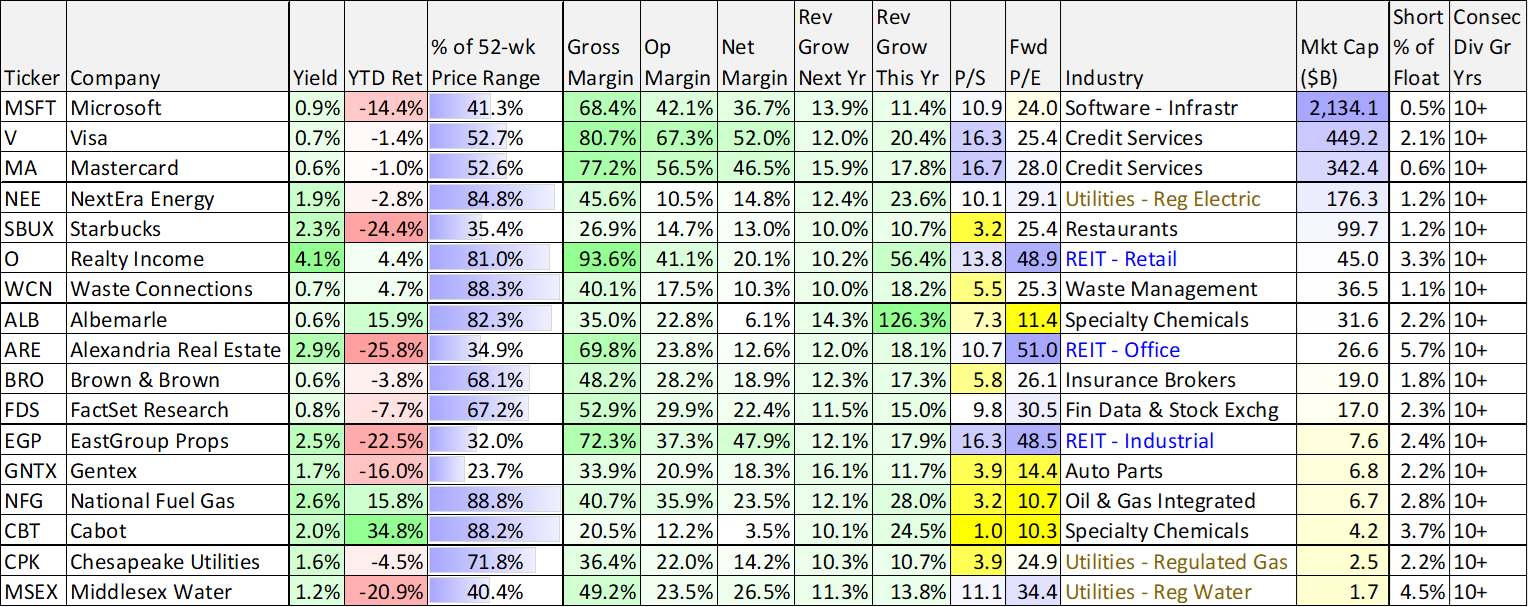

When it comes to investing, you need to know your goals and you need to do your due diligence. There are no shortcuts. However, running quantitative screens based on available data can be one source of investment ideas for further research. In this report, we share data on 15 very impressive businesses (by the numbers).

The stocks in the above table are the only ones to pass our screening requirements, including:

>10% revenue growth (this year and next),

>20% gross margins,

>10% operating margins,

At least 10 consecutive years of dividend growth.

We have written reports on several of these businesses, and in fact own a few of them. For example, here is our recent free report on Realty Income. We also own Microsoft (MSFT). And here and here are reports on two more we’ve recently written up and currently own. In fact, we currently own five stocks from this list, mostly in our Income Equity Portfolio.

But before you go investing in any of the stocks on this list, you need to first understand the business and understand if (and how) the stocks may (or may not) fit into your overall investment strategy. Disciplined, goal-focused, long-term investing has been a winning strategy over and over again throughout history. We believe it will be this time too.