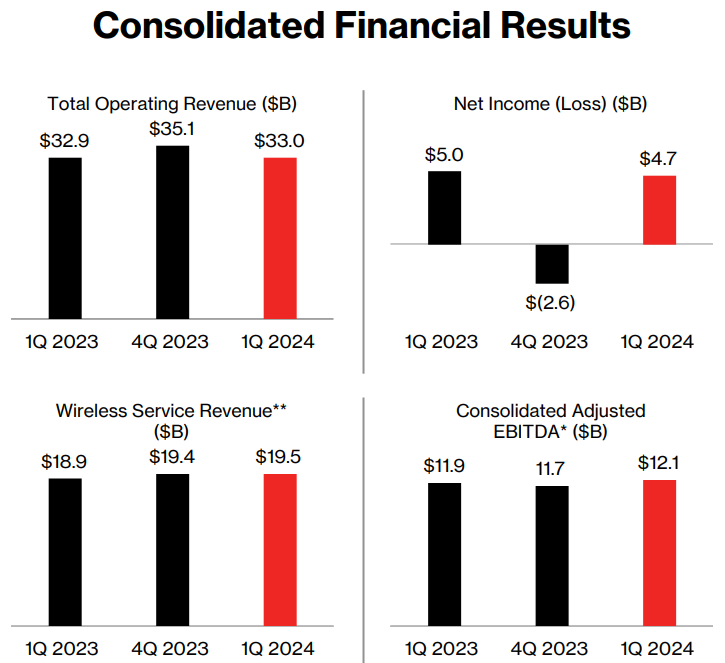

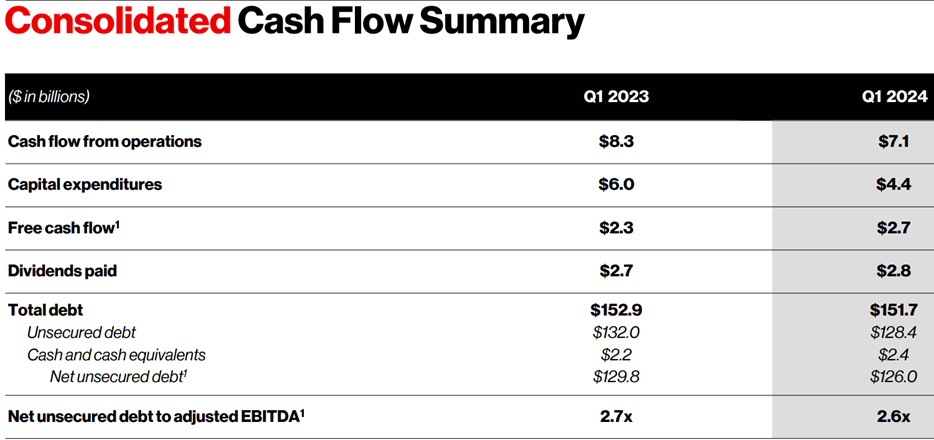

Verizon’s latest quarterly earnings essentially show stagnant revenue and tight cash flow (as compared to the dividend payout), but steady positive net income.

And Verizon services are a critically important part of the economy (Verizon’s services are not going away).

And one challenge in paticular the company noted in its earnings release was higher interest rates:

Interest expense for the first quarter was $1.6 billion compared to $1.2 billion for the first quarter 2023 due to lower capitalized interest and higher interest rates on our outstanding debt balance.

Not to mention, the 6.5% dividend yield is becoming less compelling as compared to bonds, as interest rates on bonds have risen from around 0.0% to almost as high as Verizon’s dividend (depending on duration and credit quality)

Valuation:

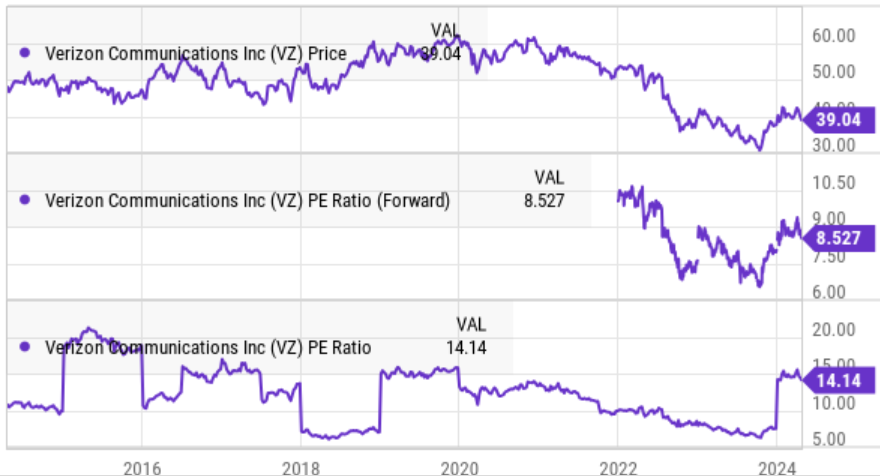

From a valuation standpoint, Verizon isn’t particularly compelling either. For example, earnings just released were $4.7 billion in Q1, so even if we generically annualize that (ignoring seasonality) it trades ($4.7 x 4) / 170B) mkt cap) or approximately 9x earnings. And here is at look at historical valuation metrics.

And as alluded to earlier, Verizon has not been particularly compelling on a total returns basis (price gains plus dividends reinvested) as compared to the S&P 500, an underperformance trend that I expect to continue over the long-term (again, the business really isn’t growing).

The Takeaway:

If you are trying the beat the S&P 500 (or even just keep pace with it) then stay the heck away from Verizon! It’s not going to happen!

However, if the market were to temporarily crash, Verizon would likely crash a lot less, and you would have short-term bragging rights. But inevitably, the market is going higher and Verizon will not keep up over the long-term.

On the other hand, if you are looking for big steady income and less market volatility, Verizon may certainly help you achieve that goal (it can even add a little risk-reducing diversification to your overall investment portfolio).

It really all comes down to your personal investment goals. Don’t get distracted by the media pundits with megaphones. Instead, do what is right for you!