If you have the luxury of being a long-term investor, you have a distinct advantage and highly lucrative opportunity that is not available to others. Specifically, you can benefit from long-term compound growth (the eighth wonder of the world), particularly as it pertains to powerful secular trends. In this report, we review one such business (a SaaS application monitoring company) that will benefit from cloud migration and digitization secular trends over the long-term, despite the recent steep share price sell off (buying opportunity) so far this year.

Datadog (DDOG)

Datadog is a performance monitoring and security platform for cloud applications. It’s Software-as-a-Service (SaaS) solutions monitor data across the technology stack to help businesses secure their systems, avoid downtime, and ensure customers are getting the best user experience. The company was named a leader in the 2022 Gartner Magic Quadrant for Application Performance Monitoring and Observability.

Datadog’s website gives a variety of use case examples on how its adds value for clients, such as these two, for example:

“During Neto’s migration project, the visibility provided by Datadog was critical to maintaining platform reliability and ensuring business as usual for Neto’s customers. For six months, Neto’s legacy and cloud infrastructures were running simultaneously as customer assets were transferred from MySQL to hosted Amazon Aurora databases. Datadog helped ensure the accurate, on-time migration of these customer assets by collecting, aggregating, and displaying metrics from databases in both environments on a single platform.”

“Our DevOps and SRE teams use the Datadog RUM to APM connection to visualize the full user journey and pinpoint the exact source of an errant or slow customer request. The automatic correlation of the frontend and backend enables our teams to communicate using the same language when resolving errors across the stack.”

Rapid Revenue Growth

One of the most astounding characteristics of Datadog is simply its rapid revenue growth—a clear indication that users value the company’s offerings. For example, here is a look at quarterly revenue growth going back to 2018 (Datadog was founded in 2010, but went public via IPO on September 19, 2019).

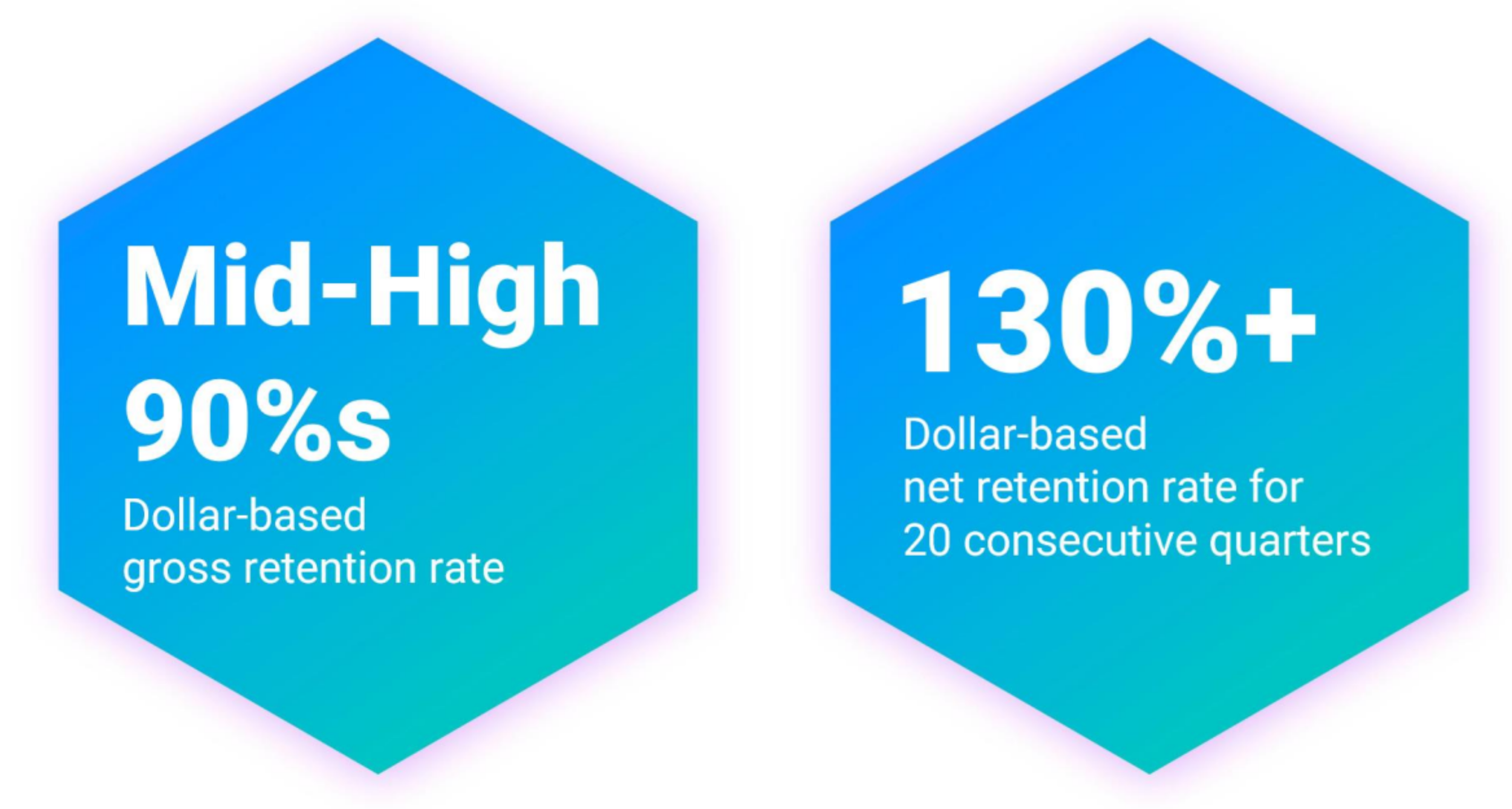

Important to note is that revenue is sticky, as Datadog demonstrates both high gross and net retention ratios, meaning customers don’t often leave, but they do often expand the relationship by adopting more Datadog products.

Large TAM

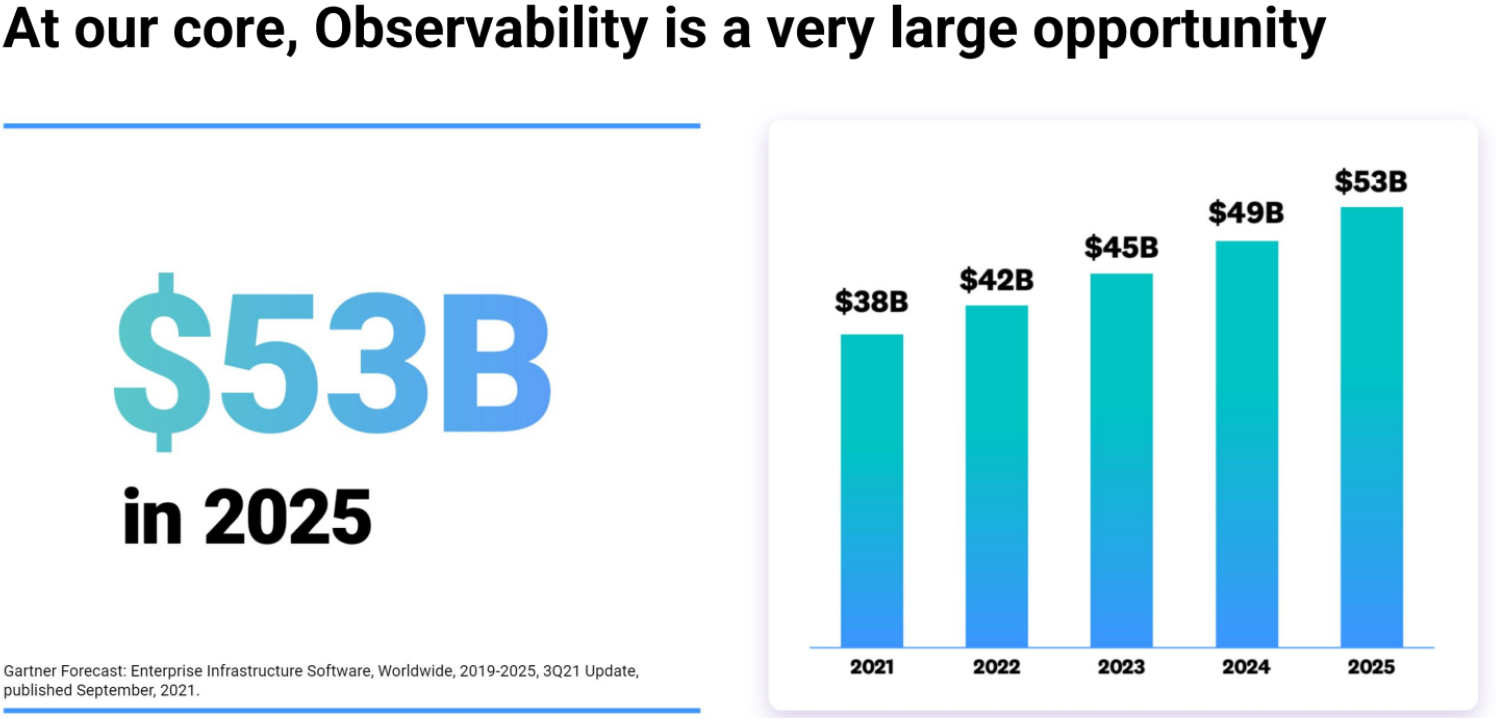

And what makes this high revenue growth trajectory even more attractive is simply that there is a large total addressable market (“TAM”) so the company can continue to grow rapidly (i.e. Datadog has room to run if it can keep executing).

To be specific, Datadog’s high-growth and large TAM are fueled by the massive digital revolution and cloud migration—secular trends that incredibly are still in their early innings as organizations have a long way to go on this consistently top priority. Digitization makes things work better and faster (see use case examples above) and the migration to the cloud saves costs and improves organizational operations.

Founder-Led Business

It is also attractive that Datadog is still run by its founders. CEO Olivier Pomel cofounded the company along with CTO Alexis Lê-Quôc, in 2010. They are both self-made billionaires, as per Forbes.

Recent Earnings Update

Datadog announced quarterly earnings in early August, whereby the company exceeded expectations but noted somewhat weaker growth with large organizations. According to CEO Olivier Pomel:

In Q2, while we overall saw strong customer growth dynamics, we have seen some variability in growth among our customers. We saw our larger spending customers continue to grow but at a rate that was lower than historical levels. This effect was more pronounced in certain industries, particularly in consumer discretionary, which includes e-commerce and food and delivery customers and affected more specifically our products with a strong volume based component such as log management and APM suite. Note that we did not see this with our SMB and lower spending customers who continued growing with us as they have in the past.

While these near growth data points and the current micro climate are leading us to be prudent with our short term outlook, we remain very bullish about our opportunities and confident in our execution as we continue to see positive trends underpinning our business.

However, despite the slower growth form large customers, the long-term secular trend is firmly intact, as Pomel went on to explain:

Now let me speak to our longer-term outlook. We recognize the macro environment is uncertain as we look into the back half of 2022. But we also see no change to the long-term trends towards cloud-based services and modern DevOps environments, and Observability remains critical to that journey. We continue to drive market leadership and for our customer's value, efficiency and cost savings to solve their complex monitoring problems.

Valuation

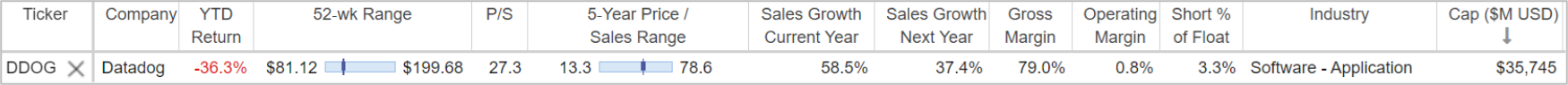

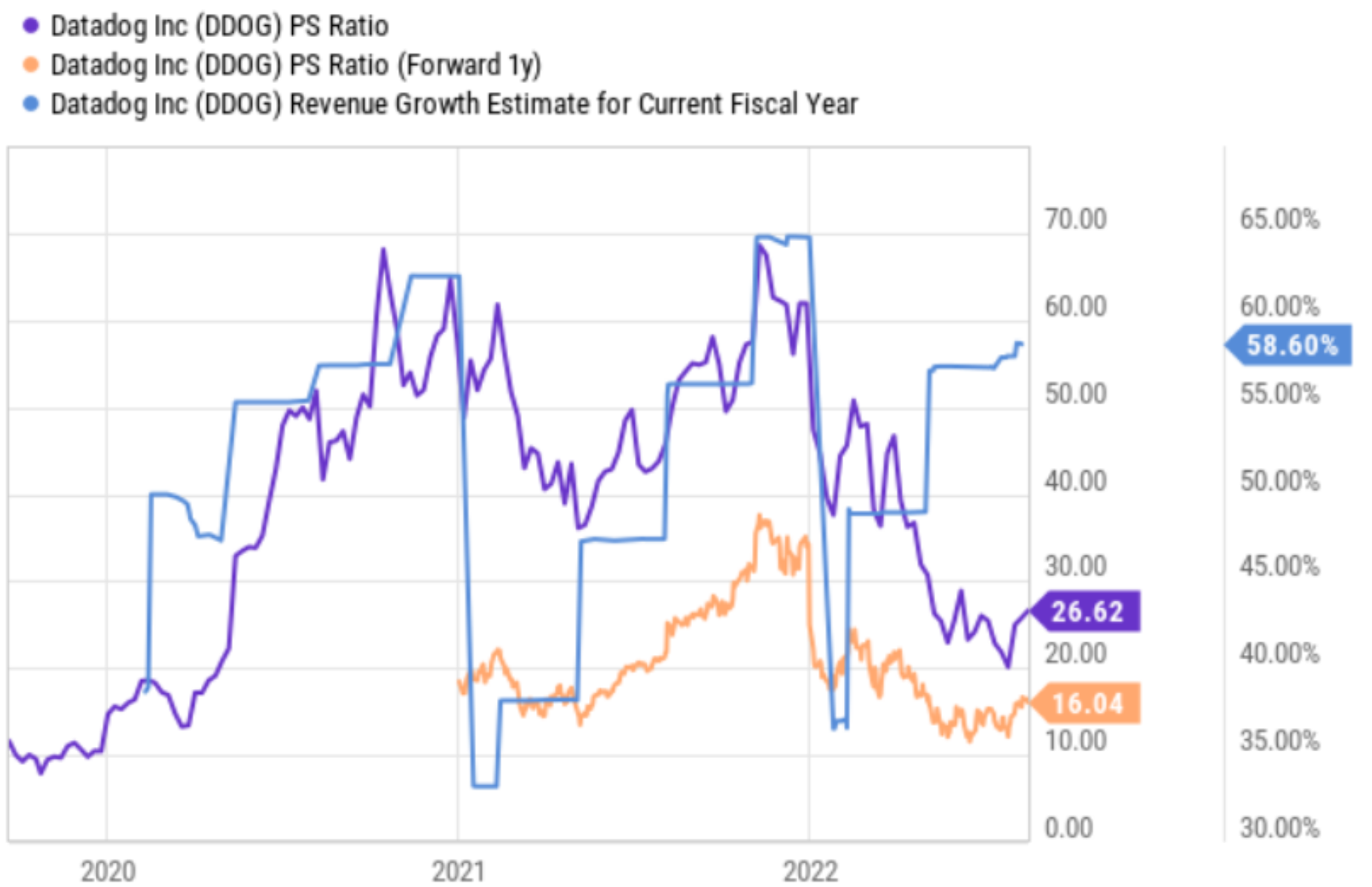

Like almost all high-growth stocks, shares of Datadog have sold off hard this year as the Fed raises interest rates. More specifically, rising rates and an economy (arguably) in recession has created near-term uncertainty, despite the fact that the long-term secular growth story remains firmly intact. Furthermore, Datadog’s financial position continues to strengthen as revenue growth continues, free cash flow grows and earnings improve.

From a price-to-sales ratio standpoint, Datadog shares currently trade at a lower valuation than typical, especially considering growth estimates remain high. Worth mentioning, Datadog has a history of providing conservative revenue guidance, which ultimately gets increased quarterly as the year progresses (as you can see in the chart below).

A 1-year forward price-to-sales ratio of 16x is arguably very high, but not when compared to an expected revenue growth rate in excess of 35% this year and next year (and as compared to the longer-term secular growth opportunities).

Risks

Of course there are risks to investing in Datadog, such as high volatility (like we have seen so far this year—the shares are down more than 36% year-to-date). However, that’s often the price you pay (volatility) for the best long-term returns. Given the company’s leadership and the large TAM, Datadog could benefit from many years of compounding growth (compound growth is truly the eighth wonder of the world, in our opinion).

Execution risk is also a factor for Datadog. It’s easy to say the growth trajectory is high and that will automatically continue, but the reality is that Datadog has to execute to bring future growth to reality. Datadog also faces competition, such as Splunk (SPLK), however the secular cloud opportunity is so large that their is room for multiple winners.

The fact that Datadog generates little earnings is another risk factor. From a long-term investment standpoint it is easy to argue that the earnings are so low because the company is investing heavily in future growth (for example, R&D margin is high and SG&A expenses are high), but at some point in the future Datadog needs to deliver strong earnings. In the immediate term, Datadog is on track for outstanding future performance, but some investors will still argue that a bird in the hand is better than two in the bush (especially in a rising interest rate environment whereby future earnings are worth a lessor amount than when rates were lower).

Recession risk is another factor to keep an eye on, especially considering Datadog is a higher volatility stock that can be hurt even harder than other businesses during a recession. The counter argument, however, is simply that the shares are already pricing in a recession considering they’re down over 36% this year and the valuation is more attractive. This argument sits well with many “buy low” investors especially considering the long-term growth story remains intact.

The Bottom Line

Datadog is an impressive high-growth business, benefiting from a massive secular trend, and the share price has sold off hard this year, thereby making for a more attractive entry point on the basis of a lower valuation and continuing exceptional long-term growth prospects. The cloud migration and digital revolution are real, and Datadog will continue to benefit. We don’t currently have a position in Datadog, but it is high on our watchlist for a future position in our long-term Disciplined Growth Portfolio.