It takes a special mindset (and a certain financial fortitude) to be a long-term growth stock investor. But if you can persevere through years of lumpy financial results, whipsawing volatility and the constant drumbeat of naysayers, you could end up getting in early on the next mega-cap growth stock. In this report, we rank our top 10 “non-mega-cap” growth stocks, starting with #10 and counting down to our top ideas.

What is a Mega-Cap Stock?

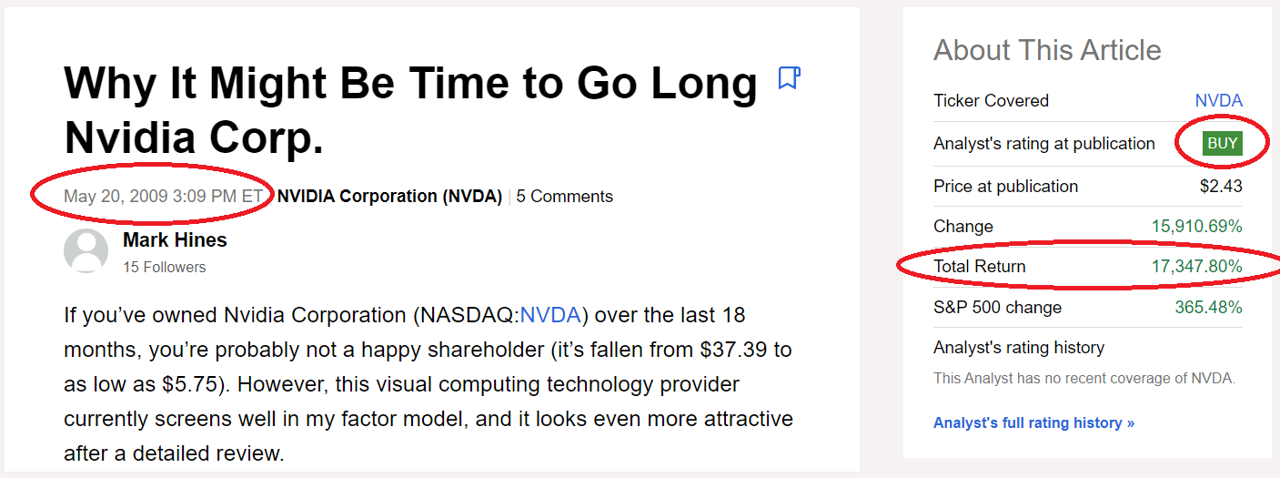

There are a variety of definitions of “mega-cap stock,” such as companies with market capitalization over $200 billion, or companies with market caps in the top 50th percentile of the S&P 500, but in a nutshell—mega caps are really big companies (think Apple, Microsoft, Meta, Google and Nvidia). Furthermore, mega caps all started out as significantly smaller businesses. And if you had invested early, then you would have enjoyed significant long-term gains. For example, if you would have invested in Nvidia back in 2009 (when it was still just a mid-cap stock), you’d be up over 17,347%!

And while many mega-cap stocks can still go much higher (and likely will), its much more challenging for very large companies to continue growing at such a rapid rate (because they’re already so big). Therefore, we exclude mega caps from our rankings in this report (although we do include a few in our table below, for reference).

Recent “High-Growth” IPOs

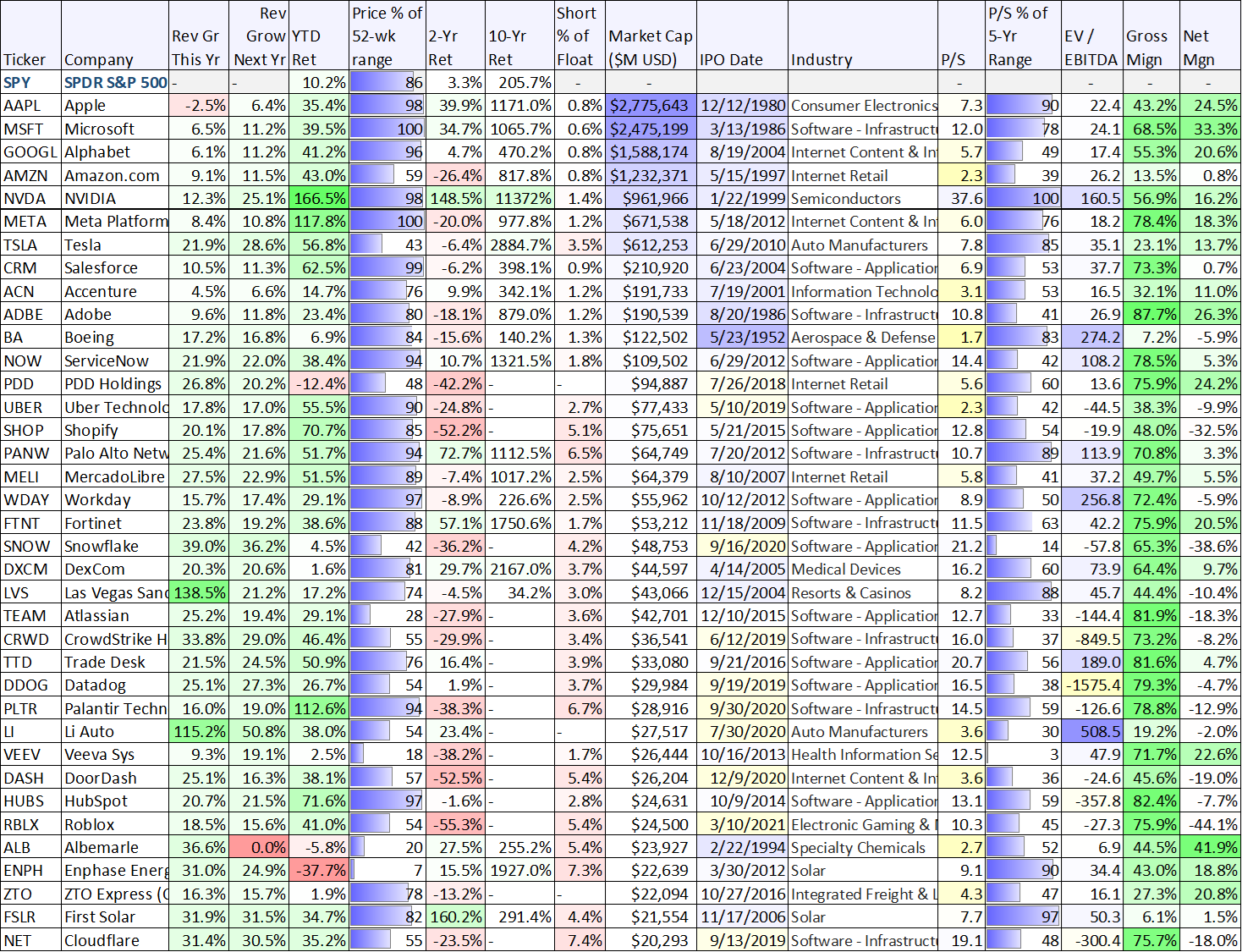

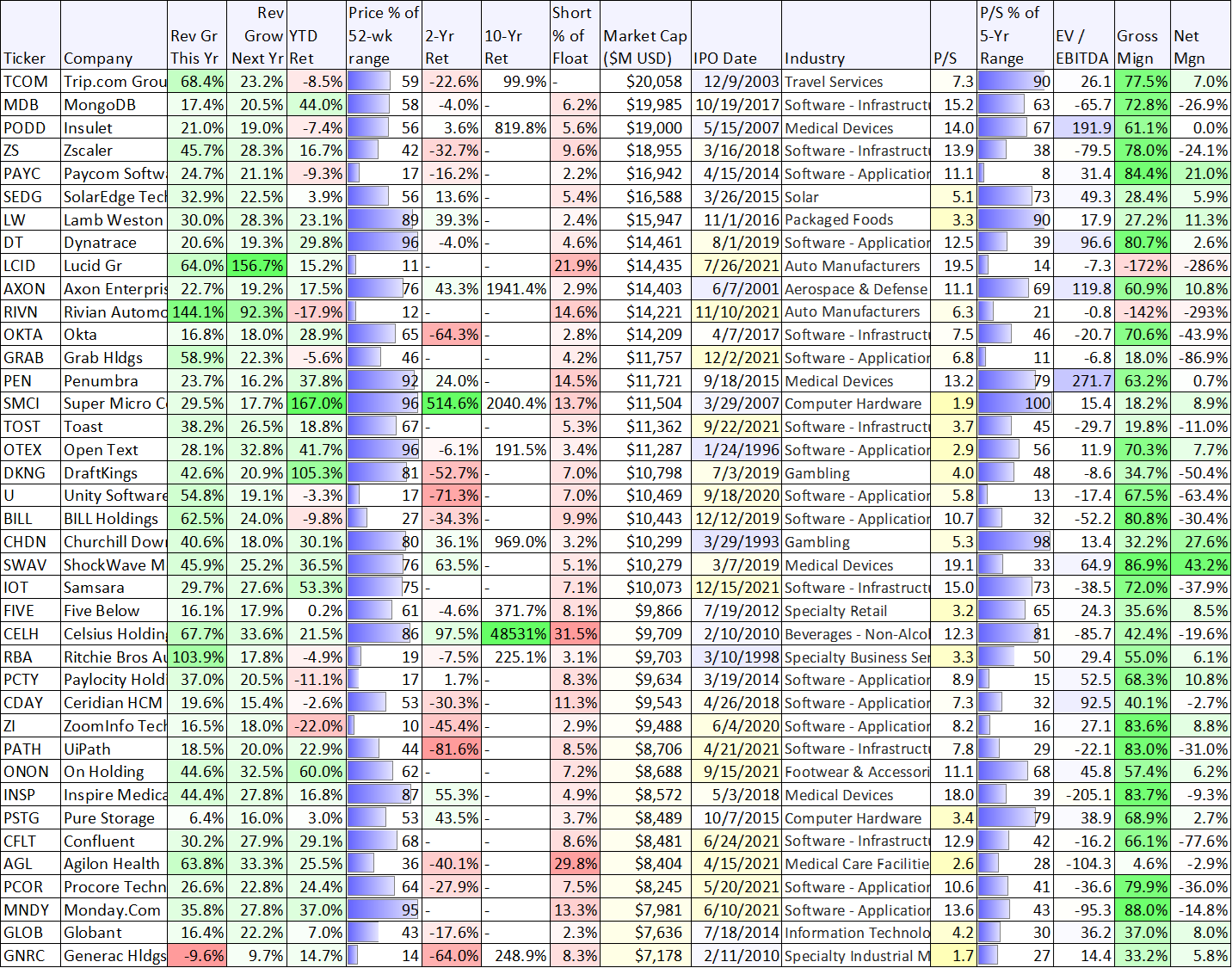

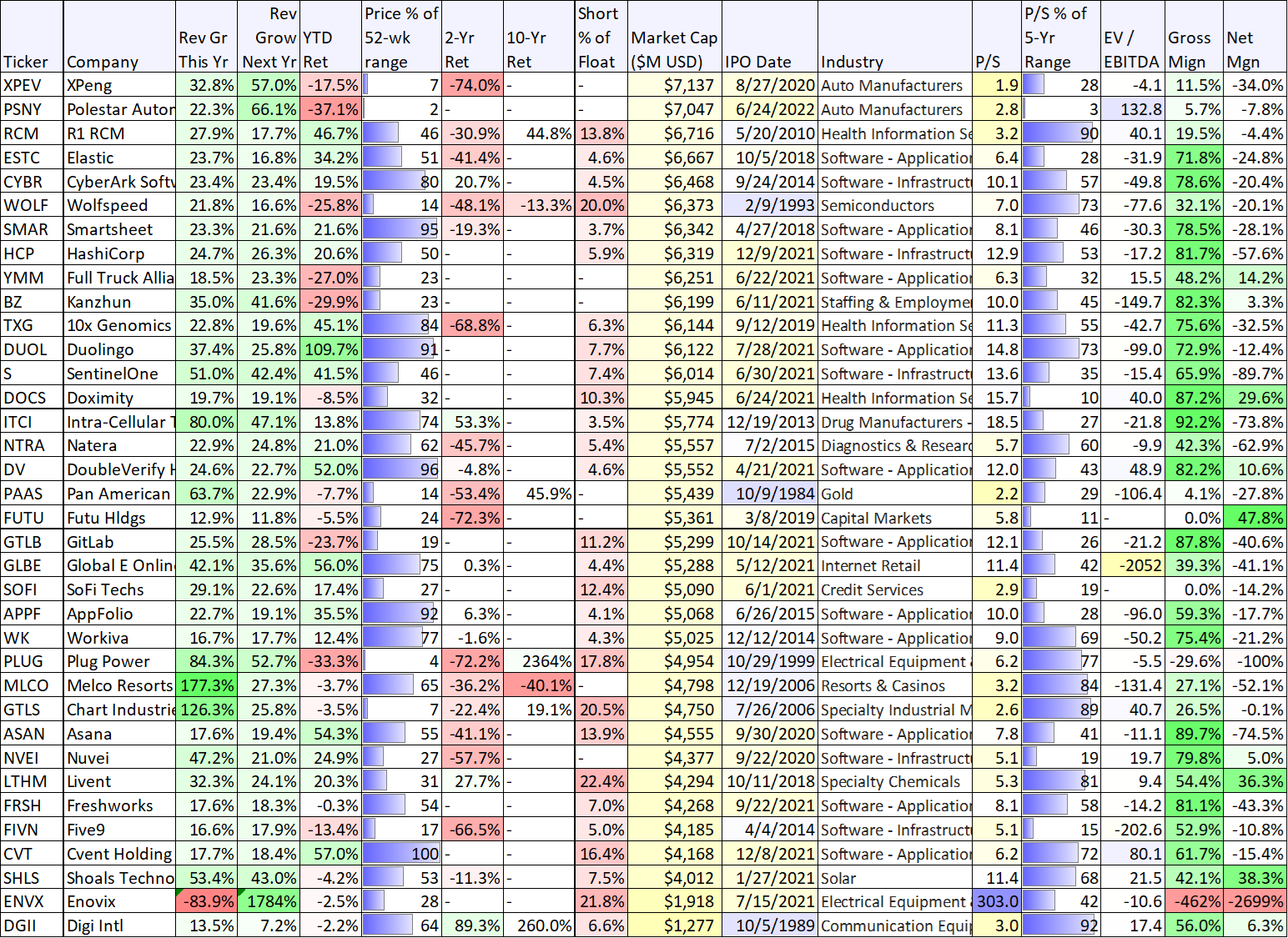

Before we get into our top 10 rankings and countdown, it’s worth considering the recent batch of newly-public high-growth companies (IPOs within the last few years) as you can see in the following table (see “IPO Date” column).

(access a downloadable spreadsheet version of this chart here).

The companies included in the above table have high growth rates (most of them over 15% revenue growth, for this year and next), and we also added a handful of well-known mega-cap stocks for comparison purposes.

Not surprisingly, there were a lot of growth stocks that went public in 2019-2021 when market valuations were very strong (and they could raise a lot of capital by selling shares at a very healthy price). However, as you can also see in the table, a lot of these recent IPOs have performed very poorly over the last two years as valuations have come down significantly (see 2-year return column). You likely recognize at least a few of the popular names in the table.

So with that backdrop in mind, and before we get into our official top 10 ranking, let’s start with an honorable mention from the above table.

*Honorable Mention: Celsius Holdings (CELH)

Celsius (it has a $9.7B market cap in our table, sorted by market cap) is basically an energy drink company (offering a variety of flavors with proprietary clinically-proven formulas), and its revenues have been growing at an absolutely incredible pace. The driving force behind its recent rapid revenue growth is its relatively new (within the last year) distribution deal with Pepsi. According to CEO John Fieldly in the company’s latest earnings press release):

“During the first quarter of 2023, Celsius delivered an all-time quarterly record revenue of $260 million in sales and over $34 million in net income, driven by expanded availability and increased consumer awareness. In addition, we continue to further transition into PepsiCo’s best in class distribution system.”

Distribution is a huge deal, and if you’ve been in a US grocery or convenience store lately, you’ve probably come across a Celsius display, such as the ones below.

Celsius has plans to keep growing. Its corporate mission is:

To become the global leader of a branded portfolio which is proprietary, clinically-proven or patented in its category, and offers significant health benefits).

And as compared to competitor Monster Beverage (distributed by Coca-Cola), Celsius continues to have significant room for growth in terms of revenue and market cap.

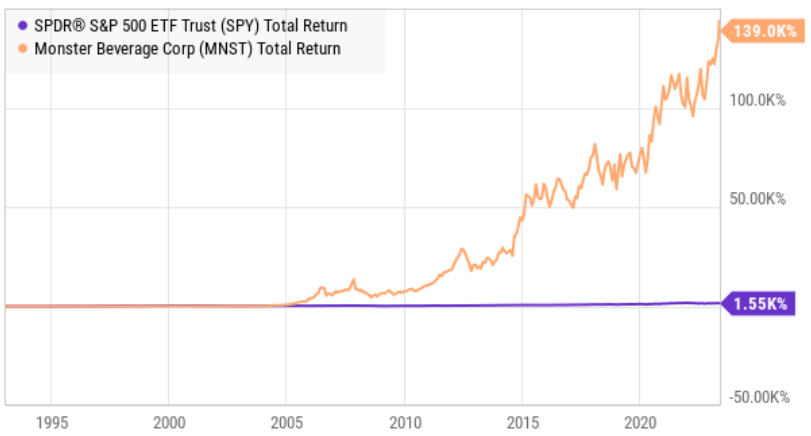

And if Monster’s historical price returns trajectory (following its Coke deal) is any guide (see below), Celsius is still just getting started.

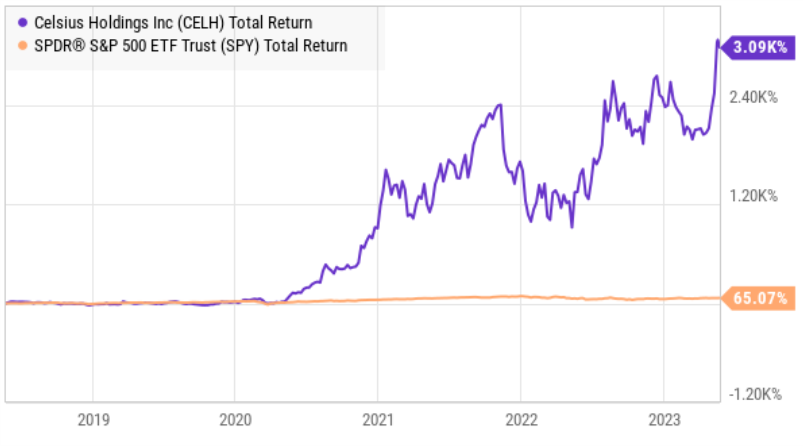

For reference, here is a look at Celsius’ recent price returns (below). The shares started to take off during the pandemic as lockdowns forced sales outside of mainly fitness clubs and into the mainstream (and now the Pepsi deal is taking the sales to new levels).

We’ve owned the shares since they traded in the $60’s (the current price is above $130), and we’d have ranked it higher on this list if it weren’t for the recent steep share price surge (the market cap is now 12.7x TTM sales—a lot for a “consumer staples” stock) and the very high short interest (recently over 30%). We continue to own shares, and we’ll consider adding more on any steep share price pullback (because Celsius appears to still have a lot more upside ahead). If you are curious, you can access our initial 2021 Celsius report (to see how we were thinking about it during the pandemic and before the Pepsi deal) using the following link.

Now let’s get into the actual top 10…

10. Datadog (DDOG)

Datadog is a very high growth “observability and security” platform for cloud applications. Its highly-regarded solutions monitor data across the technology stack to help businesses secure their systems, avoid downtime, and ensure customers are getting the best user experience.

The company is an industry leader and will continue to benefit from the ongoing digital revolution and migration to the cloud (a secular trend that is still just getting started, and now reaccelerating following the post pandemic slowdown).

As members know, we purchased shares of Datadog in March (in the $60’s), and it is increasingly attractive following its latest earnings release, whereby it beat revenue and earnings estimates and also raised forward guidance. Growing revenues at a very impressive rate (and with gross margins near 80%, and an impressive land-and-expand track record), yet still trading at only 14.7 times forward sales, Datadog continues to present a highly attractive long-term buying opportunity. You can access our previous Datadog report using the link below.

9. SoFi Technologies (SOFI)

SoFi is an online financial services company and bank that targets younger high-income customers. It generates the majority of its revenues from loan origination, and it has recently faced heavy fear and selling pressure. Specifically, a Supreme Court decision (regarding student loan forgiveness and forbearnace) is expected in the next few weeks, and it could significantly affect the business and the share price.

In addition to legal challenges, fear regarding recent bank failures has kept the price artificially low in our view (the shares trade at only 2.9 times sales) despite continuing rapid revenue growth.

Rising interest rates have been a significant driver of revenue growth recently as the shares head toward GAAP profitability this year. And if sentiment changes (like we believe it should) these shares can rise significantly in the short run, and over the long-term the upside is even bigger as the total addressable market opportunity is quite large. You can access our recent SoFi report here.

8. Albemarle (ALB)

As lithium demand grows (and supply remains limited), Albemarle is increasingly attractive. The shares are down 36% from their 52-week high, but the business continues to strengthen (i.e. revenues are growing very rapidly, the market opportunity is huge and profit margins remain strong). In the following note, we consider the company’s latest strategic effort, its valuation and our opinion on investing (i.e. we own shares).

The Top 7:

Our top 7 growth stock ideas are reserved for members only, and they can be accessed here. We currently own all of the stocks on this top 10 list, and we believe the market continues to present some select, but truly impressive, long-term growth opportunities.

The Bottom Line:

If you have what it takes (and if it is consistent with your goals) the market continues to present a select variety of very attractive long-term growth opportunities, such as the ones described in this article. Just know that short- and mid-term price volatility can be the price you pay for powerful long-term price returns and compounding. We currently own all 10 of the stocks on this list (within our 30+ stock, Disciplined Growth Portfolio). And we believe that disciplined goal-focused long-term investing will continue to be a winning strategy.