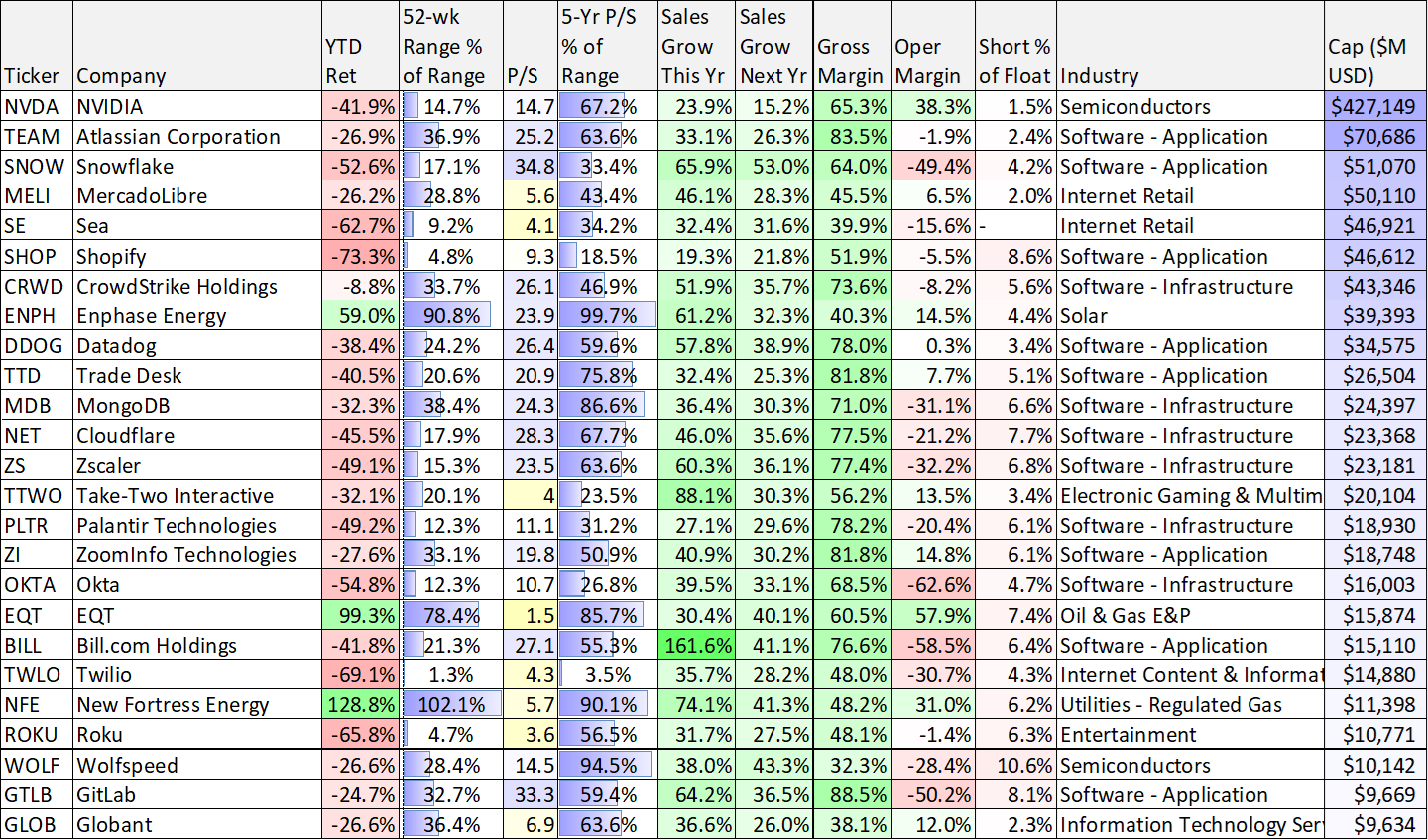

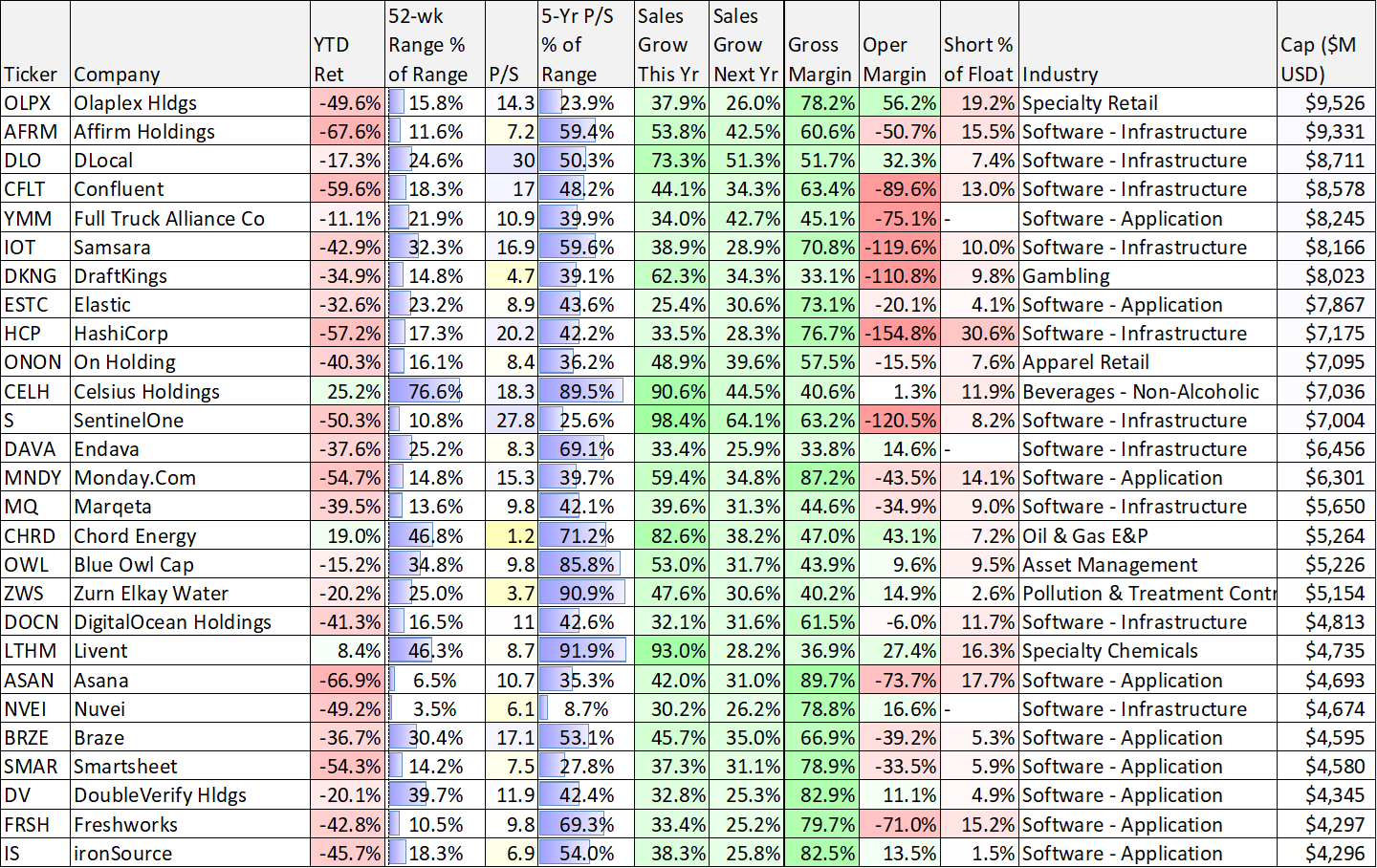

It’s been an ugly year for top growth stocks. The fed has been raising rates aggressively to battle sky-high inflation, and that has the side effect of causing high growth stocks to sell off particularly hard. For example, here is a look at 50 high-growth stocks (those with very high expected revenue growth rates for this year and next), sorted by market cap (and as you can see—the year-to-date total return column has a lot or red!).

(data as of Tues 09-Aug-22)

You likely see a bunch of names you know. For example, we continue to own two of the six stocks on the list that actually have positive year-to-date returns (we own them in our Disciplined Growth Portfolio). And a select few other names are also very attractive and worth considering. For your reference, the list also includes data on growth rates, margins, short interest, industries, market caps and more.

Worth Considering:

In 2021, it seemed a new growth investor was born every minute and poured more money into what had been working best, despite the ugly sky-high valuations. And now that valuations have come crashing down, they believe they’re wise to avoid growth stocks like the plague. In reality, every investor is different, and each should focus on what works best for their own personal situation. Disciplined goal-focused long-term investing has been a winning strategy throughout history, and we believe it will be this time too.