Closed-end funds (CEFs) are often an income-investor favorite because they can offer big distribution yields (often paid monthly). However, CEFs come in a variety of shapes and sizes. In this report, we share a list of important information on over 100 big-dividend CEFs and then share more information on five of them that we believe are particularly attractive right now.

100 Big-Dividend CEFs

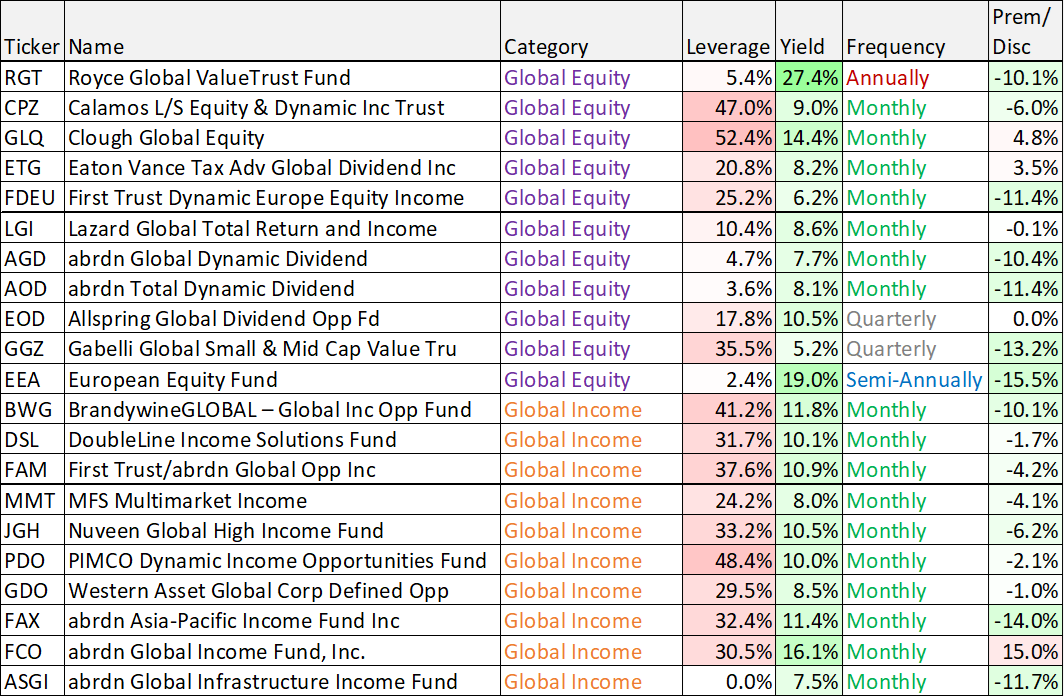

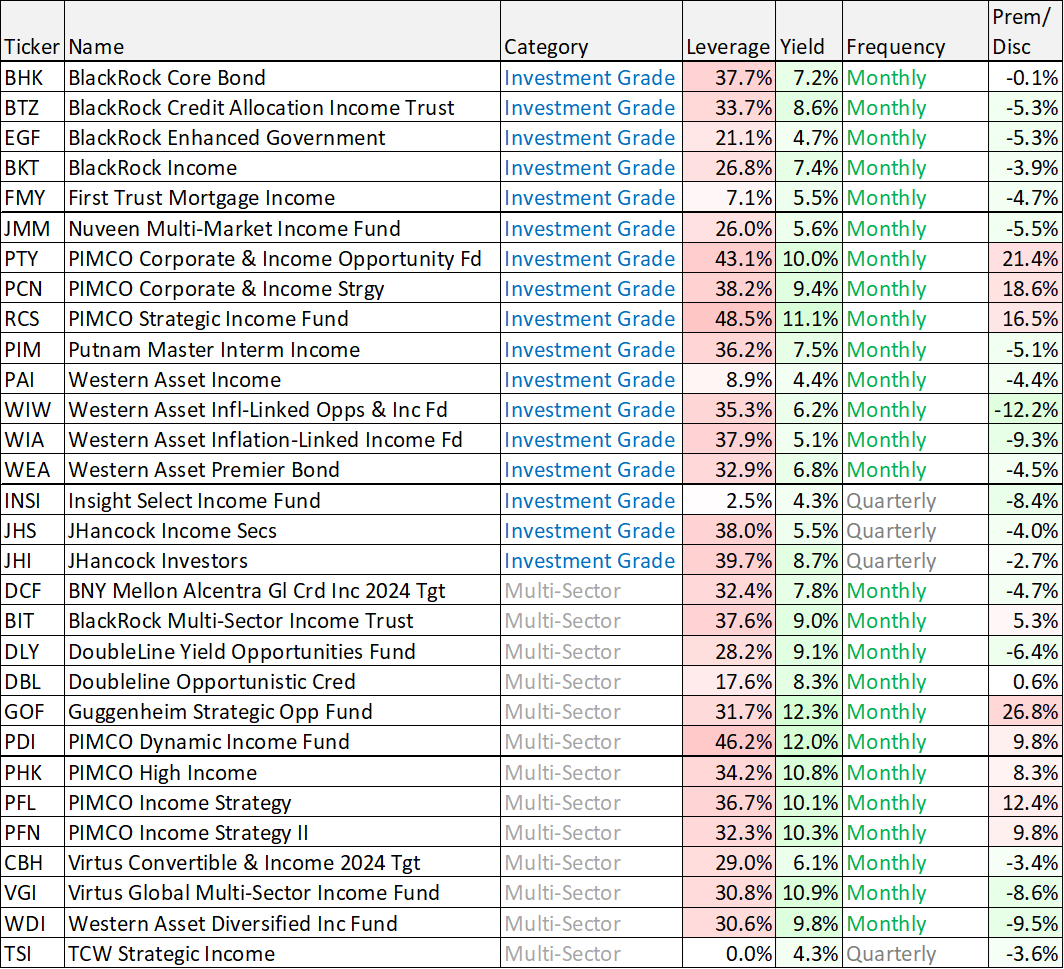

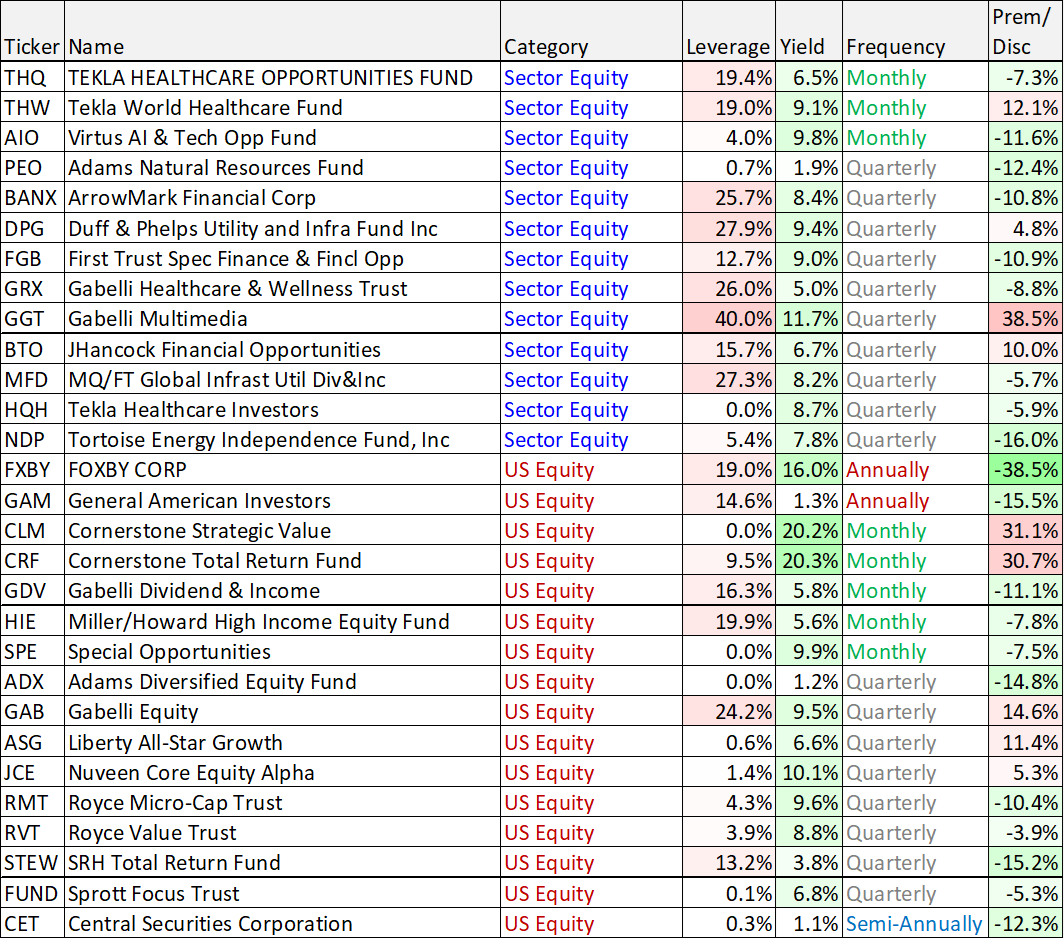

For starters, here is the list of 100, including names, tickers, categories, leverage, yields, dividend frequency and premiums/discounts. The list is sorted by category.

You may recognize a few of your favorites on the list (for example, there are a lot of popular PIMCO CEFs that current trade at premiums to NAV).

5 Top Big-Dividend CEFs Worth Considering:

We’ve reviewed the list, and offer more information of 5 big-dividend CEFs that we find particularly attractive, as described below.

BlackRock Credit Income Trust (BTZ), Yield: 8.6%

BTZ is an attractive investment-grade bond CEF that offers a compelling yield (currently 8.6%) paid monthly, and it currently trades at a nice discount to NAV (~5.3%). We have owned this fund in the past, and appreciate the strong management team and resources of BlackRock (not to mention the very reasonable management fees as compared to some other bond CEFs). Furthermore, we really like this fund now because as inflation slows, the fed will likely reduce its interest rate hike trajectory, and as interest rate expectations fall, bond prices (e.g. BTZ) will rise. Bond funds often use more leverage than stock funds (by way of regulation, bond funds are typically allowed up to 50% leverage) and BTZ clocks in with 33.7% leverage—a healthy dose that will likely magnify income payments and price appreciation over time (knock on wood). We are currently considering re-adding BTZ to our Income Equity Portfolio (we sold it earlier this year to avoid some losses).

Adams Diversified Equity Fund (ADX), Yield: 6.0%+

The Adams Diversified Equity Fund has been paying dividends to investors for over 80 years! And we currently like it for a variety of reasons including its wide price discount to NAV. ADX currently trades at a 14.7% discount, which makes its 0.58% expense ratio (which is very low to begin with) even easier to accept. The fund invests in equities across sectors, but currently (and typically) has larger allocations to some growthier sectors (such as technology and consumer discretionary). Because of the sector allocations, the fund is down this year (much like the rest of the market), but is also poised for a strong rebound as inflation eventually falls and the market recovers. Furthermore ADX is a great way to get exposure to sectors that typically aren’t know for paying high dividends (such as technology and discretionary) as ADX generates its income from a combination of dividends and long-term capital gains (no recent returns of capital, although the fund has had some short-term gains recently as management repositions the fund for market conditions). The fund typically uses zero leverage (a good thing for risk averse people). One caveat with this fund is that it pays three smaller dividends in the first three quarters of the year, followed by a larger fourth quarter dividend (to bring the annual yield to at least 6%—often more), and that fourth quarter dividend is still coming up at the end of this year. Given the big yield, discounted price and well-managed attractive strategy, ADX is absolutely worth considering for a spot in your income-focused portfolio.

Attractive 11.6% and 10.1% Yields: Try Small Cap CEFs Now

Unlike the S&P 500, the Blue Harbinger Income Equity Portfolio has posted a positive return so far this year. There are a lot of factors that have contributed to the outperformance, and one has been the noticeable omission of small cap stocks. However, there is growing evidence to believe now is an attractive time to add an allocation to small cap stocks within your portfolio. In this report, we review two very attractive ways to do that (particularly if you are an income-focused investor) with two highly-compelling closed-end funds (CEFs) that offer big double-digit yields. We review all the details in this report. Read more.

Two More Particularly Interesting Big-Dividend CEFs

After reviewing the list, and taking into consideration current market conditions, two more CEFs standout as particularly interesting. They’re both more-or-less sector-specific CEFs (and the sectors are particularly compelling at this point in the market cycle). They both also offer double digit yields and attractive price discounts versus their net asset values. You can read more here.

The Bottom Line

CEFs are a unique high-income investment class, considering their instant diversification (they hold many securities), high distributions payments and potential to trade at wide discounts and premiums versus NAV (we generally prefer to buy at discounted prices). In our view, CEF can be an important part of a prudently-diversified, long-term, income-focused portfolio, depending on your unique individual needs and situation.